Could You Be Due An HMRC Tax Refund? Check Your Payslip Today

Table of Contents

Are you worried you might be overpaying tax? Many UK taxpayers are unknowingly entitled to an HMRC tax refund. Don't let your hard-earned money go unclaimed! This guide will show you how to check your payslip for potential tax overpayments and what steps to take to claim your HMRC tax refund. We'll cover common errors, how to spot them, and how to successfully claim your money back.

Common Payslip Errors Leading to HMRC Tax Refunds

Several common errors on your payslip can lead to significant overpayment of tax, resulting in a potential HMRC tax refund. Let's explore some of the most frequent culprits.

Incorrect Tax Code

Your tax code is a crucial number on your payslip that determines how much Income Tax is deducted from your earnings. An incorrect tax code can lead to either underpayment or, more commonly, overpayment of tax.

- Examples of incorrect tax codes: Using a code from a previous year, a code that doesn't reflect your circumstances (e.g., marriage allowance, pension contributions), or a code that's simply entered incorrectly.

- How to identify them on your payslip: Look for your tax code prominently displayed. Compare it to the code you believe you should have based on your personal circumstances. Inconsistencies are a red flag.

- Consequences of incorrect codes: Overpaying tax means you're entitled to an HMRC tax refund. Underpaying can result in a tax bill later on.

Pension Contributions

Pension contributions are often overlooked when it comes to tax. Your pension contributions can significantly reduce your taxable income, and errors in this area can lead to overpayment.

- How to check if pension contributions are correctly reflected: Your payslip should show the amount of your pension contributions and how this impacts your taxable pay. Discrepancies here could mean you are overpaying.

- Potential errors: Incorrect amounts entered, contributions not reflected at all, or incorrect tax relief applied.

- Impact on tax refund: Correctly reported pension contributions mean less tax is deducted, potentially resulting in a larger HMRC tax refund.

Marriage Allowance

The Marriage Allowance allows eligible couples to transfer part of their Personal Allowance to their spouse or civil partner, reducing their overall tax bill. This can result in a substantial tax refund.

- Who is eligible: One partner must be a basic-rate taxpayer, and the other must not use their full Personal Allowance.

- How to claim: You can claim online through the HMRC website.

- How much can be claimed back: The amount depends on the individual circumstances but can be significant over several years.

- Impact on tax refund: Claiming Marriage Allowance can lead to a substantial HMRC tax refund if it hasn't been applied correctly.

Child Benefit

Receiving Child Benefit can affect your tax liability, especially for higher earners. The High-Income Child Benefit Charge means that if your income exceeds a certain threshold, you may need to repay some of the Child Benefit received. Errors in calculating this charge can lead to overpayment.

- High-income child benefit tax charge: This applies if your income exceeds £50,000.

- How to identify overpayment on payslip: Check if any amounts are deducted related to Child Benefit.

- Claiming a refund: If you believe you've overpaid due to errors in the calculation of the High-Income Child Benefit Charge, you can contact HMRC to claim a refund.

How to Check Your Payslip for Potential Overpayments

Understanding your payslip is the first step to claiming your HMRC tax refund.

Understanding Your Payslip

Familiarising yourself with the key sections of your payslip is essential.

- Key terms: Taxable pay, tax deducted, National Insurance contributions, gross pay, net pay.

- Where to find relevant information: The exact location of this information may vary depending on your employer, but it's usually clearly labelled.

Comparing Payslips

Regularly comparing your payslips can help identify potential discrepancies.

- Look for inconsistencies in tax deducted: Sudden changes in the tax deducted could indicate an error.

- Identify sudden changes: Any significant changes warrant further investigation.

Using Online Payslip Access

Many employers offer online access to payslips.

- Login procedures: Follow your employer's instructions to access your online payslip portal.

- Navigating online payslip portals: Most portals are user-friendly and allow you to download and save your payslips.

Claiming Your HMRC Tax Refund

Once you've identified a potential overpayment, you need to gather the necessary documents and submit your claim.

Gathering Necessary Documents

To support your claim, you'll typically need the following:

- Payslips: Relevant payslips showing the incorrect tax deductions.

- P60: Your end-of-year tax statement.

- Proof of address: To verify your identity.

Submitting Your Claim

You can usually submit your claim online through the HMRC website or by phone.

- Online portal access: The HMRC website provides a secure online portal for tax refund claims.

- Telephone helpline details: HMRC offers a helpline for assistance with claiming a tax refund.

- Postal address for claims: As a last resort, you can submit your claim by post, although online is generally preferred.

Timescale for Receiving Your Refund

The processing time for a tax refund varies.

- Average processing times: HMRC aims to process claims within a certain timeframe, but this can vary.

- Factors that may affect processing time: The complexity of your claim and the volume of claims HMRC is currently processing can impact processing times.

Conclusion

Checking your payslip regularly is crucial to ensure you're not overpaying tax. Many people are entitled to an HMRC tax refund due to common errors. By following the steps outlined above, you can identify potential overpayments and claim back what's rightfully yours.

Call to Action: Don't miss out on your potential HMRC tax refund! Check your payslip today and take action to reclaim your money. Learn more about claiming your HMRC tax refund and find resources to help you on the .

Featured Posts

-

Ri Former Us Attorney Zachary Cunha Joins Private Practice

May 20, 2025

Ri Former Us Attorney Zachary Cunha Joins Private Practice

May 20, 2025 -

Development Of Chinas Space Based Supercomputer Progress And Challenges

May 20, 2025

Development Of Chinas Space Based Supercomputer Progress And Challenges

May 20, 2025 -

Rising Sea Levels Rising Credit Risk How Climate Change Impacts Home Loans

May 20, 2025

Rising Sea Levels Rising Credit Risk How Climate Change Impacts Home Loans

May 20, 2025 -

Eurovision 2024 France Presents Louanes Song

May 20, 2025

Eurovision 2024 France Presents Louanes Song

May 20, 2025 -

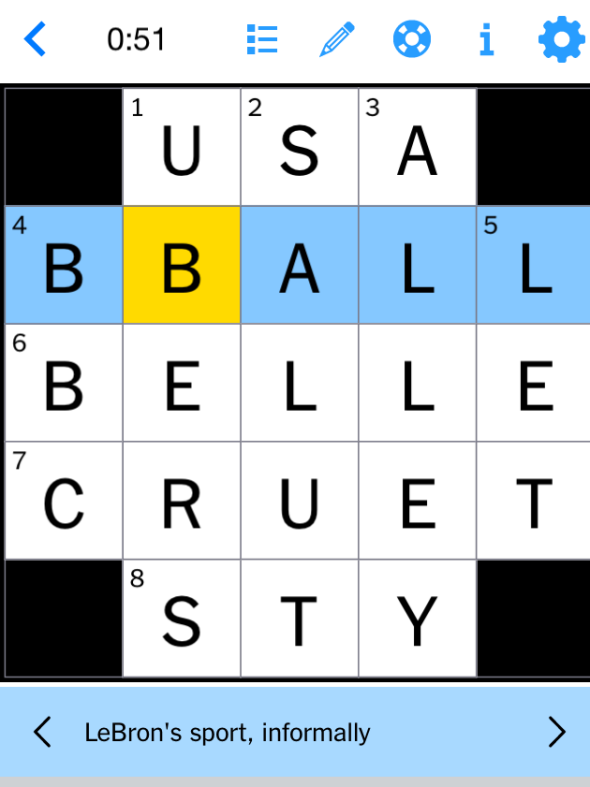

Nyt Crossword Answer Key April 25 2025

May 20, 2025

Nyt Crossword Answer Key April 25 2025

May 20, 2025