Copper Market Volatility: Impact Of China-US Trade Discussions

Table of Contents

The Role of China in Global Copper Demand

China's massive appetite for copper is a cornerstone of the global market. Its influence on copper prices is undeniable, primarily due to its enormous infrastructure projects and its position as the world's largest copper consumer.

China's Consumption & Infrastructure Projects

China's insatiable demand for copper is fueled by its ambitious infrastructure development plans. High-speed rail networks, renewable energy projects (solar, wind), and ongoing urbanization initiatives all require vast quantities of copper. Any alteration in Chinese economic policy directly impacts global copper demand.

- Construction boom and its impact on copper consumption: The ongoing construction boom in China continues to drive significant copper demand, impacting global prices. Slowdowns in construction directly translate to reduced copper consumption.

- Government spending and investment in infrastructure: Government spending decisions play a crucial role. Increased investment in infrastructure projects leads to higher copper demand, while reduced spending can trigger price drops.

- Influence of environmental regulations on copper demand: China's increasingly stringent environmental regulations influence the types of copper-intensive projects undertaken, and thus the overall demand. This creates both challenges and opportunities for the copper industry.

Impact of Trade Wars on Chinese Copper Imports

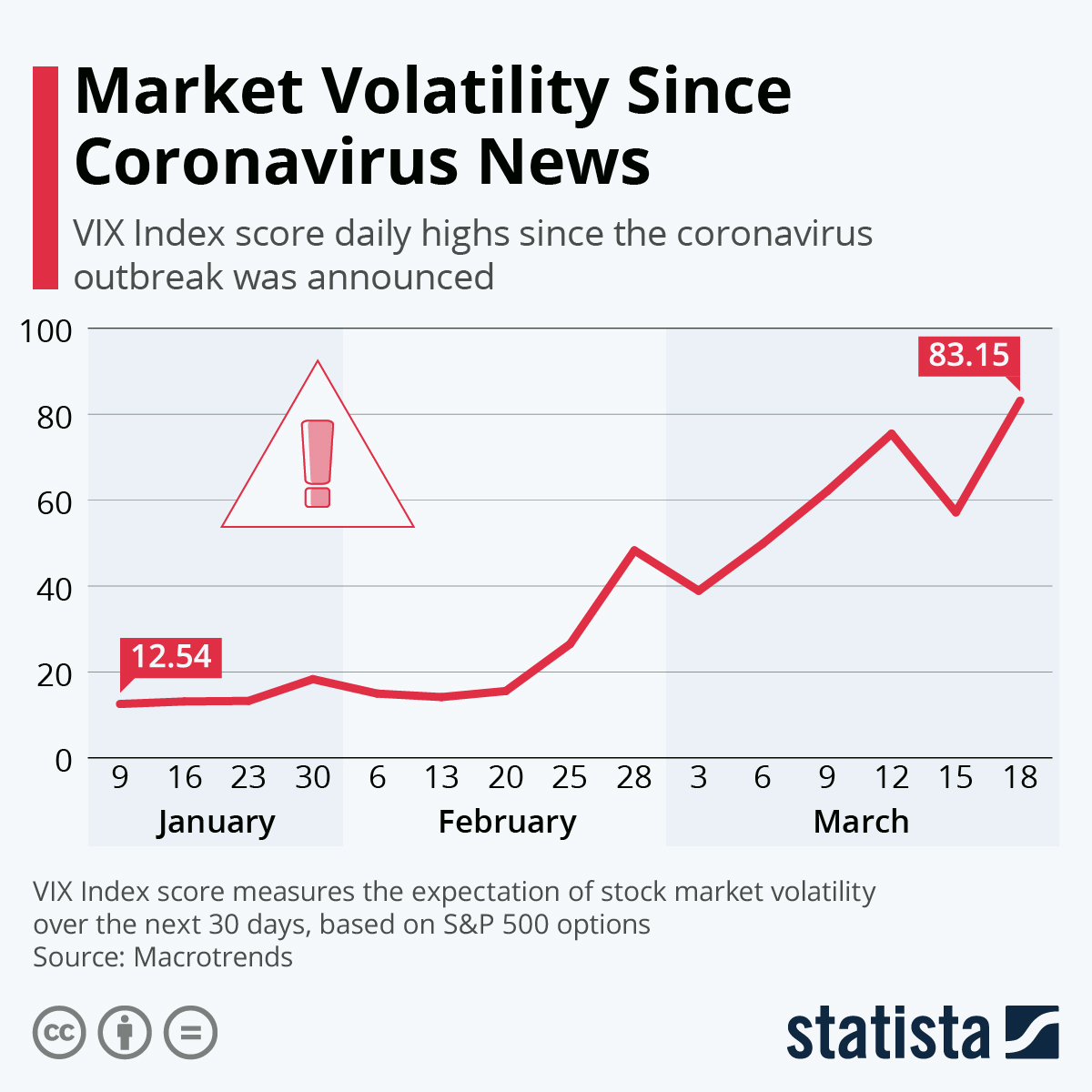

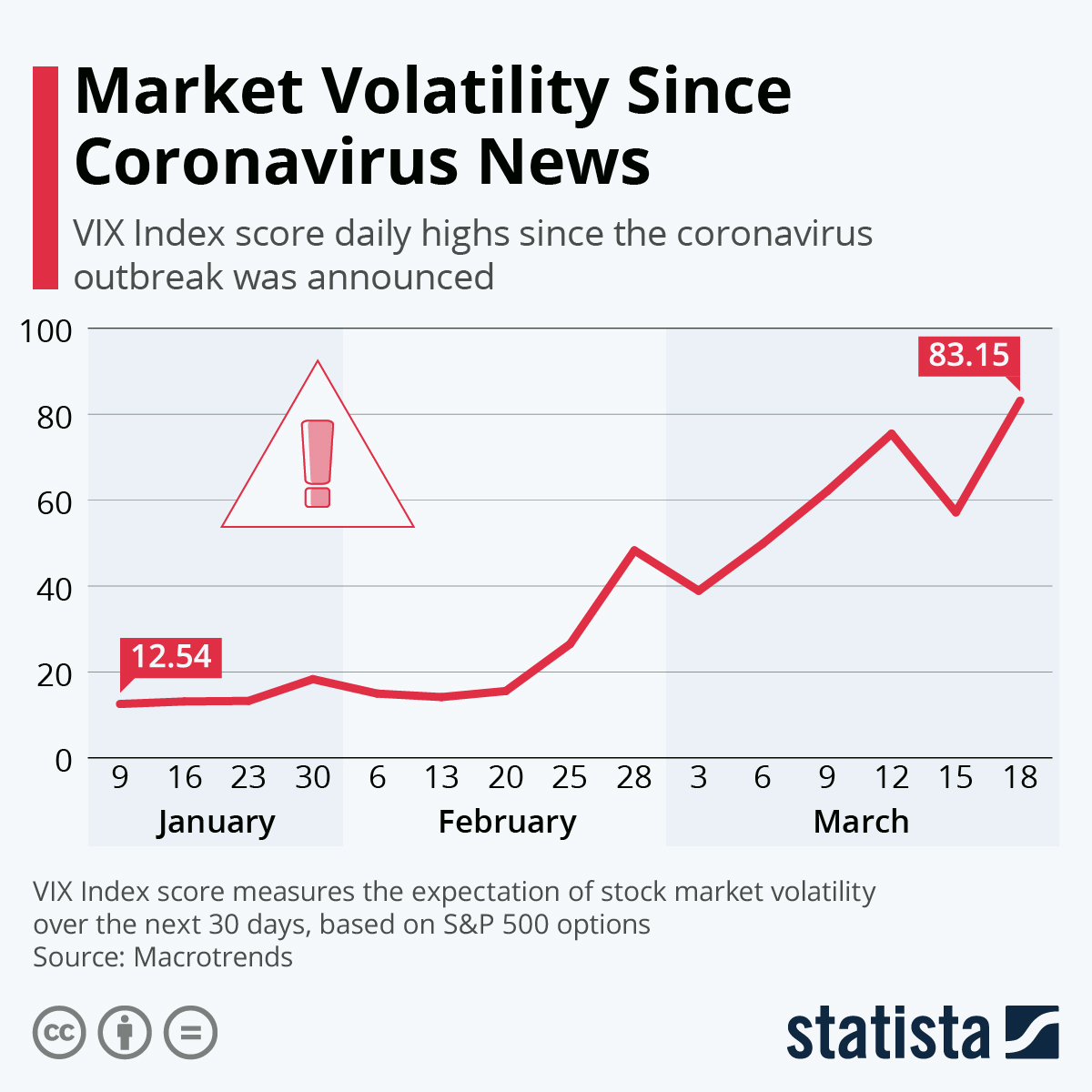

Trade tensions between the US and China have significantly influenced copper prices. Tariffs imposed on copper imports can disrupt supply chains, leading to price increases and uncertainty for both producers and consumers.

- Analysis of past tariff impacts on copper prices: Historical data reveals a clear correlation between the imposition of tariffs and subsequent fluctuations in copper prices. Past trade wars have demonstrated the sensitivity of the copper market to such measures.

- The role of alternative suppliers to China: Trade disputes have pushed China to explore alternative copper suppliers, impacting the market share of traditional exporters and potentially altering global supply dynamics.

- The effect on Chinese investment in overseas copper mines: Geopolitical risks and trade tensions have influenced Chinese investment strategies in foreign copper mines, adding another layer of complexity to the market.

US Economic Policies and Their Influence on Copper Prices

US economic policies, particularly monetary policy and trade strategies, exert considerable influence on global copper markets.

US Monetary Policy and Interest Rates

Changes in US interest rates directly impact the value of the US dollar, the currency in which copper is primarily traded. A stronger dollar generally makes copper more expensive for buyers using other currencies, potentially reducing demand.

- Correlation between interest rate changes and copper prices: Historical data shows a clear, albeit not always linear, relationship between US interest rate changes and copper price movements.

- Impact of quantitative easing on commodity markets: Quantitative easing programs by the US Federal Reserve can impact commodity prices, including copper, by influencing inflation and market liquidity.

- Effect of a strong dollar on copper imports into the US: A stronger dollar can make copper imports into the US less expensive, influencing the balance of trade and overall market dynamics.

US Trade Policies and Their Global Ripple Effect

US trade policies, including tariffs and trade agreements, have far-reaching effects on global supply chains and the stability of the copper market. These policies often create uncertainties for businesses and investors.

- Analysis of the impact of previous trade disputes on copper: Past trade disputes highlight the significant impact of protectionist measures on copper prices and market sentiment.

- The role of international trade organizations in stabilizing copper markets: International organizations like the WTO play a crucial role in attempting to stabilize copper markets by promoting free and fair trade.

- The impact of sanctions and trade restrictions on copper supply: Sanctions and trade restrictions imposed on certain countries can disrupt copper supply chains and lead to significant price volatility.

Geopolitical Risks and Copper Market Volatility

Geopolitical events beyond the US-China trade relationship can significantly influence copper market volatility. Political instability or conflict in major copper-producing countries can severely disrupt supply chains and cause price spikes.

Global Political Instability and its Influence

Political instability, conflict, or natural disasters in major copper-producing regions can lead to supply shortages and drive up prices. This underscores the importance of geopolitical factors in the copper market.

- Impact of political unrest in key copper-producing regions: Political turmoil in countries like Chile or Peru, major copper producers, can have immediate and substantial impacts on global copper supply.

- Supply chain disruptions due to geopolitical factors: Geopolitical events can disrupt copper supply chains, impacting production, transportation, and ultimately, market prices.

- Investment decisions affected by global political uncertainty: Political uncertainty discourages investment in the copper mining sector, leading to lower production and potential price increases.

Conclusion

The interconnectedness between China-US trade discussions and copper market volatility is undeniable. Understanding the complex interplay of Chinese economic policies, US monetary and trade strategies, and broader geopolitical factors is vital for navigating this dynamic commodity market. Staying informed about evolving trade negotiations and global economic trends is crucial for making sound investment decisions. Continuous monitoring of copper market volatility and its relationship to China-US trade is paramount for all stakeholders. By carefully analyzing these influential factors, businesses and investors can mitigate risks and capitalize on emerging opportunities within the ever-shifting landscape of the copper market.

Featured Posts

-

U 20 Asia Iran Raih Kemenangan Besar 6 0 Atas Yaman

May 06, 2025

U 20 Asia Iran Raih Kemenangan Besar 6 0 Atas Yaman

May 06, 2025 -

Rihannas Post Engagement Style Red Heels And Cool Confidence

May 06, 2025

Rihannas Post Engagement Style Red Heels And Cool Confidence

May 06, 2025 -

Azerbaydzhan Zakriv Ofis Vvs Prichini Ta Naslidki

May 06, 2025

Azerbaydzhan Zakriv Ofis Vvs Prichini Ta Naslidki

May 06, 2025 -

Patrick Schwarzeneggers Bronco A West Coast Icon

May 06, 2025

Patrick Schwarzeneggers Bronco A West Coast Icon

May 06, 2025 -

Ariana Grande And Jeff Goldblum Collaborate On I Dont Know Why

May 06, 2025

Ariana Grande And Jeff Goldblum Collaborate On I Dont Know Why

May 06, 2025