Canadians And 10-Year Mortgages: A Look At Low Adoption Rates

Table of Contents

The Perceived Risks of Long-Term Mortgage Commitments

Many Canadians hesitate to commit to a 10-year mortgage due to the perceived risks associated with such a long-term financial obligation. This apprehension stems from several key factors.

Uncertainty about future interest rates and financial situations

- Fear of high interest rates: The biggest concern is being locked into a potentially high interest rate for a full decade. If mortgage rates drop significantly during that period, borrowers will miss out on the opportunity to refinance at a lower rate.

- Job insecurity and unexpected expenses: Life is unpredictable. Job loss, illness, or unexpected major expenses can severely impact a household's ability to meet long-term mortgage payments.

- Inability to refinance: The inability to refinance a 10-year mortgage without incurring significant penalties adds to the perceived risk, especially in a volatile economic climate.

The psychological impact of a decade-long commitment can be significant. The perceived lack of flexibility contributes to a preference for shorter-term mortgages among many Canadian homeowners.

Limited Flexibility and the Penalty for Breaking the Mortgage

Committing to a 10-year mortgage significantly limits flexibility.

- High penalties: Breaking a 10-year mortgage early typically involves substantial penalties, making it a financially risky move.

- Life changes: Major life changes such as job relocation, marriage, or divorce necessitate flexibility that a 10-year mortgage may not offer. These unexpected circumstances could make maintaining the mortgage challenging.

The financial implications of early mortgage termination are substantial and act as a strong deterrent for many Canadian borrowers considering longer-term options.

The Prevalence of Shorter-Term Mortgages in Canada

The Canadian mortgage market is heavily dominated by shorter-term mortgages, primarily 5-year fixed-rate options.

The popularity of 5-year fixed-rate mortgages

- Manageable risk: Five years feels like a more manageable timeframe for many Canadians, allowing them to reassess their financial situation and mortgage rates regularly.

- Rate renegotiation: The opportunity to renegotiate rates every five years provides a sense of control and the ability to adapt to changing market conditions.

- Market familiarity: The familiarity and widespread availability of 5-year terms contribute to their popularity.

The perceived manageable risk and flexibility of 5-year terms significantly outweigh the potential long-term benefits of a 10-year mortgage for many.

The role of mortgage brokers and financial advisors in shaping consumer choices

Mortgage brokers and financial advisors play a crucial role in shaping consumer choices regarding mortgage terms.

- Influence of professional advice: Their recommendations heavily influence borrowers' decisions, often favoring shorter-term options due to perceived simplicity and reduced risk.

- Misconceptions and lack of education: Widespread misconceptions and a lack of comprehensive education on the potential benefits of longer-term mortgages contribute to the low adoption rate.

- Industry practices: Industry practices may inadvertently steer Canadians towards shorter-term options, leading to a lack of awareness regarding the potential advantages of 10-year mortgages.

A shift in industry practices towards promoting a more balanced perspective on mortgage term choices is needed to increase consumer awareness.

Potential Benefits of Choosing a 10-Year Mortgage in Canada

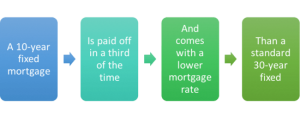

Despite the perceived risks, 10-year mortgages offer potential benefits that should not be overlooked.

Lower interest rates (potentially)

- Potential for lower rates: In certain market conditions, 10-year mortgages can offer lower interest rates compared to shorter-term options. This is because lenders often offer lower rates to incentivize longer-term commitments.

- Market conditions: The availability of lower rates depends heavily on prevailing economic conditions and market forecasts.

It's crucial to compare rates across different terms to ascertain if a 10-year mortgage offers a lower rate in the current market.

Predictability and financial stability

- Fixed payments: The predictability of fixed payments for a decade provides significant peace of mind and allows for better long-term financial planning.

- Budget certainty: Knowing your mortgage payments for ten years allows for more accurate budgeting and financial forecasting.

This predictability contributes significantly to improved long-term financial stability.

Reduced total interest paid (potentially)

- Lower rate impact: If a lower interest rate is secured with a 10-year mortgage, the total interest paid over the life of the mortgage can be lower compared to a series of shorter-term mortgages.

- Comparison is key: A thorough comparison of total interest paid over the entire amortization period is necessary to determine if a 10-year mortgage is financially advantageous.

Factors to Consider Before Choosing a 10-Year Mortgage

Before committing to a 10-year mortgage, careful consideration of several factors is crucial.

Personal financial stability and risk tolerance

- Assess financial security: A thorough assessment of personal financial security and risk tolerance is paramount. Can you confidently commit to the same mortgage payments for a decade, even with potential unforeseen circumstances?

- Risk appetite: Are you comfortable with the reduced flexibility and potential penalties associated with breaking the mortgage early?

Honest self-assessment regarding financial security and risk tolerance is essential.

The current economic climate and interest rate forecasts

- Economic outlook: Analyzing the current economic climate and interest rate forecasts is crucial for evaluating the viability of a 10-year mortgage.

- Professional advice: Seeking professional financial advice from a mortgage broker or financial advisor to help navigate the complexities of the current market is highly recommended.

Understanding current market conditions and seeking expert advice can greatly enhance the decision-making process.

Conclusion: Making Informed Decisions about Canadian 10-Year Mortgages

Choosing the right mortgage term requires a careful evaluation of personal circumstances, risk tolerance, and market conditions. While the perceived risks and the dominance of shorter-term mortgages in the Canadian market contribute to the low adoption rate of 10-year mortgages, it's crucial to recognize the potential long-term financial benefits. Understanding the potential advantages of lower interest rates, increased financial stability, and potentially reduced total interest payments is vital. Before deciding on a mortgage term, thoroughly research ten-year mortgage options, compare rates across different terms, and seek professional financial advice to determine if a 10-year mortgage aligns with your individual financial goals and risk tolerance. Choosing the right mortgage term, whether it's a 5-year or a ten-year mortgage option, is a significant financial decision demanding careful consideration and informed choices regarding long-term mortgages in Canada.

Featured Posts

-

Office365 Security Breach Millions Stolen Criminal Charges Filed

May 05, 2025

Office365 Security Breach Millions Stolen Criminal Charges Filed

May 05, 2025 -

Basel Bound Abor And Tynnas Journey From Germany

May 05, 2025

Basel Bound Abor And Tynnas Journey From Germany

May 05, 2025 -

Lizzo Concert Tickets How Much Do They Cost On The In Real Life Tour

May 05, 2025

Lizzo Concert Tickets How Much Do They Cost On The In Real Life Tour

May 05, 2025 -

Berlanga Vs Sheeraz A Clash Of Styles And National Pride

May 05, 2025

Berlanga Vs Sheeraz A Clash Of Styles And National Pride

May 05, 2025 -

Is Dope Girls A Success A Critical Review Of The War Drama

May 05, 2025

Is Dope Girls A Success A Critical Review Of The War Drama

May 05, 2025