Colgate Stock (CL) Suffers As Tariffs Increase Costs By $200 Million

Table of Contents

The Impact of Tariffs on Colgate's Bottom Line

The $200 million cost increase represents a substantial challenge for Colgate-Palmolive, a leading player in the global consumer staples market. This financial burden stems directly from increased tariffs imposed on various aspects of the company's operations.

$200 Million Cost Increase Explained

The tariff increases primarily affect Colgate's raw materials and manufacturing processes across its global operations. These tariffs impact various aspects of production, including:

- Packaging materials: Increased costs for plastic, cardboard, and other packaging components represent a substantial portion of the $200 million increase.

- Key ingredients: Several ingredients used in Colgate's diverse product portfolio, including toothpaste, soap, and other oral hygiene products, have faced higher import duties.

- Manufacturing logistics: Tariffs imposed on transportation and logistics further exacerbate the cost increase, impacting the overall supply chain efficiency.

A breakdown of the cost increase reveals a disproportionate impact across different product lines and geographical regions. For instance, certain products heavily reliant on imported ingredients experienced a greater cost surge than those manufactured primarily using domestically sourced materials. This underscores the complex interplay of global trade policies and their impact on multinational corporations.

Impact on Profit Margins and Earnings

The substantial cost increase directly translates into a significant squeeze on Colgate's profit margins and overall earnings. While precise figures may vary based on quarterly reports, analysts predict a notable decrease in profit margin percentage.

- Profit margin compression: The $200 million cost increase is expected to significantly lower Colgate's already slim profit margins, potentially impacting future dividend payouts.

- Reduced earnings per share: The decreased profitability directly impacts earnings per share (EPS), a key metric for investors assessing the company's financial health.

- Potential impact on dividends: The strain on profitability could lead to a review of Colgate's dividend policy, potentially affecting investor returns.

The coming financial reports will be crucial in fully understanding the extent of the damage to Colgate’s bottom line.

Colgate's Response to Increased Costs

Faced with this significant challenge, Colgate-Palmolive is implementing a multi-pronged strategy to mitigate the impact of the tariff-induced cost increases.

Price Adjustments and Strategic Initiatives

Colgate is exploring various options to offset the increased costs, including a combination of price adjustments and operational efficiencies.

- Strategic price increases: The company has already implemented selective price increases on certain product lines in various markets, aiming to pass some of the increased cost burden onto consumers. The magnitude of these increases varies depending on the product, region, and consumer price sensitivity.

- Supply chain optimization: Colgate is actively exploring alternative sourcing options for raw materials and packaging, seeking more cost-effective suppliers or shifting production to regions with more favorable tariff conditions.

- Operational efficiency improvements: Colgate is likely to implement various cost-cutting measures internally to improve operational efficiency, potentially through streamlining processes and optimizing production techniques.

Investor Sentiment and Market Reaction

The news of the $200 million tariff-related cost increase has understandably impacted investor sentiment. The stock price has experienced a significant drop, reflecting the market’s concern regarding Colgate's near-term financial outlook.

- Stock price volatility: CL stock price has shown significant volatility since the announcement, with short-term fluctuations reflecting investor uncertainty.

- Analyst ratings: Several financial analysts have revised their ratings for Colgate stock, with some downgrades reflecting concerns about the impact of increased costs.

- Investor confidence: The overall investor confidence in Colgate-Palmolive has taken a hit, with uncertainty regarding the long-term effects of these tariffs on the company's performance.

The market's reaction highlights the significant sensitivity of consumer staples stocks to external economic factors like tariffs.

Long-Term Implications for Colgate and Investors

The long-term impact of these tariffs on Colgate-Palmolive and its investors remains uncertain, carrying significant risks and uncertainties.

Future Outlook and Potential Risks

The increased costs, alongside the potential for reduced consumer demand due to price increases, pose challenges to Colgate's long-term competitiveness and profitability.

- Market share erosion: Competitors who are less affected by these tariffs could gain market share, potentially at Colgate's expense.

- Price elasticity of demand: The extent to which Colgate can pass on increased costs to consumers through price hikes without significantly impacting demand remains a crucial factor.

- Future tariff uncertainties: The uncertainty surrounding future tariff changes adds another layer of risk, making long-term financial planning more challenging.

Investment Strategies for Colgate Stock

Investing in Colgate stock (CL) currently requires careful consideration of the inherent risks. This is not financial advice, but rather general guidance.

- Risk management: Investors should consider diversification strategies to mitigate the impact of potential negative performance by Colgate.

- Long-term perspective: For long-term investors with a high risk tolerance, Colgate's proven brand strength and global reach may still offer potential for recovery and growth.

- Monitoring performance: Closely monitoring Colgate's financial reports and news releases is essential to assess the company's performance and adapt investment strategies accordingly.

Conclusion

The $200 million cost increase imposed by tariffs presents a significant challenge to Colgate-Palmolive. The company's response, while multifaceted, will require careful execution and monitoring. The impact on profit margins, investor sentiment, and the long-term outlook are significant concerns. While the company is actively seeking solutions, investors must carefully weigh the risks and potential returns before making investment decisions regarding Colgate stock (CL). Keep an eye on Colgate stock (CL) and monitor Colgate-Palmolive's performance closely as the situation unfolds. Stay updated on the latest developments affecting Colgate stock prices and the consumer staples sector.

Featured Posts

-

Watch The Full Trailer For Mission Impossible The Final Reckoning

Apr 26, 2025

Watch The Full Trailer For Mission Impossible The Final Reckoning

Apr 26, 2025 -

Jorgensons Repeat Win American Cyclist Conquers Paris Nice Again

Apr 26, 2025

Jorgensons Repeat Win American Cyclist Conquers Paris Nice Again

Apr 26, 2025 -

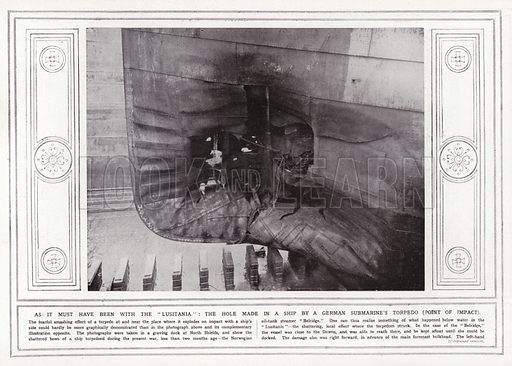

The Lady Olive A Lost Ship And A German Submarines Role

Apr 26, 2025

The Lady Olive A Lost Ship And A German Submarines Role

Apr 26, 2025 -

Dispute At Mangalia Shipyard Navalistul Union Calls On Netherlands Embassy For Action

Apr 26, 2025

Dispute At Mangalia Shipyard Navalistul Union Calls On Netherlands Embassy For Action

Apr 26, 2025 -

Karli Kane Hendrickson A Comfortable Chat In The Easy Chair

Apr 26, 2025

Karli Kane Hendrickson A Comfortable Chat In The Easy Chair

Apr 26, 2025