Credit Suisse To Pay Up To $150 Million To Whistleblowers

Table of Contents

Details of the Credit Suisse Whistleblower Settlement

The $150 million settlement represents a substantial sum, reflecting the severity of the alleged misconduct at Credit Suisse. This payout is a powerful statement regarding the SEC’s commitment to pursuing and penalizing corporate wrongdoing. The SEC investigation focused on potential violations of various laws, including the critical Foreign Corrupt Practices Act (FCPA), which prohibits bribery of foreign officials. The investigation likely involved a comprehensive review of Credit Suisse's internal controls and compliance procedures.

- The settlement amount: The $150 million reflects the significant impact of the alleged misconduct and the potential harm to investors and the public.

- SEC investigation scope: The SEC’s investigation likely encompassed multiple aspects of Credit Suisse’s operations, examining potential violations beyond the FCPA.

- Financial penalties: Beyond the whistleblower payouts, Credit Suisse likely faced additional financial penalties as part of the settlement agreement.

- Internal control failures: The settlement underscores significant weaknesses in Credit Suisse’s internal controls and compliance systems. This highlights the need for stronger corporate governance.

- Admission of guilt: Notably, the settlement does not constitute an admission or denial of guilt by Credit Suisse.

The Role of Whistleblowers in Exposing Corporate Misconduct

Whistleblowers are indispensable in uncovering corporate misconduct that might otherwise remain hidden, shielded by complex corporate structures and internal power dynamics. Their actions are vital for maintaining ethical standards and protecting investors and the public. The SEC's whistleblower program, with its significant financial incentives, plays a crucial role in encouraging individuals to come forward with information. The potential rewards are substantial, as demonstrated by the Credit Suisse case.

- Whistleblower protection: The SEC actively investigates claims of retaliation against whistleblowers, ensuring protection for those who report wrongdoing. This protection is crucial for encouraging individuals to speak up.

- Reporting channels: Confidential reporting channels are essential; individuals must feel safe and comfortable reporting potential wrongdoing without fear of reprisal.

- Financial rewards: The substantial financial rewards offered under the SEC's whistleblower program provide strong motivation for individuals to come forward, even when facing significant risks.

- Retaliation prevention: The SEC actively pursues cases of retaliation against whistleblowers, emphasizing the importance of protecting those who report misconduct.

- Credit Suisse case significance: The Credit Suisse case showcases the potential for substantial financial rewards for whistleblowers who expose serious corporate misconduct, strengthening the incentive to report such actions.

Implications for Corporate Compliance and Future Whistleblower Actions

The Credit Suisse settlement serves as a stark warning to other financial institutions about the importance of robust compliance programs. This case has far-reaching implications for corporate governance, risk management, and regulatory scrutiny. Companies must take proactive steps to strengthen their internal controls and reporting mechanisms.

- Strengthened compliance programs: Financial institutions must review and enhance their internal controls and compliance programs to ensure adherence to regulatory standards and best practices.

- Regulatory scrutiny: Increased regulatory scrutiny is expected in the financial sector following this significant settlement, highlighting the need for proactive compliance.

- Best practices adoption: Implementing best practices for whistleblower protection and reward programs is vital for fostering a culture of ethical conduct.

- Increased reporting: This case may encourage more individuals to report potential misconduct, leading to further investigations and settlements across the financial industry.

- Corporate governance overhaul: The settlement reinforces the need for robust corporate governance structures to prevent and detect financial misconduct.

Conclusion

The Credit Suisse settlement, amounting to up to $150 million paid to whistleblowers, underscores the growing importance of strong corporate compliance programs and the substantial rewards available for exposing financial misconduct. This landmark agreement highlights the critical role of whistleblowers in maintaining ethical corporate conduct and suggests increased scrutiny on financial institutions. The substantial financial incentives offered by the SEC's whistleblower program are clearly effective in encouraging individuals to report wrongdoing.

Call to Action: Are you aware of potential financial misconduct within your organization? Learn more about whistleblower rights and reporting procedures. Understanding the intricacies of reporting financial wrongdoing and the potential rewards for whistleblowers is crucial for fostering ethical conduct within financial institutions. Protect yourself and report potential misconduct. The Credit Suisse case proves it can make a real difference. Contact the SEC or a qualified legal professional to discuss your options and understand your rights as a whistleblower.

Featured Posts

-

Sensex Today 800 Point Surge Nifty Above 18 500 Live Updates

May 10, 2025

Sensex Today 800 Point Surge Nifty Above 18 500 Live Updates

May 10, 2025 -

Wolves Rejection Fueled His Rise Now Hes Europes Best

May 10, 2025

Wolves Rejection Fueled His Rise Now Hes Europes Best

May 10, 2025 -

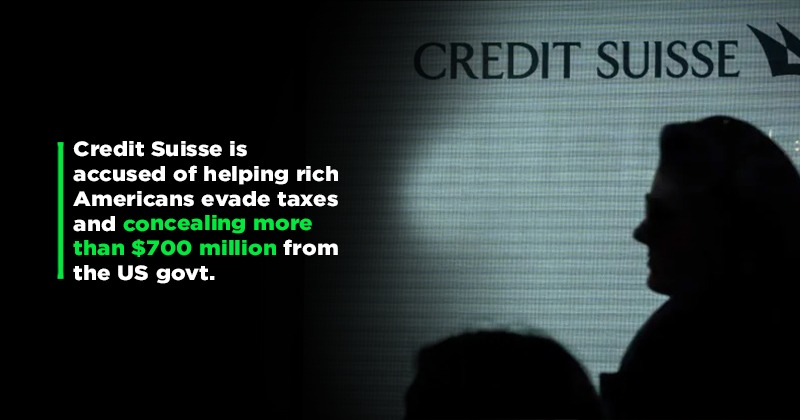

Gazas Struggle For Survival Examining The Effects Of Israels Blockade

May 10, 2025

Gazas Struggle For Survival Examining The Effects Of Israels Blockade

May 10, 2025 -

Floridai Transznemu No Letartoztatasa Noi Mosdo Hasznalata Kormanyepueletben

May 10, 2025

Floridai Transznemu No Letartoztatasa Noi Mosdo Hasznalata Kormanyepueletben

May 10, 2025 -

2025 Hurun Global Rich List Elon Musks Billions Lost But Still Number One

May 10, 2025

2025 Hurun Global Rich List Elon Musks Billions Lost But Still Number One

May 10, 2025