Crack The Code: 5 Do's And Don'ts For Private Credit Job Seekers

Table of Contents

Do's for a Successful Private Credit Job Search:

1. Target Your Resume and Cover Letter:

Your resume and cover letter are your first impression. Don't waste this crucial opportunity! Tailoring each application to the specific requirements of the private credit job is paramount.

- Specificity is Key: Instead of generic statements, highlight experiences directly relevant to the job description. Did you manage a portfolio of private debt investments? Quantify your success! For example, "Increased portfolio yield by 15% through effective risk management and proactive deal sourcing."

- Keyword Optimization: Carefully review the job description and incorporate relevant keywords like underwriting, portfolio management, due diligence, financial modeling, distressed debt, mezzanine financing, direct lending. This helps Applicant Tracking Systems (ATS) identify your application.

- Showcase Expertise: Demonstrate a clear understanding of various private credit strategies, including direct lending, mezzanine financing, and distressed debt investing. Highlight your knowledge of different debt structures and their implications.

2. Network Strategically:

Networking is your secret weapon in the competitive private credit job market. Don't underestimate the power of connections.

- Industry Events: Attend conferences and workshops focused on private credit, private equity, and alternative lending. These events provide excellent networking opportunities and insights into current market trends.

- LinkedIn Leverage: Actively engage on LinkedIn. Join relevant groups, participate in discussions, and connect with professionals working in finance jobs and investment jobs within the private credit sector.

- Informational Interviews: Reach out to professionals for informational interviews. These conversations can provide invaluable insights into specific firms and uncover hidden job opportunities.

3. Master the Technical Skills:

Proficiency in crucial technical skills is non-negotiable in the world of private credit.

- Financial Modeling: Become proficient in Excel, particularly in DCF analysis and other valuation techniques.

- Credit Analysis: Master credit analysis and underwriting principles. Understanding credit risk assessment and due diligence procedures is crucial.

- Software and Databases: Familiarity with relevant financial software and databases (e.g., Bloomberg Terminal) will significantly enhance your appeal.

4. Prepare for Behavioral and Technical Interviews:

Preparation is key to acing the interview. Expect both behavioral and technical questions.

- Behavioral Questions: Practice answering common behavioral interview questions, focusing on your problem-solving skills, teamwork abilities, and analytical capabilities within the context of private credit or alternative lending.

- Technical Proficiency: Be ready to discuss your understanding of various private credit strategies, market trends, and your experience in private debt analysis.

- Company Research: Thoroughly research the firm's investment strategy and recent transactions. Demonstrating genuine interest shows initiative.

5. Follow Up Effectively:

Don't let your efforts end with the interview. Following up professionally is crucial.

- Thank-You Notes: Send personalized thank-you notes after each interview, reiterating your interest and highlighting key discussion points.

- Consistent Contact: Maintain contact (without being overly persistent) to demonstrate your continued interest in the private credit job and the firm.

- Proactive Follow-up: Follow up on your application status after a reasonable time, but always do so respectfully.

Don'ts for a Private Credit Job Search:

1. Don't Submit Generic Applications: Avoid the "one-size-fits-all" approach. Each application should be tailored to the specific requirements of the private credit job.

2. Don't Neglect Networking: Networking is essential for uncovering hidden job opportunities and gaining valuable insights into the private credit industry.

3. Don't Underestimate Technical Skills: Lack of proficiency in financial modeling and credit analysis can significantly hinder your chances of securing a role in private debt or alternative lending.

4. Don't Underprepare for Interviews: Thorough preparation, including research on the firm and practice answering technical and behavioral questions related to private credit, is critical.

5. Don't Neglect Follow-Up: Failing to follow up can leave a negative impression and reduce your chances of getting hired for your desired private credit jobs.

Conclusion:

Securing a role in private credit requires a strategic and comprehensive approach. By diligently following these "dos" and avoiding the "don'ts," you'll significantly increase your chances of landing your dream job. Remember to tailor your application materials, network effectively, master the necessary technical skills, prepare meticulously for interviews, and follow up diligently. Crack the code to your private credit job search today! Start your journey by [link to relevant job board or resource].

Featured Posts

-

Posible Alineacion De Instituto Novedades Y Citados Para Enfrentar A Lanus

May 23, 2025

Posible Alineacion De Instituto Novedades Y Citados Para Enfrentar A Lanus

May 23, 2025 -

Metallica Dublin Aviva Stadium Weekend 2026

May 23, 2025

Metallica Dublin Aviva Stadium Weekend 2026

May 23, 2025 -

Sam Cook Englands New Test Bowler For Zimbabwe Series

May 23, 2025

Sam Cook Englands New Test Bowler For Zimbabwe Series

May 23, 2025 -

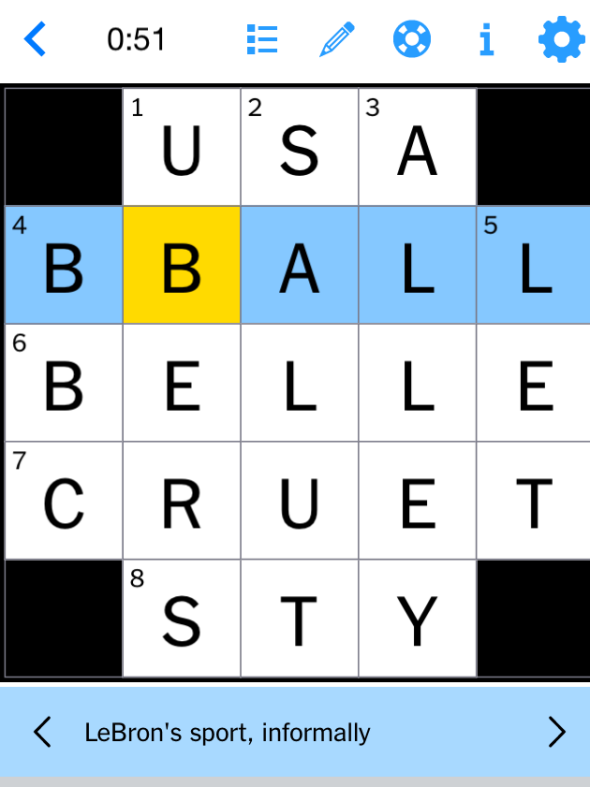

Nyt Mini Crossword Solution April 8 2025 Tuesday

May 23, 2025

Nyt Mini Crossword Solution April 8 2025 Tuesday

May 23, 2025 -

Environmental Concerns In The Pilbara Rio Tintos Response To Recent Criticism

May 23, 2025

Environmental Concerns In The Pilbara Rio Tintos Response To Recent Criticism

May 23, 2025