China Diversifies LPG Sources: Middle East Replaces US Amid Trade Tensions

Table of Contents

The Rise of Middle Eastern LPG Exports to China

The Middle East has rapidly become a crucial source of LPG for China. Countries like Saudi Arabia and Qatar are experiencing a surge in LPG exports, filling the gap left by the decreased imports from the US. This shift is driven by several interconnected factors:

- Increased production capacity in the Middle East: Significant investments in refinery infrastructure and petrochemical plants across the Middle East have led to a substantial increase in LPG production, creating a surplus readily available for export. Saudi Aramco, for instance, has significantly boosted its LPG production capacity, making it a major player in the global market.

- Favorable pricing and long-term contracts: Middle Eastern suppliers often offer competitive pricing and the security of long-term contracts, mitigating price volatility and supply chain disruptions that have plagued LPG imports from other regions. This predictability is highly valued by Chinese energy companies.

- Improved logistics and infrastructure for LPG transportation: Enhanced shipping routes and the development of specialized LPG carriers have streamlined the transportation of LPG from the Middle East to China, reducing costs and transit times. This improved logistics efficiency is a key factor in the rising prominence of Middle Eastern suppliers.

- Geopolitical stability (relative to other regions): Compared to some other regions, the Middle East, while not without its complexities, offers a relatively stable geopolitical environment, providing Chinese importers with a degree of assurance regarding supply consistency. This perceived stability is a significant advantage in securing long-term energy supply agreements.

Keywords: Middle East LPG exports, Saudi Arabia LPG, Qatar LPG, China LPG imports, LPG trade routes.

The Impact of US-China Trade Tensions on LPG Trade

The escalating trade war between the US and China significantly impacted the flow of LPG between the two countries. The imposition of tariffs on US LPG imports made them considerably less competitive in the Chinese market. This led to:

- Increased tariffs on US LPG imports to China: These tariffs substantially increased the cost of US LPG, making it less attractive compared to alternatives from the Middle East and other regions. This directly influenced the purchasing decisions of Chinese importers.

- Uncertainty and unpredictability in US-China trade relations: The volatile nature of the trade dispute created uncertainty about future import costs and supply reliability, prompting Chinese companies to diversify their sourcing strategies. This uncertainty pushed many away from dependence on a single supplier.

- Chinese companies seeking more reliable and stable LPG sources: Faced with trade uncertainties and escalating tariffs, Chinese energy companies actively sought out more reliable and predictable LPG suppliers, leading them towards the Middle East. This actively sought diversification was a direct response to the instability caused by US trade policy.

- Impact on Chinese energy security and pricing: The trade tensions exposed vulnerabilities in China's energy security. The diversification away from the US was not merely an economic response but also a strategic move to protect the nation's access to essential energy resources.

Keywords: US-China trade war, LPG tariffs, energy security China, China US trade relations, LPG price volatility.

China's Long-Term LPG Import Strategy and Diversification

China's response to the challenges posed by the US-China trade war has been a proactive and multi-faceted strategy for long-term LPG supply security. This involves:

- Exploration of new LPG import partners (e.g., Russia, Australia): China is actively expanding its LPG import network to include other reliable sources, such as Russia and Australia, further reducing its dependence on any single region. This approach minimizes risks associated with geopolitical instability and supply chain disruptions.

- Investment in domestic LPG production and infrastructure: China is also investing heavily in boosting its domestic LPG production capacity and strengthening its supporting infrastructure, aiming for greater energy independence. This strategy ensures self-sufficiency, which will further contribute to energy security.

- Strategic reserves to mitigate supply disruptions: China is building strategic LPG reserves to cushion against potential future supply shocks, ensuring a buffer in case of unexpected disruptions in imports. These reserves serve as a crucial safeguard to the energy security of the nation.

- Long-term contracts to ensure stable supply: Securing long-term contracts with multiple international suppliers is a core element of China's strategy, providing price stability and predictable access to LPG. These contracts are essential to maintain supply consistency in the long run.

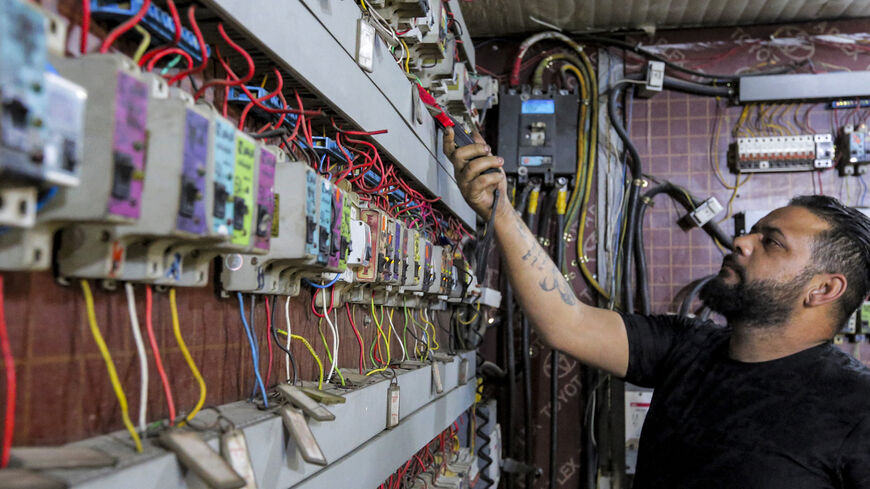

The Role of Infrastructure Development in Facilitating LPG Trade

The shift in LPG supply chains requires substantial infrastructure development to support the increased import volumes and ensure efficient distribution within China. This includes:

- Investment in new LPG import terminals in China: Significant investments are being made in the construction and expansion of LPG import terminals across China, boosting the capacity to handle the influx of LPG from diverse sources. This infrastructure is crucial to support large-scale imports.

- Expansion of pipeline infrastructure to transport LPG domestically: The existing pipeline network is being expanded to efficiently transport LPG from import terminals to consumption centers across the country. This is an essential improvement in the domestic LPG distribution network.

- Modernization of storage facilities to ensure efficient handling of LPG: China's LPG storage facilities are being modernized and expanded to handle the growing volumes efficiently and safely, ensuring the effective management and distribution of this essential fuel resource. The efficient handling of LPG is key to its success as a fuel source.

Keywords: China LPG strategy, LPG diversification, energy independence China, Russia LPG exports, Australia LPG, domestic LPG production, LPG infrastructure, China LPG infrastructure development, LPG pipelines, LPG storage, LPG terminals.

Conclusion: China's Evolving LPG Landscape and Future Prospects

China's successful diversification of its LPG sources, driven by trade tensions with the US and the pursuit of energy security, is a significant development in the global energy market. The Middle East has emerged as a crucial supplier, but China's strategy extends beyond any single region, prioritizing a resilient and diversified import portfolio. This shift underlines the importance of diversification for ensuring reliable energy supplies. For further insights into the dynamics of China's energy market and the evolving global LPG trade, follow [link to relevant resource/website/report]. Stay informed about how China diversifies LPG sources and the implications for the global energy market.

Featured Posts

-

White House Cocaine Incident Secret Service Investigation Concludes

Apr 24, 2025

White House Cocaine Incident Secret Service Investigation Concludes

Apr 24, 2025 -

Is The 77 Inch Lg C3 Oled Tv Worth It My Comprehensive Review

Apr 24, 2025

Is The 77 Inch Lg C3 Oled Tv Worth It My Comprehensive Review

Apr 24, 2025 -

Hegseths Actions Aligning With Trump Despite Signal App Debate

Apr 24, 2025

Hegseths Actions Aligning With Trump Despite Signal App Debate

Apr 24, 2025 -

A Day In The Life The Untold Story Of Chalet Girls In Europes Ski Resorts

Apr 24, 2025

A Day In The Life The Untold Story Of Chalet Girls In Europes Ski Resorts

Apr 24, 2025 -

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025