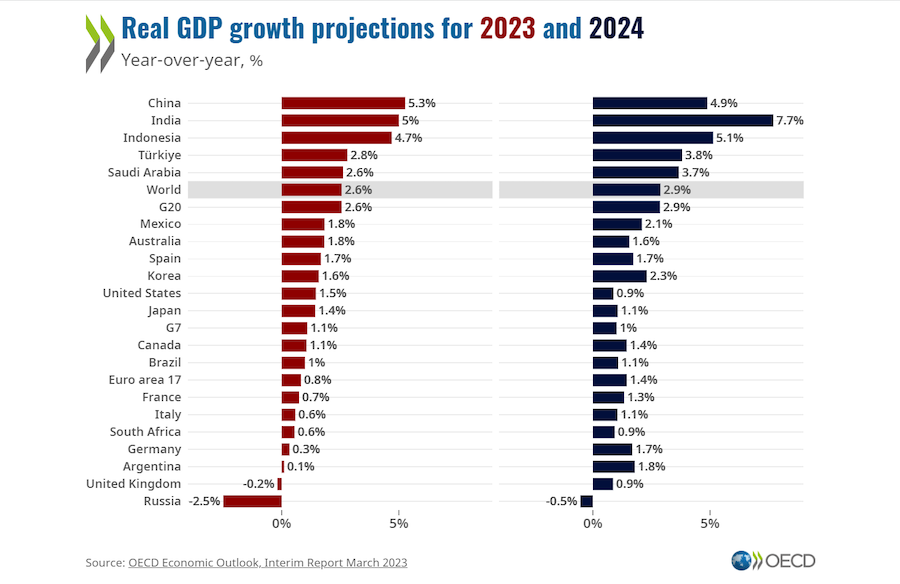

Canadian Economic Growth To Stagnate In 2025: OECD Prediction

Table of Contents

Factors Contributing to Stagnant Canadian Economic Growth in 2025

Several interconnected factors contribute to the OECD's prediction of stagnant Canadian economic growth in 2025.

Global Economic Slowdown

The global economic landscape presents considerable headwinds. High global inflation, persistent supply chain issues, and ongoing geopolitical risks are all impacting Canada's economic performance.

- Impact of inflation on consumer spending: Elevated inflation erodes purchasing power, leading to reduced consumer spending, a key driver of economic growth. Canadians are forced to cut back on discretionary purchases, impacting various sectors.

- Challenges in global supply chains affecting Canadian businesses: Disruptions to global supply chains continue to increase production costs and limit the availability of goods and services, hindering Canadian businesses' ability to operate efficiently.

- The effect of geopolitical tensions on investment and trade: Geopolitical instability creates uncertainty, discouraging investment and impacting Canadian trade relationships with key partners. This uncertainty makes businesses hesitant to expand or make long-term commitments.

High Interest Rates and Monetary Policy

The Bank of Canada's aggressive monetary policy, implemented to combat inflation, is another significant factor. While necessary to control inflation, higher interest rates have a dampening effect on economic growth.

- The effect of interest rate hikes on borrowing costs for businesses and consumers: Higher interest rates increase borrowing costs for businesses, making investment less attractive and potentially leading to reduced hiring and expansion. Consumers face higher mortgage payments and loan interest, leading to decreased spending.

- Potential impact on investment and consumer spending: Increased borrowing costs translate directly to reduced investment by businesses and curtailed spending by consumers, leading to slower economic growth.

- The trade-off between inflation control and economic growth: The Bank of Canada faces a difficult balancing act: controlling inflation without triggering a significant economic slowdown. This trade-off is at the heart of the current economic challenges.

Housing Market Correction

The cooling Canadian housing market is also contributing to the slowdown. After years of rapid growth, the market is experiencing a correction.

- Declining house prices: A decrease in house prices impacts consumer wealth and confidence, reducing overall spending.

- Reduced construction activity: The slowdown in the housing market leads to reduced construction activity, impacting jobs and related industries.

- Impact on consumer wealth and confidence: Homeowners experiencing declining property values may become more cautious with their spending, further impacting economic growth.

Potential Impacts of Stagnant Economic Growth

Stagnant Canadian economic growth in 2025 will have far-reaching consequences.

Job Market

The slowdown could negatively affect the Canadian job market.

- Potential job losses in specific sectors: Sectors sensitive to consumer spending or investment, such as retail and construction, may experience job losses.

- Increased unemployment claims: As businesses struggle, unemployment claims are likely to rise, increasing the strain on social safety nets.

- Challenges for job seekers: A weaker job market creates challenges for those seeking employment, potentially leading to longer periods of unemployment.

Government Finances

The government's fiscal position will also be impacted.

- Reduced tax revenue: Slower economic growth translates to reduced tax revenue for both federal and provincial governments.

- Increased government spending on social programs: Higher unemployment and reduced consumer spending may lead to increased demand for social programs, putting pressure on government budgets.

- Potential impact on government debt: Reduced revenue and increased spending could exacerbate government debt levels.

Consumer Confidence

Stagnant growth will likely dampen consumer confidence.

- Decline in consumer confidence: Concerns about job security and economic outlook can lead to a decline in consumer confidence.

- Reduced discretionary spending: Lower consumer confidence translates to reduced discretionary spending, further slowing economic activity.

- Potential impact on retail sales: Reduced consumer spending directly impacts retail sales, potentially leading to store closures and job losses in the retail sector.

Conclusion: Understanding and Navigating Stagnant Canadian Economic Growth in 2025

The OECD's prediction of stagnant Canadian economic growth in 2025 is driven by a confluence of factors, including a global economic slowdown, high interest rates, and a housing market correction. These factors are expected to impact the job market, government finances, and consumer confidence. Understanding these potential impacts is crucial for navigating the coming economic challenges. Staying informed about the evolving Canadian economic landscape is vital for both individuals and businesses. Stay informed about the evolving Canadian economic landscape by following our updates on the Canadian economic growth forecast. For further analysis, explore resources from the Bank of Canada and Statistics Canada.

Featured Posts

-

Baldonis Legal Team Vows Accountability After Livelys Lawsuit Dismissal Bid

May 28, 2025

Baldonis Legal Team Vows Accountability After Livelys Lawsuit Dismissal Bid

May 28, 2025 -

Le Samsung Galaxy S25 Ultra 256 Go Top Produit A 953 75 E Notre Analyse

May 28, 2025

Le Samsung Galaxy S25 Ultra 256 Go Top Produit A 953 75 E Notre Analyse

May 28, 2025 -

Kantor Nas Dem Bali Dari Mimpi Satu Kursi Dpr Ke Kenyataan

May 28, 2025

Kantor Nas Dem Bali Dari Mimpi Satu Kursi Dpr Ke Kenyataan

May 28, 2025 -

Freeway Series Ends With Angels Victory Over Dodgers

May 28, 2025

Freeway Series Ends With Angels Victory Over Dodgers

May 28, 2025 -

Chicago Med Season 10 A Twist On The 2025 One Chicago Crossover

May 28, 2025

Chicago Med Season 10 A Twist On The 2025 One Chicago Crossover

May 28, 2025