Crack The Code: 5 Do's And Don'ts To Secure A Private Credit Role

Table of Contents

Do's: Maximizing Your Chances of Success

1. Develop Specialized Expertise:

The private credit market is diverse. To stand out, focus on a niche area. Whether it's distressed debt, real estate lending, mezzanine financing, or another specialty within private debt, developing in-depth expertise is crucial.

- Niche Down: Instead of broadly stating "experience in finance," highlight your specific experience. For example, "managed a portfolio of $50 million in distressed debt assets, achieving a 15% annualized return."

- Certifications Matter: Obtain relevant certifications like the Chartered Financial Analyst (CFA) charter or the Chartered Alternative Investment Analyst (CAIA) designation to demonstrate your commitment and competency. These credentials signal a deeper understanding of private credit investment strategies and risk management.

- Stay Updated: The private credit landscape is constantly evolving. Stay informed on market trends, regulatory changes (like those impacting leveraged lending), and new investment strategies through industry publications, conferences, and continuous learning. Keywords: Private credit expertise, distressed debt, real estate finance, mezzanine financing, CFA, CAIA, leveraged lending.

2. Network Strategically:

Networking is paramount in securing a private credit role. It's not just about collecting business cards; it's about building genuine relationships.

- Attend Industry Events: Private credit conferences and industry meetups offer invaluable networking opportunities.

- Leverage LinkedIn: Actively engage on LinkedIn, connect with professionals in private credit, and participate in relevant groups and discussions.

- Informational Interviews: Reach out to professionals in private credit for informational interviews. These conversations provide insights into the industry and can open doors to potential opportunities. Keywords: Networking, Private credit conferences, LinkedIn, informational interviews, private equity networking.

3. Craft a Compelling Resume and Cover Letter:

Your resume and cover letter are your first impression. Make them count.

- Quantify Your Achievements: Instead of simply listing responsibilities, quantify your achievements whenever possible. Use metrics to demonstrate your impact (e.g., "Increased portfolio profitability by 10%").

- Tailor Your Application: Don't use a generic template. Customize your resume and cover letter to each specific job description, highlighting the skills and experiences most relevant to the role. Keywords: Resume writing, cover letter, private credit resume, financial modeling, analytical skills, private debt jobs.

4. Master the Interview Process:

The interview is your chance to showcase your skills and personality.

- Behavioral Questions: Prepare for behavioral questions using the STAR method (Situation, Task, Action, Result).

- Technical Skills: Be prepared to demonstrate your technical skills, such as financial modeling, valuation, and credit analysis.

- Ask Insightful Questions: Research the firm thoroughly and prepare insightful questions to demonstrate your interest and knowledge. Keywords: Interview skills, private credit interview, financial modeling interview, STAR method.

5. Showcase Your Understanding of Risk Management:

Private credit involves inherent risks. Demonstrating your understanding of risk management is crucial.

- Credit Analysis Expertise: Show your proficiency in credit analysis, including assessing borrower creditworthiness, structuring transactions to mitigate risk, and monitoring portfolio performance.

- Due Diligence: Highlight your experience in conducting thorough due diligence investigations, identifying potential risks, and developing mitigation strategies. Keywords: Risk management, credit analysis, due diligence, portfolio management, credit risk.

Don'ts: Common Mistakes to Avoid

- Neglecting Networking: Don't underestimate the power of networking. It's a crucial aspect of securing a private credit role.

- Submitting Generic Applications: Tailoring your application to each job is essential. Generic applications often get overlooked.

- Lack of Industry Knowledge: Stay updated on industry news and trends. Show your understanding of current market dynamics.

- Poor Interview Preparation: Thorough preparation is key to acing the interview. Practice answering both technical and behavioral questions.

- Underestimating the Importance of Risk Management: Demonstrate a deep understanding of credit risk and your approach to mitigation. Keywords: Job search mistakes, private credit job search, interview tips, avoiding common errors.

Conclusion

Securing a private credit role requires dedication and a strategic approach. By following these do's and don'ts, you'll significantly improve your chances of success. Remember to develop specialized expertise, network effectively, craft compelling applications, master the interview process, and showcase your understanding of risk management. Don't delay – start implementing these strategies today and crack the code to your dream private credit role or private lending job!

Featured Posts

-

M Ivaskeviciaus Isvarymo Analize 11 Aspektu Kuriuos Svarbu Zinoti

Apr 29, 2025

M Ivaskeviciaus Isvarymo Analize 11 Aspektu Kuriuos Svarbu Zinoti

Apr 29, 2025 -

2025 Nfl International Games The Packers Potential Double Header

Apr 29, 2025

2025 Nfl International Games The Packers Potential Double Header

Apr 29, 2025 -

You Tubes Growing Popularity Among Older Viewers A Resurgence Of Classic Content

Apr 29, 2025

You Tubes Growing Popularity Among Older Viewers A Resurgence Of Classic Content

Apr 29, 2025 -

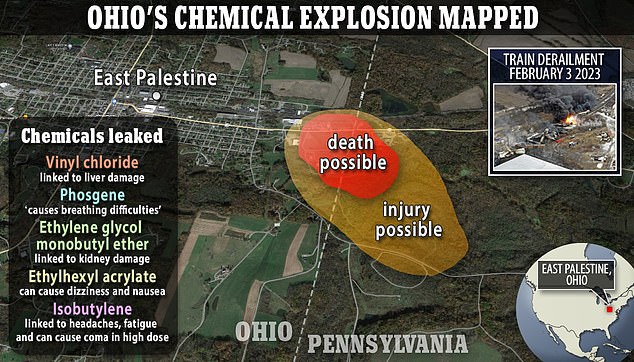

Toxic Chemical Fallout Ohio Derailments Impact On Building Contamination

Apr 29, 2025

Toxic Chemical Fallout Ohio Derailments Impact On Building Contamination

Apr 29, 2025 -

Buying Capital Summertime Ball 2025 Tickets A Practical Approach

Apr 29, 2025

Buying Capital Summertime Ball 2025 Tickets A Practical Approach

Apr 29, 2025