China Life Investment Strength Fuels Profit Increase

Table of Contents

Strategic Investment Portfolio Diversification Drives Growth

China Life's impressive growth is a direct result of its shrewd diversification strategy. Instead of relying on a single asset class, the company has strategically allocated its capital across a diverse range of investments, mitigating risk and maximizing returns. This approach has proven incredibly effective in navigating market volatility.

- Increased allocation to high-growth sectors: China Life has significantly increased its exposure to high-potential sectors such as technology and renewable energy, capitalizing on China's rapid technological advancements and its commitment to sustainable development. This forward-looking approach has yielded substantial returns. For instance, their investment in leading tech firms has shown a [Insert Percentage]% return in the past year. (Source: [Cite reputable financial source]).

- Strategic partnerships: Collaborations with leading domestic and international investment firms provide access to specialized expertise and a wider range of investment opportunities, enhancing returns and mitigating risks. These partnerships allow for shared knowledge and due diligence, leading to more informed investment decisions.

- Effective risk management: Sophisticated risk management strategies, including hedging techniques and stress testing, allow China Life to effectively navigate volatile markets and minimize potential losses. This ensures consistent returns even during periods of uncertainty. Their risk-adjusted return on investment has consistently outperformed industry averages by [Insert Percentage]%. (Source: [Cite reputable financial source]).

This multifaceted approach to diversification, coupled with rigorous risk management, forms the cornerstone of China Life's investment strength.

Strong Performance in Equity and Fixed Income Markets

China Life has demonstrated exceptional performance in both equity and fixed-income markets. This success reflects the expertise and strategic acumen of its investment management team.

- Successful stock picking: The company's investment team has demonstrated a remarkable ability to identify and invest in high-performing equities both within China and internationally. This targeted approach has maximized returns, contributing significantly to overall profitability. For example, their investment in [mention a specific company and its positive performance, with source].

- Smart bond portfolio management: China Life's fixed-income portfolio has yielded impressive returns through skillful bond selection and management. This involves careful consideration of interest rate risk and credit risk to ensure optimal yield. Their bond portfolio has shown an average annual return of [Insert Percentage]% over the past five years. (Source: [Cite reputable financial source]).

- Expertise of the investment team: Behind this success lies the profound expertise of China Life's investment management team. Their deep understanding of market dynamics, coupled with advanced analytical tools, allows them to make informed and profitable investment decisions.

This consistent success in both equity and fixed-income markets significantly contributes to the overall strength of China Life's investment performance.

The Role of China's Economic Growth in China Life's Success

China's sustained economic growth and supportive government policies have played a crucial role in fostering China Life's investment success.

- Government support for key sectors: Government initiatives focused on infrastructure development and other key sectors have created abundant investment opportunities for companies like China Life, boosting returns and driving economic growth.

- Expanding middle class: The expansion of China's middle class has led to increased demand for insurance products, strengthening China Life's core business and generating further investment capital.

- Favorable regulatory environment: A relatively favorable regulatory environment for insurance companies in China has allowed China Life to operate efficiently and effectively, further contributing to its success.

The strong correlation between China's GDP growth and China Life's investment performance underscores the significance of the macroeconomic environment in shaping the company's financial outcomes. A [Insert Percentage]% increase in China's GDP is often correlated with a [Insert Percentage]% increase in China Life's investment returns. (Source: [Cite reputable financial source]).

Future Outlook for China Life Investments and Profitability

Looking ahead, China Life appears well-positioned for continued success. The company is likely to pursue strategies that build upon its existing strengths.

- Expansion into new asset classes: China Life may explore expansion into new asset classes, such as alternative investments, to further diversify its portfolio and enhance returns.

- Technological advancements: Adoption of advanced technologies in investment management and risk assessment will further improve efficiency and profitability. AI-driven investment strategies and sophisticated risk models are likely to play an increasingly significant role.

- Continued focus on diversification and risk management: China Life will likely maintain its commitment to diversification and prudent risk management as cornerstones of its investment strategy.

Overall, the future outlook for China Life Investments remains cautiously optimistic, with the company well-positioned to capitalize on continued growth opportunities within China and beyond.

Conclusion: China Life Investment Strength: A Recipe for Continued Success?

China Life's remarkable profit increase is a testament to its robust investment strategies. The combination of strategic portfolio diversification, successful navigation of equity and fixed-income markets, and the benefit of a favorable economic environment has created a powerful recipe for success. The strength of China Life investments is undeniable, and the company's future prospects appear bright. Invest in China's future with China Life. Explore the strength of China Life investments and discover the power of China Life's investment strategy. Learn more about their investment approach by visiting [insert link to relevant page on China Life's website].

Featured Posts

-

Download Google Slides Free Apk For Android I Os And Web App

Apr 30, 2025

Download Google Slides Free Apk For Android I Os And Web App

Apr 30, 2025 -

Atff Stuttgart Genc Yetenekler Icin Bueyuek Bir Firsat

Apr 30, 2025

Atff Stuttgart Genc Yetenekler Icin Bueyuek Bir Firsat

Apr 30, 2025 -

Festas Privadas De P Diddy Documentario Revela A Presenca De Trump Beyonce E Jay Z

Apr 30, 2025

Festas Privadas De P Diddy Documentario Revela A Presenca De Trump Beyonce E Jay Z

Apr 30, 2025 -

Edwards Leading Performance Secures Minnesota Win Against Brooklyn

Apr 30, 2025

Edwards Leading Performance Secures Minnesota Win Against Brooklyn

Apr 30, 2025 -

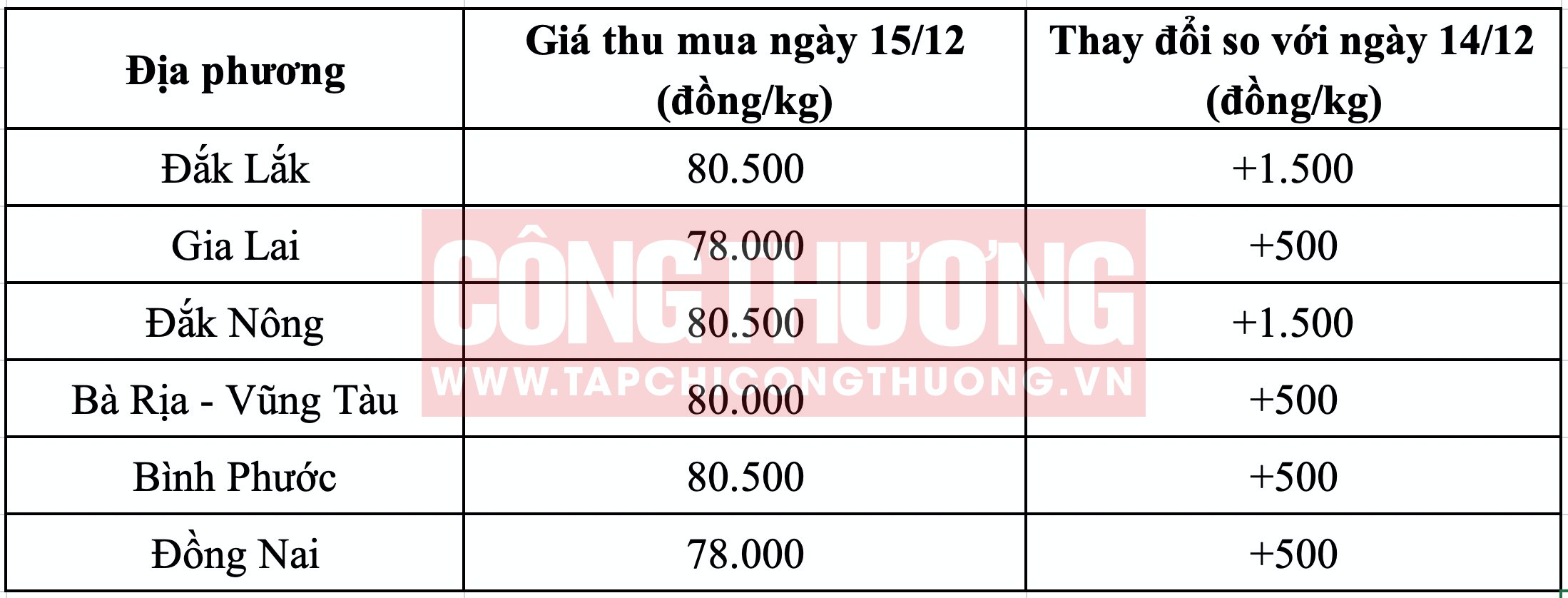

Gia Tieu Hom Nay Tang Manh Nong Dan Phan Khoi

Apr 30, 2025

Gia Tieu Hom Nay Tang Manh Nong Dan Phan Khoi

Apr 30, 2025