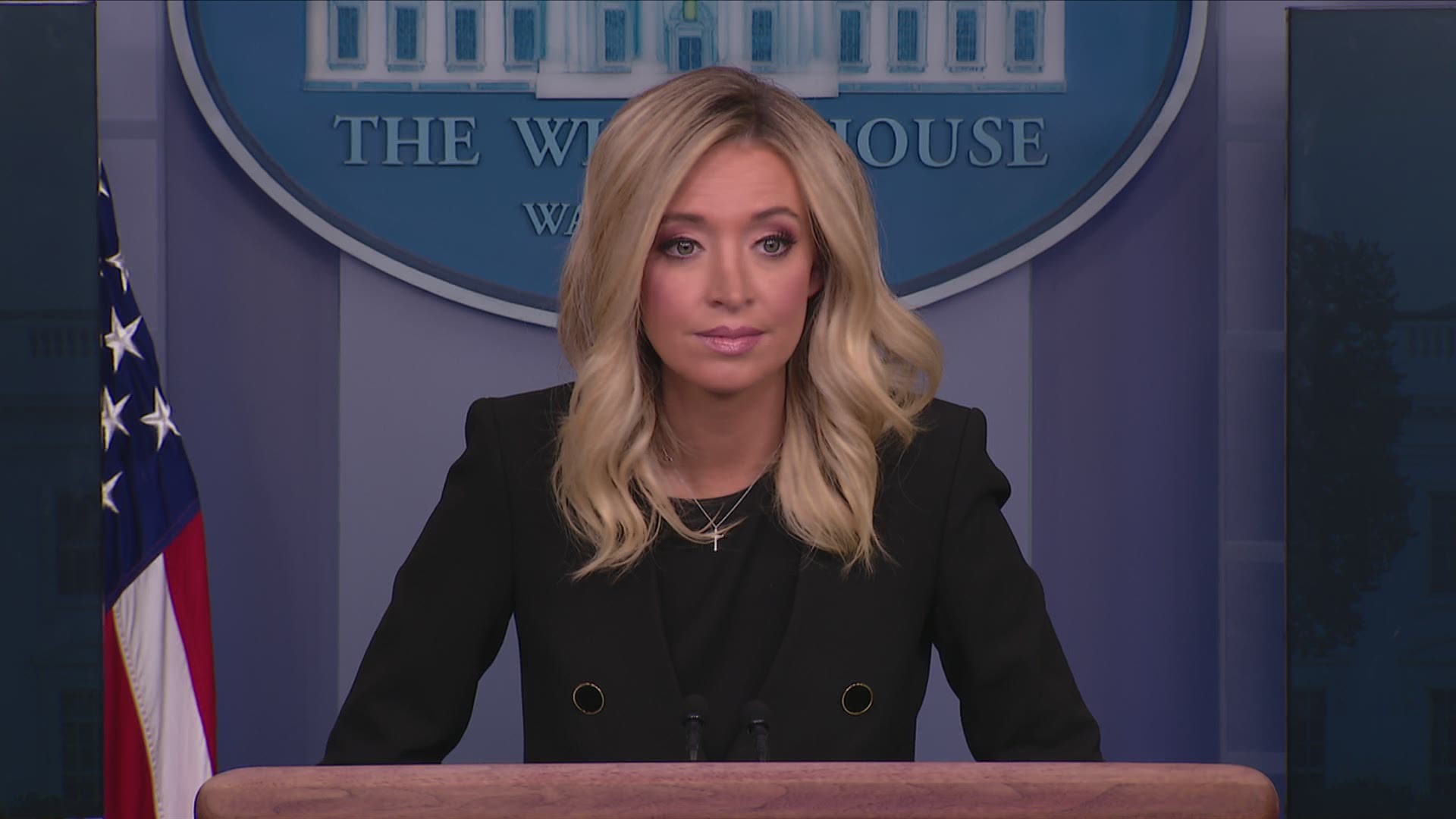

Carney's First Press Conference: A New Era For The Economy?

Table of Contents

Key Announcements and Policy Shifts from Carney's Press Conference

Carney's inaugural press conference set the tone for his governorship, outlining his approach to monetary policy and economic management. The overarching themes centered on navigating the post-financial crisis landscape, fostering sustainable economic growth, and managing inflation within the Bank's target range.

-

Specific policy changes announced: The conference may have included announcements such as adjustments to the Bank Rate (interest rate), modifications to the quantitative easing (QE) program, or changes in the forward guidance provided to markets. For example, a reduction in the Bank Rate might have signaled a belief in strengthening economic conditions, while an extension of QE could have indicated a continued need for stimulus.

-

New economic forecasts and their rationale: The Bank would have presented updated economic forecasts, outlining projected GDP growth, inflation rates, and unemployment figures. The rationale behind these forecasts would have been explained, highlighting key assumptions and potential risks. These forecasts are crucial indicators of the Bank's assessment of the economic climate.

-

Carney's overall assessment of the economic situation: Carney’s initial assessment likely ranged from cautiously optimistic to frankly concerned, depending on the prevailing economic conditions at the time. This assessment would have formed the basis for the policy decisions announced.

-

Any significant changes to the Bank's forward guidance: Forward guidance, a relatively new tool in monetary policy, aims to manage market expectations. Changes to this guidance would signal adjustments in the Bank's approach to interest rates and other policy tools in the future. Clear and effective communication is critical here.

Keywords: Monetary policy, interest rates, quantitative easing, economic forecast, forward guidance, Bank of England

Market Reaction and Investor Sentiment Following the Press Conference

The market's immediate reaction to Carney's press conference offered a crucial gauge of investor confidence and the perceived effectiveness of the announced policies. Analyzing this reaction provides insight into how the market interpreted the Governor's statements and outlook.

-

Changes in major stock indices immediately following the conference: A positive reaction would likely be reflected in increased stock prices across major indices. Conversely, a negative reaction might lead to declines.

-

Shifts in bond yields and their interpretation: Changes in bond yields reflect shifting investor expectations regarding future interest rates and economic growth. Lower yields often indicate greater investor confidence and vice-versa.

-

Changes in currency exchange rates: The pound sterling's value against other currencies would have fluctuated based on market sentiment. Strengthening or weakening of the pound would provide additional insights into the market's interpretation of the press conference.

-

Quotes from leading financial analysts about the market's reaction: Analyzing expert opinions and interpretations from reputable financial analysts provides a valuable context to understand the complex interplay of factors driving market reactions. Their insights often illuminate the subtleties missed in simple price movements.

Keywords: Market reaction, investor sentiment, stock market, bond yields, currency exchange rates, financial analysis

Long-Term Implications and Potential Economic Scenarios

The long-term consequences of the policies announced during Carney's first press conference are complex and depend on a variety of factors. Analyzing potential scenarios allows for a more comprehensive understanding of the possible outcomes.

-

Potential impacts on inflation and employment: The policies announced would likely have a direct impact on inflation and employment levels. For example, lowering interest rates might stimulate economic growth but could also lead to higher inflation if not managed effectively.

-

Risks and challenges associated with the new policy direction: Any new policy approach has inherent risks and challenges. It's crucial to acknowledge these to understand the potential for unintended consequences.

-

Potential for economic growth or recession under different scenarios: Different economic scenarios, ranging from robust growth to a potential recession, should be considered based on the success or failure of the new policy approach. A thorough risk assessment is crucial.

-

Comparison to previous economic policies and their outcomes: Comparing Carney’s approach with previous monetary policies and their results offers valuable perspective. This helps to gauge the potential effectiveness of his new direction.

Keywords: Long-term implications, economic growth, inflation, employment, economic recession, risk assessment

Conclusion

Carney's first press conference offered a glimpse into his approach to economic management. The announcements regarding interest rates, quantitative easing, and forward guidance, along with the market's reaction, suggest a cautious but proactive strategy aimed at balancing economic growth and inflation control. The long-term implications remain to be seen, but the conference undoubtedly marked a significant moment in the economic narrative.

To stay updated on the evolving economic landscape and the impact of Carney's policies, continue following news and analysis related to Carney's press conference and the Bank of England's actions. Understanding the nuances of these events is crucial for navigating the economic climate.

Keywords: Carney's press conference, economic policy, Bank of England, economic analysis, financial news.

Featured Posts

-

Corinthians Vs Santos Quem E O Favorito No Paulistao Segundo As Casas De Apostas

May 05, 2025

Corinthians Vs Santos Quem E O Favorito No Paulistao Segundo As Casas De Apostas

May 05, 2025 -

Esc 2025 Vorentscheid Heat One Wie Viele Zuschauer Sahen Zu

May 05, 2025

Esc 2025 Vorentscheid Heat One Wie Viele Zuschauer Sahen Zu

May 05, 2025 -

Nba Scoring Update Westbrook Moves Past Garnett Into Top 20

May 05, 2025

Nba Scoring Update Westbrook Moves Past Garnett Into Top 20

May 05, 2025 -

Another Simple Favor Blake Lively And Anna Kendricks Red Carpet Chemistry

May 05, 2025

Another Simple Favor Blake Lively And Anna Kendricks Red Carpet Chemistry

May 05, 2025 -

Las Vegas Golden Knights A Strong Stanley Cup Bid

May 05, 2025

Las Vegas Golden Knights A Strong Stanley Cup Bid

May 05, 2025