Canadian Tire Acquires Hudson's Bay Brand Assets For $30 Million

Table of Contents

Financial Details and Transaction Structure of the Canadian Tire Hudson's Bay Deal

The $30 million purchase price represents a relatively small investment for Canadian Tire, a company with substantial financial resources. This suggests a focus on acquiring valuable intangible assets rather than physical infrastructure. The transaction primarily involved the purchase of the Hudson's Bay Company trademark, associated logos, and potentially certain design elements crucial to the brand's identity. The payment structure, reportedly a straightforward cash transaction, ensured a swift and efficient closing. While the initial investment is relatively low, Canadian Tire may choose to invest further in marketing and revitalizing the Hudson's Bay brand to maximize its potential.

- Acquisition cost: $30 million CAD

- Payment method: Cash

- Assets acquired: Hudson's Bay Company trademark, related logos, and potentially design elements.

- Future investment: Potential for significant future marketing and brand development spending.

Strategic Rationale Behind Canadian Tire's Acquisition

Canadian Tire's acquisition of the Hudson's Bay brand assets aligns with its broader strategy of expanding its product portfolio and targeting new market segments. The motivation likely stems from several key factors:

- Enhanced Brand Portfolio Diversification: Canadian Tire's existing brand portfolio focuses primarily on automotive, home improvement, and sporting goods. The acquisition of Hudson's Bay provides access to a prestigious and established brand with a history of selling higher-end apparel and home goods.

- Access to a New Customer Demographic: Hudson's Bay's customer base tends to skew towards a higher income bracket than Canadian Tire's typical customer. This acquisition offers an opportunity to expand reach into a new demographic.

- Potential for Cross-Promotional Opportunities: The two brands, while distinct, share some overlap in customer segments. This allows for potential cross-promotion initiatives to enhance brand awareness and drive sales.

- Expansion into Higher-End Market Segments: The integration of the Hudson's Bay brand allows Canadian Tire to explore the higher-end market segment without creating a completely new brand from scratch.

Market Impact and Competitive Analysis Following the Acquisition

The "Canadian Tire Acquires Hudson's Bay Brand Assets" deal has significant implications for the competitive landscape of Canadian retail. Major department stores like Simons and Holt Renfrew might face increased competition, particularly in specific product categories. Canadian Tire's acquisition could lead to shifts in market share, impacting established players.

- Increased competition with other department stores: This intensifies the rivalry within the Canadian retail sector.

- Potential for market share gains for Canadian Tire: The integration of Hudson's Bay could lead to increased customer traffic and market share.

- Changes in pricing strategies and promotional offers: Competition may lead to adjusted pricing and promotional activities.

- Consumer Response: Consumer reactions will be key to determine the success of the integration. Brand loyalty and acceptance of the integration by Hudson's Bay customers will be crucial.

Future Implications and Potential for the Hudson's Bay Brand Under Canadian Tire

The long-term success of the integration hinges on Canadian Tire's strategic approach to leveraging the Hudson's Bay brand. Several scenarios are plausible:

- Integration of Hudson's Bay branding into select Canadian Tire stores: A phased approach might involve integrating Hudson's Bay branding into specific sections of larger Canadian Tire stores, offering a curated selection of higher-end products.

- Launch of new product lines under the Hudson's Bay brand name: Canadian Tire could use the Hudson's Bay brand to launch new product lines, leveraging the brand's reputation for quality and style.

- Expansion of the Hudson's Bay online presence: A revitalized online presence for Hudson's Bay could expand the brand's reach and attract a wider audience.

Conclusion: Analyzing the Long-Term Effects of the Canadian Tire Hudson's Bay Acquisition

The "Canadian Tire Acquires Hudson's Bay Brand Assets" deal represents a bold strategic move by Canadian Tire. The acquisition's success will depend on effective integration, leveraging the Hudson's Bay brand's heritage, and navigating the competitive retail landscape. The $30 million investment represents a significant gamble, but one with the potential to reshape the Canadian retail market. The long-term impact remains to be seen, but the potential for a successful integration is undeniably there. We encourage you to share your thoughts on this impactful acquisition and its potential implications. What are your predictions for the future of the Hudson's Bay brand under Canadian Tire's ownership? Further reading on Canadian retail mergers and acquisitions can provide additional insights into this dynamic market.

Featured Posts

-

Kya Tam Krwz Ksy Kw Dyt Kr Rhe Hyn

May 17, 2025

Kya Tam Krwz Ksy Kw Dyt Kr Rhe Hyn

May 17, 2025 -

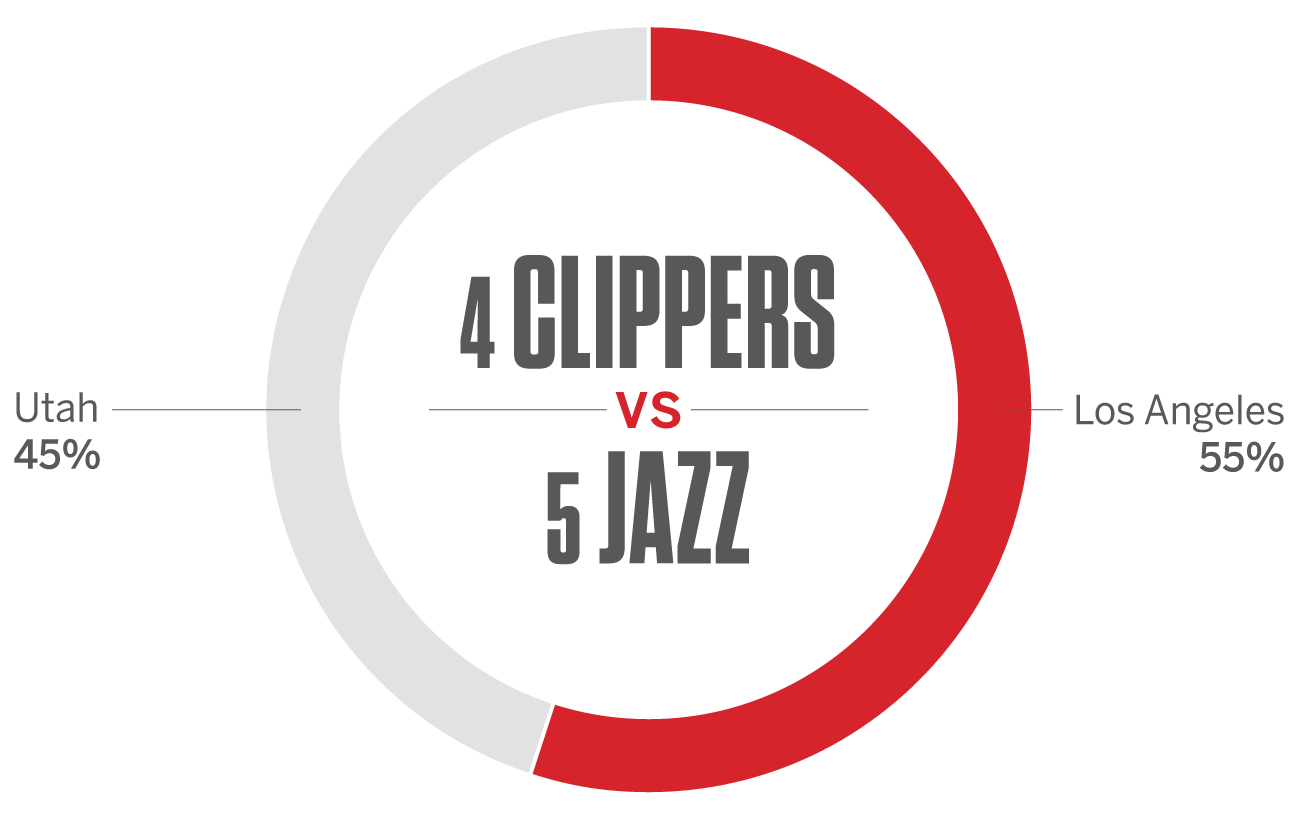

Nba Playoffs Predicting The Celtics Vs Cavaliers Matchup

May 17, 2025

Nba Playoffs Predicting The Celtics Vs Cavaliers Matchup

May 17, 2025 -

Limited Stock Boston Celtics Finals Gear Under 20

May 17, 2025

Limited Stock Boston Celtics Finals Gear Under 20

May 17, 2025 -

The Knicks Fight For Survival An Overtime Thriller

May 17, 2025

The Knicks Fight For Survival An Overtime Thriller

May 17, 2025 -

Late Goals Secure Bayern Munich Win Against Vf B Stuttgart

May 17, 2025

Late Goals Secure Bayern Munich Win Against Vf B Stuttgart

May 17, 2025