Canadian Conservatives Outline Plan For Tax Cuts And Fiscal Responsibility

Table of Contents

Proposed Tax Cuts

The Conservative plan centers around substantial tax reductions for both individuals and corporations, aiming to inject much-needed capital into the Canadian economy and improve the financial well-being of Canadians.

Individual Income Tax Reductions

The Conservatives plan to reduce individual income tax rates across the board, providing relief for Canadians at all income levels. This broad-based approach aims to benefit families, individuals and retirees.

- Specific examples of proposed rate reductions: While specific percentages may vary depending on the final platform, the plan generally proposes a reduction in all tax brackets, potentially resulting in savings ranging from several hundred to several thousand dollars annually, depending on income level.

- Impact on average Canadian families: The proposed cuts are designed to provide meaningful relief for average Canadian families, leaving them with more disposable income to spend, save, or invest. This increased purchasing power is expected to further stimulate the economy.

- Targeted tax relief: The party may also include targeted tax relief for specific groups like families with children (potential child tax credit enhancements) and seniors (potential adjustments to the age pension or related benefits). Details on these specific measures would be available closer to the election.

Corporate Tax Rate Cuts

Lowering the corporate tax rate is a central component of the Conservatives' plan, aiming to encourage business investment, job creation, and increased international competitiveness for Canadian businesses.

- Proposed corporate tax rate reduction: The proposed reduction aims to make Canada a more attractive destination for foreign investment and encourage domestic companies to expand and hire. This could involve a significant percentage reduction from the current rate.

- Impact on job growth and economic competitiveness: By reducing the tax burden on corporations, the Conservatives believe this will free up capital for businesses to invest in expansion, research and development, and hiring more employees, ultimately boosting economic competitiveness.

- Comparison to other G7 countries: The plan will likely highlight how Canada's corporate tax rate compares to other G7 nations, emphasizing the need for a more competitive rate to attract investment and create jobs.

Fiscal Responsibility Measures

Central to the Conservative plan is a commitment to fiscal responsibility, ensuring that tax cuts are accompanied by responsible spending and a commitment to long-term financial stability.

Spending Controls

The Conservatives emphasize the importance of fiscal prudence, outlining plans for government spending restraint and efficiency improvements to offset the revenue impact of tax cuts.

- Specific examples of planned spending cuts or program reviews: The party is likely to highlight areas where they see opportunities for cost savings through program efficiency reviews and a reduction in non-essential spending. Specific details on targeted programs may vary.

- Commitment to balanced budgets: The plan aims to achieve balanced budgets within a reasonable timeframe, demonstrating a strong commitment to responsible fiscal management. Details on the timeline will be a key part of their platform.

- Long-term fiscal sustainability: The Conservatives will need to demonstrate how their combination of tax cuts and spending controls will lead to long-term fiscal sustainability and responsible debt management.

Enhanced Government Efficiency

The plan incorporates measures to streamline government operations and reduce administrative costs, ensuring taxpayers' money is used effectively.

- Examples of proposed administrative reforms: This may include initiatives to improve the efficiency of government departments, reduce bureaucracy, and adopt more modern technological solutions for service delivery.

- Improved transparency and accountability: The Conservatives might emphasize commitments to greater transparency in government spending and stronger accountability mechanisms to ensure public funds are used responsibly.

- Planned audits or reviews of government programs: The party might propose regular audits and program reviews to identify areas for improvement and cost savings, ensuring value for money.

Economic Growth and Job Creation

The Conservatives argue that their plan will stimulate private sector growth, leading to increased job creation and a stronger Canadian economy.

Stimulating the Private Sector

The tax cuts and fiscal responsibility measures are designed to create a more favorable environment for private sector growth, leading to increased investment and employment.

- Encouraging business investment and job creation: Lower taxes for businesses and individuals are expected to increase investment, expansion, and the creation of new jobs.

- Predictions regarding the potential impact on GDP growth: The Conservatives may provide economic modelling to demonstrate the potential positive impact of their plan on GDP growth.

- Projected increases in employment numbers: The party is likely to project increases in employment across various sectors as a result of the proposed policies.

Targeted Investments in Key Sectors

The plan may include targeted investments in key sectors (infrastructure, technology, clean energy) to further boost economic growth and ensure Canada remains competitive on the global stage.

- Specific sectors targeted for investment: Strategic investments in infrastructure, technology, and potentially clean energy, are likely to be central to stimulating growth and innovation.

- Contribution to long-term economic growth: These strategic investments are intended to provide a foundation for sustained economic growth and create high-quality jobs.

- Partnerships with the private sector: The plan may emphasize opportunities for public-private partnerships to maximize the impact of investments.

Conclusion

The Canadian Conservative Party's plan for tax cuts and fiscal responsibility represents a significant economic policy proposal. By reducing tax burdens while implementing robust spending controls, the Conservatives aim to create a stronger, more dynamic Canadian economy. Understanding the details of this plan – from individual tax reductions to measures ensuring fiscal responsibility – is crucial for every Canadian. Learn more about the Conservative Party's detailed plan for tax cuts and fiscal responsibility by visiting their official website and engaging in informed discussions about the future of the Canadian economy.

Featured Posts

-

Experts Link Trumps Budget Cuts To Increased Tornado Season Risks

Apr 24, 2025

Experts Link Trumps Budget Cuts To Increased Tornado Season Risks

Apr 24, 2025 -

Chinas Shift To Middle Eastern Lpg Replacing Us Imports Amid Tariffs

Apr 24, 2025

Chinas Shift To Middle Eastern Lpg Replacing Us Imports Amid Tariffs

Apr 24, 2025 -

Nba All Star Game 2024 Additions Of Green Moody And Hield

Apr 24, 2025

Nba All Star Game 2024 Additions Of Green Moody And Hield

Apr 24, 2025 -

Google Fis New 35 Unlimited Plan Everything You Need To Know

Apr 24, 2025

Google Fis New 35 Unlimited Plan Everything You Need To Know

Apr 24, 2025 -

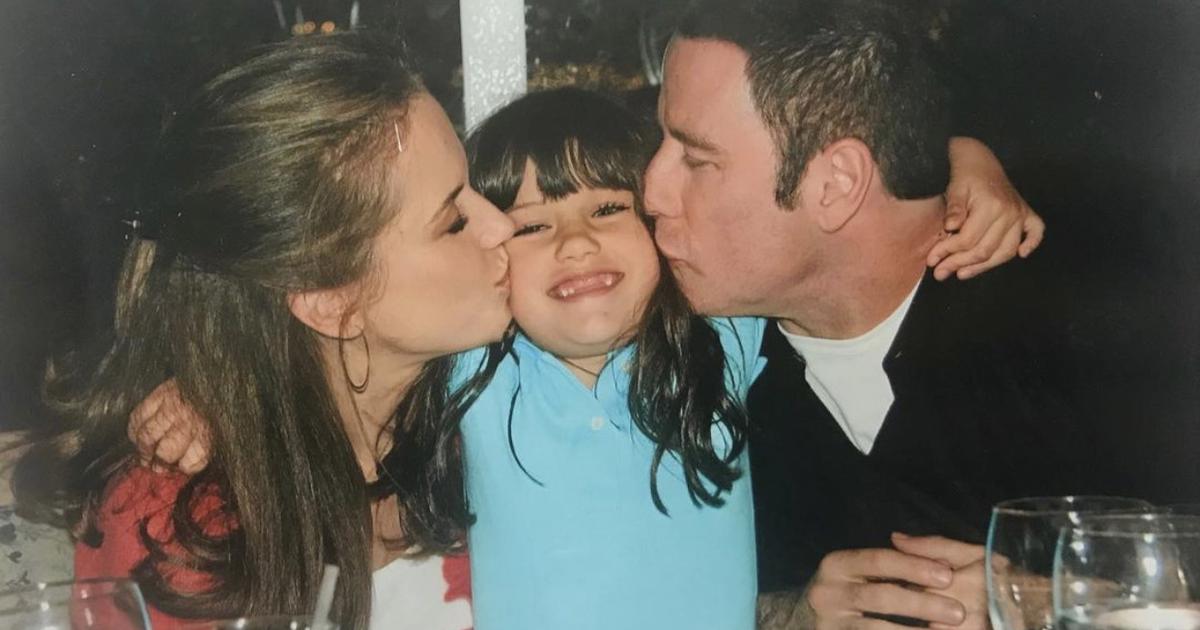

Kci Johna Travolte Ella Bleu Prerasla Je U Pravu Ljepoticu

Apr 24, 2025

Kci Johna Travolte Ella Bleu Prerasla Je U Pravu Ljepoticu

Apr 24, 2025