Congo's Cobalt Export Ban And Its Global Market Implications

Table of Contents

The DRC's Cobalt Dependence and the Potential for an Export Ban

The DRC's dominance in global cobalt production is undeniable. However, this dominance is intertwined with significant challenges. Concerns regarding ethical sourcing and human rights violations in artisanal cobalt mining are widespread. These issues, coupled with the inherent volatility of commodity markets, create significant risks for the global EV industry.

- DRC Cobalt Mining: The country's cobalt production is a complex mix of large-scale industrial mining and small-scale, artisanal mining. The latter often operates with little to no oversight, leading to concerns about child labor and unsafe working conditions.

- Government Regulation and Resource Nationalism: The DRC government faces pressure to exert greater control over its valuable cobalt resources. A potential export ban could stem from a desire for increased government revenue, enhanced negotiation leverage with international buyers, or a broader strategy of resource nationalism.

- Feasibility of a Ban: The legal and political feasibility of a complete cobalt export ban is debatable. International trade agreements and potential economic sanctions could significantly impact the DRC's decision-making. However, the potential for increased domestic processing and value-added activities might incentivize such a move.

Impact on the Global Electric Vehicle (EV) Industry

The EV industry's reliance on cobalt for battery production is undeniable. A significant disruption to cobalt supply would have cascading effects across the entire EV battery supply chain.

- EV Battery Supply Chain Disruption: A cobalt export ban would immediately create a shortage of this crucial raw material, leading to delays in EV production and potential price increases for consumers.

- Battery Raw Materials and Alternatives: The industry is actively exploring alternative battery technologies and cobalt substitutes, including nickel-manganese-cobalt (NMC) batteries with reduced cobalt content and lithium iron phosphate (LFP) batteries that are cobalt-free. However, transitioning to these alternatives requires significant investment and time.

- Vulnerability of the EV Industry: The dependence on the DRC for cobalt highlights the vulnerability of the EV industry to geopolitical risks and supply chain disruptions. Diversification of sourcing and the development of alternative technologies are critical to mitigating these risks.

Price Volatility and Market Fluctuations

A cobalt export ban from the DRC would almost certainly cause significant price volatility in the cobalt market.

- Cobalt Price Forecast: The immediate impact would likely be a sharp increase in cobalt prices, potentially reaching record highs. This would drive up the cost of EV batteries and, consequently, the price of electric vehicles.

- Market Speculation and Supply and Demand: Market speculation could further exacerbate price volatility, with traders anticipating future shortages and driving prices even higher. The imbalance between supply and demand would be a major driver of these fluctuations.

- Investment Implications: Investors in the mining and EV sectors need to carefully consider the risks associated with cobalt price volatility. Diversification of investments and hedging strategies become crucial in such an uncertain market.

Geopolitical Implications and International Relations

A cobalt export ban would have far-reaching geopolitical consequences, significantly impacting the DRC's relationships with its major trading partners.

- DRC-China Relations: China is a major investor in the DRC's mining sector. A ban could strain relations between the two countries, potentially leading to diplomatic tensions.

- International Trade and Economic Sanctions: International pressure and potential economic sanctions could be brought to bear on the DRC to ensure a continued flow of cobalt to the global market.

- Responsible Sourcing and International Organizations: International organizations are increasingly focused on promoting responsible sourcing of cobalt, emphasizing ethical mining practices and human rights. A ban could potentially accelerate these efforts, leading to stricter regulations and greater scrutiny of the entire supply chain.

Conclusion

The potential for a cobalt export ban from the DRC presents a significant challenge to the global EV industry and the broader economy. The impact on cobalt prices, EV production, and international relations would be profound. Understanding the complexities of this issue is crucial for stakeholders across the supply chain.

Call to Action: Stay informed about the evolving situation regarding Congo's cobalt export ban. Understanding the intricacies of this critical issue is vital for navigating the future of the global cobalt market and the electric vehicle revolution. Follow developments closely to understand the impact of Congo's cobalt policies on your business and investments.

Featured Posts

-

The Hollywood Strike What It Means For Film And Television Production

May 16, 2025

The Hollywood Strike What It Means For Film And Television Production

May 16, 2025 -

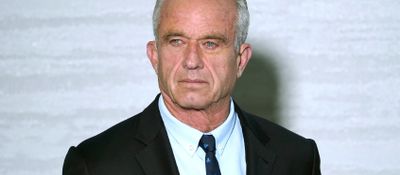

Exclusive Tensions Rise As Trump Officials Confront Rfk Jr On Pesticides

May 16, 2025

Exclusive Tensions Rise As Trump Officials Confront Rfk Jr On Pesticides

May 16, 2025 -

Deep Dive Into Androids Youthful New Ui

May 16, 2025

Deep Dive Into Androids Youthful New Ui

May 16, 2025 -

Pulaski Boil Water Order Extended To Saturday

May 16, 2025

Pulaski Boil Water Order Extended To Saturday

May 16, 2025 -

Paysandu 0 1 Bahia Resultado Resumen Y Goles Del Partido

May 16, 2025

Paysandu 0 1 Bahia Resultado Resumen Y Goles Del Partido

May 16, 2025