CFP Board CEO Announces 2026 Retirement

Table of Contents

[CEO's Name]'s Legacy and Achievements at the CFP Board

[CEO's Name]'s tenure as CEO of the CFP Board has been marked by significant achievements that have shaped the financial planning profession. Their leadership has been instrumental in strengthening the CFP certification and enhancing the public's trust in financial advisors. Key accomplishments during their time include:

-

Increased Number of CFP Professionals: Under [CEO's Name]'s leadership, the number of CFP professionals has experienced substantial growth, reflecting the increasing demand for qualified financial planners. This growth signifies a rising awareness and adoption of the CFP certification as the gold standard in financial planning.

-

Strengthened Ethical Standards: [CEO's Name] has championed efforts to reinforce the ethical standards and fiduciary duty expected of CFP professionals. This has involved updates to the Code of Ethics and Professional Responsibility, ensuring CFP certificants adhere to the highest ethical conduct.

-

Improvements to the Certification Process: The CFP certification process has been streamlined and enhanced under [CEO's Name]'s guidance, making it more efficient and accessible for aspiring financial planners. This includes improvements to the exam structure, continuing education requirements, and overall candidate experience.

-

Successful Advocacy Initiatives: The CFP Board, under [CEO's Name]'s leadership, has undertaken various advocacy initiatives to promote the value of financial planning to consumers and policymakers. This includes successful lobbying efforts to ensure favorable regulatory environments for financial professionals.

[CEO's Name]'s contributions extend beyond the CFP Board itself; their leadership has significantly benefited the financial planning profession as a whole, raising the bar for professionalism and ethical conduct. “[Insert a quote from the press release or other official statement about their legacy and accomplishments],” stated [Source].

The Search for the Next CFP Board CEO: What to Expect

The search for [CEO's Name]'s successor will undoubtedly be a thorough and rigorous process. The CFP Board will likely engage a reputable executive search firm to identify and vet potential candidates. The selection criteria will almost certainly prioritize:

-

Strong Leadership Skills: The next CEO will need to effectively manage a complex organization, navigate political landscapes, and inspire confidence among stakeholders.

-

Deep Understanding of Financial Planning: A solid grasp of financial planning principles, industry trends, and regulatory frameworks is crucial. The ideal candidate will possess a comprehensive understanding of the CFP certification and its importance within the broader financial services landscape.

-

Experience in Non-Profit Management: The CFP Board is a non-profit organization, requiring experience in managing finances, fundraising, and stakeholder relations within this specific context.

The timeline for the search and appointment is expected to [Insert timeline if available, or a reasonable speculation]. While specific candidates remain undisclosed at this stage, the Board will likely consider both internal and external candidates with proven track records in leadership and financial services.

Implications for the Future of the CFP Certification and Financial Planning

The transition in CFP Board leadership will inevitably bring about changes, albeit potentially subtle, in the organization's strategic direction. Potential implications include:

-

CFP Certification Process: While the core principles of the CFP certification are unlikely to change drastically, there might be adjustments to the continuing education requirements or exam content to reflect evolving industry trends and regulatory updates.

-

Strategic Direction of the CFP Board: The incoming CEO may bring a fresh perspective and strategic vision to the organization, potentially influencing areas such as technology adoption, advocacy efforts, and international expansion.

-

Regulatory Landscape: The CFP Board's relationship with regulatory bodies will continue to be paramount. The incoming CEO will need to effectively navigate the regulatory environment and advocate for the interests of CFP professionals.

Maintaining Public Trust and Professional Standards

Maintaining public trust in CFP professionals is paramount. During this transitional period, the CFP Board must ensure continued high ethical standards and robust enforcement mechanisms are in place. This includes continued education and resources for CFP professionals on ethical conduct, compliance, and fiduciary responsibilities, reassuring the public that CFP certificants are held to the highest standards. The CFP Board's commitment to consumer protection and upholding the fiduciary duty of financial advisors must remain unwavering.

Conclusion

The upcoming retirement of [CEO's Name] marks a significant moment for the CFP Board and the broader financial planning landscape. Their legacy of increased CFP professional numbers, strengthened ethical standards, and improvements to the certification process will be felt for years to come. The selection of their successor will be crucial in ensuring the continued growth and success of the CFP certification and the profession as a whole. The focus now shifts to a smooth transition and the appointment of a leader who can build upon the existing foundation and navigate the evolving challenges facing financial planning.

Call to Action: Stay informed about the CFP Board's CEO search and the future of financial planning by regularly visiting the CFP Board website and following their updates. Understanding the implications of this CFP Board CEO retirement is vital for all CFP professionals and those considering pursuing the CFP certification.

Featured Posts

-

Graeme Souness Picks His Best Premier League Player Ever

May 03, 2025

Graeme Souness Picks His Best Premier League Player Ever

May 03, 2025 -

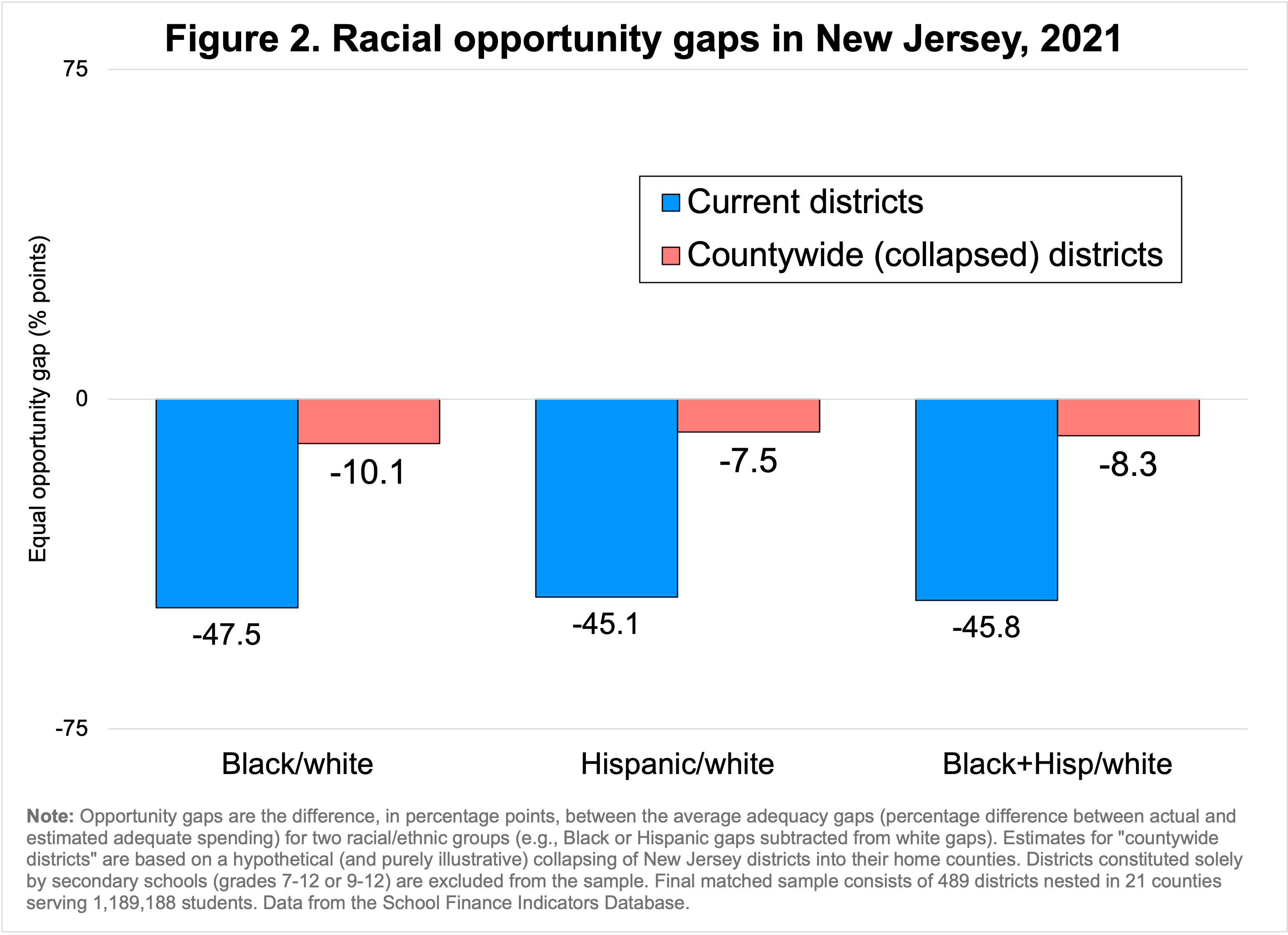

The Negative Impact Of Dividing The Keller School District

May 03, 2025

The Negative Impact Of Dividing The Keller School District

May 03, 2025 -

Analysis Tory Response To Nigel Farages Reform Party Announcement

May 03, 2025

Analysis Tory Response To Nigel Farages Reform Party Announcement

May 03, 2025 -

Lotto Results For Saturday April 12th

May 03, 2025

Lotto Results For Saturday April 12th

May 03, 2025 -

Kunjungan Presiden Erdogan Ke Indonesia 13 Kesepakatan Kerja Sama Ri Turkiye

May 03, 2025

Kunjungan Presiden Erdogan Ke Indonesia 13 Kesepakatan Kerja Sama Ri Turkiye

May 03, 2025