Canadian Dollar Gains Momentum Following Trump's Carney Negotiation Comments

Table of Contents

Trump's Comments and Market Reaction

Trump's remarks, while not explicitly focused on the Canadian dollar's value, indirectly influenced the currency markets. [Insert link to reliable news source detailing Trump's comments]. His statements, which [summarize the relevant parts of Trump's statements], triggered a swift and noticeable reaction in the forex market. The CAD/USD exchange rate experienced a [percentage]% increase within [timeframe] of the comments being released. Trading volume also spiked, indicating a significant surge in activity as traders reacted to the news.

- Specific quotes from Trump's statement: [Insert direct quotes relevant to the Canadian economy or US-Canada relations].

- CAD/USD exchange rate before and after the comments: [Insert data showing the exchange rate before and after, potentially with a chart or graph].

- Significant shifts in trading volume: [Quantify the increase in trading volume – e.g., a 20% increase compared to the average daily volume].

The overall market sentiment following Trump's comments was predominantly positive regarding the Canadian dollar, although some analysts expressed caution about the sustainability of this upward trend. The short-term optimism largely reflected a perceived easing of trade tensions between the US and Canada, boosting investor confidence in the Canadian economy.

Underlying Factors Contributing to CAD Strength

While Trump's comments played a significant role, the CAD's strengthening wasn't solely driven by political pronouncements. Several underlying economic factors contributed to the increase in its value.

- Key Canadian economic indicators and their impact on the CAD: Positive economic data, such as robust GDP growth figures, a strong trade balance, and low unemployment rates, all point towards a healthy Canadian economy, making the CAD more attractive to investors.

- Global economic factors influencing the Canadian dollar: Global economic trends, such as fluctuating oil prices (a major Canadian export) and overall global economic stability, can significantly impact the CAD's performance. A strong global economy generally benefits the Canadian dollar.

- Mention of any relevant geopolitical events impacting currency markets: Geopolitical events impacting global markets, such as international trade agreements or shifts in global power dynamics, can also influence the CAD's value.

Potential Long-Term Implications for the CAD

The long-term implications of the recent CAD surge and Trump’s comments remain uncertain. However, several potential scenarios can be analyzed.

- Long-term outlook for the CAD/USD exchange rate: Predicting future exchange rates is inherently speculative. However, continued strong economic performance in Canada and any sustained easing of trade tensions with the US could support a stronger CAD in the long term.

- Impact on Canadian exports and imports: A stronger CAD can make Canadian exports more expensive in foreign markets and imports cheaper within Canada. This could impact businesses in both sectors, requiring careful adjustment of strategies.

- Potential implications for Canadian inflation: Increased imports due to a stronger CAD could exert downward pressure on inflation. However, other factors could offset this effect.

Conclusion: Navigating the Shifting Landscape of the Canadian Dollar

In conclusion, the recent rise in the Canadian dollar's value is a multifaceted phenomenon influenced by both political pronouncements and underlying economic fundamentals. Trump's comments certainly played a role in the short-term market reaction, but the sustained strength of the CAD also reflects the overall health of the Canadian economy. It's crucial to monitor both economic data releases and geopolitical news to understand future fluctuations in the CAD. Investors should consider diversifying their portfolios and adopting strategies that account for the inherent volatility of currency markets. This is not financial advice; consult with a financial professional before making any investment decisions. To stay informed about Canadian dollar fluctuations and monitor the Canadian dollar exchange rate effectively, continue following news related to Canadian economic indicators and international trade developments.

Featured Posts

-

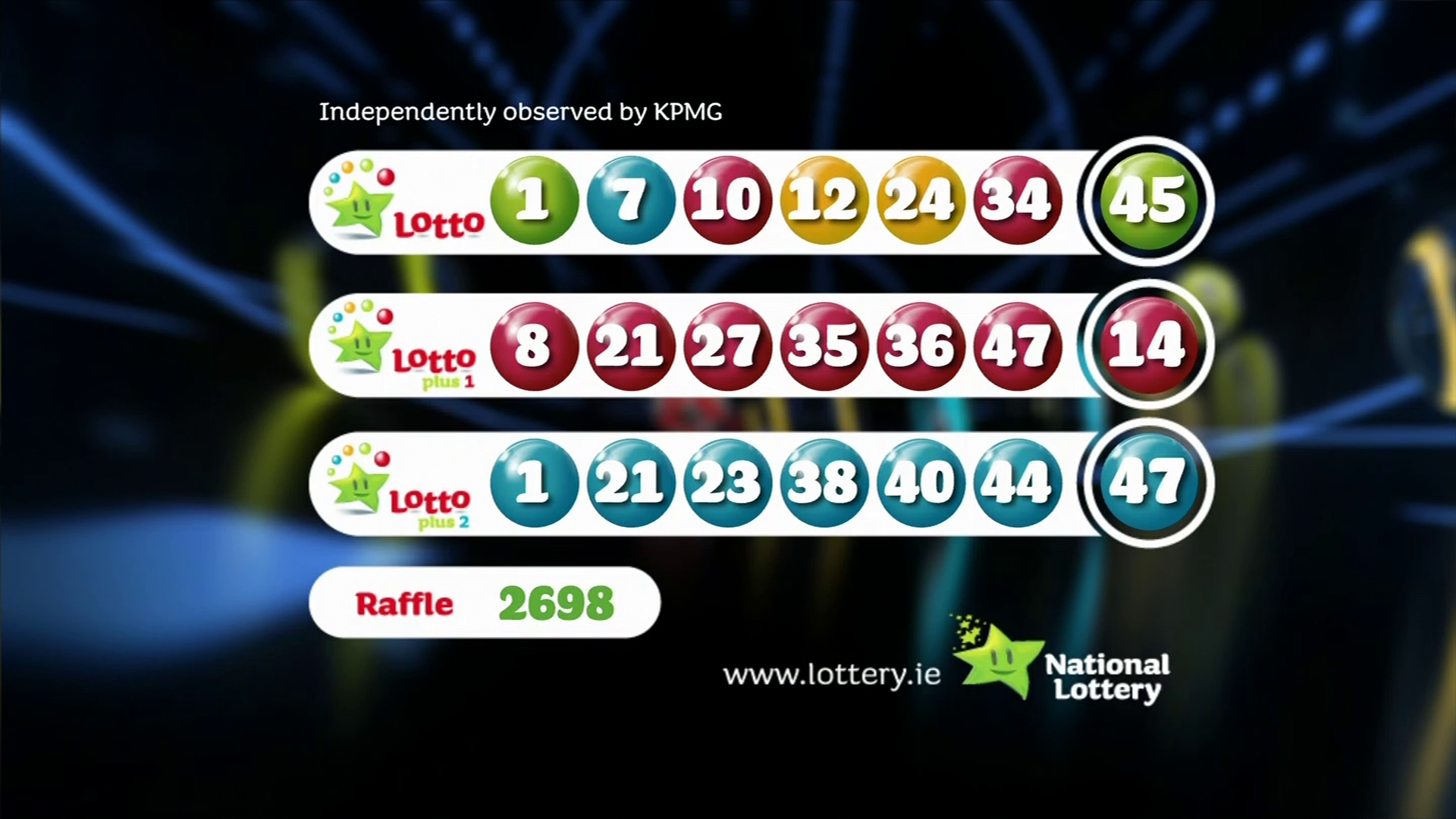

Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2 Draws

May 02, 2025

Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2 Draws

May 02, 2025 -

Ponant Agent Incentive 1 500 Flight Credit On Paul Gauguin Cruises

May 02, 2025

Ponant Agent Incentive 1 500 Flight Credit On Paul Gauguin Cruises

May 02, 2025 -

Fortnite Players Revolt Against Music Change

May 02, 2025

Fortnite Players Revolt Against Music Change

May 02, 2025 -

Kampen Start Kort Geding Tegen Enexis Over Stroomaansluiting

May 02, 2025

Kampen Start Kort Geding Tegen Enexis Over Stroomaansluiting

May 02, 2025 -

Riot Platforms Inc Early Warning Report Details On Proxy Waiver

May 02, 2025

Riot Platforms Inc Early Warning Report Details On Proxy Waiver

May 02, 2025