Cooling Spanish Inflation Bolsters Case For European Central Bank Rate Cut

Table of Contents

Spain's Declining Inflation: A Key Indicator

Analyzing the recent drop in Spanish inflation figures.

- CPI figures: Spain's Consumer Price Index (CPI) has shown a consistent decline in recent months, falling from a peak of X% in [Month, Year] to Y% in [Month, Year]. This represents a significant deceleration compared to the previous year.

- Reasons for the decrease: Several factors contribute to this decline, including a substantial easing of energy prices, government implemented measures to mitigate the cost of living crisis, and a softening of demand.

- Comparison to other Eurozone countries: While other Eurozone countries have also experienced a slowdown in inflation, Spain's reduction is particularly noteworthy due to its significant economic weight within the Eurozone. This substantial decrease surpasses the rate of inflation reduction in several other major Eurozone economies.

Spain's relatively large economy and its significant contribution to the Eurozone's GDP mean that its inflationary trends significantly influence the overall Eurozone inflation rate. Any easing of inflationary pressures in Spain consequently translates into a lower average inflation rate for the entire Eurozone.

The impact of lower Spanish inflation on overall Eurozone inflation.

- Interconnectedness of Eurozone economies: The economies of the Eurozone are deeply intertwined. A decrease in Spanish inflation can have a ripple effect, impacting prices and consumer behavior in other member states.

- Spain's influence on Eurozone average: Because Spain is a large economy, its lower inflation directly lowers the overall inflation average calculated for the Eurozone. This has a substantial impact on the ECB's policy decisions.

- ECB's inflation target: The ECB aims for an inflation rate of 2% over the medium term. Spain's contribution to lower Eurozone inflation brings the bloc closer to achieving this target, potentially opening the door for an ECB rate cut.

ECB's Current Monetary Policy and Future Outlook

The ECB's current stance on interest rates and quantitative tightening.

- Recent decisions: The ECB has recently maintained its interest rates at [current rate], citing ongoing concerns about inflation. However, the recent data points suggest a potential shift in strategy.

- Reasoning behind the current policy: The ECB's previous reasoning centered on controlling inflation, even at the expense of potential economic slowdowns. Quantitative tightening measures aimed to reduce the money supply and curb inflationary pressures.

- Implications of maintaining the current policy: Continuing with the current tight monetary policy could stifle economic growth across the Eurozone, potentially leading to a deeper recession.

The ECB utilizes various tools to manage monetary policy, including adjusting interest rates, implementing quantitative easing (QE) or quantitative tightening (QT), and setting reserve requirements for banks.

Arguments for and against an ECB rate cut.

- Arguments for a rate cut: Proponents argue that a rate cut is necessary to stimulate economic growth, reduce borrowing costs for businesses and consumers, and prevent a more severe economic downturn. The cooling Spanish inflation provides strong support for this argument.

- Arguments against a rate cut: Opponents express concern that a rate cut could reignite inflation, potentially weakening the Euro and destabilizing the financial markets. They advocate for maintaining a cautious approach and waiting for further evidence of sustained disinflation.

- Expert opinions: Many economists and financial analysts believe that Spain’s cooling inflation, coupled with slowing economic growth in the Eurozone, makes a rate cut increasingly likely in the coming months. However, some experts still caution against premature easing.

Economic Implications of an ECB Rate Cut

Potential benefits of a rate cut for the Eurozone economy.

- Lower borrowing costs: A rate cut would make borrowing cheaper for businesses and consumers, potentially stimulating investment and consumption.

- Economic growth stimulation: Lower interest rates could encourage businesses to expand, creating jobs and boosting economic activity.

- Impact on investment: Reduced borrowing costs would make investment projects more attractive, potentially leading to increased capital expenditure and innovation.

The potential positive effects of an ECB rate cut are significant, especially given the current economic climate.

Potential risks associated with an ECB rate cut.

- Increased inflation: A rate cut could potentially reignite inflationary pressures, especially if it occurs prematurely or if underlying inflation remains stubbornly high.

- Weakening of the Euro: A rate cut could lead to a decline in the value of the Euro, making imports more expensive and potentially impacting the Eurozone's trade balance.

- Implications for financial stability: A rate cut could also have implications for financial stability, potentially increasing the risk of asset bubbles and excessive borrowing.

It is crucial to carefully assess the potential risks associated with a rate cut to ensure a balanced approach.

Comparison to other central banks' actions.

- Federal Reserve: The Federal Reserve in the US has recently [mention recent Fed actions regarding interest rates].

- Bank of England: The Bank of England has taken a [mention recent Bank of England actions regarding interest rates] approach.

- Comparison to ECB: The ECB's decision will likely depend on the specific economic conditions within the Eurozone and its assessment of the risks and benefits of a rate cut compared to these other central banks.

Conclusion

In summary, the cooling of Spanish inflation significantly bolsters the case for an ECB rate cut. Spain’s economic weight within the Eurozone means its inflation trends have a considerable impact on the overall inflation picture, and the recent drop in Spanish inflation brings the Eurozone closer to the ECB's inflation target. While there are potential risks associated with a rate cut, the potential benefits of stimulating economic growth and reducing borrowing costs are substantial. The ECB's decision will be crucial in shaping the future trajectory of the Eurozone economy. Stay tuned for further updates on the ECB’s response to the evolving inflation landscape in Spain and across the Eurozone. Understanding the interplay between Spanish inflation and the ECB's decisions is crucial for navigating the current economic climate.

Featured Posts

-

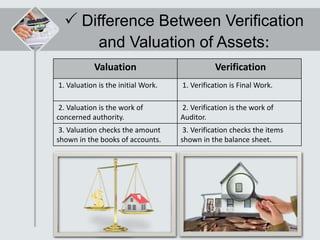

Banksy On Your Wall Verification And Valuation

May 31, 2025

Banksy On Your Wall Verification And Valuation

May 31, 2025 -

Harvard Reprieve Extended Judges Ruling On Foreign Student Ban

May 31, 2025

Harvard Reprieve Extended Judges Ruling On Foreign Student Ban

May 31, 2025 -

Faizan Zaki Secures Scripps National Spelling Bee Championship

May 31, 2025

Faizan Zaki Secures Scripps National Spelling Bee Championship

May 31, 2025 -

Team Victoriouss Tour Of The Alps Strategy A Winning Formula

May 31, 2025

Team Victoriouss Tour Of The Alps Strategy A Winning Formula

May 31, 2025 -

Exclusive Investigation Launched Into Attempted Impersonation Of White House Chief Of Staff

May 31, 2025

Exclusive Investigation Launched Into Attempted Impersonation Of White House Chief Of Staff

May 31, 2025