Check Today's Personal Loan Interest Rates And Apply Now

Table of Contents

Understanding Personal Loan Interest Rates

Personal loan interest rates represent the cost of borrowing money. Lenders charge interest as a percentage of the principal loan amount. This interest is added to your loan, increasing the total amount you repay. Understanding how interest rates work is crucial for securing the best possible deal.

A key term to understand is APR (Annual Percentage Rate). The APR represents the yearly cost of your loan, including interest and any other fees. It's a crucial factor to compare when shopping for a personal loan. Always compare APRs from different lenders, not just the stated interest rate.

Several factors influence your personal loan interest rate:

- Credit Score: This is arguably the most significant factor. A higher credit score (generally 700 or above) demonstrates creditworthiness to lenders, resulting in lower interest rates. A lower credit score often means higher rates or even loan denial.

- Loan Amount: Larger loan amounts typically carry higher interest rates due to increased risk for the lender.

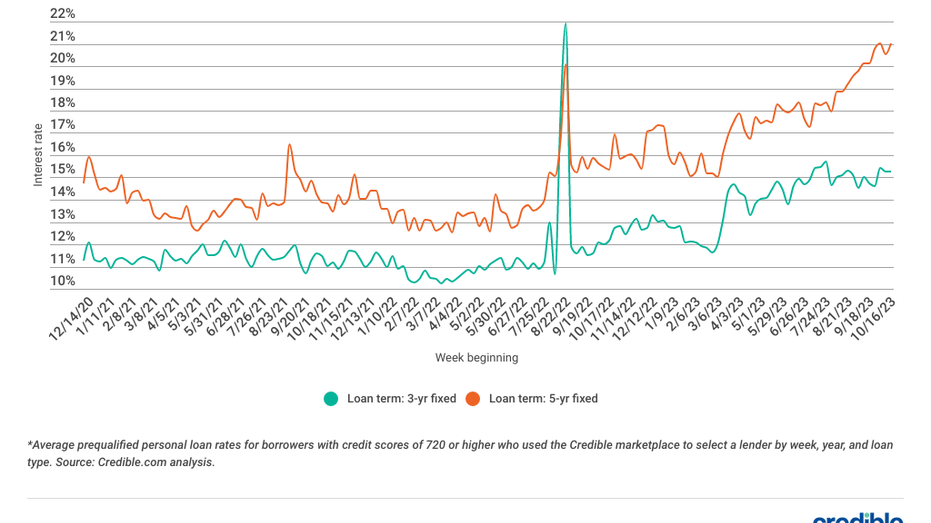

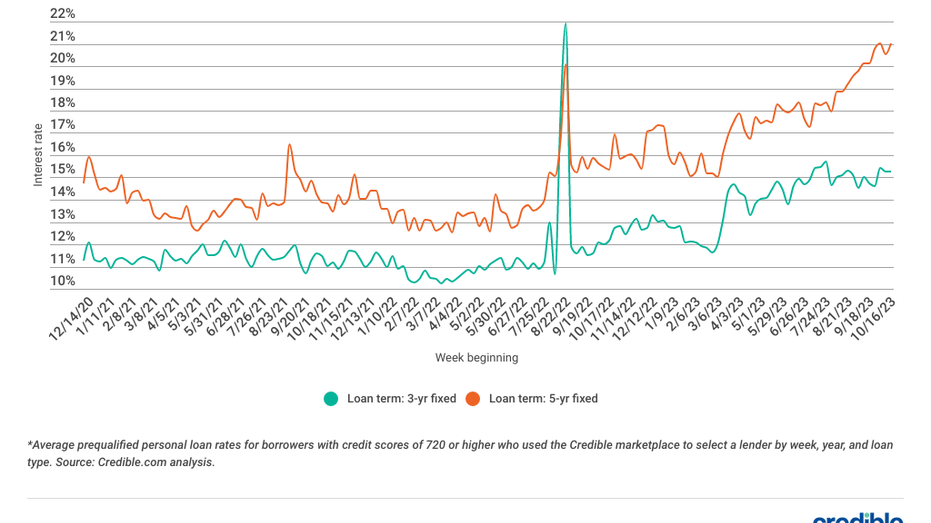

- Loan Term: The length of your loan (e.g., 12 months, 36 months, 60 months) affects your monthly payments and the total interest paid. Longer terms result in lower monthly payments but significantly higher total interest over the life of the loan.

- Interest rates fluctuate daily: Market conditions and lender policies impact rates, making it essential to check regularly for the best deals.

How to Check Today's Personal Loan Interest Rates

Checking today's personal loan interest rates is easier than ever. You can explore several avenues to find the best rates:

- Online Lenders: Many online lenders offer quick and easy pre-qualification options, providing an estimate of your potential interest rate without a hard credit pull.

- Banks and Credit Unions: Traditional banks and credit unions also offer personal loans. Their rates can vary, so it's worth comparing offers from several institutions.

- Online Comparison Tools: Numerous websites specialize in comparing personal loan rates from various lenders. These tools save you time and effort by presenting multiple offers side-by-side. This allows for easy comparison of APR and other terms.

Pre-qualification is a valuable tool. It allows you to check your eligibility without significantly affecting your credit score. This helps you shop around and compare offers before formally applying for a loan. Remember to always compare offers from multiple lenders to ensure you secure the best personal loan interest rate.

Factors to Consider Before Applying for a Personal Loan

Before committing to a personal loan, carefully consider these factors:

- Compare APRs and Fees: Don't just focus on the stated interest rate. Compare the APR, which includes all fees, to get a true picture of the loan's total cost. Watch out for origination fees, late payment fees, and prepayment penalties.

- Understand Loan Terms and Repayment Schedules: Carefully review the loan agreement, understanding the repayment schedule, including the monthly payment amount, the loan term, and the total amount you'll repay.

- Assess Your Budget and Repayment Capability: Ensure you can comfortably afford the monthly payments without jeopardizing your other financial obligations. A realistic budget is vital to avoid falling behind on payments.

- Avoid Overborrowing: Only borrow the amount you absolutely need. Avoid taking on more debt than you can handle.

Applying for a Personal Loan: A Step-by-Step Guide

Applying for a personal loan online is generally straightforward:

- Gather Required Documents: Typically, you'll need proof of income (pay stubs, tax returns), identification (driver's license, passport), and possibly bank statements.

- Complete the Application Form: Fill out the application form accurately and completely. Inaccurate information can delay the process or even result in rejection.

- Monitor the Application Status: Once submitted, keep track of the application status. Most lenders provide online portals or email updates.

- Contact the Lender if Needed: If you have questions or need clarification, don't hesitate to contact the lender.

Expect a decision within a few days to several weeks, depending on the lender and the complexity of your application.

Conclusion

Checking today's personal loan interest rates is crucial for securing affordable financing. Understanding the factors influencing rates, comparing offers from multiple lenders, and carefully reviewing loan terms before applying are all essential steps. Don't delay! Check today's personal loan interest rates and apply now to secure the best financing for your needs. Find the lowest personal loan interest rates and start your application today. Take control of your finances and secure the best personal loan for you.

Featured Posts

-

Sinners Post Ban Comeback A Hamburg Date Set

May 28, 2025

Sinners Post Ban Comeback A Hamburg Date Set

May 28, 2025 -

Jadwal Lengkap Km Lambelu Nunukan Makassar Juni 2025

May 28, 2025

Jadwal Lengkap Km Lambelu Nunukan Makassar Juni 2025

May 28, 2025 -

Nl West 2024 Dodgers And Padres Unbeaten Start

May 28, 2025

Nl West 2024 Dodgers And Padres Unbeaten Start

May 28, 2025 -

Rent Freeze Warning E3 Billion Cost To Housing Corporations

May 28, 2025

Rent Freeze Warning E3 Billion Cost To Housing Corporations

May 28, 2025 -

Chicago Med Season 10 A Twist On The 2025 One Chicago Crossover

May 28, 2025

Chicago Med Season 10 A Twist On The 2025 One Chicago Crossover

May 28, 2025