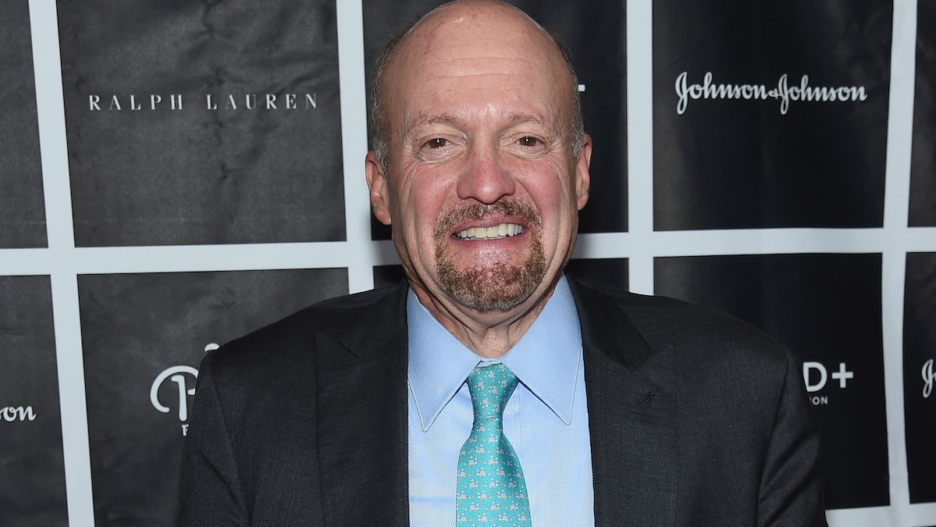

CoreWeave (CRWV) Stock: Jim Cramer's Perspective And Investment Implications

Table of Contents

Jim Cramer's Stance on CoreWeave (CRWV): A Detailed Look

Unfortunately, readily available, public information regarding Jim Cramer's specific and detailed stance on CoreWeave (CRWV) stock is limited at this time. A thorough search of his Mad Money episodes, his Twitter feed, and other public appearances yields no clear, direct statement about CRWV. This lack of explicit commentary doesn't necessarily imply indifference; many factors influence a stock's inclusion in his discussions. However, without direct quotes or references, we can only speculate about his potential opinion based on his general commentary on the cloud computing and AI sectors. This will be addressed further in the following sections, alongside our own analysis. We will continue to monitor for any future statements from Jim Cramer regarding CRWV and update this section accordingly. Keywords: Jim Cramer CoreWeave, Cramer's opinion on CRWV, Mad Money CRWV.

CoreWeave's Business Model and Growth Prospects

CoreWeave's core business lies in providing scalable and sustainable cloud computing infrastructure, specializing in high-performance computing (HPC) and particularly focusing on the needs of artificial intelligence (AI) workloads. This niche within the broader cloud computing market gives CoreWeave a significant competitive advantage.

Competitive Advantages:

- Specialized Infrastructure: CoreWeave's infrastructure is specifically designed for the demanding computational requirements of AI and machine learning, unlike many general-purpose cloud providers.

- Sustainability Focus: The company utilizes a sustainable infrastructure, appealing to environmentally conscious businesses and investors.

- Strategic Partnerships: Collaborations with key players in the technology sector could expand their market reach and enhance service offerings.

Growth Potential Factors:

- Explosive AI Market: The rapid growth of the AI market necessitates substantial infrastructure, creating significant demand for CoreWeave's services.

- Technological Innovation: Continuous innovation in GPU technology and cloud computing architectures will support CoreWeave's ability to offer cutting-edge solutions.

- Data Center Expansion: Strategic expansion of data centers in key locations will allow CoreWeave to reach a broader global client base.

Strengths and Weaknesses:

- Strengths: Specialized infrastructure, strong focus on AI, sustainability commitment.

- Weaknesses: Relative newcomer to the market, potential competition from larger cloud providers, reliance on specific technologies.

Keywords: CoreWeave business model, cloud computing stocks, AI infrastructure investment, CRWV growth potential.

Financial Performance and Valuation of CRWV Stock

Analyzing CRWV's financial performance requires accessing recent financial statements and reports, which are readily available through public channels. Key metrics to consider include revenue growth, profitability (operating margins), and overall financial health. Comparing these metrics to industry competitors and analyzing the company's valuation (using metrics like P/E ratio, price-to-sales ratio, and market capitalization) is essential for understanding its investment potential. It's crucial to consider factors such as debt levels, cash flow, and the overall economic climate. Keep in mind that all financial data is subject to change and should be regularly updated.

Key Financial Highlights (Placeholders – Replace with Actual Data):

- Revenue Growth (Last Quarter/Year): [Insert Data]

- Profitability (Operating Margin): [Insert Data]

- Market Capitalization: [Insert Data]

- P/E Ratio: [Insert Data]

Potential Risks:

- Competition: Intense competition from established cloud computing giants.

- Technological Shifts: Rapid changes in technology could render current infrastructure obsolete.

- Economic Downturn: A general economic slowdown could negatively impact demand for cloud services.

Keywords: CRWV financial analysis, CoreWeave valuation, CRWV stock price, stock market analysis.

Investment Implications and Strategies for CRWV Stock

Given the lack of a clear, public statement from Jim Cramer on CoreWeave, formulating an investment strategy necessitates a thorough evaluation of the factors discussed above. The high growth potential of the AI infrastructure market makes CRWV an interesting prospect, but it's also important to acknowledge the inherent risks involved in investing in a relatively young company in a rapidly evolving sector.

Potential Investment Strategies:

- Buy: For investors with a high-risk tolerance and a long-term investment horizon, CRWV might be a suitable addition to a diversified portfolio.

- Hold (If already invested): Current investors may want to continue monitoring the company's progress and re-evaluate their holdings periodically.

- Sell: Investors concerned about the risks associated with CRWV may consider selling their shares, though this should be considered carefully based on individual investment goals.

Risk Management:

- Diversification: Spread your investments across multiple assets to mitigate risk.

- Due Diligence: Conduct thorough research before making any investment decisions.

- Stop-Loss Orders: Consider using stop-loss orders to limit potential losses.

Keywords: CRWV investment strategy, CoreWeave stock investment, buying CRWV stock, risk management.

Conclusion: Making Informed Decisions on CoreWeave (CRWV) Stock

While publicly available information about Jim Cramer's specific views on CoreWeave (CRWV) stock is currently limited, our analysis reveals a company with significant potential within the burgeoning AI infrastructure market. CoreWeave's business model, focusing on specialized cloud computing for AI workloads, positions it for growth. However, investors should carefully consider the associated risks and conduct their own due diligence before investing. Remember to factor in the company's financial performance, competitive landscape, and overall market conditions. To make a truly informed decision regarding CoreWeave (CRWV) stock, consult additional financial resources, review company filings, and seek advice from a qualified financial advisor. Don't rely solely on the opinions of any single analyst, but rather build your own informed perspective before investing in CRWV or any other stock.

Featured Posts

-

Potential Release Date For Dexter Resurrection Trailer Surfaces Online

May 22, 2025

Potential Release Date For Dexter Resurrection Trailer Surfaces Online

May 22, 2025 -

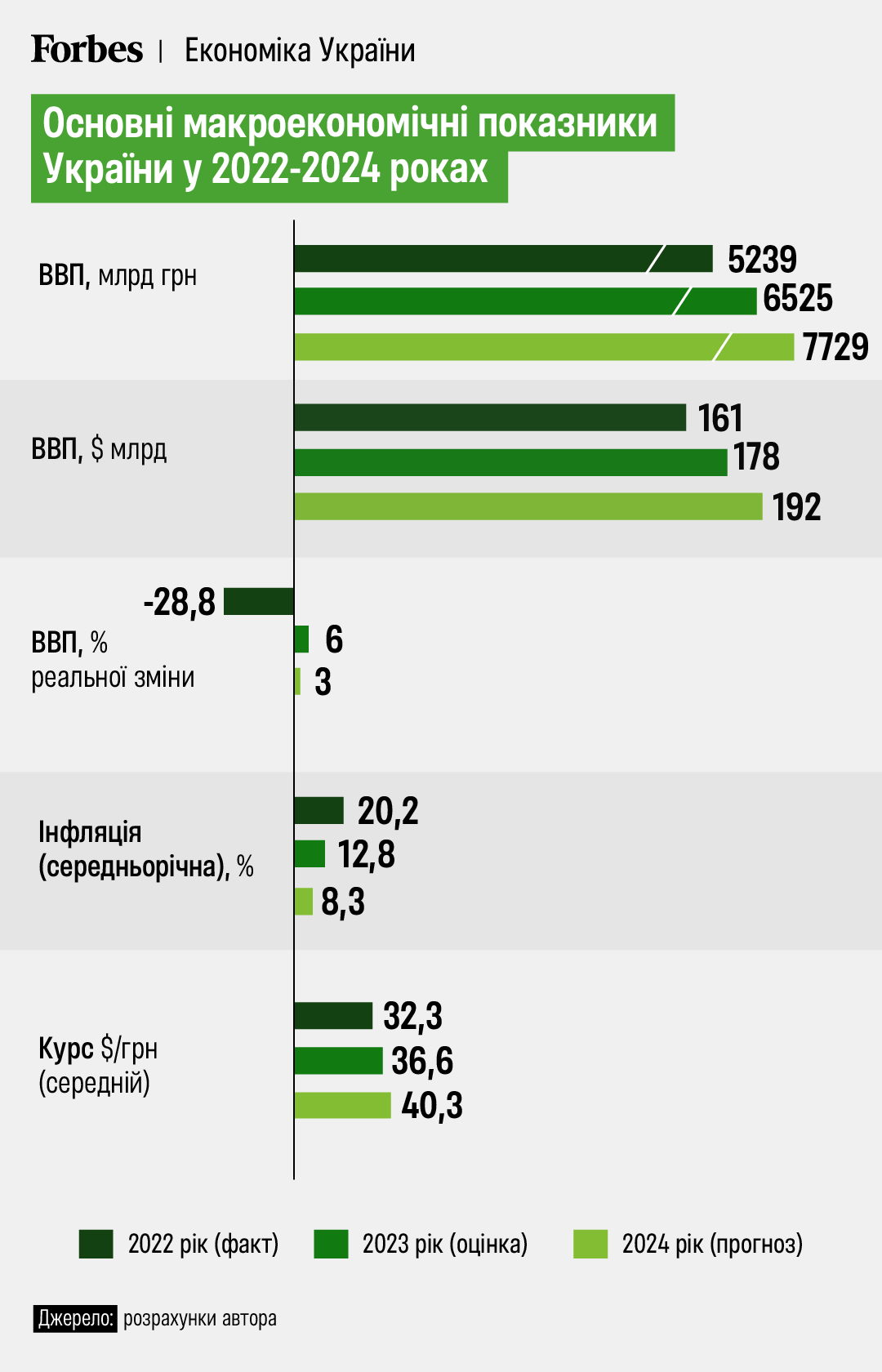

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodom U 2024 Rotsi

May 22, 2025

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodom U 2024 Rotsi

May 22, 2025 -

Trans Australia Run Record Breaking Attempt Imminent

May 22, 2025

Trans Australia Run Record Breaking Attempt Imminent

May 22, 2025 -

Klopp Real Madrid In Teknik Direktoerue Olabilir Mi

May 22, 2025

Klopp Real Madrid In Teknik Direktoerue Olabilir Mi

May 22, 2025 -

The Traverso Family A Cannes Film Festival Photography Dynasty

May 22, 2025

The Traverso Family A Cannes Film Festival Photography Dynasty

May 22, 2025