China's Lithium Export Restrictions: A Potential Windfall For Eramet?

Table of Contents

The Global Lithium Market and China's Dominance

China currently holds a commanding position in the lithium processing and refining sector. Its dominance is not merely a matter of production volume; it’s a strategic control over the entire supply chain. The global demand for lithium-ion batteries is skyrocketing, fueled by:

- The rapid expansion of the electric vehicle (EV) market: Governments worldwide are incentivizing EV adoption, leading to exponential growth in battery demand.

- The growing need for large-scale energy storage: Renewable energy sources like solar and wind power require efficient energy storage systems, further driving lithium demand.

This heavy reliance on China creates significant supply chain vulnerabilities. A disruption in Chinese lithium exports can trigger price spikes and shortages, impacting the entire global EV and renewable energy sectors. According to recent reports, China accounts for approximately [insert statistic]% of global lithium processing and [insert statistic]% of global lithium exports. This dominance highlights the precariousness of the current global lithium market.

China's Export Restrictions: Implications for the Global Market

China's recent lithium export restrictions represent a significant development with far-reaching consequences. While the specifics of these restrictions may vary, their overall impact is clear:

- Price increases: Reduced supply inevitably leads to higher prices, impacting the cost of EVs and energy storage systems.

- Supply shortages: The global market faces a potential shortage of refined lithium, delaying EV production and hindering renewable energy projects.

- Increased geopolitical tensions: China's actions highlight the geopolitical risks associated with relying on a single dominant supplier for critical raw materials.

The response from other lithium-producing countries has been varied, with some increasing their production capacity to address the shortfall, while others grapple with the challenges of scaling up their operations to meet the growing global demand. This creates both opportunities and challenges for companies like Eramet.

Eramet's Strategic Positioning and Potential Gains

Eramet, with its significant lithium operations strategically located outside of China, is well-positioned to benefit from this disruption. The company's existing infrastructure and production capacity offer a compelling alternative to the previously dominant Chinese supply chain.

- Diversified geographic footprint: Eramet’s mines are located in regions less susceptible to geopolitical risks, providing a reliable and stable source of lithium.

- Expanding production capacity: Eramet is actively investing in expanding its lithium production and refining capabilities, aiming to meet the growing global demand.

- Sustainable lithium production: Eramet focuses on environmentally responsible and sustainable mining practices, appealing to increasingly ESG-conscious consumers and investors.

By leveraging its strategic advantages and focusing on sustainable practices, Eramet has the potential to significantly increase its market share and revenue, capitalizing on the void left by China's reduced exports.

Risks and Challenges for Eramet

While the opportunity for Eramet is substantial, several challenges remain:

- Increased competition: Other lithium producers are also expanding their operations, leading to increased competition in the market.

- Lithium price volatility: Lithium prices are notoriously volatile, creating uncertainty for businesses operating in this sector.

- Regulatory hurdles and environmental concerns: Obtaining permits and navigating environmental regulations can be complex and time-consuming. Addressing the environmental and social impact of lithium mining is crucial for long-term sustainability.

Conclusion: Will China's Lithium Export Restrictions Benefit Eramet? A Call to Action

China's lithium export restrictions present a significant disruption to the global lithium market, creating both challenges and substantial opportunities. Eramet, with its strategic geographic location, expanding production capacity, and commitment to sustainable practices, is exceptionally well-positioned to capitalize on this shift. The potential windfall for Eramet is significant, offering prospects for substantial revenue growth and increased market share. To learn more about Eramet's activities in the lithium market and stay informed about the evolving global lithium landscape, visit their website and follow their investment news. Understanding the future of lithium and its geopolitical implications is crucial for investors and businesses alike. Consider Eramet stock as a potential investment opportunity within this rapidly growing and evolving market.

Featured Posts

-

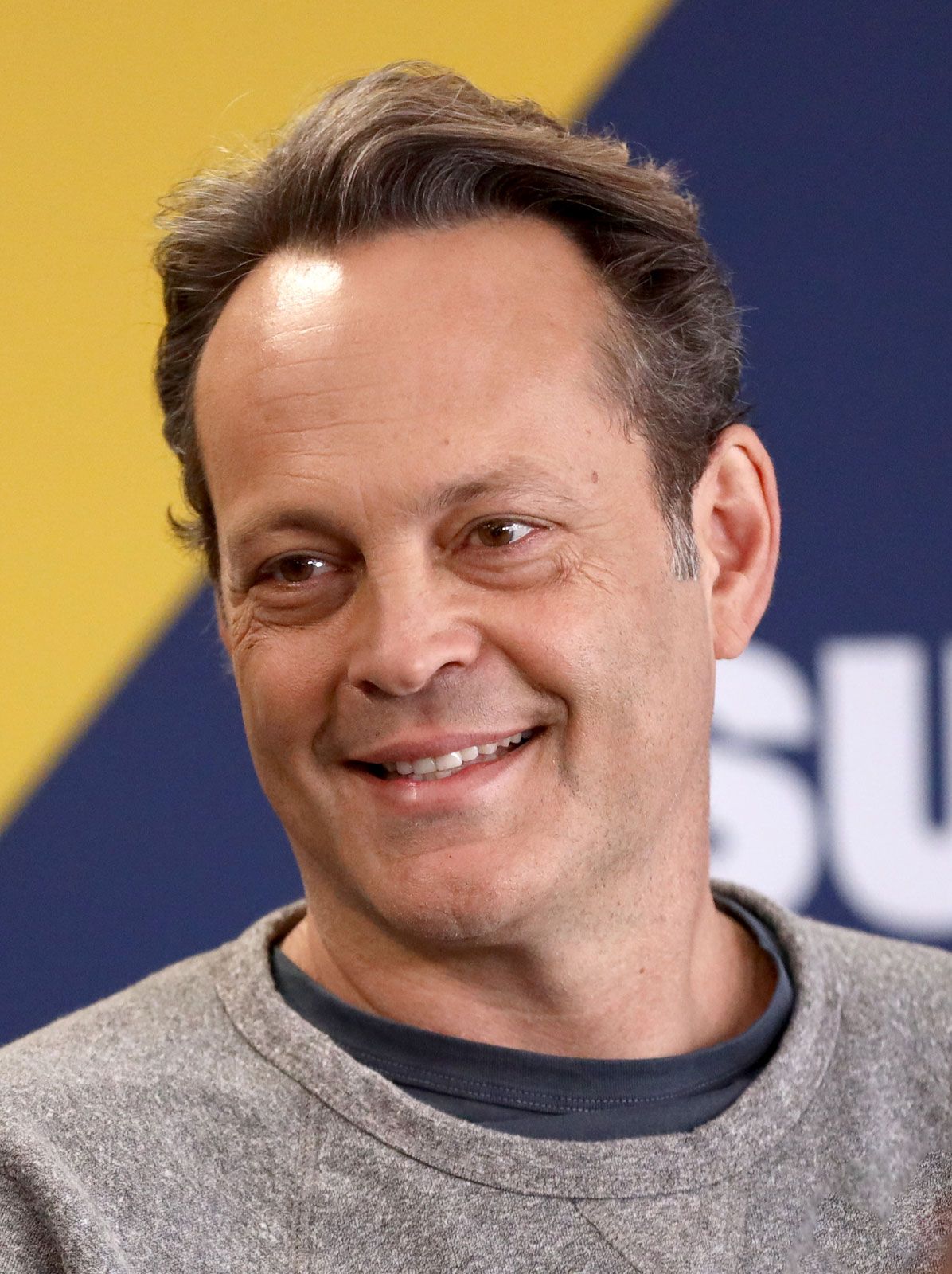

First Look Nonna Trailer Showcases Vince Vaughns New Netflix Film

May 14, 2025

First Look Nonna Trailer Showcases Vince Vaughns New Netflix Film

May 14, 2025 -

Tommy Furys Revelation Molly Mae Hague Fans React

May 14, 2025

Tommy Furys Revelation Molly Mae Hague Fans React

May 14, 2025 -

Trafico Ilegal De Armas Republica Dominicana Como Puente Entre Ee Uu Y Haiti

May 14, 2025

Trafico Ilegal De Armas Republica Dominicana Como Puente Entre Ee Uu Y Haiti

May 14, 2025 -

Ted The Animated Series New Voices Same Hilarious Ted

May 14, 2025

Ted The Animated Series New Voices Same Hilarious Ted

May 14, 2025 -

Federer Honorary Starter At The 24 Hours Of Le Mans

May 14, 2025

Federer Honorary Starter At The 24 Hours Of Le Mans

May 14, 2025