Court-Appointed Monitor Suggests Lion Electric Liquidation

Table of Contents

The Court-Appointed Monitor's Report and its Findings

A court-appointed monitor, tasked with overseeing Lion Electric's financial situation, has issued a report recommending liquidation. This process usually follows a period of financial distress where the company struggles to meet its obligations. The monitor's role is to impartially assess the company's financial health, explore options for recovery, and provide recommendations to the court. The recommendation for liquidation suggests that the monitor deemed other options, like restructuring, infeasible.

The key findings within the report, which led to the liquidation recommendation, point to a confluence of severe financial issues:

- Unsustainable debt levels: Lion Electric accumulated significant debt, making it challenging to service its financial obligations and hindering its ability to invest in growth and innovation.

- Cash flow problems: The company experienced persistent negative cash flow, meaning it was spending more money than it was bringing in, a critical sign of financial instability.

- Production challenges: Production delays and inefficiencies plagued Lion Electric, impacting its ability to meet demand and generate sufficient revenue.

- Inability to secure further funding: Despite attempts, Lion Electric failed to secure necessary funding to address its financial woes, indicating a lack of investor confidence.

- Market competition pressures: Intense competition within the burgeoning EV market further exacerbated Lion Electric's challenges, squeezing profit margins and hindering its market share growth.

Impact on Lion Electric's Stock and Investors

The court-appointed monitor's recommendation for Lion Electric liquidation has had a dramatic and immediate impact on the company's stock price, leading to a significant drop. This reflects a loss of investor confidence in the company's future prospects and the substantial risk of losing invested capital.

The implications for investors are severe:

- Significant stock price drop: The immediate consequence is a dramatic decline in the value of Lion Electric shares, resulting in substantial financial losses for shareholders.

- Loss of investor confidence: The liquidation recommendation erodes investor trust not only in Lion Electric but also potentially in the broader EV sector.

- Potential legal actions by investors: Investors may explore legal avenues to recover losses, potentially leading to lawsuits against the company or its leadership.

- Impact on shareholder equity: Shareholder equity will likely be significantly diminished or entirely wiped out during the liquidation process.

- Implications for future investments in the EV sector: This case could make investors more cautious about investing in other EV companies, especially those exhibiting signs of financial vulnerability.

Potential Alternatives to Liquidation and Their Likelihood

While the court-appointed monitor recommended liquidation, alternative solutions existed, though their feasibility remains questionable given Lion Electric's current predicament. These alternatives include:

- Restructuring plan viability: A comprehensive restructuring plan could have potentially addressed the company's debt and operational challenges. However, the monitor's report suggests that such a plan was deemed unviable.

- Potential acquisition offers: A potential buyer might have acquired Lion Electric, injecting capital and potentially revitalizing the company. However, a lack of such offers indicates a lack of confidence in the company's turnaround potential.

- Government bailouts (likelihood and implications): Government intervention, such as bailouts, is possible but unlikely given the complexities and potential political ramifications.

- Debt negotiations and refinancing opportunities: Negotiations with creditors to restructure debt or secure refinancing could have provided short-term relief, but the severity of the situation likely precluded this option.

- Chapter 11 bankruptcy filing (as an alternative to liquidation): Filing for Chapter 11 bankruptcy could have allowed Lion Electric to reorganize its finances and operations under court supervision. However, this path might still lead to liquidation if a viable restructuring plan cannot be implemented.

The Broader Implications for the Electric Vehicle Industry

The potential liquidation of Lion Electric carries broader implications for the EV industry, beyond just the company itself.

- Impact on investor confidence in the EV sector: The event could trigger a period of increased scrutiny of the financial health of other EV companies, potentially impacting investor confidence and valuations across the sector.

- Potential for consolidation within the EV industry: The failure of Lion Electric might lead to further consolidation, with stronger players acquiring weaker ones to gain market share and resources.

- Increased scrutiny of EV company financials: Investors and regulators will likely pay closer attention to the financial reporting and operational efficiency of EV companies.

- Effects on the supply chain: The liquidation could disrupt the supply chain, impacting suppliers and potentially delaying projects for other EV companies.

- Government regulations and support for the EV sector: Governments might review their support policies for the EV industry following the Lion Electric situation, potentially adjusting regulations or increasing financial aid.

Conclusion

The court-appointed monitor's recommendation for Lion Electric's liquidation highlights the challenges and risks inherent in the rapidly evolving EV industry. The unsustainable debt, cash flow problems, and intense competition contributed to the company's downfall. This situation underscores the importance of robust financial management, operational efficiency, and securing sufficient funding for EV companies navigating a competitive landscape. The impact on investors is significant, with potential for substantial losses and legal ramifications. The broader EV industry faces increased scrutiny and potential consolidation.

Call to Action: Stay updated on the Lion Electric liquidation proceedings and monitor the impact of this decision on the EV industry. Understand the risks involved in investing in financially distressed companies. Consult a financial advisor regarding your Lion Electric investments and before making any investment decisions related to other companies in the EV sector or similar ventures facing financial difficulties.

Featured Posts

-

Analyzing Chris Finchs Impact On The Minnesota Timberwolves Performance

May 07, 2025

Analyzing Chris Finchs Impact On The Minnesota Timberwolves Performance

May 07, 2025 -

Papez Francisek Tradicionalni Blagoslov Mesta In Sveta

May 07, 2025

Papez Francisek Tradicionalni Blagoslov Mesta In Sveta

May 07, 2025 -

Le Tournage De Mercredi Jenna Ortega Revele Des Details Sur Sa Rencontre Avec Lady Gaga

May 07, 2025

Le Tournage De Mercredi Jenna Ortega Revele Des Details Sur Sa Rencontre Avec Lady Gaga

May 07, 2025 -

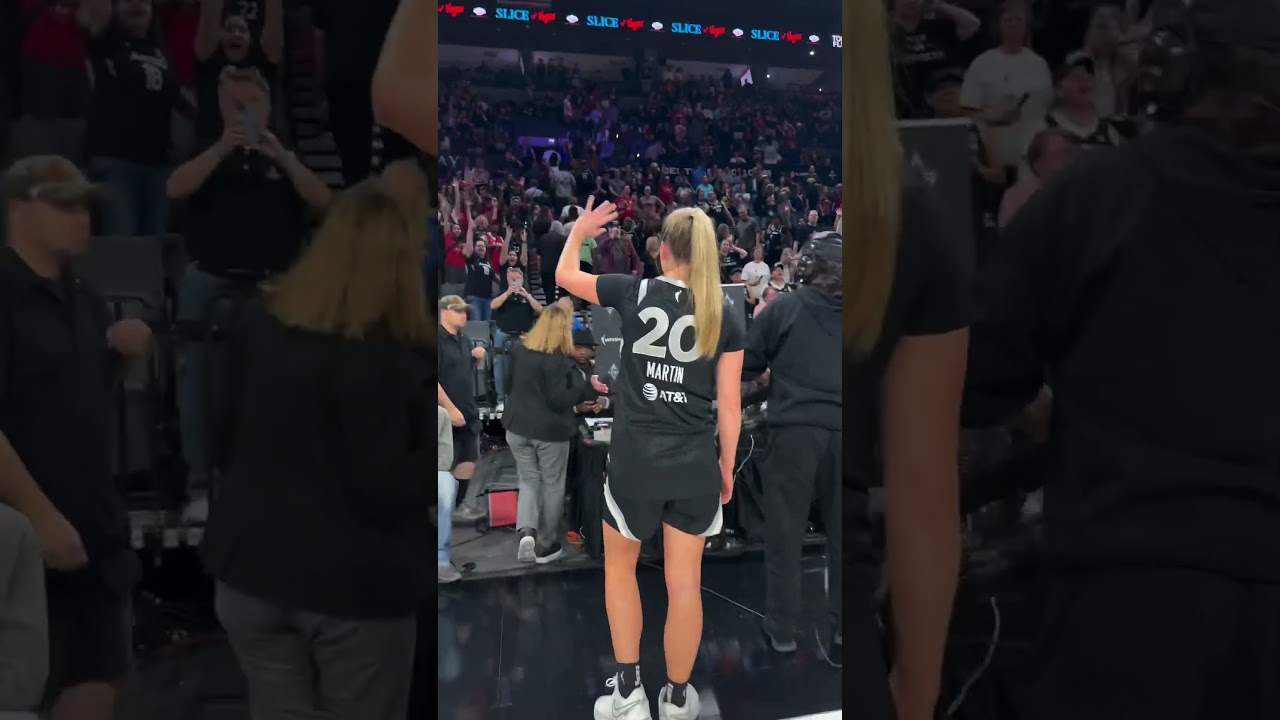

Kelsey Plum And Kate Martins Wholesome Courtside Exchange A Delight For Aces Fans

May 07, 2025

Kelsey Plum And Kate Martins Wholesome Courtside Exchange A Delight For Aces Fans

May 07, 2025 -

Papal Conclave Explained How The Next Pope Is Chosen

May 07, 2025

Papal Conclave Explained How The Next Pope Is Chosen

May 07, 2025