CMOC Acquires Lumina Gold For $581 Million: A Major China Mining Deal

Table of Contents

Deal Details and Financial Implications

Acquisition Price and Structure

CMOC's acquisition of Lumina Gold closed at $581 million, a price reflecting Lumina Gold's significant gold reserves and operational capabilities. The transaction structure involved a combination of cash and stock, with the exact breakdown remaining undisclosed pending regulatory filings. The deal's completion was subject to several conditions precedent, including regulatory approvals from relevant jurisdictions and the satisfaction of customary closing conditions. The finalization of this significant China mining deal is expected to solidify CMOC's presence on the global stage.

CMOC's Strategic Rationale

CMOC's decision to acquire Lumina Gold is driven by a multifaceted strategic rationale:

- Portfolio Diversification: The acquisition allows CMOC to diversify its portfolio beyond its existing mining interests, mitigating risk and enhancing its overall market position.

- Access to Gold Reserves: Lumina Gold boasts substantial gold reserves and production capacity, providing CMOC with immediate access to a valuable commodity.

- Geographical Expansion: This deal expands CMOC's operational footprint into new geographic markets, strengthening its global reach and resilience.

- Market Leadership: The acquisition strengthens CMOC's standing in the global gold market, positioning it as a major player with considerable influence.

The strategic fit between CMOC and Lumina Gold is evident, offering synergistic opportunities for enhanced efficiency and profitability.

Impact on CMOC's Stock Price

The immediate impact of the acquisition on CMOC's stock price (CMOC:HK) remains to be seen, though analysts predict a positive long-term effect. The short-term fluctuations will likely be influenced by market sentiment and investor reaction. However, the long-term implications are positive, considering the added value and potential revenue streams generated by Lumina Gold's assets. Further analysis is needed to fully assess the extent of this influence.

Lumina Gold's Assets and Operations

Key Gold Assets and Reserves

Lumina Gold possesses substantial gold reserves located primarily in [mention specific geographical locations with coordinates if available]. These reserves represent a significant asset for CMOC, contributing to its overall production capacity and long-term profitability. Detailed maps illustrating the locations of Lumina Gold's key mines and projected reserve estimates are expected to be released by CMOC in the coming weeks.

Operational Efficiency and Production Capabilities

Lumina Gold's operational efficiency has consistently been rated highly within the industry, demonstrating a strong track record of production and cost management. CMOC plans to leverage this existing efficiency, while also investing in further improvements to optimize operations and maximize gold production. This commitment will ensure that Lumina Gold remains a significant contributor to CMOC's future growth.

Environmental and Social Responsibility

CMOC has pledged to integrate Lumina Gold's existing environmental, social, and governance (ESG) initiatives into its broader operational framework. This commitment underscores CMOC's dedication to responsible mining practices and sustainable resource management. Transparency and adherence to international ESG standards will be critical aspects of CMOC's integration strategy for Lumina Gold.

Geopolitical and Market Implications

China's Growing Influence in the Mining Sector

The CMOC acquisition of Lumina Gold reflects China's broader strategy to secure access to global natural resources. This deal further solidifies China's presence in the international mining sector, positioning the country as a key player in the global gold market. This trend is expected to continue, with further Chinese investment in international mining projects anticipated in the future.

Impact on the Global Gold Market

This significant acquisition will undoubtedly impact the global gold market. The increased production capacity resulting from CMOC's control over Lumina Gold's assets could influence global gold prices and supply chains. The competitive landscape will also be affected, as other players in the gold mining industry adjust to CMOC's enhanced market position.

Regulatory and Legal Aspects

The successful completion of this $581 million deal hinges on securing necessary regulatory approvals from relevant jurisdictions. Navigating international regulations and ensuring compliance with legal frameworks will be crucial for CMOC. Any potential hurdles or delays in the regulatory process could impact the deal's timeline and overall success.

Conclusion

The CMOC acquisition of Lumina Gold for $581 million represents a pivotal moment in the global mining industry. This major China mining deal expands CMOC's portfolio, boosts its gold reserves, and strengthens its position in the international market. The strategic implications are far-reaching, impacting gold prices, supply chains, and competitive dynamics. This acquisition further underscores China's growing influence in securing global resources.

Stay tuned for more updates on this major China mining deal and the future of CMOC's global expansion. Follow this space for further analysis of the CMOC acquisition of Lumina Gold, and keep abreast of developments in China's mining sector through relevant industry publications and official company announcements.

Featured Posts

-

Son Dakika Erzurum Okul Kapanislari Ve Tatil Guenleri Vali Aciklamasi

Apr 23, 2025

Son Dakika Erzurum Okul Kapanislari Ve Tatil Guenleri Vali Aciklamasi

Apr 23, 2025 -

Adeyemi Zeigt Stil Der Bvb Star Glaenzt In Dortmund

Apr 23, 2025

Adeyemi Zeigt Stil Der Bvb Star Glaenzt In Dortmund

Apr 23, 2025 -

Thoma Bravo Acquires Jeppesen From Boeing For 5 6 Billion

Apr 23, 2025

Thoma Bravo Acquires Jeppesen From Boeing For 5 6 Billion

Apr 23, 2025 -

200 Manifestanti Contro La Violenza Vetrine Di Ristoranti Palestinesi Danneggiate

Apr 23, 2025

200 Manifestanti Contro La Violenza Vetrine Di Ristoranti Palestinesi Danneggiate

Apr 23, 2025 -

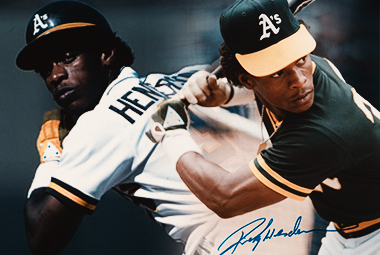

Record Setting Steals Milwaukees Nine Bases In First Four Innings

Apr 23, 2025

Record Setting Steals Milwaukees Nine Bases In First Four Innings

Apr 23, 2025