Canadian Dollar Vulnerable Under Minority Federal Government

Table of Contents

Canada's current economic climate is a complex tapestry woven with threads of global uncertainty and domestic political instability. The Canadian dollar (CAD), a key indicator of the nation's economic health, has recently shown signs of vulnerability. This article will explore the significant impact of Canada's minority federal government on the Canadian dollar's performance, analyzing the inherent risks and potential consequences for investors and the Canadian economy. The vulnerability of the Canadian dollar under the current minority federal government is a critical issue that requires careful consideration.

<h2>Political Instability and Investor Sentiment</h2>

A minority government, by its very nature, breeds uncertainty. The constant threat of elections, the need for coalition building, and the potential for sudden shifts in policy create a volatile environment that significantly impacts investor sentiment. This uncertainty is a major factor influencing the Canadian dollar's exchange rate.

- Increased risk aversion among foreign investors: Foreign investors, seeking stable returns, are naturally hesitant to commit capital to a country with a politically unstable government. The perceived risk increases, leading to a decrease in investment.

- Potential capital flight from Canada: Existing foreign investment may be withdrawn, as investors seek safer havens for their capital. This outflow of capital weakens the Canadian dollar.

- Reduced foreign direct investment (FDI): The uncertainty discourages new foreign direct investment, hindering economic growth and further impacting the CAD. Prospective investors are more likely to choose politically stable regions.

- Negative impact on long-term economic growth: Sustained political instability undermines confidence in Canada's long-term economic prospects, which negatively affects the Canadian dollar’s value in the long run.

The CAD/USD exchange rate is a prime example of this vulnerability. Periods of heightened political uncertainty often coincide with a weakening of the CAD against the USD and other major currencies.

<h2>Impact of Policy Uncertainty on the Canadian Economy</h2>

Minority governments often struggle to implement consistent and long-term economic strategies. The reliance on compromises and coalitions can lead to fragmented and potentially conflicting policies, impacting various sectors and ultimately affecting the Canadian dollar.

- Difficulty in implementing long-term economic strategies: Ambitious, long-term plans are often hampered by the short-term focus demanded by the precarious nature of a minority government.

- Potential for budget deadlock and delayed fiscal stimulus: Disagreements on budgetary allocations can lead to delays or even failures in crucial fiscal stimulus programs, hindering economic growth.

- Uncertainty surrounding trade agreements and international relations: Negotiating and ratifying trade deals becomes more complicated, potentially impacting key export sectors and investor confidence.

- Impact on key economic sectors like natural resources and manufacturing: Policy inconsistencies can create uncertainty for businesses in key sectors, impacting investment decisions and employment.

This inherent policy uncertainty translates into volatility in the CAD, as markets react to the shifting sands of government priorities.

<h2>Comparison with Previous Minority Governments</h2>

Examining the historical performance of the Canadian dollar under previous minority governments provides valuable insight. Analyzing past periods of minority rule allows us to draw parallels and potentially anticipate future trends.

- Analyze trends in the CAD's exchange rate during those periods: Historical data can reveal correlations between political instability and CAD fluctuations.

- Compare the levels of political instability: Assessing the degree of political uncertainty in previous minority governments helps gauge the current situation's severity.

- Identify any similarities or differences with the current situation: Comparing the current political climate with past instances allows for a more informed assessment of the CAD's potential trajectory.

By studying these historical parallels, we can potentially predict the likely impact of the current political situation on the Canadian dollar.

<h3>Specific Policy Areas Affecting the CAD</h3>

Certain policy areas have a more direct and significant impact on the Canadian dollar's value than others. Understanding these areas and the potential for changes or uncertainties is crucial:

- Fiscal policy (budget deficits, taxation): Large budget deficits or significant tax changes can affect investor confidence and the value of the CAD.

- Monetary policy (interest rates set by the Bank of Canada): Interest rate adjustments by the Bank of Canada to manage inflation or economic growth directly influence the CAD's attractiveness to foreign investors.

- Trade policy (bilateral agreements, international trade relations): Uncertainty or changes in trade policy can impact exports and imports, leading to fluctuations in the CAD.

<h2>Conclusion: Navigating the Canadian Dollar's Vulnerability</h2>

The link between a minority government's instability and the Canadian dollar's vulnerability is undeniable. Political uncertainty, policy inconsistencies, and the resulting shifts in investor sentiment all contribute to fluctuations in the CAD's exchange rate. Understanding these dynamics is crucial for navigating the current economic landscape. To effectively manage investments and understand the fluctuations of the Canadian dollar, it's essential to stay informed about Canadian politics and economic developments. Monitor the Canadian dollar closely, understand Canadian dollar volatility, and stay informed about the Canadian dollar's performance under the current government. Utilize reputable resources like the Bank of Canada website, financial news outlets, and economic analysis reports to track the CAD and gain valuable insights into its performance. Understanding the vulnerability of the Canadian dollar under the current government is key to making informed financial decisions.

Featured Posts

-

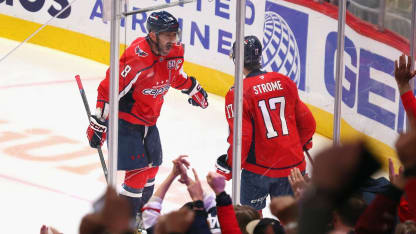

Ovechkins 894th Goal Nhl History Made Cp News Alert

Apr 30, 2025

Ovechkins 894th Goal Nhl History Made Cp News Alert

Apr 30, 2025 -

Beyonces Childrens Public Appearances A Look At The Family Dynamic

Apr 30, 2025

Beyonces Childrens Public Appearances A Look At The Family Dynamic

Apr 30, 2025 -

Trump Removes Doug Emhoff From Holocaust Memorial Council

Apr 30, 2025

Trump Removes Doug Emhoff From Holocaust Memorial Council

Apr 30, 2025 -

Kideia Papa Fragkiskoy I Parastasi Dynameon Stin Romi

Apr 30, 2025

Kideia Papa Fragkiskoy I Parastasi Dynameon Stin Romi

Apr 30, 2025 -

Buzelio Tylejimas Po Savo Vardo Turnyro Vilniuje Ka Tai Reiskia

Apr 30, 2025

Buzelio Tylejimas Po Savo Vardo Turnyro Vilniuje Ka Tai Reiskia

Apr 30, 2025