Canadian Investors Pour Money Into US Stocks: A New High

Table of Contents

Why the Surge in Cross-Border Investment?

Several key factors contribute to the dramatic increase in Canadian investment in US stocks.

Attractive US Market Performance

The US stock market has shown remarkable strength in recent years, significantly outpacing the Canadian market in certain sectors. This robust performance is a major draw for Canadian investors seeking higher returns.

- High-Performing Sectors: The technology sector, with its innovative giants like Apple (AAPL) and Microsoft (MSFT), has been a significant contributor to this growth. The healthcare sector, fueled by advancements in biotechnology and pharmaceuticals, has also seen impressive gains. Furthermore, the energy sector has experienced volatility but also significant growth periods due to global energy demands.

- Strong Market Indicators: The S&P 500, a benchmark index for US large-cap stocks, has shown consistent growth, further bolstering investor confidence and attracting Canadian investment. This positive trajectory makes US stocks an attractive option for building wealth.

The Weakness of the Canadian Dollar

The fluctuating exchange rate between the Canadian dollar (CAD) and the US dollar (USD) plays a crucial role. A weaker CAD means that Canadian investors get more USD for their money, potentially boosting their returns when converting profits back to CAD.

- CAD/USD Exchange Rate Impact: Periods of CAD weakness can significantly amplify the returns on US stock investments when the profits are converted back to Canadian dollars. For example, if the CAD depreciates against the USD, a 10% gain in a US stock can translate to a larger percentage gain when converted to CAD.

- Exchange Rate Volatility: However, it's important to note that this is a double-edged sword. Fluctuations in the exchange rate introduce currency risk, meaning losses are also amplified if the CAD strengthens against the USD.

Seeking Diversification

Diversification is a cornerstone of sound investment strategy, and Canadian investors are increasingly recognizing the benefits of diversifying their portfolios beyond the Canadian market.

- Reduced Portfolio Volatility: Investing in US stocks reduces reliance on the Canadian economy and market performance. By spreading investments across different markets and sectors, investors can potentially mitigate risks associated with economic downturns in Canada. Investing in different asset classes within the US market like bonds and real estate further reduces this risk.

- Access to a Wider Range of Investment Opportunities: The US market offers a much broader range of companies and sectors compared to the Canadian market, providing access to diverse investment opportunities not readily available at home.

Which US Stocks are Canadian Investors Favoring?

Canadian investors are demonstrating a preference for certain sectors and companies within the US market.

Sector-Specific Analysis

While the technology sector remains a popular choice, Canadian investors are also increasingly diversifying into other promising sectors.

- Technology Giants: As mentioned, companies like Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Google (GOOGL) remain highly attractive due to their market dominance and consistent growth.

- Consumer Staples: Companies in the consumer staples sector, offering essential goods and services, are seen as relatively stable investments, even during economic uncertainty.

- Energy: Despite the volatility, the energy sector, particularly renewable energy, attracts considerable Canadian interest given the country's significant energy resources and expertise.

Top Performing US Companies

Data shows significant Canadian investment in several top-performing US companies. While specific investment figures are often confidential, observing market trends reveals clear favourites.

- Tesla (TSLA): The electric vehicle maker has attracted significant attention from Canadian investors due to its innovative technology and market leadership.

- NVIDIA (NVDA): The leading graphics processing unit (GPU) maker continues to benefit from the growing demand for AI and high-performance computing.

The Risks and Rewards of Investing in US Stocks from Canada

While the potential rewards of investing in US stocks are significant, Canadian investors must be aware of the associated risks.

Currency Risk

The fluctuating CAD/USD exchange rate is a double-edged sword. While a weaker CAD can boost returns, a stronger CAD can reduce or even erase profits.

Tax Implications

Investing in US stocks involves tax implications for Canadian residents.

- Tax Treaties: Canada and the US have a tax treaty to avoid double taxation, but understanding the specific rules regarding capital gains taxes and withholding taxes is crucial.

- Professional Advice: Consulting a tax professional familiar with cross-border investing is highly recommended to ensure compliance and optimize tax efficiency.

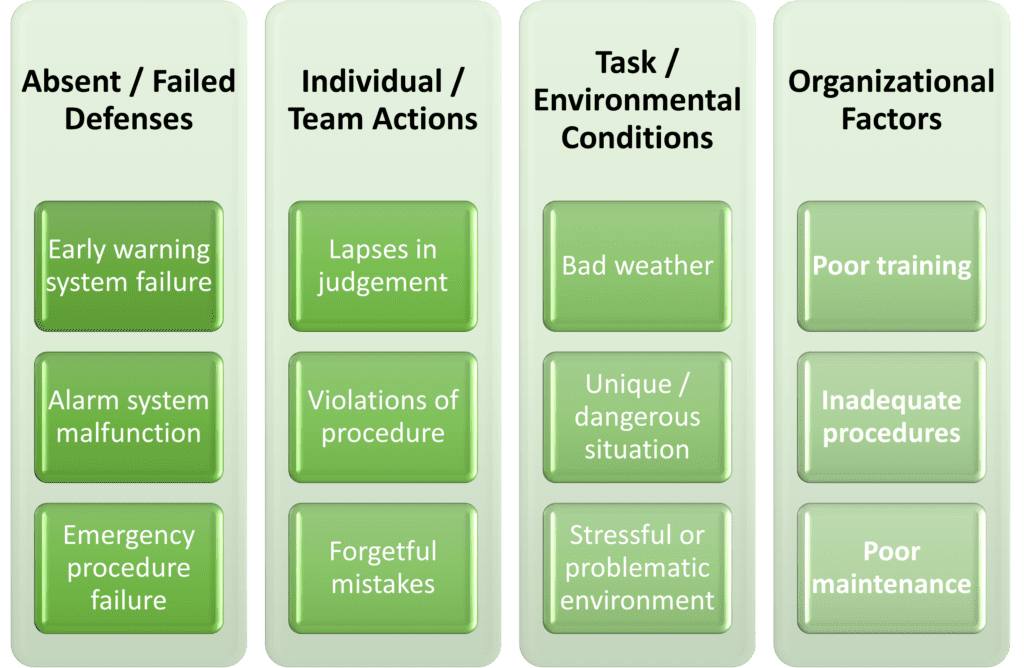

Regulatory Differences

Navigating the regulatory differences between Canadian and US markets requires careful attention. While both markets are well-regulated, understanding these nuances is essential for informed decision-making.

Conclusion

The substantial increase in Canadian investment in US stocks reflects a compelling trend driven by attractive US market performance, a weaker Canadian dollar, and the pursuit of portfolio diversification. While the potential rewards are significant, Canadian investors must carefully consider the currency risk, tax implications, and regulatory differences involved. Consider diversifying your portfolio with US stocks, but remember to conduct thorough research and seek professional advice to make informed investment decisions aligned with your risk tolerance and financial goals. Learn more about cross-border investing and don't miss out on the opportunity to invest in the growing US stock market.

Featured Posts

-

Chinas Automotive Market Challenges And Opportunities For Brands Like Bmw And Porsche

Apr 23, 2025

Chinas Automotive Market Challenges And Opportunities For Brands Like Bmw And Porsche

Apr 23, 2025 -

Trumps Fda Policies Positive Implications For Biotech Investment

Apr 23, 2025

Trumps Fda Policies Positive Implications For Biotech Investment

Apr 23, 2025 -

High Winds Fuel Power Outages Across Lehigh Valley

Apr 23, 2025

High Winds Fuel Power Outages Across Lehigh Valley

Apr 23, 2025 -

Millions Lost Office365 Security Failure Under Investigation

Apr 23, 2025

Millions Lost Office365 Security Failure Under Investigation

Apr 23, 2025 -

Planirajte Svoju Uskrsnu Kupovinu Otvorene Trgovine

Apr 23, 2025

Planirajte Svoju Uskrsnu Kupovinu Otvorene Trgovine

Apr 23, 2025