CFP Board CEO To Retire In Early 2026: Impact On Financial Planning

Table of Contents

The Leadership Transition at the CFP Board

The upcoming leadership transition at the CFP Board is of paramount importance. A smooth and efficient handover is crucial for maintaining the organization's stability and credibility within the financial planning industry. Finding a suitable successor who can effectively navigate the complexities of the role is a critical challenge. The next CEO will need a deep understanding of financial planning, regulatory compliance, and the intricacies of the CFP certification process. They must also possess strong leadership qualities, strategic vision, and the ability to foster collaboration among diverse stakeholders.

- Succession planning process at the CFP Board: The CFP Board's internal process for identifying and selecting the next CEO will be crucial. Transparency and a well-defined timeline are essential to build confidence.

- Timeline for appointing a new CEO: A swift yet thorough search process is necessary to minimize any disruption to ongoing initiatives. Delays could create uncertainty and potentially impact consumer confidence.

- Potential candidates and their qualifications: The ideal candidate will possess a blend of experience in financial services, leadership, and regulatory affairs. Their track record should demonstrate a commitment to ethical standards and a proven ability to manage complex organizations.

- Impact on ongoing CFP Board initiatives: The transition should not impede the CFP Board's ongoing efforts in areas such as enhancing the CFP certification process, advancing ethical standards, and advocating for the financial planning profession.

Impact on CFP Certification and Standards

The retirement of the CEO raises questions about the potential impact on the integrity and value of the CFP certification. The CEO plays a pivotal role in upholding the rigorous standards associated with the designation. Maintaining the high standards of the CFP exam, continuing education requirements, and ethical guidelines will be paramount during the transition. Any perceived slippage in standards could diminish the value of the CFP certification and erode consumer confidence in CFP professionals.

- Potential changes to the CFP certification process: While significant changes are unlikely immediately, the new CEO may bring fresh perspectives on improving the CFP certification process, potentially influencing exam content or continuing education requirements.

- Maintaining the value and prestige of the CFP designation: The CFP Board must actively work to preserve the value and prestige of the CFP mark, highlighting its importance to consumers seeking qualified financial advisors.

- Addressing any concerns about standards slippage during the transition: Open communication and proactive measures to ensure consistent standards are vital to address potential concerns and maintain public trust.

- Impact on consumer confidence in CFP professionals: Maintaining public confidence in CFP professionals hinges on the CFP Board's ability to navigate this transition effectively and assure the continued integrity of the certification.

Future Implications for the Financial Planning Profession

The CEO's retirement has broader implications for the entire financial planning industry. It creates an opportunity to reassess the profession's trajectory and prepare for future challenges. The new CEO's vision will play a significant role in shaping the CFP Board's strategic direction and influencing industry practices. Factors such as evolving regulations, technological advancements (fintech), and shifting consumer expectations will all impact the profession's future.

- Potential legislative or regulatory changes affecting financial advisors: The new leadership will need to be adept at navigating the regulatory landscape and advocating for the interests of CFP professionals.

- Emerging trends in financial planning and their impact on CFP professionals: The CFP Board must adapt to emerging trends, such as robo-advisors and personalized financial planning tools, ensuring that CFP professionals remain relevant and competitive.

- Opportunities for growth and innovation within the financial planning industry: The transition presents an opportunity to foster innovation and explore new avenues for growth within the profession.

- The role of technology and fintech in the future of financial planning: The integration of technology and fintech will likely continue to reshape the financial planning landscape, requiring adaptation from CFP professionals and the CFP Board.

Conclusion: Navigating the Future of Financial Planning Post-CEO Retirement

The retirement of the CFP Board CEO in early 2026 marks a significant turning point for the financial planning profession. A smooth leadership transition is crucial to maintaining the integrity of the CFP certification and fostering public confidence. The new CEO will need to navigate challenges and seize opportunities to ensure the continued growth and relevance of the financial planning industry. The CFP Board's ability to adapt to evolving regulations, technological advancements, and consumer expectations will determine the future success of CFP professionals and the overall financial planning landscape. Stay tuned for updates on the CFP Board's leadership transition and its impact on your financial planning career. Continue to learn more about the value of CFP certification and how it impacts your financial future. The future of financial planning depends on it.

Featured Posts

-

The 1975 And Olivia Rodrigo To Headline Glastonbury 2024

May 02, 2025

The 1975 And Olivia Rodrigo To Headline Glastonbury 2024

May 02, 2025 -

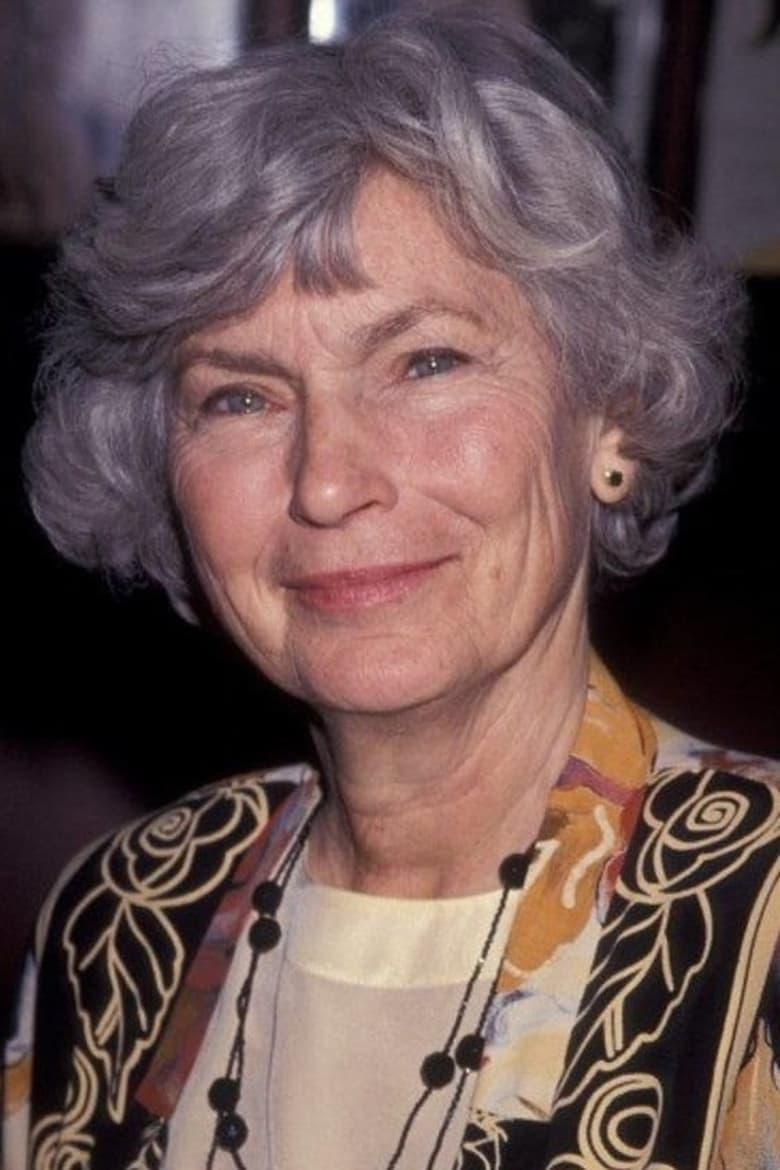

Remembering Priscilla Pointer A Century Of Stage And Screen Excellence

May 02, 2025

Remembering Priscilla Pointer A Century Of Stage And Screen Excellence

May 02, 2025 -

Camera Chaveiro Discreta Avaliacao Precos E Onde Encontrar

May 02, 2025

Camera Chaveiro Discreta Avaliacao Precos E Onde Encontrar

May 02, 2025 -

Lady Raiders Home Court Disadvantage 59 56 Loss To Cincinnati

May 02, 2025

Lady Raiders Home Court Disadvantage 59 56 Loss To Cincinnati

May 02, 2025 -

Italy Vs France Six Nations Ireland Watches On

May 02, 2025

Italy Vs France Six Nations Ireland Watches On

May 02, 2025