CoreWeave (CRWV) Stock: What Jim Cramer Thinks You Should Know

Jim Cramer's Stance on CoreWeave (CRWV): A Deep Dive

Unfortunately, readily available, direct quotes from Jim Cramer specifically addressing CoreWeave (CRWV) stock are currently scarce. His shows, like "Mad Money," often cover established giants in the tech sector, and newer entrants like CoreWeave might not yet be frequent subjects of his commentary. However, we can infer potential viewpoints by analyzing his general approach to similar companies in the cloud computing and AI sectors. Cramer often favors companies with demonstrable revenue growth, strong market positioning, and a clear path to profitability.

- Specific positive comments (if any) from Cramer: As of the writing of this article, no specific positive comments about CRWV have been publicly identified from Jim Cramer.

- Specific negative comments (if any) from Cramer: Similarly, no specific negative comments have been publicly identified.

- Overall sentiment expressed by Cramer (bullish, bearish, neutral): Based on the lack of direct commentary, we can only conclude that Cramer's public stance on CRWV is currently neutral. However, given his general enthusiasm for growth in the AI sector, a bullish stance isn't entirely improbable depending on future financial performance of the company.

CoreWeave's Business Model and Market Position

CoreWeave provides cloud computing services specifically designed to handle the demanding computational requirements of AI and machine learning workloads. Its core business centers around offering high-performance computing (HPC) infrastructure, including powerful GPUs, optimized for training large language models and other AI applications. This focus on a niche, high-growth market segment gives CoreWeave a significant competitive advantage.

- Key competitors: CoreWeave competes with industry giants like Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure. However, CoreWeave differentiates itself by focusing on the specialized needs of AI development and deployment, a segment where the major cloud providers are also heavily investing.

- CoreWeave's market share: Precise market share figures are difficult to obtain for this rapidly evolving market, but CoreWeave's rapid growth indicates it's gaining a substantial foothold in the AI-focused cloud computing niche.

- Growth potential: The explosive growth of the AI market presents enormous growth potential for CoreWeave. As AI adoption increases across various industries, demand for the type of specialized cloud infrastructure CoreWeave offers is expected to skyrocket.

CoreWeave (CRWV) Stock Performance and Financial Health

CoreWeave's stock price performance since its public listing (IPO) has shown volatility, reflecting the inherent risk associated with investing in a relatively young company in a rapidly changing technology sector. Analyzing CRWV's financial statements is crucial for gauging its long-term viability.

- Recent stock price trends: Investors should monitor daily stock price movements through reliable financial news sources and charting tools.

- Key financial ratios: Closely examining key financial ratios like the price-to-earnings (P/E) ratio and revenue growth rate offers valuable insights into the company's financial health and growth trajectory.

- Analyst ratings and price targets: Tracking analyst ratings and price targets from reputable financial institutions can provide a broader market perspective on CRWV's investment potential. However, remember that these are just opinions and not guarantees of future performance.

Investment Considerations for CoreWeave (CRWV): Risks and Rewards

Investing in CRWV, like any stock, involves both potential rewards and significant risks. A balanced perspective is essential before making any investment decisions.

- Risk factors to consider: The competitive landscape, reliance on a niche market, regulatory changes, and overall market volatility are key risks to consider.

- Potential return on investment scenarios: The high growth potential of the AI market presents significant upside potential, but success is not guaranteed.

- Diversification strategies: Diversifying your investment portfolio to mitigate risks associated with CRWV is strongly recommended.

Conclusion

While Jim Cramer hasn't publicly commented extensively on CoreWeave (CRWV) stock, the company's strong positioning within the booming AI cloud computing market presents a compelling case for investors. However, the inherent risks associated with a relatively young company in a rapidly evolving sector must be carefully considered. This analysis aims to provide insights, not financial advice. Remember to conduct your own thorough research, understand the associated risks, and align your investment decisions with your personal risk tolerance and investment goals. Make informed decisions about your CoreWeave (CRWV) investment strategy.

Ex Councillors Wife Challenges Racial Hatred Tweet Conviction

Ex Councillors Wife Challenges Racial Hatred Tweet Conviction

Scor Devastator In Liga Natiunilor Georgia Armenia 6 1

Scor Devastator In Liga Natiunilor Georgia Armenia 6 1

Core Weave Crwv Stock Surge Nvidia Investment Fuels Growth

Core Weave Crwv Stock Surge Nvidia Investment Fuels Growth

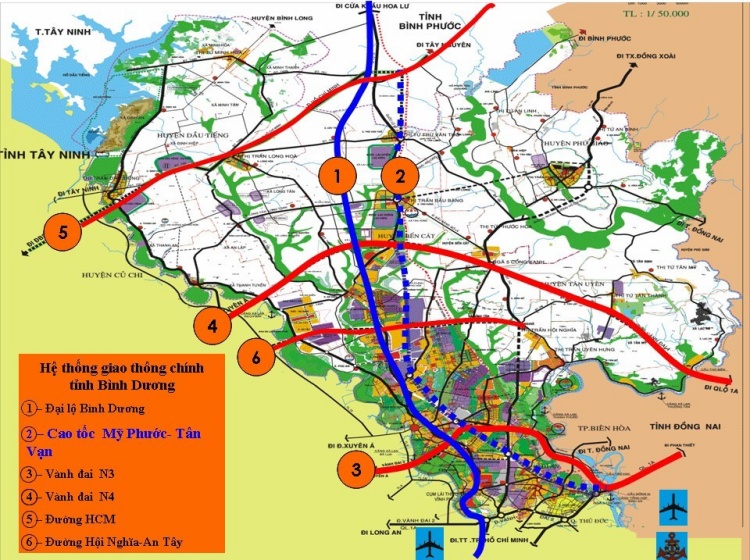

Ket Noi Giao Thong Tp Hcm Ba Ria Vung Tau Nhung Tuyen Duong Chinh

Ket Noi Giao Thong Tp Hcm Ba Ria Vung Tau Nhung Tuyen Duong Chinh

Dexter Resurrection Brings Back A Fan Favorite Villain

Dexter Resurrection Brings Back A Fan Favorite Villain