CoreWeave Inc. (CRWV) Stock Price Increase: Analysis Of Today's Gains

Table of Contents

Today witnessed a significant jump in CoreWeave Inc. (CRWV) stock price, leaving investors wondering about the forces behind this surge. This article analyzes the key factors contributing to today's gains in CRWV stock, examining market trends, company news, and potential future implications. We'll delve into the specifics to help you understand this exciting development in the cloud computing sector and the CoreWeave (CRWV) stock price increase.

Impact of Recent Company Announcements on CRWV Stock Price

Positive Earnings Report and Revenue Projections

- Exceeded analyst expectations: CoreWeave reported earnings that significantly surpassed analysts' consensus estimates, indicating robust financial performance.

- Strong revenue growth: The company demonstrated impressive year-over-year revenue growth, showcasing the increasing demand for its cloud computing services. Specific figures should be included here if available from the actual earnings report (e.g., "Revenue increased by X% compared to the same period last year").

- Positive outlook for future quarters: Management provided an optimistic outlook for the coming quarters, further boosting investor confidence in CoreWeave's future growth trajectory. This should include specific details from their forward guidance if available.

- Details on specific growth areas (e.g., AI, machine learning): CoreWeave highlighted significant growth within the high-demand AI and machine learning sectors, emphasizing its strategic positioning in these rapidly expanding markets. Mention any specific client wins or successful deployments in these areas.

The exceptional performance detailed in CoreWeave's earnings report, exceeding expectations across multiple key metrics, fueled the surge in the CRWV stock price. The strong revenue growth and positive outlook provided a clear signal of the company's financial health and growth potential. Upward revisions to future guidance solidified this positive sentiment.

Strategic Partnerships and Acquisitions

- Announced new partnerships (mention specific companies if any): Mention any newly formed strategic alliances with major technology companies or industry players. Highlight the benefits of these partnerships for CoreWeave's market reach and service offerings. For example, "A new partnership with [Company Name] will expand CoreWeave's access to [Specific Market/Technology]".

- Successful integration of recent acquisitions: If CoreWeave recently acquired other companies, discuss the successful integration of these acquisitions and the resulting synergies. Highlight how these acquisitions have contributed to revenue growth and expanded capabilities.

- Expansion into new markets: Discuss any expansion into new geographic markets or service verticals, demonstrating the company's strategic growth initiatives. This could include details on new data center locations or expansion into new industries.

Strategic partnerships and acquisitions often play a crucial role in driving a company's growth and market share. The successful integration of acquisitions and the formation of strategic alliances signal a proactive management team and a long-term vision for expansion. These factors contribute directly to positive investor sentiment and, ultimately, influence the CoreWeave (CRWV) stock price.

Market Trends Influencing CoreWeave (CRWV) Stock Performance

Overall Market Sentiment and Sector Performance

- Positive overall market sentiment: A generally positive market sentiment often lifts individual stocks, including CRWV. Discuss any positive macroeconomic factors that contributed to this sentiment.

- Strong performance in the cloud computing sector: The overall strength of the cloud computing sector boosts investor confidence in companies like CoreWeave. Mention any key industry trends that benefit cloud providers.

- Comparison to competitor stock performance: Compare CoreWeave's stock performance to that of its competitors to identify whether the increase is unique to CoreWeave or part of a broader sector trend.

The favorable market conditions and the robust performance of the broader cloud computing sector created a supportive environment for CoreWeave's stock price to rise. The positive market sentiment significantly influenced the CRWV stock price increase.

Increased Investor Interest in AI and Machine Learning

- Growing demand for AI infrastructure: The surge in demand for AI infrastructure and computational power is a major catalyst for CoreWeave's growth. Explain this trend and its connection to CoreWeave's services.

- CoreWeave's strategic positioning in this market: Highlight CoreWeave's strategic initiatives and capabilities in the AI and machine learning space. Explain how the company is well-positioned to capitalize on this growth.

- Mention of any AI-related projects or announcements: If CoreWeave has announced any new AI-related projects or partnerships, mention them here, emphasizing their contribution to the increased investor interest.

The growing demand for AI infrastructure is a key driver of the CoreWeave (CRWV) stock price. CoreWeave's strategic focus on this area positions the company for significant future growth, boosting investor confidence and driving up the CRWV stock price.

Technical Analysis of CRWV Stock Price Movement

Trading Volume and Volatility

- High trading volume indicating significant investor activity: High trading volume suggests strong investor interest and participation in the market. Analyze the trading volume to support your claim.

- Analysis of price volatility: Discuss the volatility of the CRWV stock price and its implications for investors.

- Chart patterns suggesting continued upward trend: Mention any chart patterns (e.g., bullish flags, head and shoulders) that suggest a potential continuation of the upward trend.

The high trading volume associated with the CRWV stock price increase signifies significant investor interest and activity, adding weight to the positive price movement. Technical analysis can provide additional insights into the potential continuation of the upward trend.

Support and Resistance Levels

- Identification of key support and resistance levels: Identify crucial support and resistance levels on the CRWV stock chart. These levels act as indicators of potential price reversals or continuations.

- Analysis of how these levels influenced the price action: Explain how the price reacted to these support and resistance levels, providing context for the price movement.

- Prediction of potential future price targets: Based on technical analysis, provide potential future price targets, while emphasizing that these are predictions and not guarantees.

Technical analysis of support and resistance levels helps in understanding the price action and predicting potential future price targets for the CRWV stock. However, it's important to remember that these are just predictions, and the actual price movements can differ.

Conclusion

This analysis highlights several key factors contributing to the significant increase in CoreWeave Inc. (CRWV) stock price today. These include strong earnings, strategic partnerships, positive market sentiment, and the growing demand for AI infrastructure, all of which have boosted investor confidence. Understanding these drivers is crucial for evaluating the CoreWeave (CRWV) stock price and its future potential.

Call to Action: Stay informed about future developments in CoreWeave (CRWV) stock price by regularly checking financial news sources and conducting your own thorough research. Understanding the factors driving CRWV stock price is crucial for making informed investment decisions. Further analysis of CoreWeave (CRWV) stock price and its future trajectory is recommended.

Featured Posts

-

Ex Tory Councillors Wifes Appeal Tweet Sparks Racial Hatred Debate

May 22, 2025

Ex Tory Councillors Wifes Appeal Tweet Sparks Racial Hatred Debate

May 22, 2025 -

31 Year Old Singer Adam Ramey Dropout King Dies Unexpectedly

May 22, 2025

31 Year Old Singer Adam Ramey Dropout King Dies Unexpectedly

May 22, 2025 -

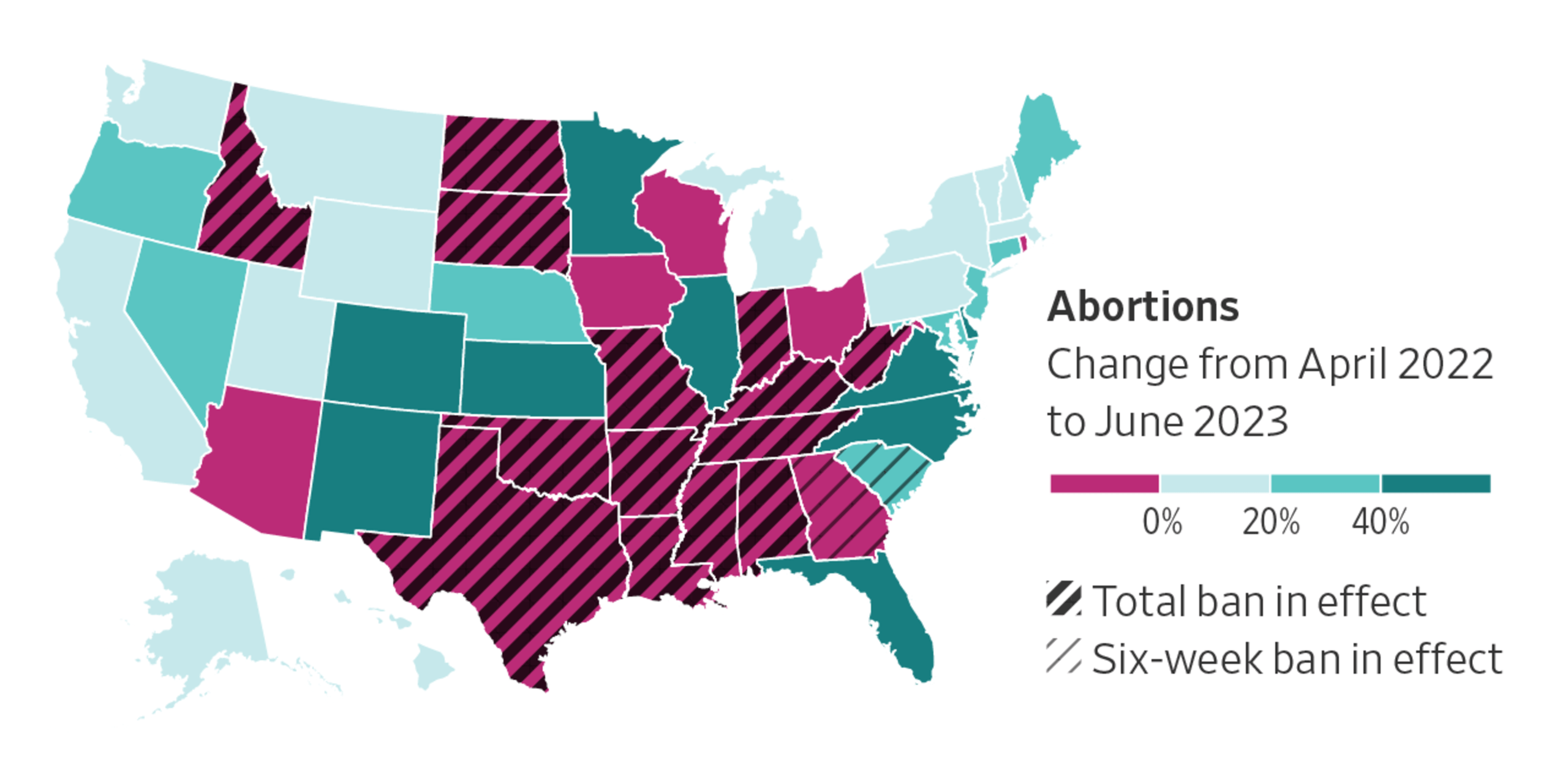

The Future Of Family Planning Over The Counter Birth Control After Roe V Wade

May 22, 2025

The Future Of Family Planning Over The Counter Birth Control After Roe V Wade

May 22, 2025 -

Accenture To Promote 50 000 Employees After Six Month Delay

May 22, 2025

Accenture To Promote 50 000 Employees After Six Month Delay

May 22, 2025 -

New Documentary Shows Pronghorn Rescue After Harsh Winter

May 22, 2025

New Documentary Shows Pronghorn Rescue After Harsh Winter

May 22, 2025