CoreWeave (CRWV) Stock Performance: Explaining Thursday's Decrease

Table of Contents

Market Sentiment and Broader Tech Sector Performance

The performance of CoreWeave (CRWV) stock is intrinsically linked to the overall health and sentiment of the technology sector. Thursday's dip wasn't isolated; a broader downturn affected many technology stocks, indirectly impacting CoreWeave (CRWV). This negative sentiment extended to the cloud computing and AI infrastructure sectors, areas where CoreWeave operates. Investors, it seems, are becoming more cautious about high-growth tech stocks in the current economic climate.

- Tech Index Performance: The Nasdaq Composite and the S&P 500 Technology sector both experienced declines on Thursday, mirroring the downward trend in CoreWeave (CRWV) stock. [Link to relevant financial news source showing Nasdaq and S&P 500 Tech sector performance]

- Negative Market Trends: Concerns about rising interest rates and potential future economic slowdown contributed to a general risk-off sentiment among investors, leading to sell-offs across the tech sector. [Link to relevant news article discussing broader market concerns]

- Investor Sentiment Shift: While the AI and cloud computing sectors remain promising long-term, short-term uncertainty has led some investors to re-evaluate their positions in high-growth, often less profitable, companies like CoreWeave.

Company-Specific News and Announcements

While no major negative news was directly released by CoreWeave (CRWV) on Thursday, the absence of positive catalysts, coupled with broader market anxieties, likely contributed to the stock's decline. It's crucial to examine recent company developments for potential contributing factors.

- Recent Earnings Reports & Analyst Ratings: While there may not have been specific negative news on Thursday itself, analysts' ratings or previous earnings reports could have fueled anxieties. Any perceived shortcomings in these areas could contribute to a negative investor outlook. [Link to relevant company press releases or financial reports]

- Market Reaction to Past Announcements: It's important to analyze how the market reacted to previous CoreWeave (CRWV) announcements. Even seemingly positive news can sometimes lead to short-term sell-offs as investors profit-take after a period of growth. [Link to analysis of market reactions to past CoreWeave announcements]

- Lack of Positive Catalysts: The absence of significant positive news or announcements in the preceding days could have left CoreWeave (CRWV) stock vulnerable to the broader market downturn.

Economic Factors and Macroeconomic Conditions

Macroeconomic factors play a significant role in influencing investor behavior and stock market performance. The decline in CoreWeave (CRWV) stock can't be considered in isolation from broader economic trends.

- Rising Interest Rates: Higher interest rates increase borrowing costs for companies and reduce the attractiveness of high-growth stocks like CoreWeave (CRWV) which often rely on future earnings rather than immediate profitability. [Link to relevant economic news source on interest rate hikes]

- Inflation and Economic Uncertainty: Persistent inflation and concerns about a potential recession can lead investors to shift away from riskier assets, including many tech stocks. [Link to economic analysis discussing inflation and recessionary risks]

- Geopolitical Events: Global instability can also impact investor sentiment, contributing to market volatility and influencing investment decisions. [Link to news about relevant geopolitical events]

Competition and Industry Dynamics

The competitive landscape within the cloud computing and AI infrastructure sectors is intense. Any developments concerning competitors can indirectly affect CoreWeave (CRWV)'s stock performance.

- Competitor Activities: Major players in the cloud computing space are constantly innovating and expanding their services. News related to competitor advancements or strategic partnerships could influence investor perceptions of CoreWeave's competitive positioning. [Mention specific competitors and link to relevant news articles]

- Industry Shifts: Changes in industry trends, such as evolving cloud computing models or shifts in customer preferences, can impact CoreWeave's future growth prospects. These shifts may cause investors to re-evaluate their investment strategies. [Link to industry analysis reports].

Conclusion

The decrease in CoreWeave (CRWV) stock on Thursday was likely a confluence of factors. Broader market anxieties stemming from the overall tech sector downturn, macroeconomic concerns, and a lack of positive company-specific catalysts all played a role. The competitive landscape also contributes to the inherent volatility of the CoreWeave (CRWV) stock. While the long-term prospects for CoreWeave (CRWV) remain dependent on the continued growth of the cloud computing and AI industries, understanding these influencing factors is crucial for investors.

Call to Action: Stay informed about CoreWeave (CRWV) stock and related market trends by regularly reviewing financial news and conducting thorough due diligence. Understanding the factors influencing CoreWeave (CRWV) stock performance is critical for developing well-informed investment strategies concerning CoreWeave (CRWV) stock and similar high-growth technology companies.

Featured Posts

-

Victorie Categorica Pentru Georgia In Fata Armeniei 6 1 In Liga Natiunilor

May 22, 2025

Victorie Categorica Pentru Georgia In Fata Armeniei 6 1 In Liga Natiunilor

May 22, 2025 -

Posthaste Signs Point To A Canadian Home Price Correction

May 22, 2025

Posthaste Signs Point To A Canadian Home Price Correction

May 22, 2025 -

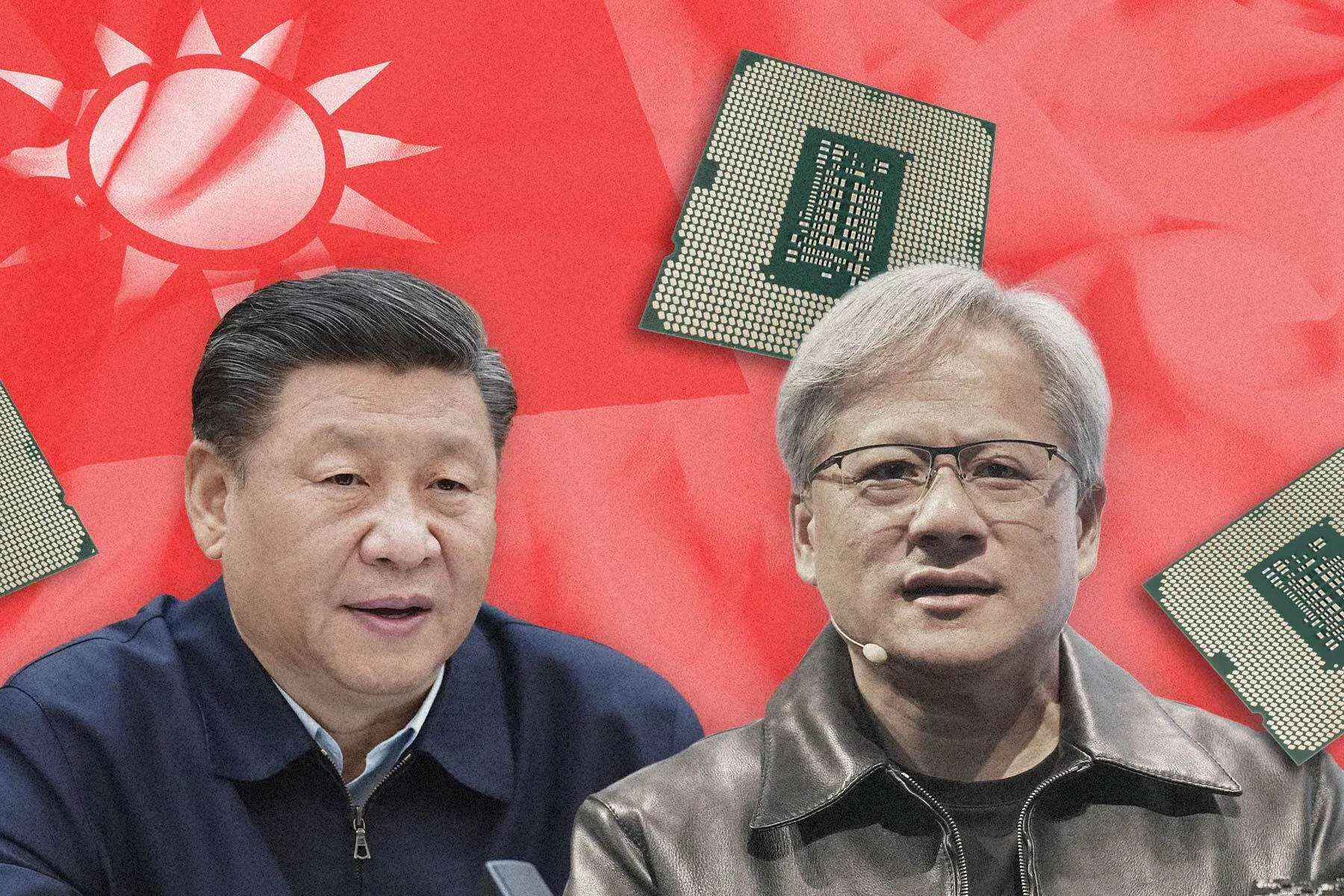

Huang Of Nvidia Condemns Us Export Controls Expresses Approval For Trump

May 22, 2025

Huang Of Nvidia Condemns Us Export Controls Expresses Approval For Trump

May 22, 2025 -

Report Georgia Invinge Armenia Cu Un Scor De 6 1 In Liga Natiunilor

May 22, 2025

Report Georgia Invinge Armenia Cu Un Scor De 6 1 In Liga Natiunilor

May 22, 2025 -

Wordle 1356 Solution Hints And Tips For March 6th

May 22, 2025

Wordle 1356 Solution Hints And Tips For March 6th

May 22, 2025