Claim Your HMRC Refund: A Guide To Checking Your Payslip

Understanding Your Payslip: Key Components for HMRC Refund Claims

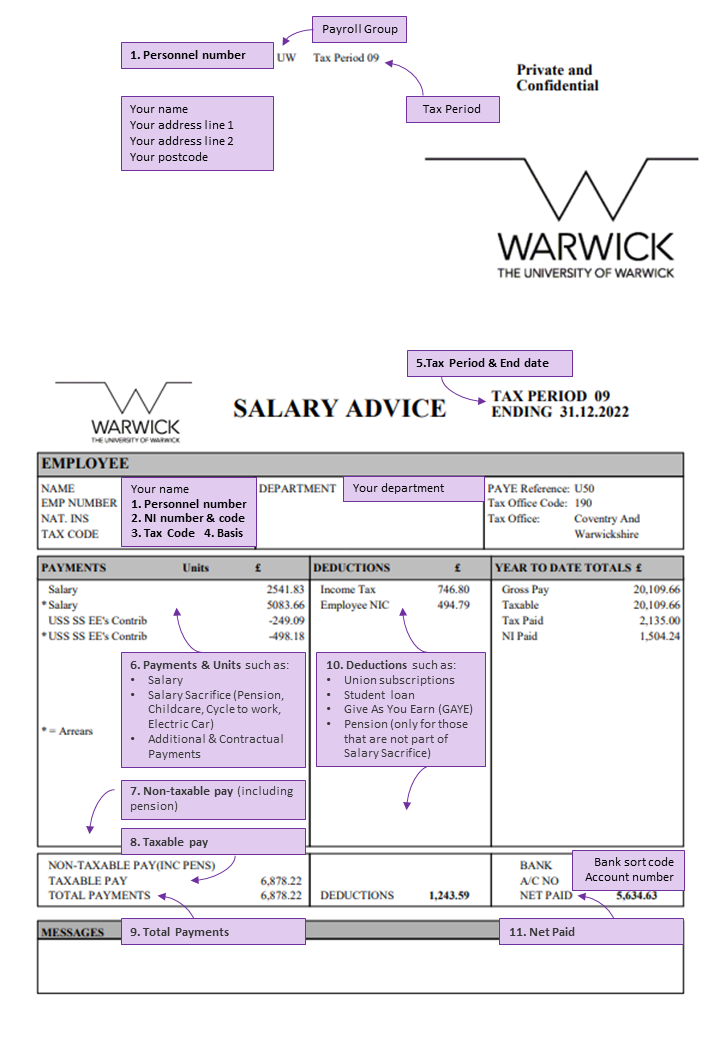

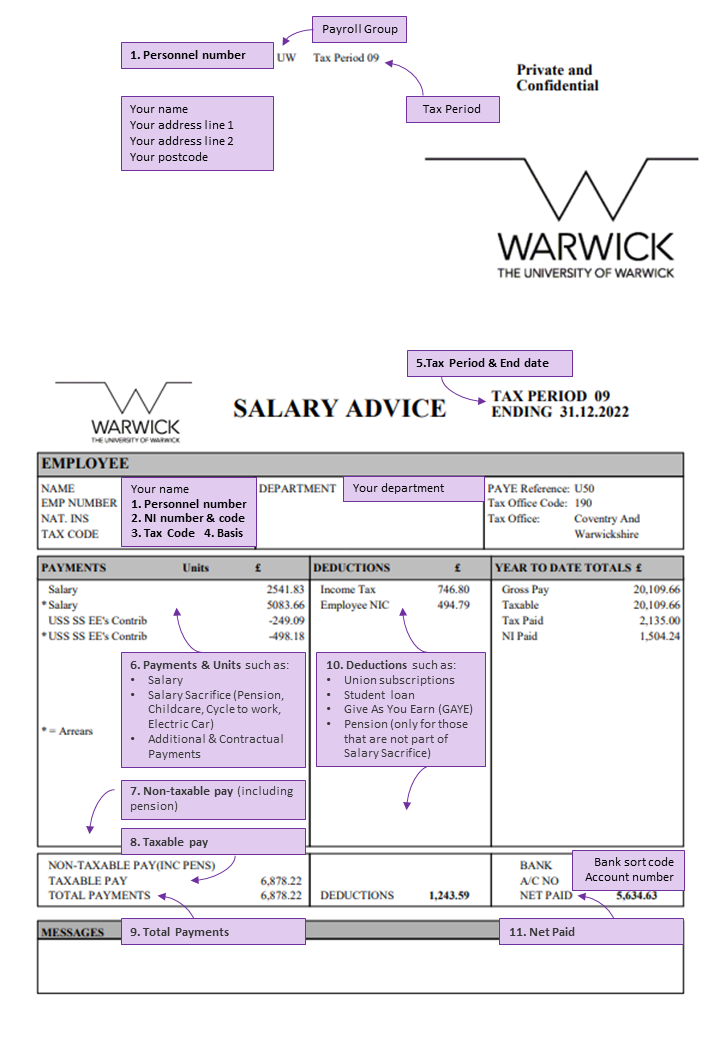

Your payslip is more than just a record of your earnings; it's a crucial document for understanding your tax liability. Several key components directly relate to your HMRC tax contributions and potential for a tax refund. Let's break them down:

- Gross Pay: This is your total earnings before any deductions are made. It's the foundation for calculating your tax and National Insurance contributions.

- Net Pay: This is your take-home pay – the amount you actually receive after all deductions (tax, National Insurance, student loan repayments, etc.) have been applied.

- Tax Deducted (PAYE): This represents the amount of Income Tax deducted from your gross pay under the Pay As You Earn (PAYE) system. This is the primary area to focus on when checking for potential overpayments.

- National Insurance Contributions: These contributions fund the UK's social security system. While not directly related to income tax refunds, understanding this deduction provides a complete picture of your earnings and deductions.

- Student Loan Repayments (if applicable): If you have a student loan, this section will show the amount deducted from your pay each month towards your repayment plan.

- Tax Code: Your tax code is a crucial piece of information that determines the amount of Income Tax deducted from your pay. Understanding your tax code is essential to ensure your tax is calculated correctly. Incorrect tax codes are a common reason for overpayment and subsequent HMRC tax refunds.

Identifying Potential Overpayments on Your Payslip

Analyzing your payslip for potential tax overpayments requires careful examination. Here's how to spot the signs:

- Compare your payslip's tax deductions with your expected tax liability: Use online tax calculators or consult a tax advisor to estimate your expected tax liability based on your income and personal circumstances. Any significant discrepancies could indicate an overpayment.

- Look for discrepancies between your tax code and your actual tax deducted: An incorrect tax code can lead to significant overpayment. Check your payslip regularly for consistency and report any inaccuracies to HMRC promptly.

- Check for any unusual deductions or adjustments: Unexpected deductions or adjustments on your payslip warrant further investigation. Contact your employer or HMRC to clarify any unusual entries.

- Consider the impact of any changes in your personal circumstances during the tax year: Significant life events like marriage, changes in employment status, or becoming a higher-rate taxpayer can affect your tax liability. These changes might not be immediately reflected in your tax code, resulting in overpayment.

Using Your P60 to Verify Your Tax Contributions

Your P60, received annually after the end of the tax year, provides a summary of your gross pay and tax deductions for that year. It acts as an important verification tool. Compare the information on your P60 to the information across all your payslips from that tax year. Any discrepancies could signal a potential overpayment that you can claim back as an HMRC tax refund.

How to Claim Your HMRC Refund

Claiming your HMRC refund is straightforward through the HMRC online portal. Here's how:

- Gather necessary information: You'll need your payslips, P60, and National Insurance number.

- Access the HMRC online portal: Log in using your Government Gateway account. If you don't have one, you'll need to create one.

- Complete the online claim form: Fill out the form accurately and completely, ensuring all information is correct.

- Keep a record of your claim: Maintain records of your claim submission and any correspondence you have with HMRC. This is crucial for tracking your claim's progress.

Conclusion

Checking your payslip for potential HMRC refunds is a simple yet potentially lucrative process. By understanding the key components of your payslip, identifying potential discrepancies, and utilizing the HMRC online services, you can effectively claim any tax overpayments. Don't delay! Check your payslips today and claim your rightful HMRC refund. Learn more about understanding your payslip and claiming your tax rebate by visiting the official HMRC website.

Affaire Aramburu Point Sur La Traque Des Suspects Neo Nazis

Affaire Aramburu Point Sur La Traque Des Suspects Neo Nazis

Public Works Ministry Awards 6 Billion In Coastal And River Defense Contracts

Public Works Ministry Awards 6 Billion In Coastal And River Defense Contracts

Mainz Henriksen Following In The Footsteps Of Klopp And Tuchel

Mainz Henriksen Following In The Footsteps Of Klopp And Tuchel

Sabalenka Triumphs In Madrid Open Opener

Sabalenka Triumphs In Madrid Open Opener

Jennifer Lawrence Desmente Rumores De Segundo Filho Com Aparicao Recente

Jennifer Lawrence Desmente Rumores De Segundo Filho Com Aparicao Recente