China's Growth Model At Risk: The Impact Of Rising Tariffs

Table of Contents

Disruption of Global Supply Chains

China's integration into global supply chains has been a key driver of its economic success. However, rising tariffs significantly disrupt these established networks, leading to widespread economic consequences.

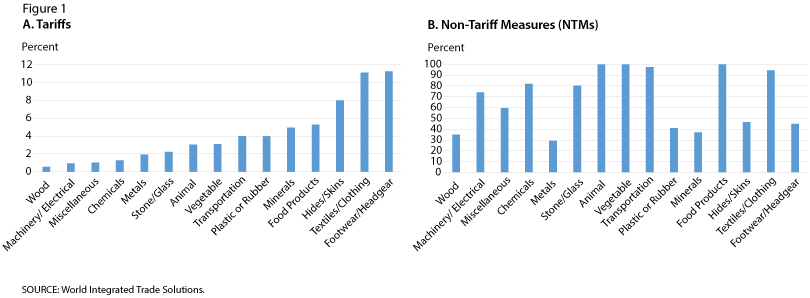

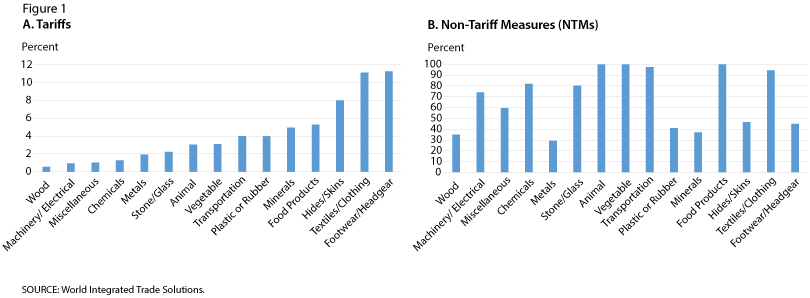

Impact on Manufacturing Exports

Rising tariffs directly increase the cost of Chinese goods in international markets. This reduced price competitiveness affects export-oriented manufacturers significantly.

- Reduced demand from major markets like the US and EU: Higher prices make Chinese products less attractive to consumers in these key markets, leading to decreased demand and potential production cutbacks.

- Increased production costs leading to price hikes: Manufacturers face increased costs in navigating tariff barriers, often passing these costs on to consumers through higher prices. This further reduces competitiveness.

- Potential for job losses in export-dependent industries: Decreased demand and reduced profitability can lead to factory closures and job losses, particularly in sectors heavily reliant on exports to tariff-imposing countries.

Reliance on Global Trade

China's growth model is intrinsically linked to its participation in global trade. Tariffs introduce significant friction into this system, creating delays, uncertainty, and increased costs for businesses.

- Difficulties sourcing raw materials and intermediate goods: Tariffs can impact the cost and availability of essential raw materials and components needed for manufacturing, leading to production bottlenecks.

- Increased logistics costs due to trade barriers: Navigating trade barriers adds complexity and expense to the supply chain, leading to increased shipping costs, longer lead times, and administrative burdens.

- Shifting of production to other countries to avoid tariffs: Businesses may relocate manufacturing operations to countries outside the scope of the tariffs to maintain competitiveness, potentially impacting China's manufacturing base.

Domestic Economic Slowdown

The impact of rising tariffs extends beyond export-oriented industries, significantly impacting domestic economic growth.

Reduced Consumer Spending

Higher prices on imported goods, a direct consequence of tariffs, lead to reduced consumer spending and a slowdown in domestic consumption, a major pillar of China's economic growth.

- Inflationary pressures impacting household budgets: Tariffs contribute to inflationary pressures, squeezing household budgets and limiting consumer spending power.

- Decline in consumer confidence impacting retail sales: Uncertainty and higher prices can negatively impact consumer confidence, leading to a decline in retail sales and overall economic activity.

- Government intervention needed to stimulate domestic demand: The Chinese government may need to implement significant fiscal and monetary policies to counteract the negative effects on consumer spending and stimulate domestic demand.

Investment Uncertainty

Tariffs create an environment of uncertainty for both foreign and domestic investors, potentially discouraging investment in China.

- Risk aversion by foreign investors seeking alternative locations: Increased uncertainty and potential for further tariff increases deter foreign direct investment (FDI), as investors seek more stable investment destinations.

- Decreased capital inflows impacting infrastructure projects: Reduced investment can impact large-scale infrastructure projects and economic development initiatives reliant on capital inflows.

- Impact on overall economic growth through reduced investment: A decrease in overall investment significantly impacts economic growth, potentially leading to slower GDP expansion.

Geopolitical Implications

The imposition of tariffs has far-reaching geopolitical implications, impacting international relations and global power dynamics.

Strained US-China Relations

Rising tariffs exacerbate existing tensions between the US and China, creating a climate of uncertainty and impacting bilateral trade relations.

- Escalation of trade wars and retaliatory measures: Tariffs often trigger retaliatory measures, escalating trade tensions and potentially harming global economic stability.

- Impact on global economic stability and cooperation: Strained relations between major economic powers create uncertainty and negatively affect global economic cooperation.

- Increased risk of further geopolitical tensions: Economic disputes can escalate into broader geopolitical tensions, creating instability in the international system.

Shift in Global Power Dynamics

The impact of tariffs could trigger a realignment of global power dynamics, potentially accelerating the rise of other economic powers.

- Increased diversification of global supply chains away from China: Businesses may seek to diversify their supply chains, reducing reliance on China and potentially impacting its manufacturing dominance.

- Growth of other regional economic blocs and trade agreements: The impact of tariffs may encourage the growth of alternative regional economic blocs and trade agreements, potentially challenging China's economic influence.

- Potential for a more multipolar global economy: A shift away from China's central role in global trade could contribute to a more multipolar global economy with a more balanced distribution of power.

Conclusion

Rising tariffs pose a serious threat to China's established growth model, impacting its global trade relationships, domestic economy, and geopolitical standing. The disruption of supply chains, reduced consumer spending, and investor uncertainty all contribute to a challenging economic landscape. Understanding the multifaceted impact of these tariffs is crucial for navigating the evolving global economic order. To avoid further deterioration, China needs to adapt its growth model by diversifying its export markets, bolstering domestic consumption, and fostering innovation. The future of China's economy hinges on effectively addressing the challenges posed by China's growth model and the impact of rising tariffs. Careful analysis of China's growth model in the face of these rising tariffs is essential for both China and the global economy.

Featured Posts

-

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 22, 2025

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 22, 2025 -

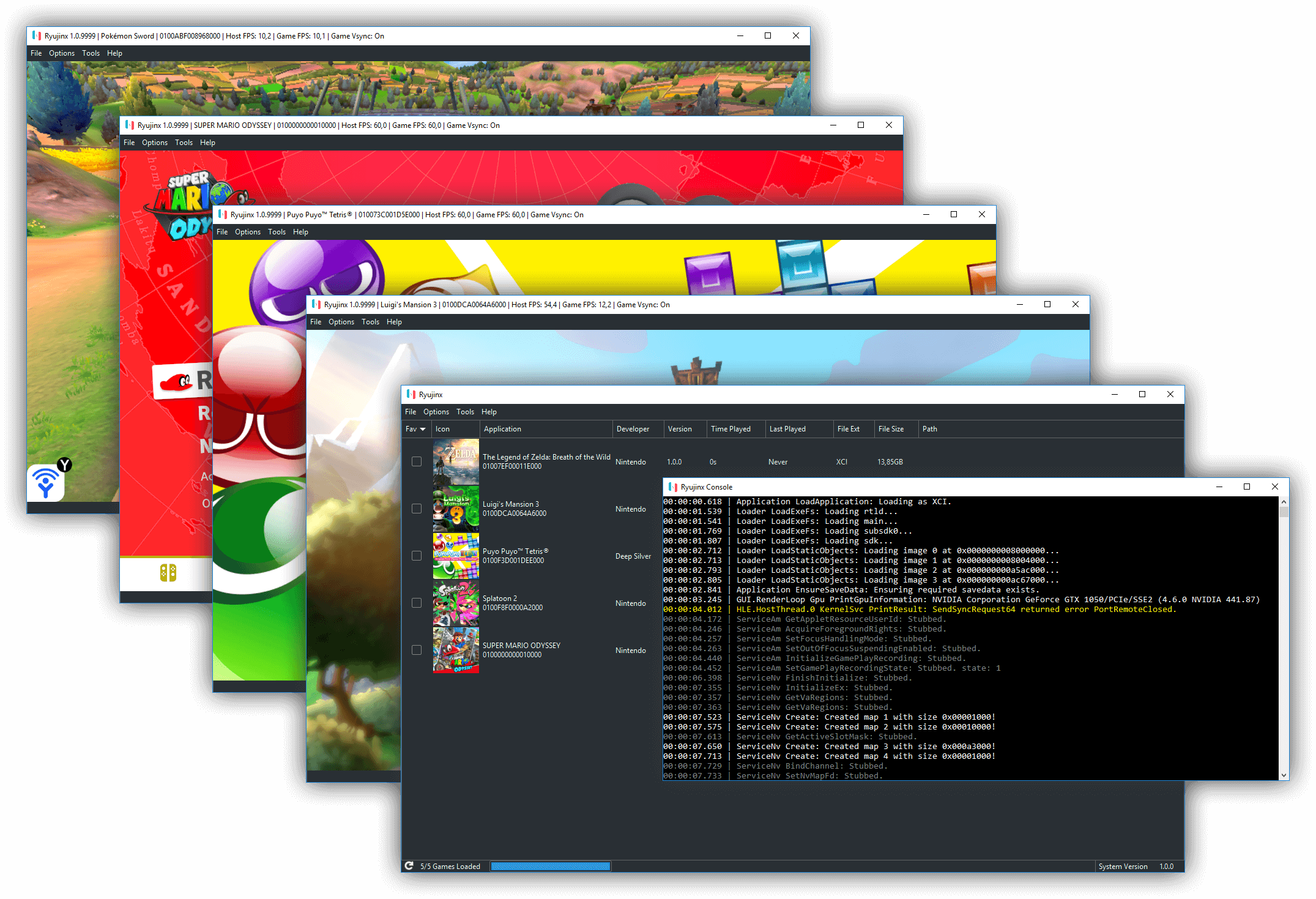

Ryujinx Emulator Development Halted Nintendo Contact Confirmed

Apr 22, 2025

Ryujinx Emulator Development Halted Nintendo Contact Confirmed

Apr 22, 2025 -

Saudi Aramco And Byd A New Ev Technology Partnership

Apr 22, 2025

Saudi Aramco And Byd A New Ev Technology Partnership

Apr 22, 2025 -

Who Will Bear The Cost Of Trumps Economic Policies

Apr 22, 2025

Who Will Bear The Cost Of Trumps Economic Policies

Apr 22, 2025 -

Vehicle Subsystem Malfunction Delays Blue Origin Launch

Apr 22, 2025

Vehicle Subsystem Malfunction Delays Blue Origin Launch

Apr 22, 2025