Could A 10x Bitcoin Multiplier Reshape Wall Street?

Table of Contents

The Impact on Traditional Financial Institutions

A 10x Bitcoin price increase would be a watershed moment, profoundly impacting traditional financial institutions in several key ways.

Increased Institutional Adoption

A 10x multiplier would likely force even the most hesitant traditional financial institutions to seriously consider Bitcoin and cryptocurrencies. The sheer magnitude of the gains would make ignoring this asset class impossible. This would lead to:

- Increased demand from institutional investors: Pension funds, hedge funds, and other large players would rush to acquire Bitcoin, driving up demand further.

- Development of new crypto-related financial products and services: Banks and investment firms would scramble to offer Bitcoin-related services, such as custody solutions, trading platforms, and derivative products.

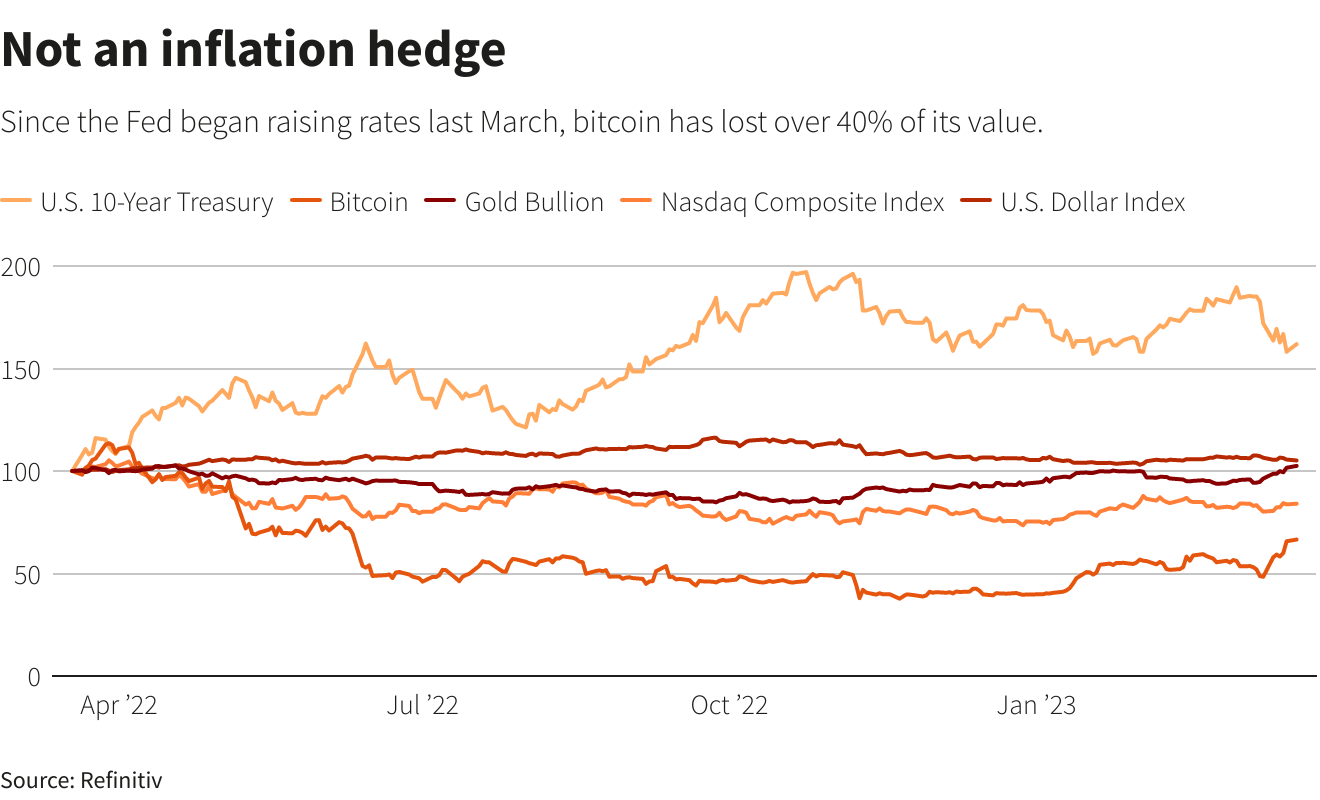

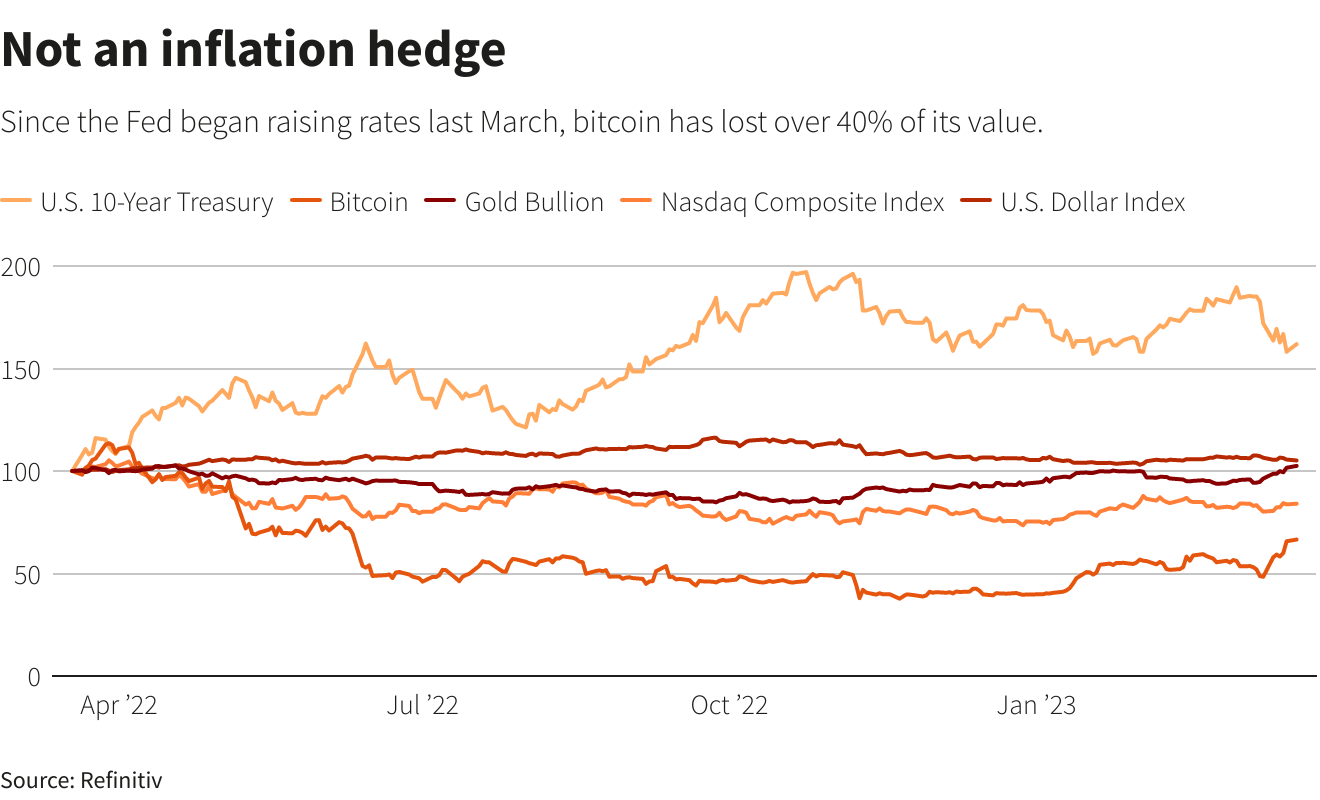

- Potential integration of Bitcoin into existing portfolio management strategies: Traditional portfolio diversification would need to be re-evaluated to accommodate Bitcoin's potential, forcing integration into existing strategies. This could involve allocating a percentage of assets to Bitcoin as a hedge against inflation or market downturns.

Rethinking Portfolio Diversification

The significant gains from a 10x Bitcoin multiplier would necessitate a reassessment of traditional portfolio diversification strategies. The previously considered "risky" asset would suddenly become a major component of many portfolios, leading to:

- Increased allocation to crypto assets: Investors would likely increase their allocation to cryptocurrencies beyond Bitcoin, exploring alternative coins (altcoins) with perceived growth potential.

- Shift in investment strategies to accommodate Bitcoin's potential volatility: New strategies would emerge to manage the inherent volatility of Bitcoin, potentially involving hedging strategies or more sophisticated risk management techniques.

- Development of hedging strategies against Bitcoin's price movements: The need to mitigate the risk associated with Bitcoin's volatility would accelerate the development of innovative hedging strategies, perhaps utilizing other cryptocurrencies or traditional assets.

Regulatory Scrutiny and Adaptation

Such a dramatic rise in Bitcoin's value would undoubtedly lead to increased regulatory scrutiny and a likely push for clearer regulatory frameworks governing Bitcoin and other cryptocurrencies. This could involve:

- Potential for stricter regulations on crypto exchanges and trading platforms: Governments would likely tighten regulations to prevent market manipulation and protect investors.

- Development of new compliance measures for institutions holding Bitcoin: Institutions holding substantial Bitcoin reserves would face increased compliance requirements to ensure transparency and prevent illicit activities.

- International harmonization of regulatory approaches to Bitcoin: Given Bitcoin's global nature, there would be a push for greater international cooperation on regulatory matters to prevent regulatory arbitrage.

The Ripple Effect on Investment Strategies

A 10x Bitcoin increase would have a cascading effect on investment strategies, fundamentally altering the landscape of the investment world.

The Rise of Bitcoin-Focused Investment Funds

The potential for massive returns would incentivize the creation and rapid growth of specialized Bitcoin investment funds. This would lead to:

- Increased competition among fund managers: Attracting investors to Bitcoin-focused funds would become a highly competitive arena.

- Development of sophisticated algorithmic trading strategies for Bitcoin: Advanced algorithmic trading techniques would be developed to capitalize on price swings and market inefficiencies.

- Attraction of new investors seeking high-yield, high-risk opportunities: The prospect of significant returns would attract investors with higher risk tolerance, driving further growth in the market.

Shifting Investor Sentiment and Risk Tolerance

The potential for massive returns from Bitcoin would fundamentally shift investor sentiment and risk tolerance. We could see:

- Increased appetite for riskier investments: The success of Bitcoin could embolden investors to consider other high-risk, high-reward investment opportunities.

- Potential for a "Bitcoin bubble" or speculative frenzy: A rapid price increase could lead to a speculative bubble, characterized by irrational exuberance and potential for a subsequent crash.

- Diversification of investment portfolios to include alternative assets: Investors may seek diversification beyond traditional stocks and bonds, exploring alternative assets like real estate, precious metals, or other cryptocurrencies.

Geopolitical Implications of a 10x Bitcoin Multiplier

A 10x Bitcoin increase carries significant geopolitical ramifications, potentially reshaping the global financial order.

Challenge to the US Dollar's Hegemony?

A 10x Bitcoin increase could potentially challenge the dominance of the US dollar as the world's reserve currency. This would involve:

- Increased adoption of Bitcoin as a store of value: Individuals and nations might increasingly view Bitcoin as a safer store of value than fiat currencies, particularly in times of economic uncertainty.

- Potential shift in international trade and financial transactions: Bitcoin could become a more widely accepted medium of exchange for international transactions, potentially reducing reliance on the US dollar.

- Increased competition from other cryptocurrencies and digital assets: The success of Bitcoin would likely stimulate innovation and competition in the cryptocurrency space, leading to the emergence of new digital assets.

Impact on Central Bank Digital Currencies (CBDCs)

The rise of Bitcoin could significantly accelerate the development and adoption of Central Bank Digital Currencies (CBDCs) worldwide. This is because:

- Central banks seeking to compete with the decentralized nature of cryptocurrencies: Central banks might view CBDCs as a way to maintain control over their monetary systems in the face of the decentralized nature of cryptocurrencies.

- Increased focus on digital financial infrastructure: The increased use of digital currencies would necessitate improvements in digital financial infrastructure.

- Potential for greater financial inclusion through CBDCs: CBDCs could potentially increase financial inclusion by providing access to financial services for unbanked populations.

Conclusion

A 10x Bitcoin multiplier is a hypothetical scenario, but examining its potential impact on Wall Street highlights the significant transformative potential of cryptocurrencies. Such a dramatic increase would likely trigger a cascade of events, reshaping investment strategies, regulatory frameworks, and the very landscape of traditional finance. The implications are far-reaching, prompting both opportunities and challenges for institutional investors, individual investors, and global financial systems. Understanding these potential impacts is crucial for navigating the future of finance. Continue exploring the evolving world of cryptocurrencies and understand how a 10x Bitcoin multiplier, while hypothetical, could drastically reshape Wall Street and the global financial system. Consider learning more about Bitcoin investment strategies and how to prepare for the potential of a future reshaped by a 10x Bitcoin multiplier.

Featured Posts

-

Bitcoin Investment Is A 1 500 Increase In 5 Years Realistic

May 08, 2025

Bitcoin Investment Is A 1 500 Increase In 5 Years Realistic

May 08, 2025 -

Can Xrp Reach New Highs After A 400 Price Increase

May 08, 2025

Can Xrp Reach New Highs After A 400 Price Increase

May 08, 2025 -

Understanding The Great Decoupling A Comprehensive Guide

May 08, 2025

Understanding The Great Decoupling A Comprehensive Guide

May 08, 2025 -

Analyzing Bitcoins Potential For A 10x Price Increase

May 08, 2025

Analyzing Bitcoins Potential For A 10x Price Increase

May 08, 2025 -

Winning Numbers Daily Lotto Friday April 18th 2025

May 08, 2025

Winning Numbers Daily Lotto Friday April 18th 2025

May 08, 2025