Canadian Dollar Forecast: Minority Government Risk

Table of Contents

H2: Political Instability and its Impact on the CAD

Political instability significantly influences the Canadian dollar forecast. A minority government, by its nature, introduces a higher degree of uncertainty compared to a majority government. This uncertainty directly impacts investor sentiment and the CAD's value.

H3: Increased Policy Uncertainty

Frequent elections and the potential for sudden policy changes inherent in a minority government create significant uncertainty for businesses and investors. This makes long-term planning incredibly challenging.

- Difficulty in implementing long-term economic plans: Minority governments often struggle to pass comprehensive economic legislation, leading to a lack of long-term strategic direction. This affects investor confidence, as they prefer stable and predictable policy environments.

- Potential for budget instability: Securing passage of annual budgets can be difficult, potentially leading to periods of fiscal uncertainty and impacting government spending on crucial infrastructure projects.

- Increased volatility in the stock market: The inherent unpredictability of a minority government translates into increased volatility in the Canadian stock market, creating ripple effects in the currency exchange market and impacting the CAD forecast.

Historical data reveals increased CAD volatility during previous periods of minority government in Canada. While precise figures vary depending on the specific economic context, a clear correlation between political instability and currency fluctuation is often observed.

H3: Difficulty Passing Legislation

The need for compromise and consensus-building in a minority government setting often leads to delays and difficulties in passing crucial legislation.

- Slower economic growth: Delays in implementing essential economic reforms can hinder economic growth, potentially impacting the CAD's value negatively.

- Delays in infrastructure projects: Infrastructure projects often require significant legislative approvals. Delays in this process can negatively impact long-term economic prospects and investor confidence, affecting the CAD forecast.

- Potential for gridlock on important trade deals: Negotiating and ratifying international trade agreements becomes significantly more challenging in a minority government context, potentially hindering export-oriented sectors and impacting the CAD's strength.

Recent legislative challenges, such as [link to relevant news article or government report], highlight the potential for gridlock and its consequences for the Canadian economy and the CAD exchange rate.

H2: Economic Impacts and their Effects on the Canadian Dollar Exchange Rate

The political instability stemming from a minority government directly affects several key aspects of the Canadian economy, subsequently influencing the CAD's exchange rate.

H3: Investor Sentiment and Capital Flows

Political uncertainty acts as a deterrent to foreign investment. This can lead to capital flight, reducing the demand for the CAD.

- Decreased demand for CAD: When investors perceive increased risk, they often reduce their holdings of CAD, leading to a decrease in demand.

- Downward pressure on the exchange rate: Reduced demand for CAD creates downward pressure on its exchange rate compared to other currencies.

- Potential for currency depreciation: Sustained capital flight and reduced demand can result in a depreciation of the Canadian dollar, impacting the CAD forecast negatively.

Data on foreign investment trends in Canada during previous minority government periods reveal a clear correlation between political uncertainty and decreased foreign investment. [Insert data or link to relevant source on foreign investment trends].

H3: Impact on Key Economic Sectors

A minority government's policies can differentially affect key economic sectors in Canada.

- Energy sector: Changes in environmental regulations or energy policies can significantly impact the energy sector and, consequently, the CAD, as Canada is a significant energy exporter.

- Natural resources: Similar to the energy sector, policies related to resource extraction and environmental regulations can influence the performance of the natural resource sector and the CAD.

- Manufacturing: Trade policies and regulatory changes can heavily influence the manufacturing sector's competitiveness, impacting exports and the CAD exchange rate.

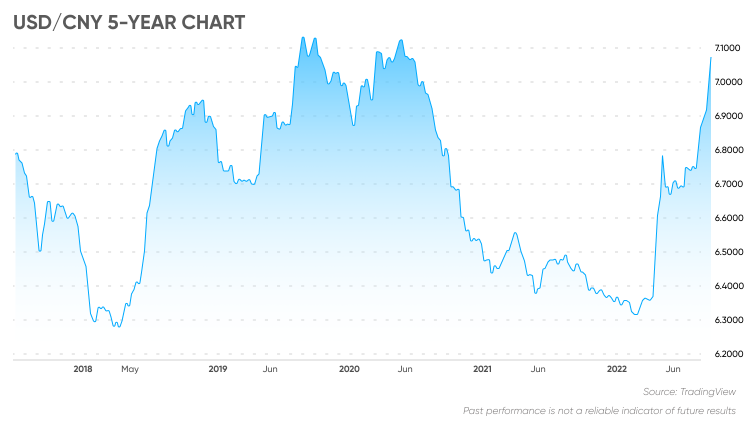

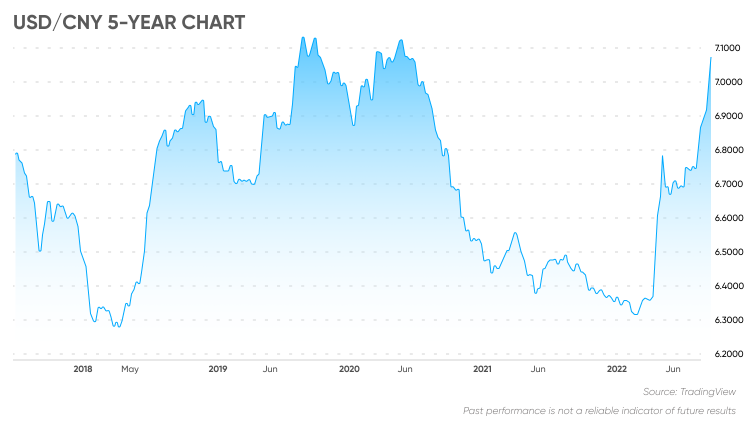

[Insert charts or graphs illustrating the correlation between specific sectors' performance and the CAD's value]. These visual aids would reinforce the impact of sector-specific policy changes on the overall CAD forecast.

H2: Forecasting the Canadian Dollar Under a Minority Government

Accurately forecasting the CAD under a minority government requires a nuanced approach that considers both economic and political factors.

H3: Analyzing Key Economic Indicators

Monitoring key economic indicators is crucial for predicting CAD movements.

- GDP growth: Strong GDP growth generally supports a stronger CAD, while slower growth weakens it.

- Inflation: High inflation can erode the CAD's purchasing power, leading to depreciation.

- Interest rates: Higher interest rates attract foreign investment, bolstering the CAD. Lower interest rates can have the opposite effect.

- Unemployment: High unemployment suggests a weaker economy and usually puts downward pressure on the CAD.

Reliable data sources for these indicators include Statistics Canada ([link to Statistics Canada website]) and the Bank of Canada ([link to Bank of Canada website]).

H3: Incorporating Political Risk into the Forecast

Political risk is a significant factor influencing the CAD forecast. It needs to be factored in alongside economic indicators.

- Quantifying political risk: Several methods exist for quantifying political risk, including using risk assessment agencies like [mention reputable risk assessment agencies].

- Adjusting investment strategies: Investors should adjust their investment strategies to account for potential political uncertainty. This might include diversifying investments or hedging against CAD volatility.

Understanding and incorporating political risk into your analysis is key for a more accurate CAD forecast.

3. Conclusion

A minority government introduces significant political risk, impacting the Canadian economy and the Canadian dollar forecast. Increased policy uncertainty, difficulty passing legislation, and potential investor hesitancy all contribute to a more volatile and unpredictable environment for the CAD. Regularly monitoring key economic indicators such as GDP growth, inflation, interest rates, and unemployment, while incorporating political risk assessments, is crucial for navigating this complexity. Stay informed about the Canadian political and economic landscape to make well-informed decisions regarding the Canadian dollar. Regularly review your Canadian dollar forecast to adjust your investment strategy accordingly. Utilize reliable resources such as Statistics Canada and the Bank of Canada to track the CAD forecast and navigate the uncertainties of a minority government. Ignoring the impact of political risk on your Canadian dollar forecast can lead to significant financial repercussions.

Featured Posts

-

Tpbl

Apr 30, 2025

Tpbl

Apr 30, 2025 -

Vusion Group Amf Cp 2025 E1027277 Informations Cles Du 24 Mars 2025

Apr 30, 2025

Vusion Group Amf Cp 2025 E1027277 Informations Cles Du 24 Mars 2025

Apr 30, 2025 -

Daisy Midgeleys Pre Coronation Street Career A Look Back

Apr 30, 2025

Daisy Midgeleys Pre Coronation Street Career A Look Back

Apr 30, 2025 -

The Rise Of Staycations A 20 Increase In Canadian Airbnb Searches

Apr 30, 2025

The Rise Of Staycations A 20 Increase In Canadian Airbnb Searches

Apr 30, 2025 -

Amanda Owen And Clive Owen Discussing Future Plans Post Divorce

Apr 30, 2025

Amanda Owen And Clive Owen Discussing Future Plans Post Divorce

Apr 30, 2025