Colgate's Sales And Profits Fall: $200 Million Tariff Impact

Table of Contents

Colgate-Palmolive, a giant in the global consumer goods market, recently reported a significant decline in sales and profits, directly attributing a staggering $200 million loss to the impact of tariffs. This alarming financial downturn raises serious questions about the future of the company and the broader consumer goods industry. This article delves deep into the specifics of this setback, exploring the underlying causes and potential long-term ramifications.

The $200 Million Tariff Impact: A Detailed Breakdown

Colgate's financial woes are largely due to a complex interplay of tariffs impacting various aspects of its operations. These tariffs haven't uniformly affected all products or markets; instead, the impact is nuanced and geographically specific.

-

Specific Tariffs: The company faced significant import tariffs on both raw materials, like certain chemical compounds used in toothpaste manufacturing, and finished goods destined for specific international markets. These tariffs were imposed by various countries, resulting in increased costs across the supply chain.

-

Impact by Product Line: The impact wasn't evenly distributed across Colgate's product portfolio. While precise figures aren't publicly available for each product category, it's clear that toothpaste, a cornerstone of Colgate's business, along with toothbrush sales, suffered the most significant revenue decline due to tariff-related price increases.

-

Geographic Impact: Markets in regions subject to higher tariffs, particularly some Asian and European countries, bore the brunt of the negative impact. These regions experienced steeper price increases, leading to reduced consumer demand and, ultimately, lower sales volumes for Colgate.

-

Mitigation Strategies: Colgate attempted to mitigate the impact of these tariffs through several strategies, including slight price adjustments in certain markets and exploring alternative sourcing options for raw materials. However, these measures proved insufficient to fully offset the substantial financial blow.

Beyond Tariffs: Other Contributing Factors to Colgate's Decline

While tariffs played a dominant role in Colgate's financial downturn, other factors exacerbated the situation:

-

Increased Competition: The oral care market is fiercely competitive. The rise of private-label brands and innovative competitors offering comparable products at lower prices has put significant pressure on Colgate's market share and pricing strategies.

-

Changes in Consumer Spending Habits: Shifting consumer preferences, particularly towards more natural and organic oral care products, have also impacted Colgate's sales. Consumers are increasingly conscious of the ingredients used in their products, forcing companies like Colgate to adapt and innovate to stay competitive.

-

Currency Fluctuations: Fluctuations in global currency exchange rates also added to Colgate's financial challenges. Variations in the value of the US dollar compared to other currencies impacted the company's international revenue streams.

-

Rising Raw Material Costs: Beyond tariffs, the general increase in raw material costs—independent of trade policies—further squeezed Colgate's profit margins, making it more difficult to maintain competitive pricing.

The Long-Term Implications for Colgate and the Consumer Goods Sector

The $200 million loss due to tariff impact has far-reaching implications for Colgate and the wider consumer goods sector:

-

Price Increases for Consumers: To offset the increased costs, Colgate may be forced to raise prices, potentially reducing consumer demand further. This scenario creates a challenging balance between profitability and maintaining market share.

-

Impact on Investment Strategies: The financial setback may force Colgate to reassess its investment strategies, potentially delaying or scaling back expansion plans in certain markets.

-

Ripple Effect on the Supply Chain: The disruption caused by tariffs has created ripples throughout Colgate's supply chain, affecting its relationships with suppliers and potentially leading to delays in product delivery.

-

Shifts in Global Manufacturing Strategies: To minimize future tariff impacts, Colgate might consider shifting some of its manufacturing operations to countries with more favorable trade policies. This would involve significant investment and strategic planning.

Colgate may employ various strategies for recovery, including streamlining operations, enhancing product innovation, and investing in more efficient supply chain management.

Investor Sentiment and Stock Market Reaction

The announcement of Colgate's reduced profits triggered a noticeable reaction in the stock market.

-

Stock Price Fluctuations: Colgate's stock price experienced a decline following the release of the financial report, reflecting investor concerns about the company's short-term prospects.

-

Analyst Comments and Predictions: Financial analysts have offered varied predictions, with some expressing cautious optimism about Colgate's long-term prospects, while others remain more reserved given the ongoing economic uncertainty.

-

Investor Outlook: The overall investor outlook is currently mixed, with many investors monitoring Colgate's strategies for navigating these challenges and its ability to regain lost ground.

Conclusion

Colgate's $200 million loss highlights the significant impact of tariffs on global businesses, particularly in the consumer goods sector. While tariffs are a major factor, increased competition, changing consumer preferences, and rising raw material costs have compounded the challenge. The long-term implications are substantial, affecting pricing, investment strategies, supply chains, and global manufacturing. Understanding the complexities of this Colgate sales and profit decline, and the pervasive impact of tariff increases, is crucial for navigating the current economic landscape. Stay informed about Colgate's response to these challenges and the continuing effects of tariffs on the consumer goods sector. Follow us for updates on Colgate's financial performance and the evolving impact of global trade policies on leading brands like Colgate-Palmolive.

Featured Posts

-

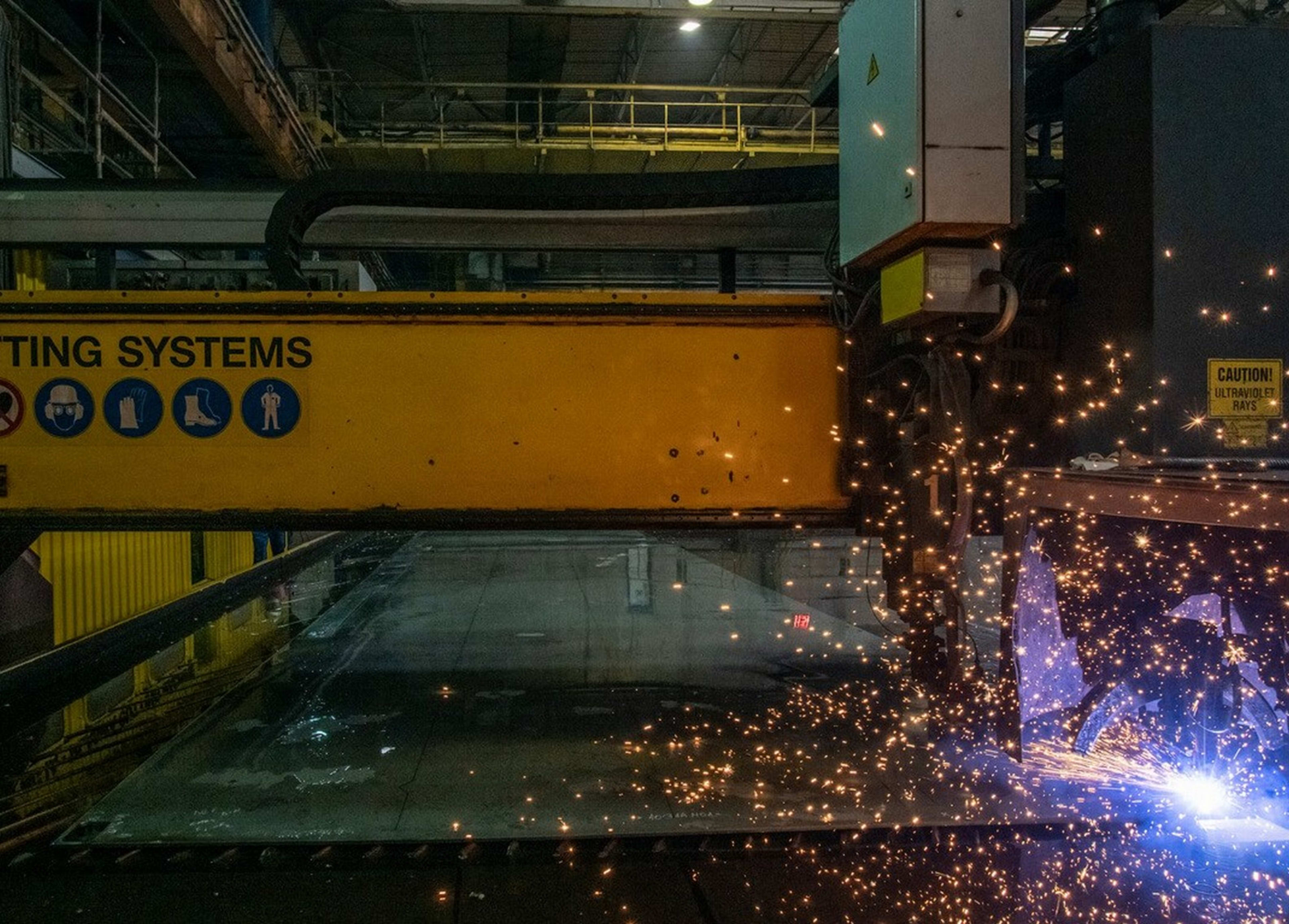

Nieuwe Combat Support Schip Van Damen Voor De Koninklijke Marine

Apr 26, 2025

Nieuwe Combat Support Schip Van Damen Voor De Koninklijke Marine

Apr 26, 2025 -

Los Angeles Wildfires A Reflection Of Societal Attitudes Towards Gambling And Risk

Apr 26, 2025

Los Angeles Wildfires A Reflection Of Societal Attitudes Towards Gambling And Risk

Apr 26, 2025 -

The Best Olive Oils From The Southern United States A Guide For Consumers

Apr 26, 2025

The Best Olive Oils From The Southern United States A Guide For Consumers

Apr 26, 2025 -

Royal Birthday Preparations King Announces Early Celebration

Apr 26, 2025

Royal Birthday Preparations King Announces Early Celebration

Apr 26, 2025 -

Stockholm Stadshotell Fullstaendig Recension Av Krogkommissionen

Apr 26, 2025

Stockholm Stadshotell Fullstaendig Recension Av Krogkommissionen

Apr 26, 2025