Canadian Dollar Strengthens: Impact Of Trump's Carney Deal Statement

Table of Contents

Understanding the Trump-Macklem Deal Statement and its Context

President Trump's recent statement hinted at a potential agreement with Bank of Canada Governor Tiff Macklem, though details remained scarce. The vagueness of the announcement fueled speculation across the forex market, causing immediate and significant reactions. The lack of specifics created uncertainty, leading to a period of heightened volatility.

- Key aspects of the perceived deal: The statement suggested a potential easing of trade tensions between the US and Canada, though no concrete policy changes were announced.

- Uncertainty surrounding the specifics: The lack of detail left market analysts scrambling to interpret the statement's meaning, leading to diverse predictions about the impact on the USD/CAD exchange rate.

- Pre-existing tensions in US-Canada trade relations: The statement came amidst ongoing discussions regarding trade imbalances and the implementation of the USMCA (United States-Mexico-Canada Agreement). The pre-existing tension made the market particularly sensitive to any perceived shifts in the bilateral relationship.

- The role of the USMCA: While the statement didn't explicitly mention the USMCA, its implication of improved trade relations could positively affect the agreement's implementation and overall trade flow between the two countries, subsequently influencing the Canadian dollar.

Immediate Impact on the Canadian Dollar (USD/CAD Exchange Rate)

Following Trump's statement, the Canadian dollar experienced a sharp appreciation against the US dollar. The USD/CAD exchange rate dropped significantly, reflecting a boost in confidence in the Canadian economy.

[Insert a chart or graph here illustrating the fluctuation of the USD/CAD exchange rate around the time of the statement. Clearly label the axes and highlight the key price movements.]

- Quantification of the Canadian dollar's appreciation: The Loonie strengthened by approximately X% against the USD within Y hours following the announcement (replace X and Y with actual figures based on market data).

- Volatility in the forex market: The forex market displayed increased volatility during the announcement and in the hours that followed, as traders reacted to the news and attempted to gauge its true implications.

- Role of speculation and market sentiment: Speculation played a major role, with market sentiment shifting from cautious pessimism to more optimistic expectations regarding future US-Canada trade relations.

Long-Term Implications for the Canadian Economy

A strengthened Canadian dollar holds both advantages and disadvantages for the Canadian economy. While some sectors will benefit, others may face challenges.

- Impact on Canadian exports and imports: A stronger Loonie makes Canadian exports more expensive for US buyers, potentially reducing demand. Conversely, it makes imports cheaper for Canadians.

- Effects on Canadian tourism: The stronger dollar could discourage US tourists from visiting Canada, impacting the tourism sector negatively. However, it might encourage Canadians to travel internationally.

- Influence on foreign investment in Canada: A stronger Canadian dollar might reduce the attractiveness of Canada as a destination for foreign investment, as returns on investments might appear smaller when converted back to other currencies.

- Effect on inflation and interest rates: The impact on inflation and interest rates depends on various factors, including the duration of the strengthened dollar and the overall economic climate. A stronger dollar could contribute to lower inflation, potentially leading to lower interest rates.

Impact on Specific Industries (e.g., Energy, Manufacturing)

The strengthening of the Canadian dollar has significant implications for specific industries heavily reliant on international trade.

- Challenges and opportunities for Canadian energy companies: Canadian energy exports, particularly oil, become less competitive on the global market with a stronger Canadian dollar, potentially impacting revenue. However, this might also incentivize increased domestic consumption.

- Impact on Canadian manufacturing and its competitiveness: The stronger currency could negatively impact the competitiveness of Canadian manufacturers, making their products more expensive for foreign buyers. This situation may necessitate adjustments in production strategies or increased focus on domestic sales.

Strategies for Investors in Response to Canadian Dollar Strengthening

The strengthening Canadian dollar requires investors to adapt their strategies to mitigate risks and potentially capitalize on new opportunities.

- Strategies for those with US dollar-denominated assets: Investors holding US dollar-denominated assets might consider hedging strategies to protect against potential losses stemming from the currency fluctuation.

- Advice for Canadian investors considering international investments: The stronger Canadian dollar makes international investments more affordable for Canadian investors, potentially opening up new opportunities.

- Recommending diversifying investment portfolios: Diversification across various asset classes and geographies is crucial to mitigating risks associated with currency fluctuations.

Conclusion

President Trump's ambiguous statement regarding a deal with Governor Macklem unexpectedly boosted the Canadian dollar. This strengthening of the Loonie has immediate and long-term implications for the Canadian economy, impacting various sectors, including energy and manufacturing, as well as influencing tourism and foreign investment. Investors need to carefully monitor the USD/CAD exchange rate and adapt their portfolios accordingly. The long-term effects of this strengthening Canadian dollar will depend on several factors, including the actual details of any future trade agreements and the overall health of the global economy.

Call to Action: Stay informed about further developments regarding the US-Canada trade relationship and the impact on the Canadian dollar exchange rate. Monitor the USD/CAD closely and consider adjusting your investment portfolio based on the evolving market conditions. Consult with a financial advisor to create a strategy that aligns with your risk tolerance and investment goals in the face of this Canadian dollar strengthening trend.

Featured Posts

-

Xrp The Ripple Protocol And Its Digital Asset

May 02, 2025

Xrp The Ripple Protocol And Its Digital Asset

May 02, 2025 -

Reform Spat Fallout Rupert Lowes Commitment To Great Yarmouth

May 02, 2025

Reform Spat Fallout Rupert Lowes Commitment To Great Yarmouth

May 02, 2025 -

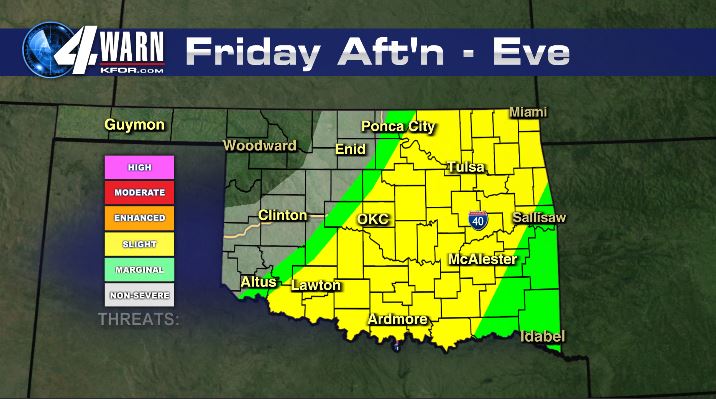

Oklahoma Severe Weather Timeline Strong Winds Expected

May 02, 2025

Oklahoma Severe Weather Timeline Strong Winds Expected

May 02, 2025 -

Watch Belgium Vs England Tv Listings Kick Off Time And Live Stream Details

May 02, 2025

Watch Belgium Vs England Tv Listings Kick Off Time And Live Stream Details

May 02, 2025 -

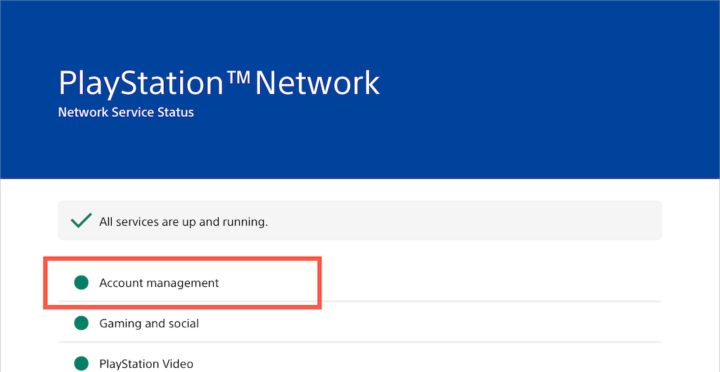

Play Station Network Sorun Giderme Ve Giris Yapma

May 02, 2025

Play Station Network Sorun Giderme Ve Giris Yapma

May 02, 2025