CMA CGM's $440 Million Acquisition Of Turkish Logistics Firm

Table of Contents

Strategic Rationale Behind CMA CGM's Investment

CMA CGM's acquisition is far more than a simple expansion; it's a calculated move designed to achieve several key strategic objectives. The company is clearly aiming to leverage this acquisition to enhance its global network, improve operational efficiency, and tap into new growth opportunities. This investment aligns perfectly with CMA CGM's long-term strategy of becoming a truly integrated logistics provider, not just a shipping company.

The potential benefits for CMA CGM are manifold:

- Increased Market Share: Penetrating the Turkish market significantly boosts CMA CGM's market share in a strategically important region.

- Enhanced Service Offerings: Acquiring an established Turkish logistics firm provides access to a robust infrastructure and existing client base, allowing CMA CGM to immediately offer a more comprehensive suite of services.

- Improved Logistics Efficiency: Integrating the acquired firm's operations into CMA CGM's global network can lead to significant synergies, streamlining processes and reducing costs.

- Diversification of Operations: This move helps diversify CMA CGM's operations, reducing reliance on specific shipping lanes and mitigating risk.

Specifically, this acquisition provides:

- Access to Turkey's strategic location: Turkey's geographical position acts as a crucial bridge between Europe and Asia, offering access to vital trade routes.

- Strengthened presence in the Black Sea region: This expansion bolsters CMA CGM's influence in a region of growing economic importance.

- Synergies with existing CMA CGM operations: The acquired firm’s expertise and infrastructure will likely complement CMA CGM's existing operations, creating substantial operational efficiencies.

- Potential for growth in the Turkish and surrounding markets: The Turkish market presents considerable growth potential, and this acquisition positions CMA CGM to capitalize on this opportunity.

Impact on the Turkish Logistics Sector

CMA CGM's acquisition will undoubtedly reshape the Turkish logistics sector. The implications are far-reaching and will likely influence competition, investment, and employment within the industry.

- Increased Competition: The entry of a global giant like CMA CGM will inevitably intensify competition among existing Turkish logistics providers. This will likely drive innovation and efficiency improvements across the board.

- Potential for Technological Advancements and Improved Infrastructure: CMA CGM's investment could trigger a wave of technological upgrades and infrastructure improvements within the Turkish logistics sector, potentially modernizing the industry.

- Impact on Employment: While increased competition might lead to some job displacement in the short term, the long-term impact on employment is likely to be positive, with potential for new jobs created through expansion and modernization.

- Attraction of Further Foreign Investment: CMA CGM's significant investment could attract additional foreign investment into the Turkish logistics sector, further boosting economic growth.

Financial Details and Market Analysis of the Acquisition

The $440 million acquisition price represents a substantial investment by CMA CGM, reflecting the strategic value of the target firm. While the exact financial details of the transaction, including payment terms, remain partially undisclosed, market analysts suggest it's a reasonable valuation given the target's market position and growth potential. Analyzing CMA CGM's recent financial performance alongside market analyses of the Turkish logistics sector reveals a strong potential return on investment (ROI) for CMA CGM. Key factors include:

- Acquisition price and payment terms: While specific details are limited, the $440 million figure signifies CMA CGM's confidence in the long-term potential of the acquisition.

- CMA CGM's financial performance in recent years: CMA CGM’s strong financial standing enables them to undertake such a significant investment.

- Market analysis of the Turkish logistics sector: Market research suggests a robust and growing market for logistics services in Turkey, promising a good return for this investment.

- Projected ROI for CMA CGM: Analysts project a strong ROI for CMA CGM over the medium to long term, driven by market growth and operational synergies.

Future Outlook and Potential for Growth

The future prospects for CMA CGM in Turkey look promising. The integration of the acquired firm into CMA CGM's global network offers significant opportunities for expansion and growth. Synergies between the two entities will likely lead to the development of innovative logistics solutions and improved efficiency.

- Potential expansion into new markets via the acquired firm’s existing network: The acquired company's pre-existing network could provide immediate access to new markets and opportunities for CMA CGM.

- Development of new logistics solutions and services: The combination of expertise and resources can spur innovation, leading to enhanced and diversified logistics solutions.

- Integration of technology to enhance efficiency and service offerings: Technology integration promises to optimize processes and improve service quality for clients.

- Long-term strategic goals for CMA CGM in Turkey: CMA CGM’s long-term strategy likely involves establishing itself as a market leader in the Turkish logistics sector, driving further growth and market share.

Conclusion: CMA CGM's Acquisition: A Pivotal Move in Global Logistics

CMA CGM's $440 million acquisition of the Turkish logistics firm represents a pivotal move in the global shipping and logistics landscape. The strategic rationale behind the deal is clear: expansion into new markets, increased market share, and enhanced service offerings. This acquisition is likely to have a significant impact on the Turkish logistics sector, fostering competition and attracting further foreign investment. The future outlook for CMA CGM in Turkey and the surrounding region appears bright, with significant potential for growth and increased profitability. Learn more about CMA CGM's acquisitions and explore the impact of CMA CGM's presence in the Turkish market to understand the far-reaching implications of this landmark deal.

Featured Posts

-

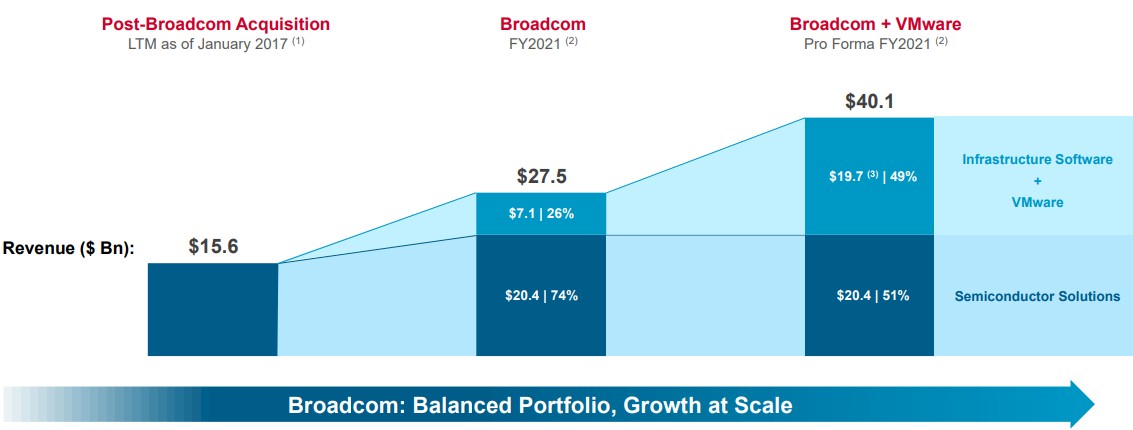

1050 Price Surge At And T Challenges Broadcoms V Mware Pricing

Apr 27, 2025

1050 Price Surge At And T Challenges Broadcoms V Mware Pricing

Apr 27, 2025 -

Federal Government Appoints Anti Vaccination Advocate To Lead Autism Study

Apr 27, 2025

Federal Government Appoints Anti Vaccination Advocate To Lead Autism Study

Apr 27, 2025 -

Offenlegung Gemaess Artikel 40 Absatz 1 Wp Hg Pne Ag

Apr 27, 2025

Offenlegung Gemaess Artikel 40 Absatz 1 Wp Hg Pne Ag

Apr 27, 2025 -

Posthaste Canadian Travel Boycotts Real Time Impact On The Us Economy

Apr 27, 2025

Posthaste Canadian Travel Boycotts Real Time Impact On The Us Economy

Apr 27, 2025 -

Ariana Grandes Dramatic Hair And Tattoo Transformation A Look At Professional Styling

Apr 27, 2025

Ariana Grandes Dramatic Hair And Tattoo Transformation A Look At Professional Styling

Apr 27, 2025

Latest Posts

-

Proposed Starbucks Raise Rejected By Union

Apr 28, 2025

Proposed Starbucks Raise Rejected By Union

Apr 28, 2025 -

Starbucks Unions Rejection Of Companys Wage Guarantee

Apr 28, 2025

Starbucks Unions Rejection Of Companys Wage Guarantee

Apr 28, 2025 -

Unionized Starbucks Employees Turn Down Companys Pay Raise Proposal

Apr 28, 2025

Unionized Starbucks Employees Turn Down Companys Pay Raise Proposal

Apr 28, 2025 -

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still High

Apr 28, 2025

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still High

Apr 28, 2025 -

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025