Chart Analysis: Bitcoin's Path To A 10x Multiplier

Table of Contents

Historical Price Analysis and Growth Patterns

Understanding Bitcoin's past performance is crucial for predicting its future. By analyzing previous bull runs, we can identify recurring patterns and assess the likelihood of a future 10x multiplier.

Identifying Past 10x (or greater) Bitcoin Price Movements

Bitcoin's history is punctuated by periods of explosive growth. Let's examine some key examples:

- 2010-2011: Bitcoin's early days saw phenomenal growth, driven by increasing awareness and early adoption.

- 2013-2014: This period witnessed a significant bull run fueled by increasing media attention and growing exchange listings.

- 2017-2018: The most significant bull run to date, marked by widespread retail investor enthusiasm and the emergence of initial coin offerings (ICOs).

These bull runs share common characteristics:

- Halving Events: The Bitcoin halving, which reduces the rate of new Bitcoin creation, often precedes periods of price appreciation.

- Regulatory Changes: Positive regulatory developments, or even the lack of overly restrictive regulations, can boost investor confidence.

- Institutional Adoption: Increased investment from large financial institutions signals growing legitimacy and fuels price increases.

- Market Sentiment and FOMO: Positive media coverage, social media hype, and fear of missing out (FOMO) contribute significantly to price momentum.

[Insert chart showcasing historical Bitcoin price action, highlighting the significant bull runs mentioned above.]

Comparing Past Cycles to Current Market Conditions

While past performance isn't indicative of future results, comparing past cycles to the current market context offers valuable insights. Current market conditions include:

- Macroeconomic Factors: High inflation in many countries is driving investors to seek alternative assets, potentially boosting Bitcoin's appeal as a hedge against inflation.

- Regulatory Landscape: While regulatory clarity varies across jurisdictions, the overall trend is towards greater acceptance and regulation, reducing uncertainty for investors.

- Institutional and Retail Adoption: Institutional adoption continues to grow, with major corporations and investment firms adding Bitcoin to their portfolios. Retail investor interest remains high, though perhaps less frenzied than in 2017.

- On-chain Metrics: Analyzing on-chain data, such as transaction volume, active addresses, and miner behavior, provides valuable insights into network activity and potential price movements. Increased on-chain activity often suggests growing demand.

Key Technical Indicators Predicting a 10x Bitcoin Multiplier

Technical analysis offers another perspective on Bitcoin's potential. Let's examine key indicators:

Moving Averages and Trendlines

Moving averages (MAs), such as the 200-day MA and 50-day MA, smooth out price fluctuations and help identify trends. Trendlines connect significant price highs and lows, offering support and resistance levels. Breakouts above resistance levels can signal significant price increases.

[Insert chart illustrating moving averages and trendlines on the Bitcoin price chart.]

Relative Strength Index (RSI) and Other Oscillators

The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Divergence between price and RSI can be a valuable predictive signal.

[Insert chart illustrating RSI and its divergence from Bitcoin's price.]

Fibonacci Retracements and Extensions

Fibonacci retracements and extensions are based on the Fibonacci sequence and identify potential support and resistance levels as well as price targets. While not foolproof, they can provide valuable insights.

[Insert chart illustrating potential Fibonacci targets for a 10x Bitcoin price increase.]

Macroeconomic Factors and Adoption Rate

Beyond technical analysis, macroeconomic conditions and adoption rates significantly impact Bitcoin's price.

Inflation and Bitcoin as a Hedge Against Inflation

High inflation erodes the purchasing power of fiat currencies, making alternative assets like Bitcoin increasingly attractive. Bitcoin's fixed supply of 21 million coins makes it a potential hedge against inflationary pressures. However, the correlation between Bitcoin's price and inflation is complex and not always direct.

Institutional Adoption and Regulatory Developments

The increasing adoption of Bitcoin by institutional investors lends credibility and reduces volatility. Positive regulatory developments, such as clear guidelines and licensing frameworks, can further boost investor confidence and price. Conversely, overly restrictive regulations can hinder growth.

Growing Global Adoption and Network Effects

As more people and businesses adopt Bitcoin, its network effect strengthens. Increased adoption leads to higher transaction volume, greater liquidity, and increased network security, all contributing to price appreciation. The growing use of Bitcoin in developing countries with unstable currencies further strengthens this trend.

Conclusion

While a 10x Bitcoin multiplier isn't guaranteed, a thorough chart analysis, combined with an understanding of macroeconomic factors and adoption rates, offers valuable insights into potential pathways. The historical analysis reveals patterns, technical indicators provide signals, and macroeconomic conditions add context to the potential price appreciation. By carefully considering these factors, investors can make more informed decisions about their Bitcoin holdings. Continue your research with further chart analysis of Bitcoin and other cryptocurrencies to better understand the evolving market landscape and navigate the path toward a potentially lucrative 10x Bitcoin multiplier.

Featured Posts

-

Andor Showrunner Hints At Rogue Ones Recut Version

May 08, 2025

Andor Showrunner Hints At Rogue Ones Recut Version

May 08, 2025 -

Merkt Marakana Barbwza Ykhsr Asnanh

May 08, 2025

Merkt Marakana Barbwza Ykhsr Asnanh

May 08, 2025 -

Uber Driver Subscription Details On The New Commission Structure

May 08, 2025

Uber Driver Subscription Details On The New Commission Structure

May 08, 2025 -

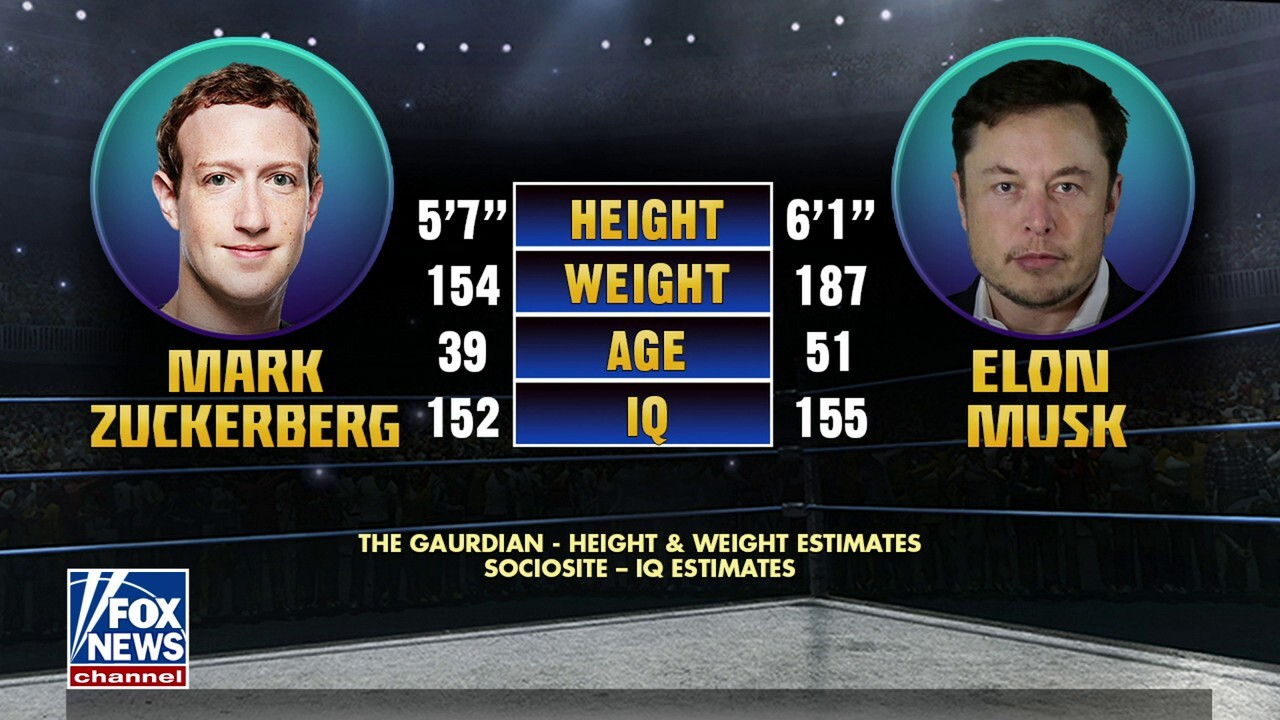

Facebook Under Trump Zuckerbergs Challenges And Opportunities

May 08, 2025

Facebook Under Trump Zuckerbergs Challenges And Opportunities

May 08, 2025 -

Kripto Para Yatirimcilari Icin Kripto Lider Detayli Analiz Ve Gelecek Tahmini

May 08, 2025

Kripto Para Yatirimcilari Icin Kripto Lider Detayli Analiz Ve Gelecek Tahmini

May 08, 2025