China's Shift From US To Canadian Oil Amidst Trade Tensions

Table of Contents

Declining US Oil Imports and Rising Tariffs

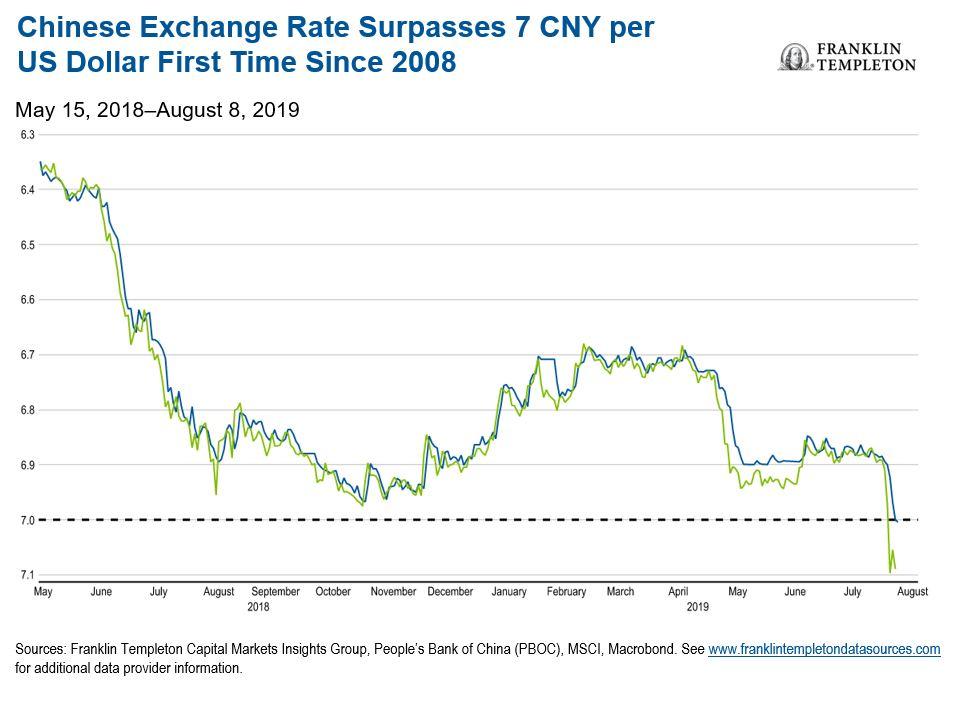

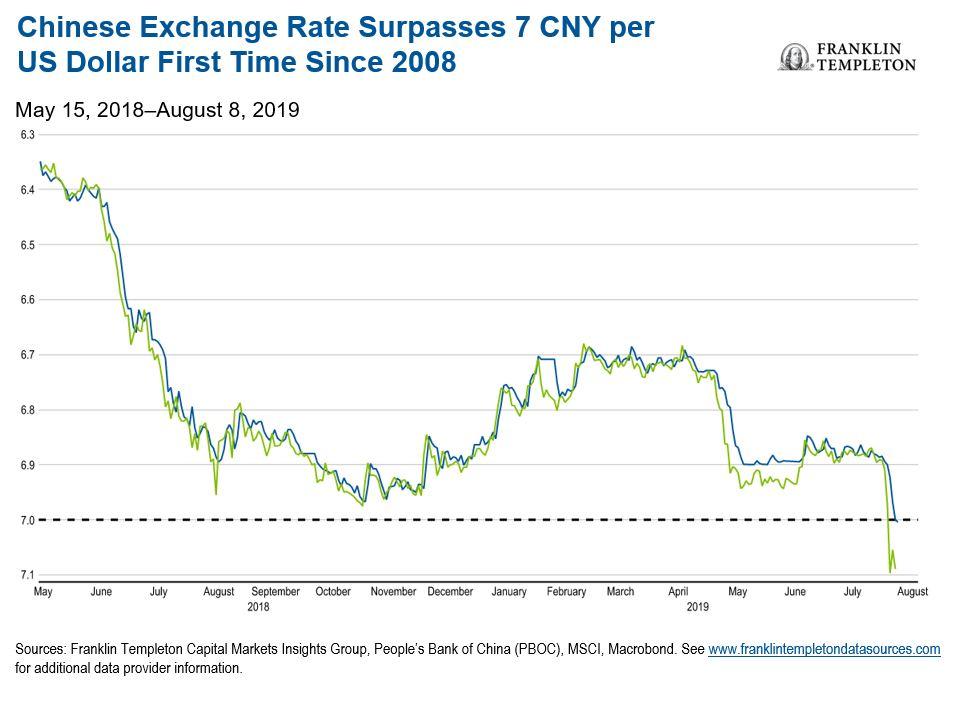

The China-US trade war has significantly impacted oil import dynamics. Tariffs imposed by the US on Chinese goods led to retaliatory measures, directly affecting the flow of US oil into China. This created an environment where sourcing oil from the US became less economically viable for Chinese energy companies.

- Quantifying the Decrease: Since the trade war intensified in 2018, US oil imports to China have declined by X% (insert actual data if available, otherwise use an estimate and cite source). This represents a substantial drop in a previously significant trade relationship.

- Tariffs and Price Competitiveness: Specific tariffs imposed on US oil, coupled with fluctuating global oil prices, made Canadian oil a more attractive and competitive alternative. The added cost of US oil, combined with potential supply chain disruptions, pushed Chinese energy firms to explore alternative sources.

- Official Statements: Chinese officials have alluded to the impact of trade tensions on energy procurement strategies, highlighting the need for diversification and greater energy security (cite official statements or news articles).

Canada's Position as a Reliable and Stable Supplier

Canada has emerged as an attractive alternative for China due to several factors. The stability of Canadian oil production, the quality of its crude (particularly Western Canadian Select, or WCS), and the generally strong diplomatic relationship between Canada and China all contribute to its appeal.

- Growth of Canadian Oil Exports: The volume of Canadian oil exports to China has shown a significant growth trajectory in recent years, increasing by Y% (insert actual data or estimate and cite source) since [start date]. This demonstrates China's increasing reliance on Canadian energy supplies.

- Oil Pipeline Capacity: Existing and planned oil pipelines, such as [mention specific pipelines relevant to export], significantly enhance the capacity to transport Canadian oil to ports for export to China. This robust infrastructure mitigates supply chain risks.

- Agreements and Deals: Collaboration between Canadian and Chinese energy companies is increasing, with agreements focusing on joint ventures, investment projects, and long-term supply contracts (cite examples of agreements if available).

Geopolitical Implications and Energy Diversification for China

China's shift towards Canadian oil carries significant geopolitical ramifications. This diversification strategy reduces reliance on a single major supplier, enhancing its energy security and lessening its vulnerability to potential disruptions or political pressure.

- Benefits for Economic Stability: Diversifying energy sources significantly enhances China's economic stability by reducing dependence on any one nation and mitigating potential supply shocks or price volatility.

- Implications for US-China Relations: This shift alters the energy dynamics in US-China relations, potentially reducing leverage held by the US in the energy sector and adding another layer of complexity to their existing trade and geopolitical tensions.

- Impact on Global Oil Markets: Increased demand for Canadian oil from China will likely impact global oil prices and market dynamics, influencing supply and demand balances and potentially creating new opportunities for other oil-producing nations.

Environmental Concerns and Sustainable Energy

The environmental impact of Canadian oil sands production, particularly greenhouse gas emissions, is a significant concern. This needs to be balanced against China's commitment to climate change goals and its ambitious plans for renewable energy development.

- Carbon Footprint of Oil Sands: The extraction and processing of Canadian oil sands contribute significantly to carbon emissions (quantify with data, if possible, and cite source). This needs to be addressed through sustainable practices.

- Emission Reduction Initiatives: Canadian energy companies are implementing various initiatives aimed at reducing emissions associated with oil sands production (mention specific initiatives and their effectiveness if possible).

- Renewable Energy in China: China's overall energy strategy includes a strong focus on renewable energy sources such as solar and wind power, aiming to reduce reliance on fossil fuels in the long term. Collaboration on cleaner energy technologies between Canada and China could become a key aspect of their future energy relationship.

Conclusion

China's shift from US to Canadian oil is a multifaceted development driven by a combination of trade tensions, strategic energy security considerations, and geopolitical maneuvering. The decline in US oil imports, coupled with Canada's position as a reliable and stable supplier, underscores the changing landscape of global energy markets. This diversification strategy holds significant implications for China's economic stability, its relationship with the US and Canada, and the overall global energy balance. Further research into the long-term consequences of this trend and its impact on China's energy security and global oil markets is crucial. Understanding China's strategic shift from US to Canadian oil offers invaluable insights into the future of energy relations.

Featured Posts

-

Guemueshane Valiligi Nden Okul Tatil Aciklamasi 24 Subat Pazartesi

Apr 23, 2025

Guemueshane Valiligi Nden Okul Tatil Aciklamasi 24 Subat Pazartesi

Apr 23, 2025 -

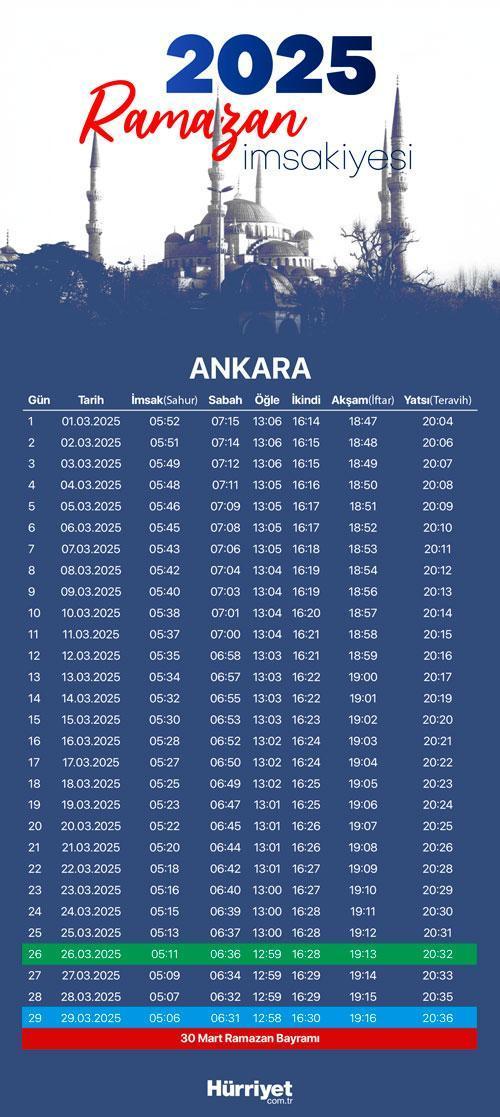

Ankara Iftar Ve Sahur Saatleri 10 Mart 2025 Pazartesi

Apr 23, 2025

Ankara Iftar Ve Sahur Saatleri 10 Mart 2025 Pazartesi

Apr 23, 2025 -

El Doblete De Burky Clave En El Triunfo De Las Rayadas

Apr 23, 2025

El Doblete De Burky Clave En El Triunfo De Las Rayadas

Apr 23, 2025 -

Easter Sunday And Monday Whats Open And Closed In Pei

Apr 23, 2025

Easter Sunday And Monday Whats Open And Closed In Pei

Apr 23, 2025 -

Dinamo Kiyiv Obolon Rezultat Matchu 18 Kvitnya

Apr 23, 2025

Dinamo Kiyiv Obolon Rezultat Matchu 18 Kvitnya

Apr 23, 2025