Climate Risk And Your Home Loan: How Rising Temperatures Could Impact Your Credit Score

Table of Contents

How Climate Change Impacts Property Values

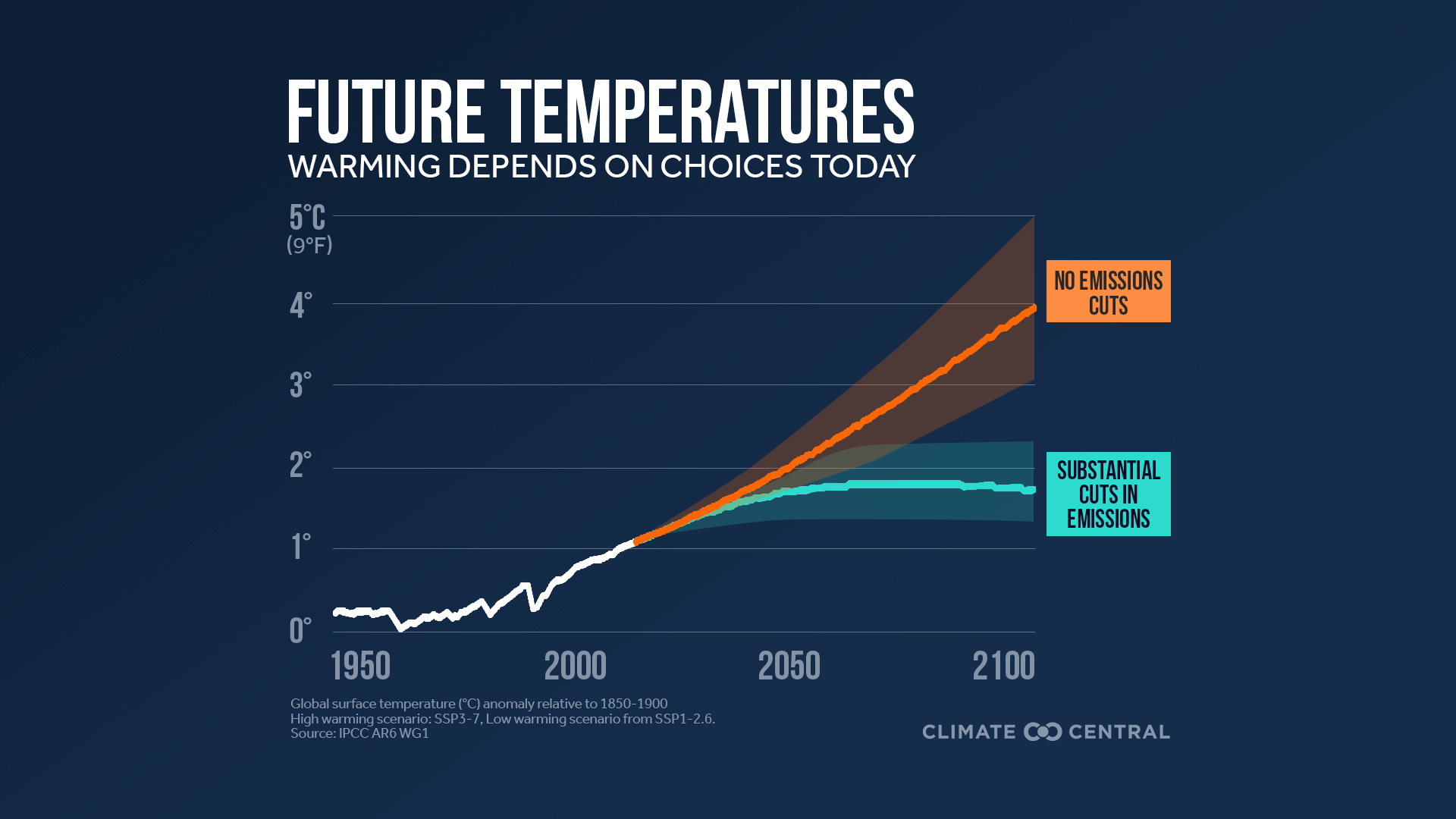

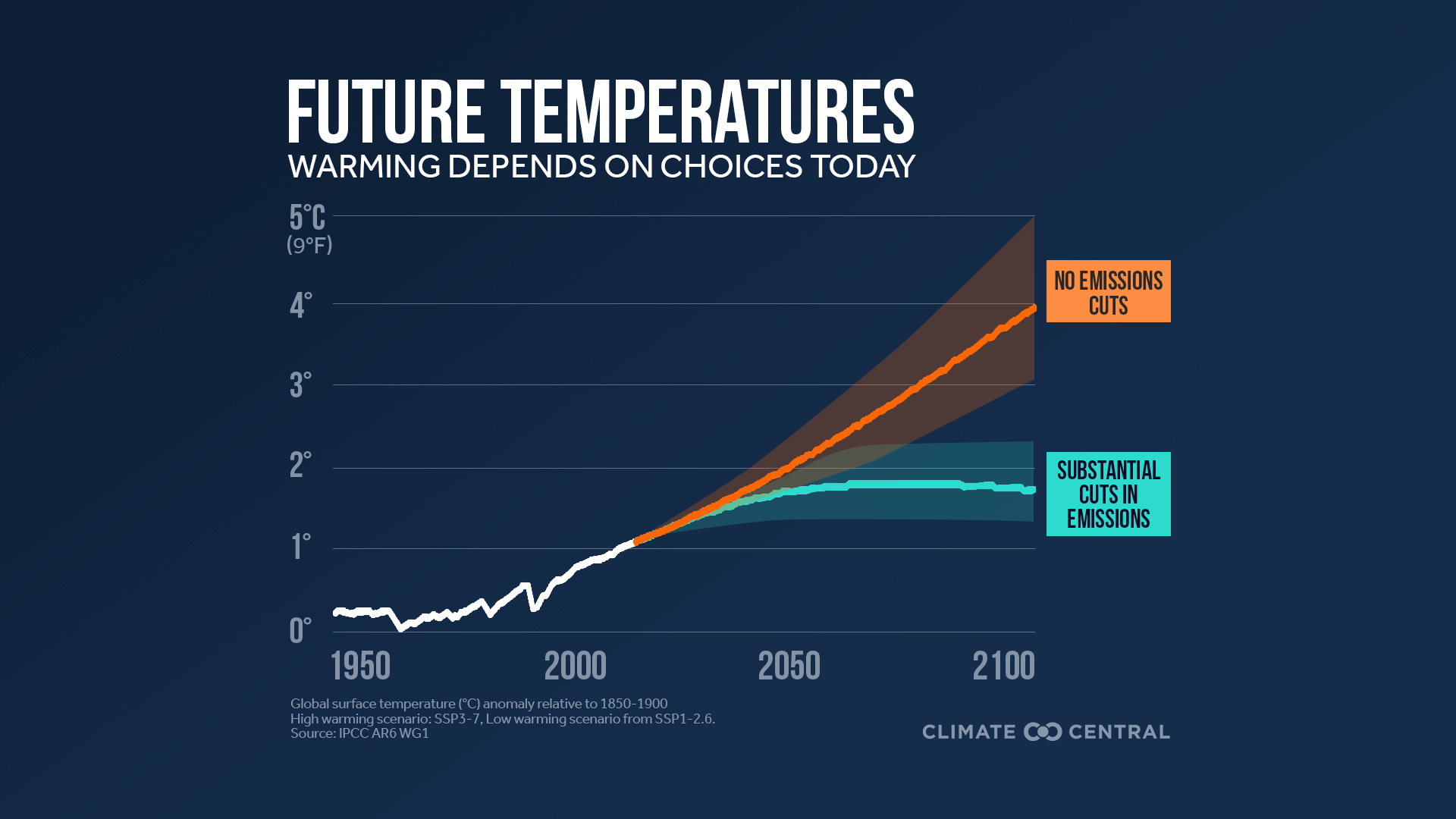

Climate change significantly impacts property values through increased risk of natural disasters and shifting market demands.

Increased Risk of Natural Disasters

The frequency and intensity of hurricanes, wildfires, floods, and droughts are escalating due to climate change. These events directly decrease property values in affected areas. For example, areas repeatedly hit by wildfires in California have seen significant drops in property values, while coastal communities facing increased hurricane risk experience similar declines.

- Increased insurance premiums: Properties in high-risk zones face dramatically higher insurance premiums, making them less attractive to buyers.

- Difficulty securing insurance: In some cases, insurance becomes completely unavailable, rendering properties unsellable or even unmortgageable.

- Property damage leading to decreased value: Direct damage from natural disasters significantly reduces a property's value.

- Forced sales at lower prices: Homeowners facing financial hardship due to climate-related damage may be forced to sell their properties at significantly reduced prices.

Shifting Demand and Market Volatility

Climate-related risks are influencing buyer preferences, leading to decreased demand for properties in high-risk zones. This shifting demand, coupled with the uncertainty surrounding future climate events, creates market volatility and price fluctuations.

- Reduced buyer interest in vulnerable areas: Many potential buyers are actively avoiding properties in areas prone to climate-related disasters.

- Increased uncertainty in the housing market: The unpredictability of climate-related events makes it difficult to assess long-term property value.

- Potential for significant capital loss: Investing in a property in a high-risk climate zone carries the substantial risk of significant capital loss.

The Impact on Your Mortgage and Credit Score

The effects of climate change on property values directly translate into risks for your mortgage and, ultimately, your credit score.

Increased Mortgage Insurance Premiums

Lenders are increasingly incorporating climate risk assessments into their lending practices. Properties deemed high-risk will likely command higher mortgage insurance premiums, impacting affordability.

- Higher monthly payments: Increased premiums lead to higher monthly mortgage payments, stretching household budgets.

- Difficulty qualifying for a loan: Higher premiums can make it difficult for some borrowers to qualify for a mortgage.

- Increased financial strain: The added financial burden can increase the risk of default.

Loan Defaults and Foreclosures

Climate-related damage can lead to loan defaults and foreclosures. If the cost of repairs exceeds the home's value, or if the homeowner is unable to maintain mortgage payments due to job loss or other climate-related financial hardship, foreclosure becomes a real possibility.

- Damage exceeding home value: Severe damage may render the property uninhabitable and less valuable than the outstanding mortgage.

- Inability to maintain mortgage payments: Financial strain from damage repair, increased insurance, or job loss can lead to missed payments.

- Significant negative impact on credit history: Foreclosure severely damages credit scores, making it difficult to secure future loans.

Difficulty Securing Future Loans

A damaged credit score due to climate-related issues can significantly hinder your ability to secure future loans. This can impact not only mortgages but also auto loans, credit cards, and other forms of financing.

- Higher interest rates on future loans: A lower credit score results in higher interest rates, increasing the cost of borrowing.

- Limited loan options: Lenders may be less willing to offer loans to borrowers with poor credit history.

- Difficulty securing financing: Securing any type of financing becomes significantly more challenging.

Mitigating Climate Risk and Protecting Your Credit Score

Proactive steps can be taken to mitigate climate risk and protect your credit score.

Assess Your Property's Climate Risk

Before purchasing or continuing to own a property, thoroughly research its climate risk. Utilize online tools and resources to assess vulnerability to natural disasters.

- Utilize flood maps and wildfire risk assessments: These tools provide valuable information about potential hazards.

- Consult with local authorities and experts: Gain insights from local officials and professionals familiar with the area's climate risks.

- Consider property elevation and proximity to water sources: These factors significantly influence vulnerability to floods and other climate-related events.

Invest in Climate-Resilient Upgrades

Home improvements that reduce climate risk can protect property value and reduce insurance premiums.

- Improved insulation: Reduces energy consumption and lowers utility bills.

- Drought-resistant landscaping: Reduces water consumption and lowers water bills.

- Energy-efficient appliances: Reduces energy consumption and lowers utility bills.

Maintain Strong Financial Health

Responsible financial planning is crucial to withstand unexpected events.

- Diversify investments: Spread your investments to mitigate risk.

- Maintain sufficient savings: Build an emergency fund to cover unexpected expenses.

- Timely mortgage payments: Maintaining a good payment history is crucial for a strong credit score.

Conclusion

Climate change poses significant financial risks to homeowners, potentially impacting property values and credit scores. Understanding the link between climate risk and your home loan is crucial. Take action today to assess your property's vulnerability and implement strategies to protect your credit score and financial well-being. Learn more about mitigating climate risk and safeguarding your home loan. Proactive planning and responsible financial management are key to navigating the challenges of climate change and maintaining your financial stability.

Featured Posts

-

Going Solo Planning Your Independent Travel Adventure

May 20, 2025

Going Solo Planning Your Independent Travel Adventure

May 20, 2025 -

Find Your Missing Hmrc Refund A Guide For Savings Account Holders

May 20, 2025

Find Your Missing Hmrc Refund A Guide For Savings Account Holders

May 20, 2025 -

Ferrariye Koetue Haber Hamilton Ve Leclerc Cin Gp Sinden Diskalifiye

May 20, 2025

Ferrariye Koetue Haber Hamilton Ve Leclerc Cin Gp Sinden Diskalifiye

May 20, 2025 -

Leeds Uniteds Championship Return Tottenham Loanees Crucial Role

May 20, 2025

Leeds Uniteds Championship Return Tottenham Loanees Crucial Role

May 20, 2025 -

Chinas Reaction To Us Typhon Missile Deployment In The Philippines

May 20, 2025

Chinas Reaction To Us Typhon Missile Deployment In The Philippines

May 20, 2025