Conquering Financial Challenges: Strategies To Manage Limited Funds

Table of Contents

Creating a Realistic Budget

A realistic budget is the cornerstone of effective financial management, especially when dealing with limited funds. It provides a clear picture of your income and expenses, allowing you to make informed decisions about your money.

Tracking Your Spending

Understanding where your money goes is the first step. Use budgeting apps, spreadsheets, or even a simple notebook to meticulously track every expense for at least a month. This detailed tracking will reveal spending patterns you may not be aware of.

- Identify essential vs. non-essential spending: Differentiate between needs (housing, food, utilities) and wants (eating out, entertainment). This distinction is vital for identifying areas where you can cut back.

- Look for areas where you can cut back: Once you see your spending patterns, you can identify areas for potential savings. Small changes can add up to significant savings over time.

- Consider using budgeting apps: Apps like Mint or YNAB (You Need A Budget) can automate tracking, categorize expenses, and provide valuable insights into your spending habits. These tools can significantly simplify budget management.

Setting Financial Goals

Defining short-term and long-term financial goals provides direction and motivation. These goals will help you stay focused and make informed financial decisions.

- Examples: Paying off high-interest debt, saving for a down payment on a house, building an emergency fund, or saving for retirement.

- Break down large goals into smaller, achievable milestones: Large goals can seem daunting. Breaking them down into smaller, manageable steps makes them less intimidating and more attainable. This approach keeps you motivated and prevents feelings of overwhelm.

Allocating Your Income

Develop a budget that allocates funds for needs, wants, and savings. A popular guideline is the 50/30/20 rule, but you can adjust it based on your circumstances.

- The 50/30/20 rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Adjust percentages: This rule is a guideline, not a strict law. Adjust the percentages based on your unique financial situation and priorities. For example, if you have significant debt, you may need to allocate a larger percentage to debt repayment initially.

Reducing Expenses and Increasing Income

Managing limited funds often requires a two-pronged approach: reducing expenses and increasing income. Both strategies are crucial for improving your financial health.

Identifying Areas to Cut Back

Review your spending habits and identify areas where you can reduce expenses without significantly impacting your quality of life. Small changes can make a big difference.

- Lower your monthly bills: Negotiate lower rates with your service providers (internet, phone, insurance). Consider switching providers for better deals.

- Reduce dining out, entertainment, and subscription services: These are often areas where significant savings can be found. Consider cooking at home more often, exploring free entertainment options, and reviewing your subscription services to eliminate unnecessary ones.

- Explore cheaper alternatives for transportation: Carpooling, biking, or using public transport can significantly reduce transportation costs.

Exploring Additional Income Streams

Supplementing your income with extra work or side hustles can significantly improve your financial situation.

- Freelancing, gig work, part-time jobs: Explore opportunities that align with your skills and interests. Websites like Upwork and Fiverr offer various freelance opportunities.

- Selling unused items: Declutter your home and sell unwanted items online or at a consignment shop.

- Consider renting out a spare room or parking space: If you have extra space, consider renting it out for additional income.

- Explore online opportunities: Participate in online surveys, offer online tutoring services, or explore other online income-generating options.

Building an Emergency Fund

An emergency fund is crucial for navigating unexpected expenses and preventing further financial hardship.

The Importance of an Emergency Fund

Having savings for unexpected expenses (medical bills, car repairs, job loss) can prevent you from falling deeper into debt.

- Aim for 3-6 months' worth of living expenses: This provides a safety net for unexpected events.

- Start small; even saving a little each month makes a difference: Consistency is key. Even small, regular savings add up over time.

- Automate savings transfers: Set up automatic transfers from your checking account to your savings account to make saving effortless.

Prioritizing Savings

Make saving a non-negotiable part of your budget. Treat it like any other essential expense.

- Consider using high-yield savings accounts: These accounts offer higher interest rates, helping your savings grow faster.

- Explore options like automatic transfers or round-up apps: These tools make saving easier and more convenient.

Seeking Professional Financial Guidance

If you're struggling to manage your finances, seeking professional advice can be invaluable.

Consulting a Financial Advisor

A financial advisor can provide personalized guidance and support.

- A financial advisor can help you create a personalized financial plan: They can tailor a plan to your specific needs and goals.

- They can provide guidance on debt management, investing, and retirement planning: A financial advisor can provide expert advice on various financial aspects.

- Look for certified financial planners (CFPs): CFPs have met specific education and experience requirements, ensuring you receive qualified advice.

Utilizing Free Resources

Many free resources are available to help you improve your financial literacy.

- Many non-profit organizations offer free financial literacy programs and workshops: These programs provide valuable education and support.

- Government websites provide information on budgeting, debt management, and financial assistance programs: Government resources can provide valuable information and potential assistance.

Conclusion

Conquering financial challenges requires a proactive and strategic approach. By implementing these strategies – creating a realistic budget, reducing expenses, increasing income, building an emergency fund, and seeking professional guidance – you can effectively manage limited funds and build a stronger financial foundation. Remember, consistent effort and smart financial decisions are key to achieving long-term financial stability. Start conquering your financial challenges today by creating a budget and taking control of your finances. Don't let limited funds limit your future; take charge and build the financial life you deserve!

Featured Posts

-

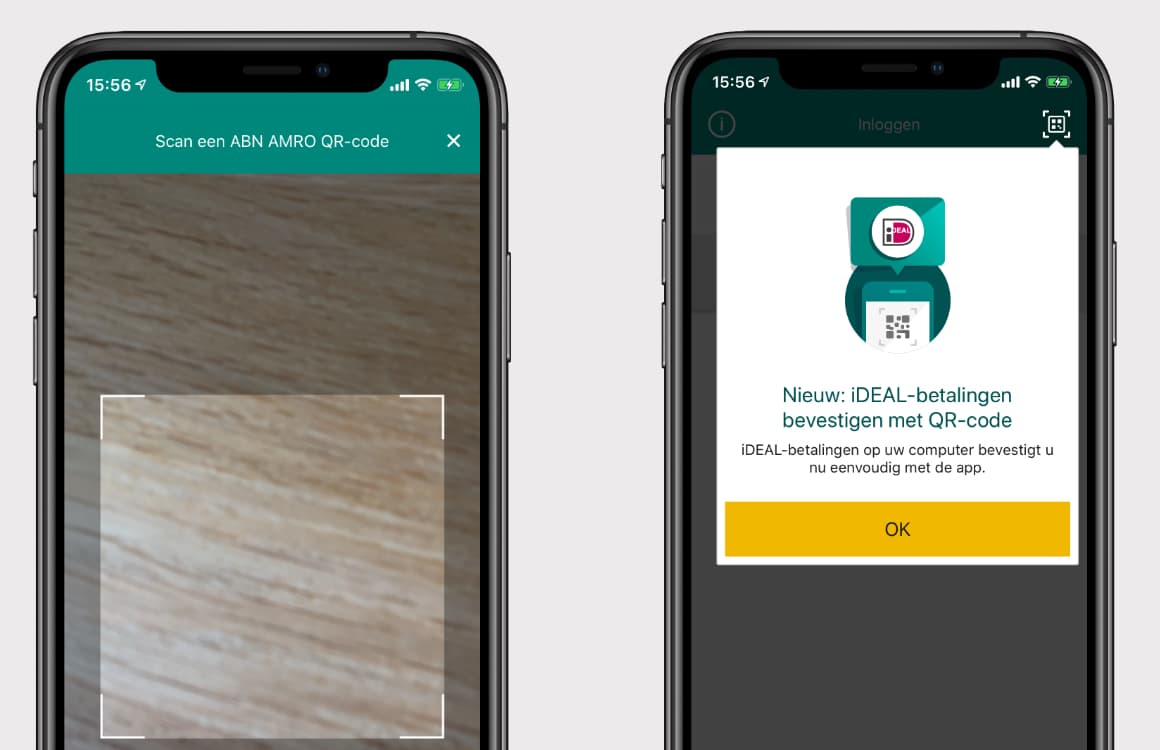

Oplossing Voor Storingen Bij Online Betalingen Abn Amro Opslag

May 22, 2025

Oplossing Voor Storingen Bij Online Betalingen Abn Amro Opslag

May 22, 2025 -

Liga De Naciones Concacaf Diversion Garantizada Con Los Memes De Canada Vs Mexico

May 22, 2025

Liga De Naciones Concacaf Diversion Garantizada Con Los Memes De Canada Vs Mexico

May 22, 2025 -

Voyage En Loire Atlantique Quiz Histoire Gastronomie Culture

May 22, 2025

Voyage En Loire Atlantique Quiz Histoire Gastronomie Culture

May 22, 2025 -

Understanding Core Weaves Crwv Sharp Rise Factors Contributing To Todays Performance

May 22, 2025

Understanding Core Weaves Crwv Sharp Rise Factors Contributing To Todays Performance

May 22, 2025 -

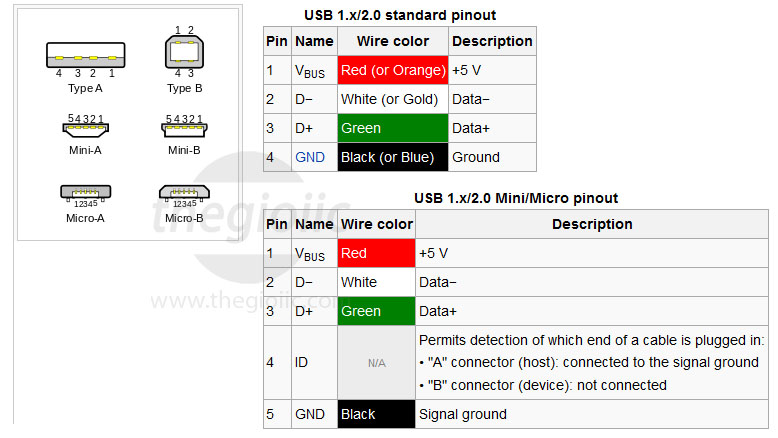

Hieu Ro Chuc Nang Hai Lo Vuong Tren Cong Usb Cua Ban

May 22, 2025

Hieu Ro Chuc Nang Hai Lo Vuong Tren Cong Usb Cua Ban

May 22, 2025