China Life's Financial Strength: Rising Profits And Stable Investments

Table of Contents

Rising Profitability at China Life

China Life's impressive financial performance is largely due to a confluence of factors, resulting in significantly increased profitability. This growth is fueled by robust premium income, enhanced operational efficiency, and shrewd strategic investments.

Record-Breaking Premiums and Revenue Growth

The expansion of China's middle class and a growing awareness of the importance of insurance have significantly boosted China Life's premium income. This surge is reflected in impressive growth across various insurance sectors.

- Life Insurance: Significant increases in life insurance premiums driven by increased demand for long-term financial security and wealth protection planning.

- Health Insurance: A notable rise in health insurance premiums, reflecting growing health concerns and the expanding need for comprehensive healthcare coverage.

- Geographic Expansion: Strategic expansion into underserved regions across China has unlocked new markets and contributed significantly to revenue diversification.

- Successful Product Launches: The introduction of innovative and competitive insurance products tailored to specific market needs has attracted a wider customer base.

Enhanced Operational Efficiency and Cost Management

China Life's commitment to operational excellence has played a vital role in boosting profit margins. The company has implemented several key strategies to streamline processes and reduce costs.

- Digital Transformation: The adoption of advanced technologies has automated many processes, reducing manual labor and improving efficiency.

- Streamlined Claim Processes: Improvements in claim processing have led to faster settlements and reduced administrative costs.

- Strategic Partnerships: Collaborations with technology providers and other industry players have optimized operational flows and cost structures.

- Rigorous Risk Management: Proactive risk management strategies have minimized potential losses and protected profitability.

Strategic Investments Driving Profitability

China Life's investment portfolio is carefully curated to maximize returns while mitigating risk. Smart investment decisions have significantly contributed to the company's overall profitability.

- Government Bonds: A significant portion of the investment portfolio is allocated to low-risk government bonds, providing stability and consistent returns.

- Real Estate Development: Strategic investments in prime real estate projects across China have generated substantial returns.

- Blue-Chip Stocks: Investments in well-established companies have contributed to capital appreciation and dividend income.

- High ROI Projects: Focused investments in high-return projects within the infrastructure and technology sectors have significantly boosted profitability.

Stable and Diversified Investment Portfolio

China Life's financial strength is further bolstered by its exceptionally stable and diversified investment portfolio, reflecting a commitment to long-term value creation and risk mitigation.

A Low-Risk Approach to Investment

China Life prioritizes capital preservation and long-term stability, adopting a cautious approach to investment management.

- Government Bonds (High Allocation): A substantial portion of the investment portfolio is allocated to government bonds, minimizing exposure to market volatility.

- Conservative Equity Investments: Equity investments are carefully selected, focusing on established companies with strong fundamentals.

- Diversification across Asset Classes: The portfolio is diversified across various asset classes, including bonds, equities, and real estate, reducing overall risk.

Geographic Diversification for Stability

China Life's investment strategy includes geographic diversification, spreading risk across multiple regions and minimizing exposure to localized economic downturns.

- Investments across Major Chinese Cities: Investments are spread across major Chinese cities, mitigating the impact of regional economic fluctuations.

- International Investments (Strategic): Measured international investments further diversify risk and access new opportunities.

Adapting to Market Volatility

China Life actively monitors market conditions and adjusts its investment strategy to navigate economic uncertainty.

- Dynamic Asset Allocation: The company employs dynamic asset allocation strategies, adjusting the portfolio's composition in response to market changes.

- Stress Testing and Scenario Planning: Robust stress testing and scenario planning help to anticipate and manage potential risks.

Future Outlook and Growth Potential for China Life

China Life's future looks bright, with significant growth potential driven by the expanding Chinese insurance market and strategic initiatives.

Opportunities in the Expanding Chinese Market

China's aging population and rising demand for financial products present lucrative opportunities for China Life.

- Growing Demand for Retirement Planning: The increasing number of retirees necessitates robust retirement planning solutions.

- Rising Health Insurance Needs: Growing health awareness translates into higher demand for health insurance products.

- Expansion into Rural Markets: Further penetration into underserved rural markets offers significant growth potential.

Technological Advancements and Digital Transformation

China Life is leveraging technological advancements to enhance efficiency, improve customer experience, and drive future growth.

- Digital Platforms and Mobile Applications: The company is investing heavily in digital platforms to enhance customer engagement and service delivery.

- Artificial Intelligence (AI) and Machine Learning: AI and Machine Learning are being integrated to optimize processes, improve risk assessment, and personalize customer interactions.

Conclusion

China Life's impressive financial performance, characterized by rising profits and a robust, stable investment portfolio, showcases a strong commitment to strategic management and long-term value creation. The company's resilience, coupled with the immense growth potential within the Chinese insurance market, positions it for continued success. Invest in China Life's strength; explore China Life's profitable investments and understand China Life's stable financial future by visiting their investor relations page for detailed financial reports.

Featured Posts

-

Dallas And Carrie Actress Priscilla Pointer Dies Aged 100

May 01, 2025

Dallas And Carrie Actress Priscilla Pointer Dies Aged 100

May 01, 2025 -

Seven Upcoming Carnival Cruise Line Announcements

May 01, 2025

Seven Upcoming Carnival Cruise Line Announcements

May 01, 2025 -

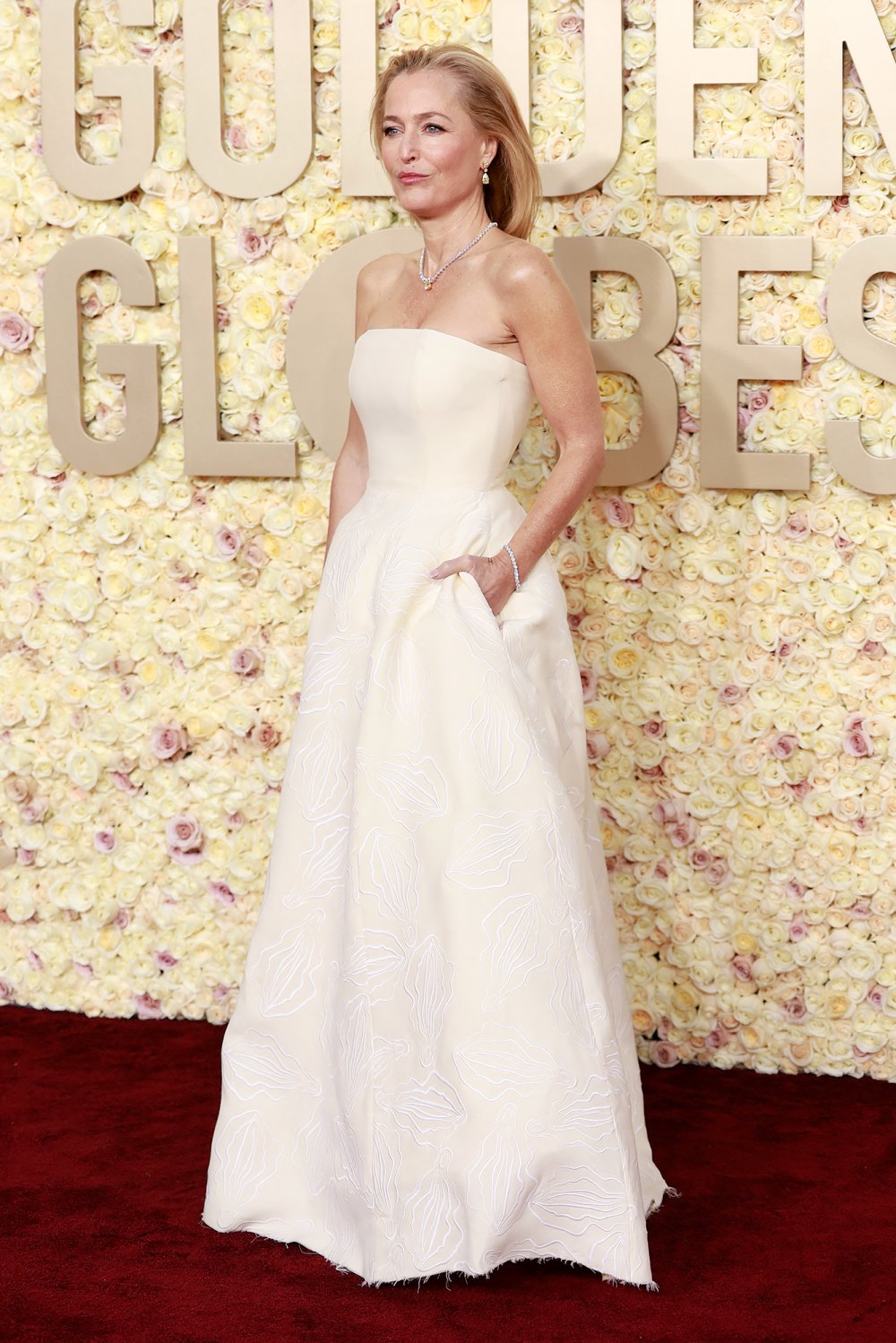

X Files Gillian Andersons Return And Unexpected Anxiety

May 01, 2025

X Files Gillian Andersons Return And Unexpected Anxiety

May 01, 2025 -

Michael Jordan Fast Facts And Key Stats

May 01, 2025

Michael Jordan Fast Facts And Key Stats

May 01, 2025 -

Tabung Baitulmal Sarawak Pemberian Bantuan Asnaf Mencapai Rm 36 45 Juta Laporan Mac 2025

May 01, 2025

Tabung Baitulmal Sarawak Pemberian Bantuan Asnaf Mencapai Rm 36 45 Juta Laporan Mac 2025

May 01, 2025