CMA CGM Bolsters Logistics Network With $440M Turkish Acquisition

Table of Contents

Details of the CMA CGM Acquisition in Turkey

Target Company Profile: Unveiling the Acquired Entity

While the specific name of the acquired Turkish company hasn't been publicly disclosed at the time of writing, (replace with the company name once available), it's understood to be a key player in Turkey's logistics sector. The company likely specializes in a combination of port operations, inland transportation, and warehousing, offering a comprehensive suite of logistics services.

- Company Name: (Insert Company Name Here)

- Years in Operation: (Insert Number of Years)

- Key Services Offered: Port operations, inland trucking, warehousing, customs brokerage, (add other services as known)

- Geographic Reach within Turkey: (Specify regions covered – e.g., major ports, industrial hubs)

- Estimated Revenue: (Insert estimated annual revenue)

- Employee Count: (Insert approximate employee count)

Acquisition Cost and Financial Implications: A $440 Million Investment

The $440 million price tag represents a significant investment for CMA CGM. While a detailed breakdown of the cost isn't yet available publicly, it suggests a strong belief in the acquired company's potential and its strategic fit within CMA CGM's broader network.

- Breakdown of Acquisition Cost: (Include details once available – e.g., percentage allocated to assets, goodwill, etc.)

- Funding Source: (Specify funding source – e.g., internal reserves, debt financing)

- Expected ROI: (Discuss expected return on investment timeframe and projected returns)

- Potential Impact on CMA CGM's Stock Price: (Analyze potential positive or negative impact on stock performance)

Strategic Rationale Behind the Acquisition: A Move for Growth and Expansion

CMA CGM's acquisition isn't random; it's a carefully calculated move to enhance its global reach and competitiveness. Turkey's strategic location bridging Europe and Asia makes it a vital hub for global trade.

- Improved Market Access in Turkey: Gaining immediate access to a well-established logistics network in a key market.

- Expansion of Logistics Capabilities: Acquiring diverse service offerings, strengthening its overall logistics capabilities.

- Synergies with Existing Operations: Creating opportunities for operational efficiencies and cost savings by integrating the acquired company's operations.

- Access to New Customer Base: Expanding its customer base and building stronger relationships in the Turkish market and beyond.

- Strengthening of Supply Chain Resilience: Diversifying its geographical footprint and reducing reliance on single-point vulnerabilities.

Impact on CMA CGM's Global Logistics Network

Enhanced Global Reach and Market Share: Expanding the Footprint

The CMA CGM acquisition Turkey dramatically boosts its global presence and market share, particularly in the strategically important Eurasian trade corridor.

- Increased Market Share in Turkey and Surrounding Regions: Gaining a significant competitive advantage in a rapidly growing market.

- Improved Connections to Eurasian Trade Routes: Strengthening its network and facilitating smoother transit across continents.

- Strengthening of its Position in the Global Shipping Industry: Consolidating its leadership position in a highly competitive industry.

Strengthened Supply Chain and Infrastructure: Optimizing Operations

The acquisition adds substantial infrastructure and strengthens CMA CGM's supply chain capabilities.

- Improved Port Handling Capacity: Enhancing efficiency and throughput in crucial Turkish ports.

- Enhanced Inland Transportation Networks: Expanding its reach to inland areas and improving connectivity across the country.

- Increased Warehousing Capabilities: Providing more storage and handling capacity to meet growing demand.

- Improved Last-Mile Delivery Options: Strengthening its last-mile delivery networks and reaching a wider range of customers.

Opportunities for Future Growth and Expansion: Long-Term Vision

This acquisition provides a springboard for further expansion and growth in Turkey and the surrounding regions.

- Potential for Further Acquisitions in Turkey: Identifying and acquiring other strategically valuable companies within the Turkish logistics sector.

- Expansion into New Service Offerings: Developing new services that leverage the acquired company's expertise.

- Leveraging the Acquired Company's Expertise for Innovation: Driving innovation and improving operational efficiency across the broader CMA CGM network.

Implications for the Turkish Logistics Market

Increased Competition and Innovation: A Catalyst for Improvement

The CMA CGM acquisition Turkey introduces a powerful competitor, potentially stimulating greater efficiency and innovation within the Turkish logistics market.

- Increased Competition for Other Logistics Providers in Turkey: Encouraging other players to enhance their services and become more competitive.

- Potential for Enhanced Efficiency and Technological Innovation in the Sector: CMA CGM's expertise could drive improvements in technology and efficiency across the Turkish market.

Job Creation and Economic Growth: A Positive Economic Impact

The acquisition is expected to contribute positively to employment and Turkey's economic growth.

- Potential Increase in Employment Opportunities: Creating jobs both within the acquired company and through the broader expansion of CMA CGM's activities.

- Contribution to the Overall Economic Growth of Turkey: Boosting foreign direct investment and stimulating further economic activity.

Foreign Investment in Turkey: A Vote of Confidence

The CMA CGM acquisition Turkey is a significant vote of confidence in the Turkish market, highlighting its growing importance in global trade.

- Positive Signal for Other Foreign Investors Considering Investments in Turkey: Encouraging further investment in the Turkish logistics sector and broader economy.

- Potential for Attracting Further Foreign Direct Investment in the Turkish Logistics Sector: Creating a positive ripple effect, attracting more international companies to invest in Turkey.

Conclusion: A Strategic Acquisition with Far-Reaching Implications

The CMA CGM acquisition in Turkey is a significant strategic move, bolstering its global logistics network and solidifying its presence in a pivotal trade region. This $440 million investment promises increased efficiency, expanded market share, and significant opportunities for future growth. The acquisition underscores the importance of Turkey's logistics sector and the continued attractiveness of the country for foreign investment. To stay updated on the ongoing impact of this and future CMA CGM acquisitions, continue following industry news and analysis. Stay informed on future CMA CGM acquisition news and their effect on global trade.

Featured Posts

-

Pfc Rejects Gensol Eo W Application Due To Submission Of Fake Documents

Apr 27, 2025

Pfc Rejects Gensol Eo W Application Due To Submission Of Fake Documents

Apr 27, 2025 -

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025 -

Sorpresa En Indian Wells Caida De Una De Las Jugadoras Favoritas

Apr 27, 2025

Sorpresa En Indian Wells Caida De Una De Las Jugadoras Favoritas

Apr 27, 2025 -

Neuer Atlas Dokumentiert Amphibien Und Reptilien In Thueringen

Apr 27, 2025

Neuer Atlas Dokumentiert Amphibien Und Reptilien In Thueringen

Apr 27, 2025 -

Us Open 2024 Svitolinas Dominant Win Over Kalinskaya

Apr 27, 2025

Us Open 2024 Svitolinas Dominant Win Over Kalinskaya

Apr 27, 2025

Latest Posts

-

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still High

Apr 28, 2025

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still High

Apr 28, 2025 -

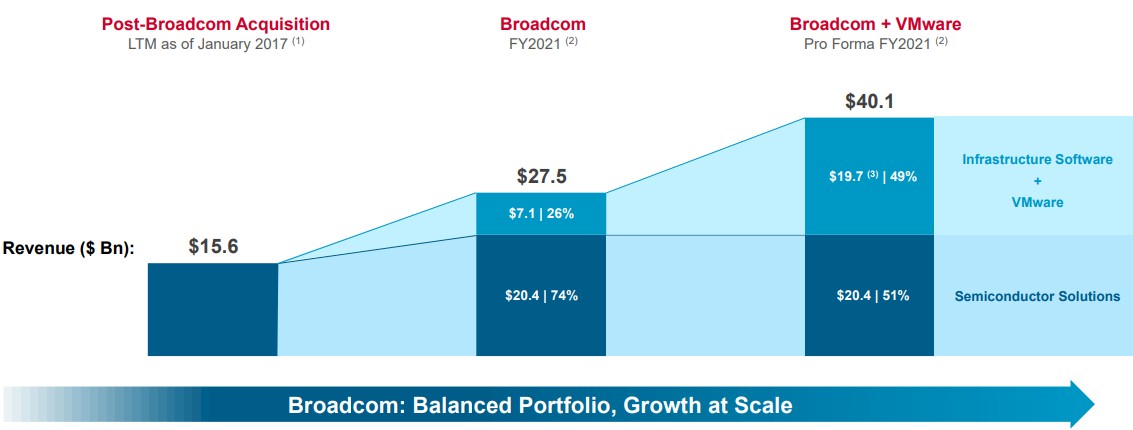

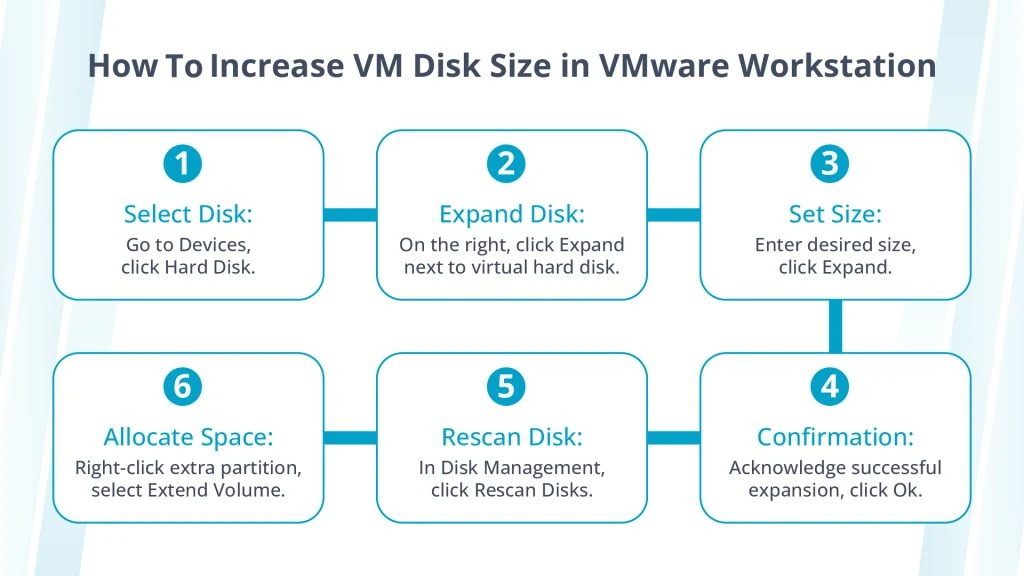

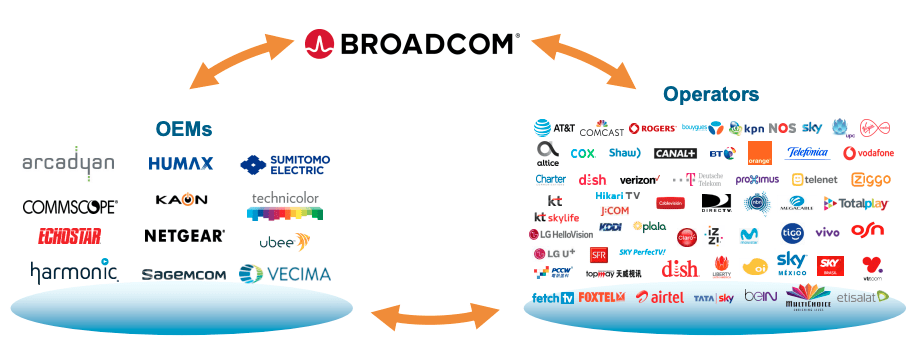

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025 -

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025 -

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025