CoreWeave (CRWV) Stock Surge: Reasons Behind Today's Jump

Table of Contents

CoreWeave's Strategic Position in the Booming AI Market

CoreWeave's specialization lies in providing high-performance GPU-powered cloud computing solutions, a critical component in the development and deployment of Artificial Intelligence (AI) applications. The burgeoning field of AI, particularly the training of large language models (LLMs) and other complex machine learning algorithms, demands immense computing power. CoreWeave's scalable and robust infrastructure, built on cutting-edge GPUs and optimized for deep learning workloads, is perfectly positioned to capitalize on this escalating demand.

- Massive growth in AI model development requires significant computing power. The complexity and scale of modern AI models are pushing the boundaries of traditional computing resources. CoreWeave's infrastructure is designed to handle this unprecedented demand.

- CoreWeave's scalable infrastructure is perfectly positioned to meet this demand. Their adaptable architecture allows for rapid scaling to meet the fluctuating needs of AI development and deployment.

- The company’s focus on sustainability in its data centers is a differentiating factor. In an increasingly environmentally conscious world, CoreWeave's commitment to sustainable practices offers a competitive advantage.

- Partnerships and collaborations with key players in the AI industry. Strategic alliances with leading AI companies provide CoreWeave with access to cutting-edge technology and a wider customer base.

Recent Developments and Positive News Catalyzing the CRWV Stock Surge

Several recent developments have likely contributed significantly to the positive market sentiment surrounding CRWV and the subsequent stock price surge. While specific details may require further investigation depending on the timing of this article's publication, we can hypothesize about potential contributing factors.

- Mention any recent positive news releases or announcements affecting CRWV. This could include announcements of new partnerships, successful product launches, or expansions into new geographical markets. Look for press releases and official company communications.

- Discuss any significant partnerships or acquisitions impacting market perception. Strategic partnerships with major technology players or acquisitions of complementary businesses can significantly boost investor confidence.

- Analyze the potential impact of recent financial reports on investor confidence. Strong earnings reports showcasing revenue growth and increasing profitability are key drivers of stock price appreciation.

- Highlight any upward revisions to growth projections by analysts. Positive analyst ratings and upward revisions of future growth projections signal a bullish outlook on the company's performance.

Increased Investor Interest and Market Sentiment

The surge in CoreWeave's stock price is not solely attributable to company-specific news; it's also a reflection of broader market trends and investor sentiment. The growing demand for AI infrastructure, coupled with a potential scarcity of readily available high-performance computing resources, has created a favorable environment for companies like CoreWeave.

- Analyze the overall trends in the tech sector influencing CRWV's stock performance. Positive sentiment towards the technology sector as a whole often translates into higher valuations for individual tech stocks.

- Discuss increased investor interest driven by AI market growth. The excitement surrounding the rapid advancements in AI and its transformative potential is attracting significant investment into the sector.

- Consider the potential impact of short-term market fluctuations on CRWV. Short-term volatility is common in the stock market, and temporary dips or spikes can influence stock prices.

- Analyze the impact of overall stock market sentiment on the CRWV price. Positive overall market sentiment tends to lift all boats, including CoreWeave.

Conclusion

The surge in CoreWeave (CRWV) stock price reflects a confluence of positive factors: the company's strong positioning within the booming AI infrastructure market, positive recent developments, and a generally bullish investor sentiment. Its strategic focus on GPU computing, scalability, and sustainable practices positions CoreWeave for substantial future growth in this dynamic sector.

Call to Action: Understanding the factors behind the CoreWeave (CRWV) stock surge is crucial for making informed investment decisions. Stay informed about the latest developments in the AI infrastructure market and continue researching CoreWeave to capitalize on potential future opportunities. Learn more about CRWV and its role in shaping the future of AI infrastructure, and consider its potential as a long-term investment in the burgeoning AI landscape.

Featured Posts

-

Finale Na Ln Shpani A Pobedi Khrvatska Po Penali

May 22, 2025

Finale Na Ln Shpani A Pobedi Khrvatska Po Penali

May 22, 2025 -

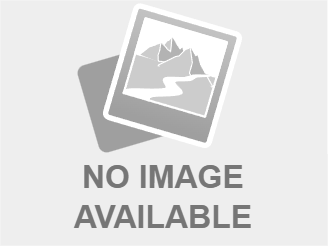

Fbi Raid In Lebanon County Pennsylvania Search Warrant Executed

May 22, 2025

Fbi Raid In Lebanon County Pennsylvania Search Warrant Executed

May 22, 2025 -

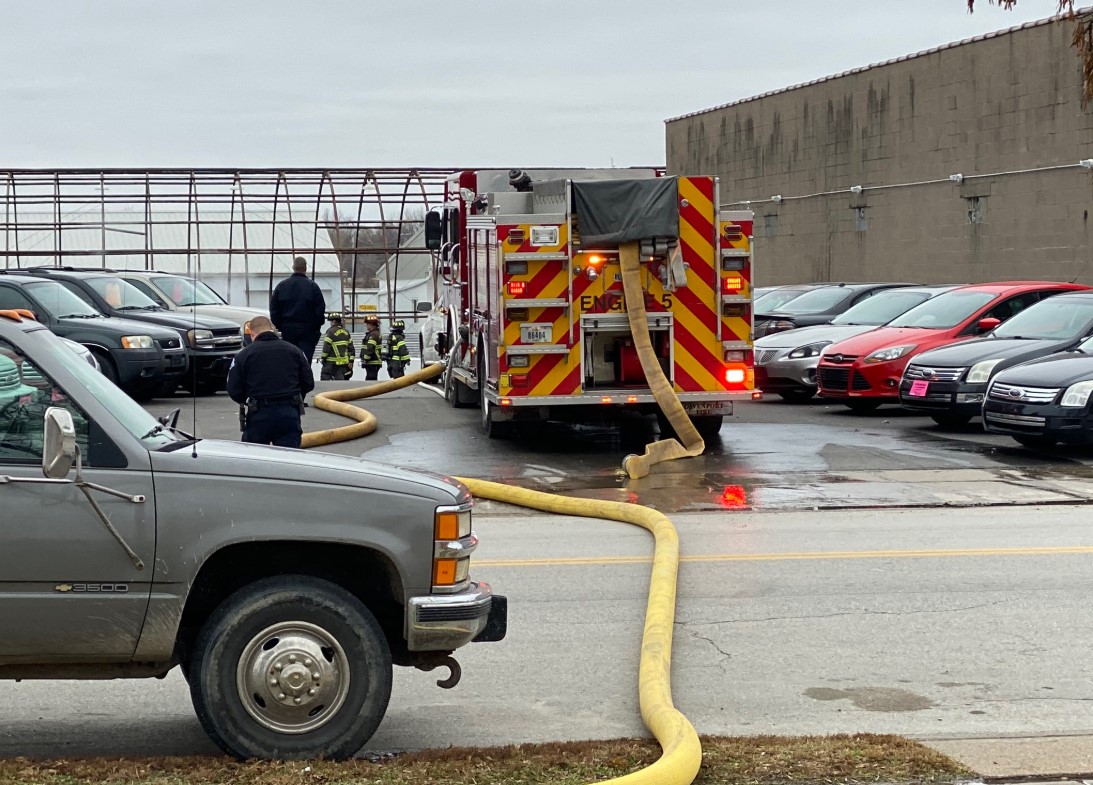

Large Fire Engulfs Used Car Dealership Crews Investigating

May 22, 2025

Large Fire Engulfs Used Car Dealership Crews Investigating

May 22, 2025 -

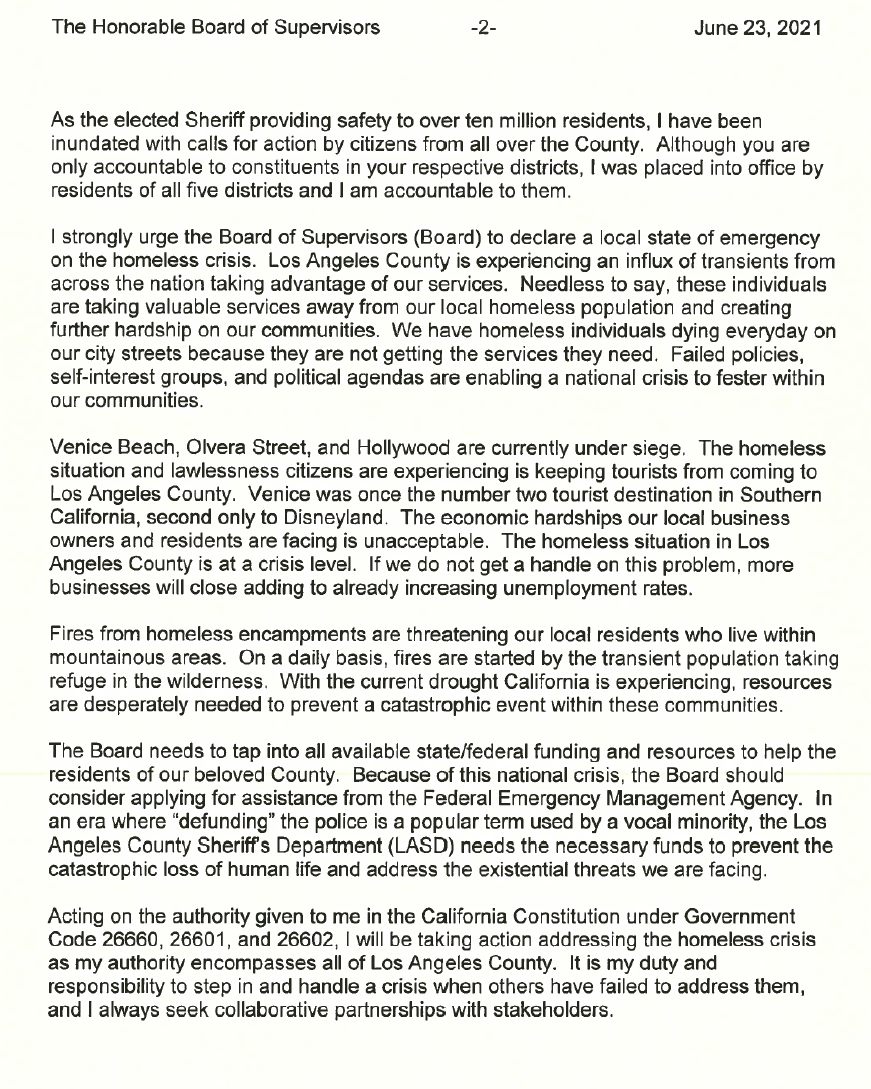

Reelection Bid Halted New Orleans Sheriff Responds To Jail Escape Crisis

May 22, 2025

Reelection Bid Halted New Orleans Sheriff Responds To Jail Escape Crisis

May 22, 2025 -

Exploring The Sound Perimeter A Study Of Musics Influence

May 22, 2025

Exploring The Sound Perimeter A Study Of Musics Influence

May 22, 2025