Compare Personal Loan Rates: Today's Offers

Table of Contents

Understanding Personal Loan Rates and APR

Understanding the difference between interest rates and APR (Annual Percentage Rate) is fundamental when comparing personal loan offers. While the interest rate represents the cost of borrowing the money, the APR provides a more comprehensive picture by including all associated fees. This means you need to look beyond just the interest rate to get the true cost of your loan. Ignoring fees could lead to a higher overall cost than anticipated.

-

Defining APR: APR encompasses the interest rate plus all other loan fees, expressed as an annual percentage. This includes origination fees, late payment fees, and any other charges.

-

Common Personal Loan Fees: Be aware of these potential additional costs:

- Origination fees: A one-time fee charged by the lender for processing the loan.

- Late payment fees: Penalties for missed or late payments.

- Prepayment penalties: Fees for paying off the loan early.

-

Why Compare APRs, Not Just Interest Rates: Focusing solely on the interest rate can be misleading. Two loans with similar interest rates can have significantly different APRs due to varying fees. Always compare APRs for an accurate cost comparison.

-

Loan Term's Impact: The length of your loan term (e.g., 36 months, 60 months) significantly impacts your total interest paid. Longer terms generally mean lower monthly payments but higher overall interest costs. Shorter terms lead to higher monthly payments but lower overall interest.

Factors Influencing Your Personal Loan Rate

Several factors determine the personal loan interest rate you'll receive. Your creditworthiness plays a significant role, alongside other financial aspects.

-

Credit Score's Influence: A higher credit score generally translates to lower interest rates. Lenders view individuals with excellent credit history as lower risk, making them eligible for more favorable terms. Improving your credit score before applying can significantly impact your loan rate.

-

Debt-to-Income Ratio (DTI): Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, indicates your debt burden. A high DTI suggests a higher risk for lenders, potentially leading to higher interest rates or loan denial.

-

Loan Amount and Term Length: Borrowing a larger amount or opting for a longer loan term typically results in a higher interest rate. This is because lenders assess higher risk with larger loans and longer repayment periods.

-

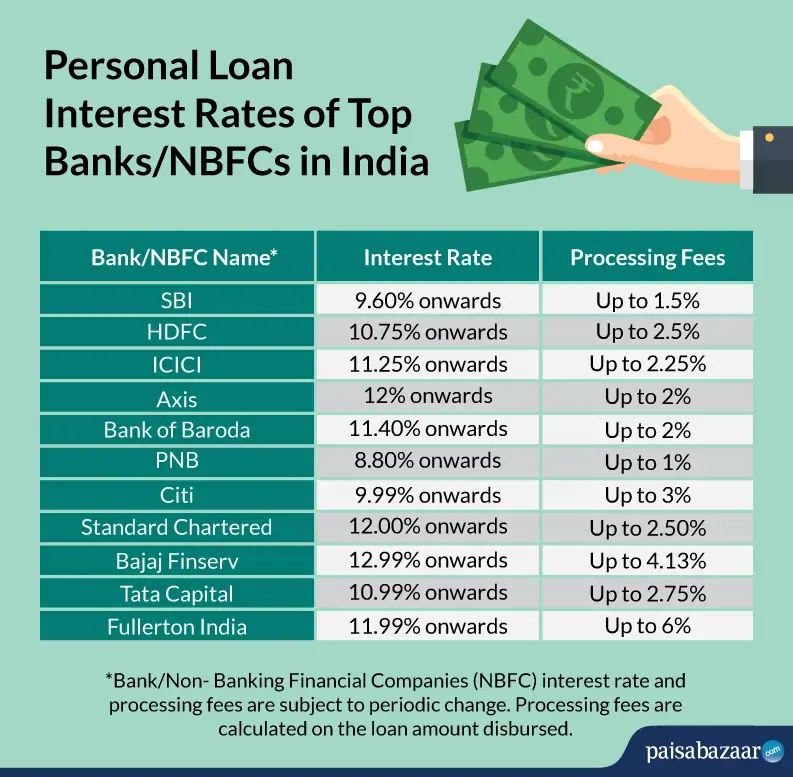

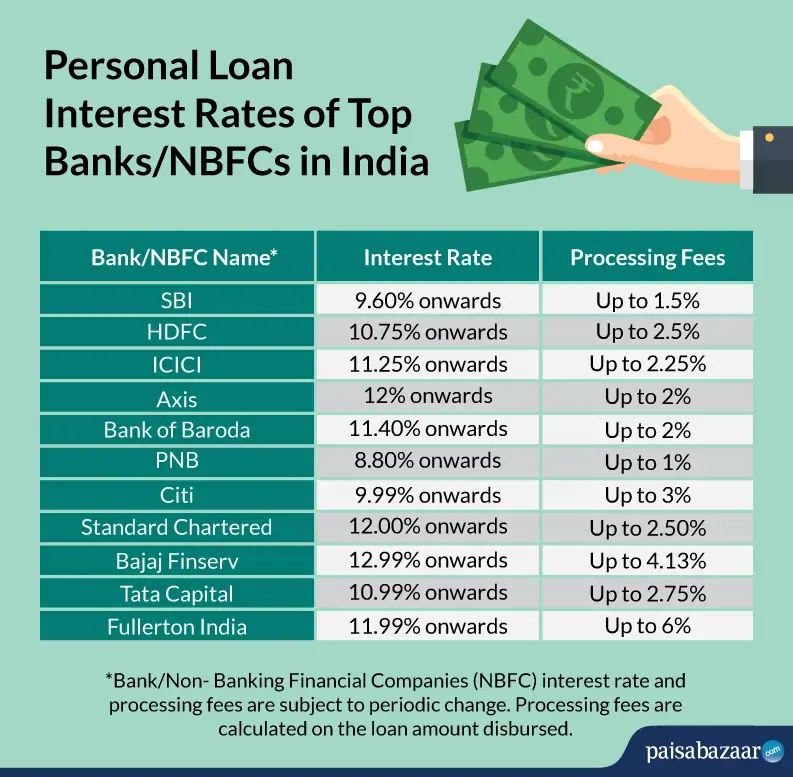

Lender Type and Rates: Different lenders offer varying interest rates.

- Banks: Often offer competitive rates, particularly for customers with strong relationships.

- Credit Unions: May provide lower rates for members, emphasizing community and customer service.

- Online Lenders: Frequently offer streamlined applications and potentially competitive rates, though it's crucial to verify their legitimacy.

How to Compare Personal Loan Rates Effectively

Comparing personal loan rates efficiently requires a systematic approach utilizing available tools and resources.

-

Loan Comparison Websites: Utilize reputable online loan comparison websites. These platforms allow you to input your financial information and compare offers from multiple lenders simultaneously, saving you time and effort.

-

Pre-Qualification's Importance: Pre-qualifying with several lenders provides rate quotes without impacting your credit score significantly. This allows you to compare offers before formally applying.

-

Obtaining Rate Quotes: Request rate quotes from at least three lenders to ensure you’re getting the best possible rate.

-

Using a Loan Calculator: Employ a loan calculator to estimate monthly payments and total interest paid for each loan offer. This tool is crucial for comparing different loan terms and amounts.

Choosing the Right Lender for Your Needs

Beyond the interest rate, consider other factors when selecting a lender.

-

Customer Service: Opt for a lender with responsive and helpful customer service, readily available to address your questions and concerns.

-

Repayment Options: Check for flexibility in repayment options, such as the ability to make extra payments or adjust payment schedules if needed.

-

Fees and Transparency: Carefully review all fees associated with the loan to avoid hidden costs and ensure the lender is transparent in its practices.

Avoiding Personal Loan Scams

Beware of potential loan scams and predatory lending practices. Protect yourself by:

-

Identifying Red Flags: Be wary of lenders who:

- Guarantee loan approval regardless of credit history.

- Request upfront fees before loan approval.

- Pressure you into making quick decisions.

- Have vague or inconsistent information about their lending practices.

-

Secure Website Verification: Ensure the lender's website uses HTTPS to protect your personal information during online transactions.

-

Protecting Personal Information: Never share sensitive information unless you're confident in the lender's legitimacy.

Conclusion

Comparing personal loan rates is essential for obtaining the best possible financing. By understanding the factors influencing rates, using comparison tools effectively, and being aware of potential scams, you can make informed decisions and secure the most favorable terms for your personal loan. Start comparing personal loan rates today and find the best offer tailored to your financial situation. Don't delay – secure the best personal loan rates available now!

Featured Posts

-

Akp Djauhari Awal Kepemimpinan Sebagai Kasatlantas Polresta Balikpapan

May 28, 2025

Akp Djauhari Awal Kepemimpinan Sebagai Kasatlantas Polresta Balikpapan

May 28, 2025 -

American Music Awards 2024 Jennifer Lopez Confirmed As Host In Las Vegas

May 28, 2025

American Music Awards 2024 Jennifer Lopez Confirmed As Host In Las Vegas

May 28, 2025 -

Nas Dem Bali Raih Satu Kursi Dpr Kantor Tak Jadi Kedai Kopi

May 28, 2025

Nas Dem Bali Raih Satu Kursi Dpr Kantor Tak Jadi Kedai Kopi

May 28, 2025 -

Falling European Car Sales Reflect Economic Downturn

May 28, 2025

Falling European Car Sales Reflect Economic Downturn

May 28, 2025 -

Marlins Defeat Nationals Reaching 500 Winning Percentage

May 28, 2025

Marlins Defeat Nationals Reaching 500 Winning Percentage

May 28, 2025