Chime Files For US IPO, Showcasing Strong Revenue Growth In Digital Banking

Table of Contents

Chime's Financial Performance: A Look at Revenue Growth and Key Metrics

Chime's IPO filing reveals a remarkable revenue growth trajectory, solidifying its position as a dominant force in digital banking. While precise figures are subject to change pending the IPO's finalization, the filing indicates substantial year-over-year increases in revenue. This robust performance is attributed to a combination of factors, including innovative features and aggressive market penetration.

- Total revenue figures for the past few years: While specific numbers are yet to be publicly released in full detail, leaked information suggests a significant upward trend, indicating substantial growth.

- Breakdown of revenue streams: Chime's revenue is likely generated from a combination of sources, including interest income on customer deposits, interchange fees from debit card transactions, and potential revenue from premium services. Further details on the exact breakdown are expected as the IPO progresses.

- Metrics demonstrating user growth and engagement: The filing highlights a rapidly expanding user base, showcasing impressive customer acquisition and retention rates. High user engagement, as measured by transaction frequency and app usage, further contributes to the company's financial strength.

- Profitability (or lack thereof): While profitability details remain to be fully disclosed, the strong revenue growth suggests that Chime is on a path towards sustained profitability, a crucial factor for attracting investors.

This impressive financial performance is driven by Chime's ability to successfully tap into the underserved market segments and offer compelling features compared to traditional banks. While specific market share figures are not yet available, Chime's rapid growth undeniably challenges the dominance of established players in the US banking sector.

The Digital Banking Landscape and Chime's Competitive Advantage

The US digital banking industry is a fiercely competitive landscape, with established players and new entrants constantly vying for market share. Competitors such as Revolut, Current, and others offer similar services, but Chime has carved out a distinct niche for itself.

- Chime's unique selling propositions (USPs): Chime's success can be attributed to several key features, including fee-free accounts, early direct deposit, and a user-friendly mobile app. These features cater specifically to the needs of a younger, tech-savvy demographic.

- Target market and demographic reach: Chime has effectively targeted younger generations and those previously underserved by traditional banking institutions, building a substantial and loyal customer base.

- Technological innovations: Chime leverages cutting-edge technology to enhance the user experience, providing seamless and efficient digital banking services. This focus on technology is a crucial differentiator in the competitive digital banking space.

- Chime's regulatory compliance and security measures: Maintaining regulatory compliance and robust security measures are paramount for a financial institution. Chime's commitment to these aspects assures customers and investors alike.

Chime differentiates itself from traditional banks by offering a superior customer experience, emphasizing convenience, accessibility, and transparency. Unlike traditional institutions with extensive branch networks and high fees, Chime prioritizes digital-first interactions and fee-free services.

Implications of the Chime IPO for the Fintech Industry

The Chime IPO has significant implications for the broader fintech sector. Its success is likely to attract further investment in the digital banking space, encouraging innovation and competition.

- Potential for attracting further investment: The successful IPO is expected to inspire more investment in digital banking startups, fueling further growth and innovation within the fintech ecosystem.

- Increased competition among digital banking providers: The entrance of Chime into the public market will intensify competition, pushing other digital banks to enhance their offerings and improve their services.

- Effect on traditional banking institutions: The success of Chime and other digital banks presents a considerable challenge to traditional banking institutions, forcing them to adapt to the changing preferences of customers.

- Future trends and innovations: Chime's success points to the growing demand for convenient, fee-free digital banking, paving the way for further innovations in areas like personalized financial management and AI-powered services.

The potential valuation of Chime’s IPO is a subject of significant speculation, reflecting the high expectations surrounding the company's future performance and the potential for significant returns for investors.

Risks and Challenges Facing Chime

While Chime's future looks promising, several risks and challenges need to be considered.

- Regulatory risks: Changes in financial regulations could significantly impact Chime's operations and profitability.

- Competition: Intense competition from both established banks and other fintech companies remains a key challenge.

- Economic downturns: Economic recessions can negatively affect consumer spending and potentially reduce Chime's revenue.

- Data security and privacy: Maintaining robust data security and protecting user privacy are crucial to maintaining customer trust.

These risks need to be carefully assessed by potential investors before making any investment decisions related to the Chime IPO.

Conclusion: The Future of Chime and Digital Banking

Chime's IPO filing signifies a pivotal moment for the US digital banking landscape. Its strong revenue growth, innovative features, and large user base are undeniably compelling. However, potential investors must carefully weigh the inherent risks before investing. Understanding the intricacies of the Chime IPO is crucial for anyone interested in participating in this dynamic sector. Stay informed about the latest developments in the Chime IPO and its impact on the future of digital banking. Learn more about the Chime IPO and its implications for the financial landscape – the future of finance may well depend on it.

Featured Posts

-

Cours Eramet 48 5 E Previsions Et Risques

May 14, 2025

Cours Eramet 48 5 E Previsions Et Risques

May 14, 2025 -

Michigan Issues Urgent Recall Of Coffee Creamer Potential For Serious Illness

May 14, 2025

Michigan Issues Urgent Recall Of Coffee Creamer Potential For Serious Illness

May 14, 2025 -

Ving Rhames Recalls Near Death Experience In First Mission Impossible Film

May 14, 2025

Ving Rhames Recalls Near Death Experience In First Mission Impossible Film

May 14, 2025 -

Alexis Kohler Nouveau Directeur General Adjoint A La Societe Generale

May 14, 2025

Alexis Kohler Nouveau Directeur General Adjoint A La Societe Generale

May 14, 2025 -

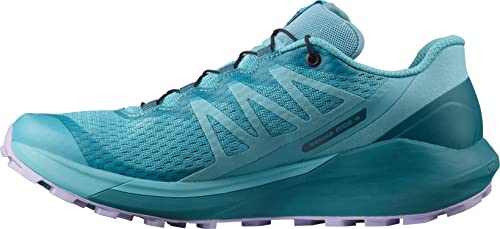

Novakove Patike Za 1 500 Evra Vrednost I Kvalitet

May 14, 2025

Novakove Patike Za 1 500 Evra Vrednost I Kvalitet

May 14, 2025