Canadian Aluminum Trader's Bankruptcy: The Impact Of The Trade War

Table of Contents

The Role of Tariffs and Trade Restrictions in the Bankruptcy

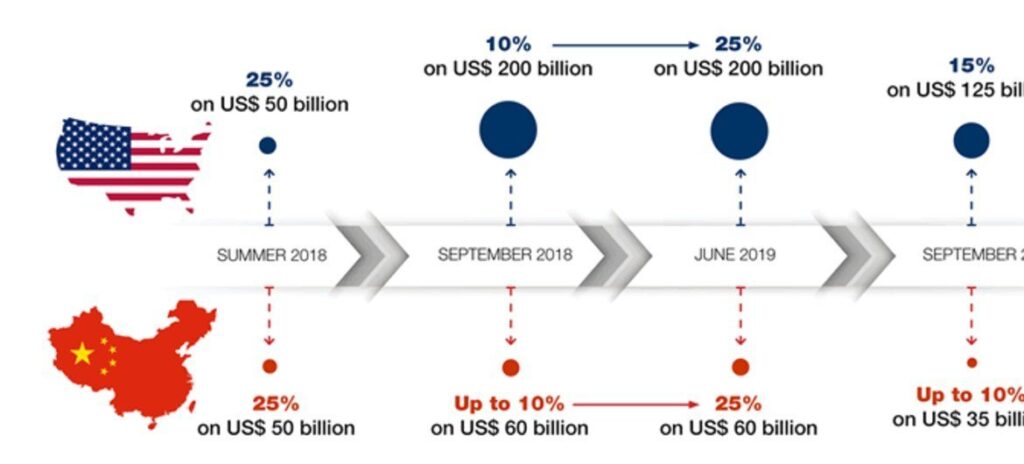

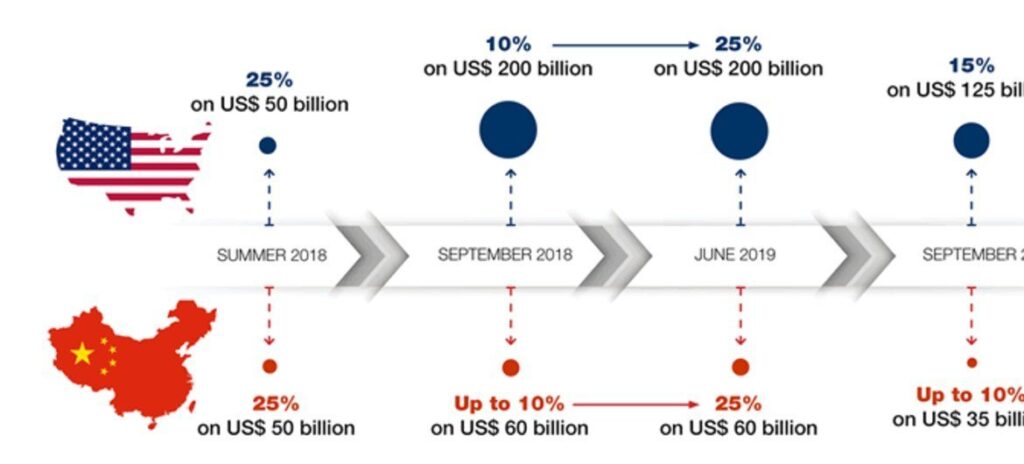

The bankruptcy highlights the crippling effects of tariffs and trade restrictions imposed during the trade war. These measures significantly increased the cost of both importing and exporting aluminum, squeezing profit margins for Canadian traders to the point of collapse. This wasn't simply a matter of increased prices; it represented a systemic disruption of the aluminum trade.

- Increased transportation costs: Trade restrictions led to longer, more complex shipping routes, significantly increasing transportation costs and reducing profitability.

- Reduced market access: Retaliatory tariffs imposed by other countries severely limited market access for Canadian aluminum, shrinking the potential customer base and further impacting profitability.

- Difficulty in securing competitive pricing: The fluctuating nature of tariffs made it extremely difficult to secure competitive pricing, leading to unpredictable costs and making long-term planning nearly impossible for traders.

- Increased administrative burden: Navigating the complex and ever-changing landscape of trade regulations added a significant administrative burden and compliance costs, further eroding already thin margins.

This ripple effect impacted the entire supply chain, from aluminum producers struggling to find buyers to consumers facing higher prices for aluminum products. The disruption created by the Canadian Aluminum Trade War extends far beyond the immediate impact on a single trader.

Impact on Canadian Aluminum Producers and the Domestic Market

The bankruptcy of this major trader has significant implications for Canadian aluminum producers who relied on it as a key buyer or supplier. The sudden loss of a major trading partner creates instability within the industry and ripple effects throughout the Canadian economy.

- Potential job losses: The bankruptcy could trigger job losses not only within the aluminum trading sector but also in related industries that rely on the aluminum supply chain.

- Decreased domestic aluminum consumption: Higher aluminum prices resulting from the trade war lead to decreased domestic consumption as businesses and consumers seek more affordable alternatives.

- Increased competition from foreign producers: Market instability created by the trade war allows foreign producers with lower costs (often due to government subsidies or less stringent regulations) to gain market share in Canada.

- Uncertainty in future aluminum pricing and trading relationships: The lack of predictability in pricing and trading partnerships makes it difficult for Canadian aluminum producers to make strategic long-term decisions.

The Canadian economy, which relies heavily on resource extraction and export, feels the impact of these issues, highlighting the vulnerabilities exposed by the Canadian Aluminum Trade War.

Geopolitical Factors and their Influence on the Aluminum Trade

The aluminum market's vulnerability is amplified by broader geopolitical instability and international relations. The Canadian Aluminum Trade War is not an isolated event but a symptom of a larger global economic and political climate.

- Impact of sanctions and political tensions: International sanctions and political tensions disrupt trade relationships, creating uncertainty and hindering the free flow of aluminum.

- Vulnerability of global aluminum supply chains: Global supply chains are inherently vulnerable to disruptions, and the trade war exacerbates this vulnerability, exposing the fragility of just-in-time inventory management strategies.

- Fluctuating exchange rates: Fluctuations in exchange rates impact the price competitiveness of Canadian aluminum on the global market, creating further uncertainty for traders.

- Influence of competing aluminum producers: Competition from other countries with significant aluminum production capacity, often benefiting from government support, adds pressure to the Canadian market.

These factors highlight the long-term implications for Canadian aluminum trade and Canada's international standing, underscoring the complexities of the Canadian Aluminum Trade War and its global context.

Alternative Strategies for Canadian Aluminum Traders

To mitigate future risks associated with trade wars and navigate the challenges of the Canadian Aluminum Trade War, Canadian aluminum traders need to adopt diversified strategies:

- Investing in domestic aluminum production and processing: Reducing reliance on imports strengthens the domestic supply chain and mitigates vulnerability to international trade disruptions.

- Developing stronger relationships with alternative international markets: Diversifying export markets reduces dependence on specific trade partners and protects against trade restrictions.

- Implementing hedging strategies to mitigate price volatility: Hedging strategies can help manage price fluctuations caused by trade wars, safeguarding profit margins.

- Improving efficiency and reducing operating costs: Enhancing operational efficiency improves competitiveness and makes businesses more resilient to external shocks.

Proactive risk management and adaptability are crucial for navigating uncertain global markets and ensuring the long-term viability of the Canadian aluminum industry.

Conclusion

The bankruptcy of the Canadian aluminum trader serves as a stark reminder of the significant and multifaceted consequences of the trade war on the Canadian aluminum industry. Tariffs, trade restrictions, and geopolitical instability have created a challenging environment, affecting producers, traders, and the broader Canadian economy. Understanding the impact of trade wars on specific sectors, such as the Canadian aluminum sector, is paramount. Businesses involved in the Canadian aluminum industry, or those considering entering the market, must carefully consider the ongoing risks associated with the trade war and implement appropriate risk mitigation strategies. Understanding the complexities of the Canadian Aluminum Trade War is crucial for navigating this challenging environment and ensuring future stability.

Featured Posts

-

Mother Of Black Girl Sold For Eyes And Skin Found Guilty A Case Study

May 29, 2025

Mother Of Black Girl Sold For Eyes And Skin Found Guilty A Case Study

May 29, 2025 -

Pcc Rokita Oficjalna Decyzja W Sprawie Wyplaty Dywidendy

May 29, 2025

Pcc Rokita Oficjalna Decyzja W Sprawie Wyplaty Dywidendy

May 29, 2025 -

Public Apology Male Escort Involved In Diddy Sex Party Controversy

May 29, 2025

Public Apology Male Escort Involved In Diddy Sex Party Controversy

May 29, 2025 -

Anton Mena Reveals Truth About Vinicius Jr And Mbappes Brotherhood At Real Madrid

May 29, 2025

Anton Mena Reveals Truth About Vinicius Jr And Mbappes Brotherhood At Real Madrid

May 29, 2025 -

Woede Bij Clubicoon Ajax Krijgt Harde Kritiek

May 29, 2025

Woede Bij Clubicoon Ajax Krijgt Harde Kritiek

May 29, 2025