Conquering Lack Of Funds: A Step-by-Step Guide To Financial Freedom

Table of Contents

Assessing Your Current Financial Situation

Understanding your starting point is crucial before you can plan your journey to financial freedom. A thorough assessment of your current financial health will provide the foundation for building a solid financial strategy. This involves a frank look at your income, expenses, assets, and liabilities.

Tracking Your Income and Expenses

This involves meticulously monitoring all sources of income and all expenses, both big and small. Accurate tracking is the cornerstone of effective financial management.

- Use budgeting apps or spreadsheets: Mint, YNAB (You Need A Budget), and Personal Capital are popular choices for tracking income and expenses. Spreadsheets like Google Sheets or Excel offer similar functionality.

- Categorize your expenses: Organize your spending into categories like housing, food, transportation, entertainment, debt payments, and savings. This categorization helps identify areas of overspending.

- Analyze your spending patterns: Review your categorized expenses to pinpoint unnecessary spending. Are you subscribing to services you don't use? Are you eating out too often? Identifying these patterns is key to cutting costs.

Calculating Your Net Worth

Determining your net worth (assets minus liabilities) provides a clear picture of your current financial health. This number reflects your overall financial position.

- List all your assets: Include checking and savings accounts, investments (stocks, bonds, mutual funds), retirement accounts (401k, IRA), real estate, and any other valuable possessions.

- List all your liabilities: This includes outstanding loans (student loans, mortgages, auto loans), credit card debt, and any other outstanding balances.

- Subtract your liabilities from your assets: The result is your net worth. A positive net worth indicates you have more assets than liabilities, while a negative net worth suggests you owe more than you own.

Identifying Debt and High-Interest Rates

High-interest debt can significantly hinder your progress towards financial freedom. Prioritizing high-interest debt repayment is crucial.

- List all your debts: Note each debt's balance, interest rate, and minimum payment.

- Prioritize high-interest debts: Focus on paying down debts with the highest interest rates first, as these cost you the most money over time. Consider strategies like the debt avalanche (highest interest first) or debt snowball (smallest debt first) methods.

- Explore debt consolidation options: Debt consolidation loans or balance transfer credit cards can help simplify debt repayment and potentially lower interest rates. However, be mindful of fees and terms.

Creating a Realistic Budget and Sticking to It

A well-structured budget is essential for managing your finances effectively. A budget allows you to allocate your funds strategically, ensuring your spending aligns with your financial goals.

The 50/30/20 Rule

This popular budgeting guideline suggests allocating your after-tax income as follows:

- 50% to needs: Housing, utilities, groceries, transportation, and essential medical expenses.

- 30% to wants: Entertainment, dining out, subscriptions, and other non-essential expenses.

- 20% to savings and debt repayment: Prioritize building an emergency fund and paying down high-interest debt.

Setting Financial Goals

Define short-term and long-term financial goals to provide direction and motivation. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART goals).

- Examples of short-term goals: Paying off credit card debt, building an emergency fund (3-6 months of living expenses), saving for a down payment on a car.

- Examples of long-term goals: Buying a house, paying off your mortgage, retiring comfortably, funding your children's education.

Regularly Reviewing and Adjusting Your Budget

Life circumstances change, so regularly review and adjust your budget to reflect your current situation. Regular review ensures your budget remains relevant and effective. Aim to review your budget at least monthly.

Increasing Your Income and Exploring Additional Revenue Streams

Boosting your income can significantly accelerate your progress toward financial freedom. Explore various avenues to increase your earning potential.

Negotiating a Raise

Research industry salaries and confidently negotiate a raise based on your performance and value to the company. Prepare a compelling case highlighting your accomplishments and contributions.

Seeking a Higher-Paying Job

Explore job opportunities that offer better compensation and benefits. Update your resume, network with professionals, and actively search for higher-paying roles.

Developing Side Hustles

Consider freelancing, consulting, or starting a small business to generate additional income. Numerous opportunities exist, depending on your skills and interests.

- Examples of side hustles: Online tutoring, freelance writing, graphic design, virtual assistance, selling crafts or goods online (Etsy, Amazon Handmade), dog walking, driving for a ride-sharing service.

Smart Saving and Investing Strategies

Saving and investing wisely are crucial for long-term financial security. A well-defined savings and investment plan will help you secure your financial future.

Building an Emergency Fund

Aim to save 3-6 months' worth of living expenses in an easily accessible account. This fund provides a safety net for unexpected expenses, preventing you from going into debt.

Investing for the Future

Consider investing in a diversified portfolio of stocks, bonds, and other assets. Investing allows your money to grow over time, building wealth for the long term.

- Consult with a financial advisor: A financial advisor can help you develop a personalized investment strategy tailored to your risk tolerance and financial goals.

- Understand your risk tolerance: Before investing, assess your comfort level with risk. Higher-risk investments offer the potential for higher returns but also carry greater risk of loss.

Utilizing Retirement Accounts

Maximize contributions to retirement accounts such as 401(k)s and IRAs to benefit from tax advantages and long-term growth. These accounts offer tax benefits and are designed for long-term growth.

Conclusion

Conquering lack of funds and achieving financial freedom requires a proactive and disciplined approach. By assessing your financial situation, creating a realistic budget, increasing your income, and implementing smart saving and investing strategies, you can build a secure financial future. Remember that overcoming financial hardship is a journey, not a sprint. Start taking action today and embark on your path towards financial freedom. Don't let lack of funds define your future; actively manage your finances and achieve your dreams! Begin conquering your lack of funds today and start building lasting financial freedom.

Featured Posts

-

Thlatht Njwm Amrykyyn Jdd Yndmwn Lmntkhb Bwtshytynw

May 21, 2025

Thlatht Njwm Amrykyyn Jdd Yndmwn Lmntkhb Bwtshytynw

May 21, 2025 -

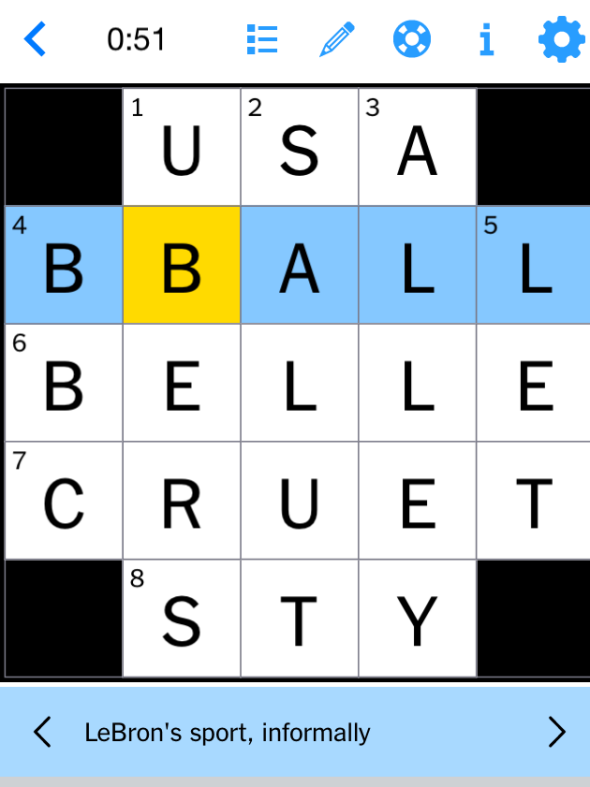

Nyt Mini Crossword Answers Today March 18 2025 Clues And Solutions

May 21, 2025

Nyt Mini Crossword Answers Today March 18 2025 Clues And Solutions

May 21, 2025 -

Discover Unique Foods At The Manhattan Forgotten Foods Festival

May 21, 2025

Discover Unique Foods At The Manhattan Forgotten Foods Festival

May 21, 2025 -

Mummy Pigs Big Announcement Peppa Pigs Family Welcomes A New Piglet

May 21, 2025

Mummy Pigs Big Announcement Peppa Pigs Family Welcomes A New Piglet

May 21, 2025 -

Is This The End David Walliams And Simon Cowells Britains Got Talent Feud

May 21, 2025

Is This The End David Walliams And Simon Cowells Britains Got Talent Feud

May 21, 2025