Core Inflation Surge Forces Bank Of Canada Into Difficult Policy Decision

Table of Contents

Understanding the Core Inflation Surge

Core inflation, which excludes volatile items like food and energy, provides a clearer picture of underlying price pressures in the economy. The recent surge in core inflation in Canada presents a significant challenge for the Bank of Canada.

Contributing Factors:

Several factors are contributing to this persistent rise in core inflation:

-

Rising wages and labor shortages: A tight labor market, with high demand and low unemployment, is pushing wages upward. These increased labor costs are then passed on to consumers in the form of higher prices for goods and services. This wage-price spiral is a major concern for central bankers.

-

Supply chain disruptions and persistent bottlenecks: The lingering effects of the pandemic, including global supply chain disruptions and port congestion, continue to constrain the availability of goods, driving up prices. These bottlenecks are particularly impactful on manufacturing and transportation costs.

-

Strong consumer demand fueled by government stimulus: Previous government stimulus measures, designed to support the economy during the pandemic, contributed to increased consumer spending and demand, further fueling inflationary pressures. This increased demand outstrips supply in many sectors.

-

Increased housing costs and rental prices: The Canadian housing market has experienced significant price increases in recent years, contributing substantially to core inflation. Rising rental costs also impact the overall inflation rate, affecting a significant portion of the population.

-

Global inflationary pressures: Canada is not immune to global inflationary pressures. Rising energy prices, commodity prices, and global supply chain issues are all contributing factors to the domestic inflation rate.

-

Analyzing the data: Statistics Canada and the Bank of Canada regularly publish data on inflation. Analyzing the weight of each factor requires careful examination of this data, comparing the contribution of each factor to the overall core inflation rate. The difference between headline inflation (which includes volatile items) and core inflation is crucial in understanding the underlying inflationary pressures. Headline inflation can be misleading due to short-term fluctuations.

The Bank of Canada's Policy Dilemma

The Bank of Canada faces a difficult choice in addressing the core inflation surge. Raising interest rates too aggressively risks triggering a recession, while inaction risks allowing inflation to become entrenched.

Options for Addressing Core Inflation:

Several policy options are available to the Bank of Canada:

-

Increasing interest rates: Raising interest rates is the most common tool used to combat inflation. Higher interest rates make borrowing more expensive, reducing consumer spending and business investment, thus cooling down the economy and dampening demand-pull inflation.

-

Maintaining current interest rates: The Bank could choose to maintain current interest rates and closely monitor economic indicators. This approach carries the risk of allowing inflation to persist but avoids the immediate economic shock of a rate hike.

-

Implementing quantitative tightening measures: This involves reducing the Bank of Canada's balance sheet by selling government bonds, effectively reducing the money supply and curbing inflation.

-

Targeting specific sectors driving inflation: The Bank could implement targeted measures to address specific sectors driving inflation, such as housing, through regulatory changes or other interventions.

-

Evaluating the options: Each policy option carries potential benefits and drawbacks. Raising interest rates, while effective in curbing inflation, could lead to slower economic growth, increased unemployment, and reduced business investment. Maintaining the status quo risks allowing inflation to spiral. Quantitative tightening can have similar impacts to interest rate hikes. Targeted measures might not be sufficient to address broad-based inflation. Historical precedent shows the Bank of Canada has used a mix of these strategies in the past, often adapting its approach based on economic data.

Potential Economic Consequences

The Bank of Canada's policy decisions will have significant consequences for the Canadian economy.

Recessionary Risks:

Aggressive interest rate hikes increase the risk of a recession. Higher interest rates make borrowing more expensive for businesses and consumers, leading to reduced investment and spending, potentially triggering a contraction in economic activity. Job losses and increased unemployment are also likely outcomes of a recession.

Inflationary Persistence:

If policy measures are insufficient, inflation could become entrenched, leading to a wage-price spiral. This occurs when rising prices lead to higher wages, which in turn lead to further price increases, creating a self-perpetuating cycle of inflation. Managing inflation expectations is also crucial; if people expect inflation to continue, they may demand higher wages, fueling further inflation.

- Economic forecasting: Economists use various forecasting models to predict the potential outcomes of different policy choices. These models take into account various economic indicators and historical data. The impact on different segments of the Canadian population will vary, with some groups more vulnerable to the effects of higher interest rates or job losses than others. Expert opinions and analysis from leading economists are crucial in navigating this uncertainty.

Conclusion

The Bank of Canada faces a complex challenge in managing the current surge in core inflation. Balancing the need to control inflation with the risk of a recession necessitates a careful consideration of policy options and their potential consequences. The decisions made will have profound implications for the Canadian economy. Understanding core inflation, its drivers, and the potential policy responses is crucial for navigating this economic uncertainty.

Call to Action: Stay informed about the Bank of Canada’s policy decisions and their impact on core inflation. Follow reputable economic news sources to understand the complexities of the Canadian economy and the ongoing efforts to manage core inflation effectively. Understanding the nuances of managing core inflation is vital for navigating the current economic climate.

Featured Posts

-

Vanja Mijatovic Demantira Glasine O Razvodu Istina O Njenom Braku

May 22, 2025

Vanja Mijatovic Demantira Glasine O Razvodu Istina O Njenom Braku

May 22, 2025 -

Tim Hieu Ve Duong Va Cau Noi Binh Duong Tay Ninh

May 22, 2025

Tim Hieu Ve Duong Va Cau Noi Binh Duong Tay Ninh

May 22, 2025 -

All The New Movies And Shows On Netflix In May 2025

May 22, 2025

All The New Movies And Shows On Netflix In May 2025

May 22, 2025 -

Jailed Tory Councillors Wife Denies Incitement In Migrant Hotel Rant

May 22, 2025

Jailed Tory Councillors Wife Denies Incitement In Migrant Hotel Rant

May 22, 2025 -

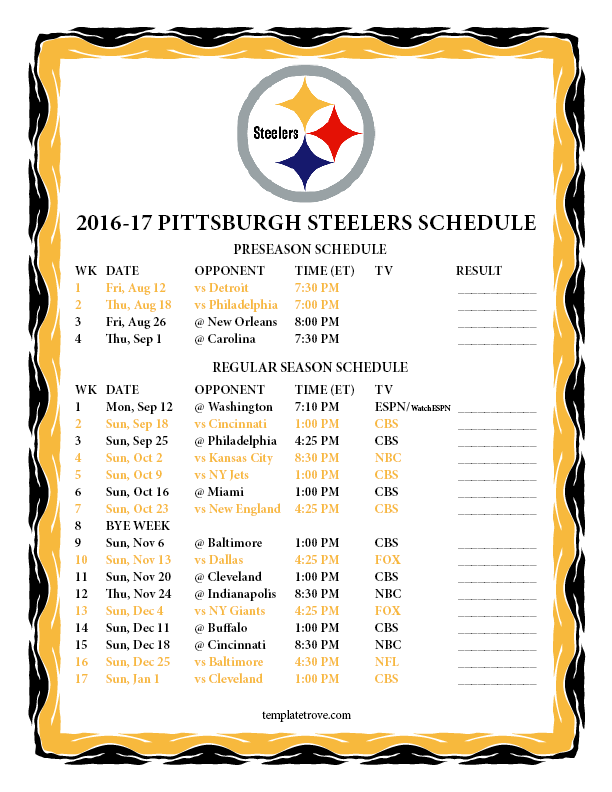

Steelers Schedule Release Key Takeaways And Analysis

May 22, 2025

Steelers Schedule Release Key Takeaways And Analysis

May 22, 2025