CoreWeave, Inc. (CRWV) Stock Surge: Reasons Behind Last Week's Rise

Table of Contents

Increased Institutional Investment in CRWV

Institutional investors, such as mutual funds, pension funds, and hedge funds, play a crucial role in driving stock prices. Their significant investment volume can significantly impact a company's market capitalization. While specific institutional investors who increased their holdings in CRWV last week may not be publicly disclosed immediately, the surge strongly suggests increased institutional interest. This heightened interest can stem from several factors:

- Increased buy-side ratings from analysts: Positive ratings from respected financial analysts often signal a strong belief in a company's future performance, encouraging institutional investment. A higher number of buy ratings for CRWV could have contributed to the surge.

- Positive press coverage highlighting CRWV's growth potential: Favorable media attention, showcasing CoreWeave's innovative technology and strong market position, attracts investor attention and boosts confidence. Articles highlighting CRWV's growth trajectory likely played a role.

- Strong financial performance exceeding market expectations: A strong Q2 earnings report or other positive financial news exceeding analyst expectations could have been a major catalyst for institutional investment in CRWV.

Growing Demand for AI Infrastructure Fuels CRWV Growth

CoreWeave's core business lies in providing high-performance computing infrastructure, which is increasingly crucial for the rapidly expanding field of Artificial Intelligence. The recent surge in AI adoption, particularly generative AI applications, directly translates to heightened demand for CoreWeave's services.

- Growing adoption of generative AI applications: The popularity of tools like ChatGPT and similar technologies fuels the need for robust AI infrastructure capable of handling massive computational workloads. CRWV is well-positioned to benefit from this trend.

- Increased need for high-performance computing resources: Training and deploying advanced AI models demand substantial computing power. CoreWeave's specialized infrastructure caters to this growing need, making them a key player in the AI revolution.

- CoreWeave's strategic partnerships and technological advantages: Strategic partnerships and innovative technologies offer CoreWeave a competitive edge in the market, further boosting investor confidence and driving demand for their services. This strengthens their position as a leading provider of AI infrastructure.

Positive Market Sentiment and Overall Tech Sector Performance

The overall market sentiment within the tech sector significantly impacts individual stock performance. A positive market outlook generally benefits companies like CoreWeave.

- Positive investor sentiment towards cloud computing companies: The cloud computing sector, in general, has seen positive investor sentiment, benefiting companies like CoreWeave that operate within this space.

- Strong overall performance of the NASDAQ: The NASDAQ's overall strength often influences individual tech stocks, leading to a positive ripple effect. A positive trend in the NASDAQ likely contributed to CRWV's performance.

- Absence of significant negative news affecting CRWV: The absence of major negative news regarding CoreWeave itself also allowed positive sentiment and market trends to drive the stock price upwards.

Speculation and Short Covering

While fundamental factors are crucial, speculation and short covering can also influence stock price movements.

- Increased trading volume suggesting speculative activity: High trading volume in CRWV stock may indicate speculative activity, potentially driving the price up beyond what might be justified solely by fundamentals.

- Potential short squeeze scenarios driving price upwards: If a significant portion of CRWV shares were shorted, a sudden surge in buying pressure could trigger a short squeeze, artificially inflating the price.

- Importance of fundamental analysis over speculation: While speculation can impact short-term price fluctuations, relying solely on speculation for investment decisions is risky. Fundamental analysis remains paramount for long-term investment success.

Conclusion

The CoreWeave (CRWV) stock surge last week resulted from a combination of factors: increased institutional investment driven by strong financials and positive outlooks, the booming demand for AI infrastructure perfectly aligned with CoreWeave's offerings, positive overall market sentiment within the tech sector, and the potential influence of speculation and short covering. Understanding these contributing elements is essential for informed investment decisions. Conduct your own thorough research, analyzing CRWV's financial statements, competitive landscape, and long-term growth prospects, before making any investment decisions. Stay informed about CoreWeave (CRWV) stock and its performance by following market news and conducting thorough due diligence. This analysis of the recent CRWV stock surge provides a starting point for your research. Remember to consult with a financial advisor before making any investment choices.

Featured Posts

-

The Latest Peppa Pig News Mummy Pig Announces Babys Gender

May 22, 2025

The Latest Peppa Pig News Mummy Pig Announces Babys Gender

May 22, 2025 -

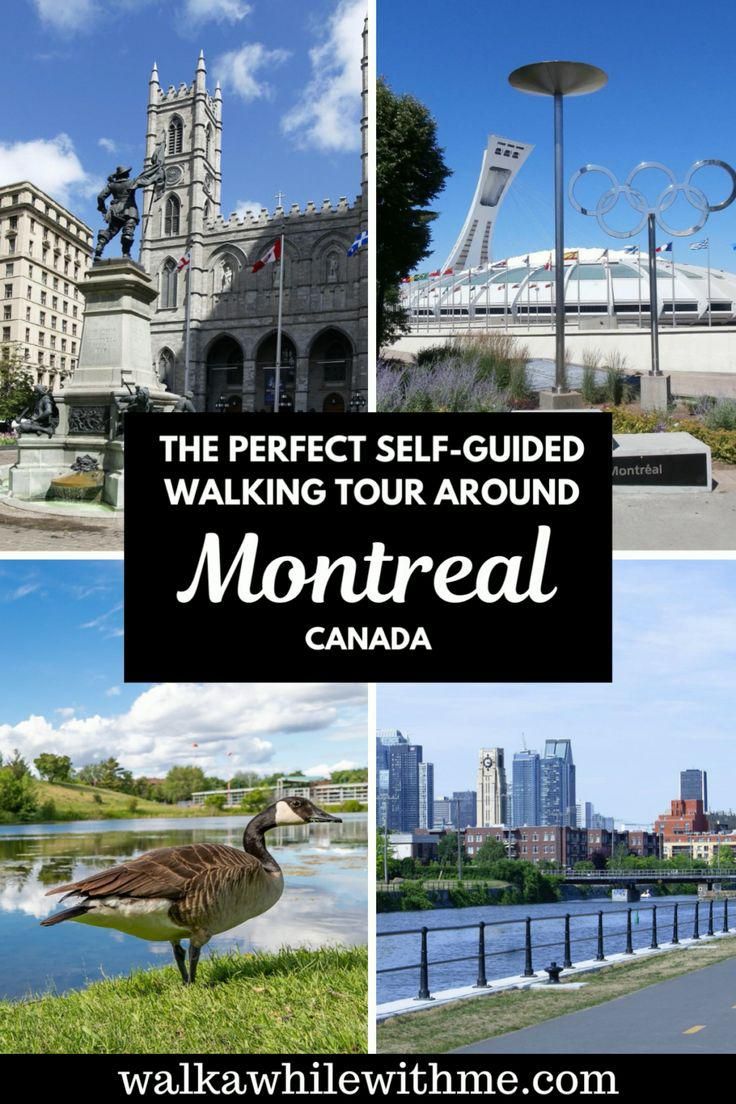

Self Guided Walking Tour Provence France Mountains To Mediterranean

May 22, 2025

Self Guided Walking Tour Provence France Mountains To Mediterranean

May 22, 2025 -

Taylor Swift Caught In The Crossfire Navigating The Blake Lively And Justin Baldoni Legal Drama

May 22, 2025

Taylor Swift Caught In The Crossfire Navigating The Blake Lively And Justin Baldoni Legal Drama

May 22, 2025 -

Embassy Releases Names Of Victims In Fatal Dc Shooting

May 22, 2025

Embassy Releases Names Of Victims In Fatal Dc Shooting

May 22, 2025 -

Cybercriminal Pleads Guilty In Multi Million Dollar Office365 Hack

May 22, 2025

Cybercriminal Pleads Guilty In Multi Million Dollar Office365 Hack

May 22, 2025