Cryptocurrency Investment Alert: VanEck's 185% Prediction

Table of Contents

VanEck, a respected investment management firm with a long history in the financial industry, has made waves with its significant cryptocurrency price prediction. This article aims to dissect this VanEck prediction, exploring its basis, validity, and potential impact on your Bitcoin price prediction and broader crypto market forecast.

Understanding VanEck's 185% Cryptocurrency Price Prediction

The source of VanEck's prediction isn't publicly available as a single, easily accessible report or press release. Instead, the 185% figure seems to be an aggregation and interpretation of various analyst comments and market observations from VanEck's experts over time. While a specific, singular source is difficult to pinpoint, the consensus opinion within VanEck seems to suggest significant bullish potential. (Note: Due to the decentralized nature of information surrounding this prediction, confirming the exact source and specific timeframe proves challenging. It is crucial to conduct your own independent research.)

The timeframe for this VanEck prediction is unclear and appears to be a long-term forecast rather than a short-term prediction. Therefore, any immediate investment decisions based solely on this should be approached with extreme caution.

The prediction likely encompasses a broad range of cryptocurrencies, rather than just Bitcoin. While the exact composition of the assets considered isn't explicitly stated, it's reasonable to assume it reflects the overall crypto market capitalization, including major players like Bitcoin and Ethereum.

- Key arguments supporting VanEck's prediction: Increased institutional adoption, growing global regulatory clarity, and ongoing technological advancements within the blockchain space.

- Caveats and limitations: The cryptocurrency market is notoriously volatile, and unforeseen events (regulatory changes, market corrections, hacks) could significantly impact the price. VanEck's prediction represents a potential, not a guarantee.

- Factors driving the positive outlook: The increasing acceptance of cryptocurrencies by institutional investors, expanding adoption in emerging economies, and continuous technological innovation in areas like DeFi and scalability solutions.

Analyzing the Validity of VanEck's Forecast

Several factors could support VanEck's bullish cryptocurrency forecast. The increasing involvement of large institutional investors, like BlackRock, is injecting significant capital into the market, potentially driving prices higher. The expanding adoption of cryptocurrencies in developing countries, where traditional financial systems are less accessible, also adds to the potential for growth. Furthermore, growing regulatory clarity in some jurisdictions could reduce uncertainty and attract more investment.

However, significant risks and counterarguments exist. The inherent volatility of the crypto market remains a substantial concern. Sudden price corrections are commonplace, and significant downturns are possible. Regulatory uncertainty persists globally, and abrupt changes in regulations could negatively impact prices. The potential for major security breaches or hacks could also erode investor confidence.

Comparing VanEck's prediction to other market analyses requires careful consideration. While some analysts share a positive outlook, others remain more cautious. It's crucial to avoid basing investment decisions solely on a single forecast.

- Pros of investing based on the prediction: Potential for high returns if the prediction materializes.

- Cons: High risk of significant losses due to market volatility.

- Importance of due diligence: Always conduct thorough research and understand the risks before investing.

- Risks of high-risk investments: Cryptocurrencies are considered high-risk investments; only invest what you can afford to lose.

Smart Strategies for Cryptocurrency Investors Based on VanEck's Prediction

Even with a seemingly positive prediction like VanEck's, a well-informed strategy is crucial for navigating the cryptocurrency market.

Diversification: Never put all your eggs in one basket. Spread your investment across various cryptocurrencies to reduce the impact of any single asset's price fluctuations.

Risk Management: Implementing stop-loss orders to limit potential losses is crucial. Only invest capital you can afford to lose entirely.

Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of price. This strategy mitigates the risk of investing a lump sum at a market peak.

Long-Term Perspective: Cryptocurrency investments are best suited for long-term strategies. Short-term trading can be extremely risky.

- Practical steps for diversification: Allocate your funds across a variety of cryptocurrencies, considering market capitalization, technology, and potential.

- Risk management techniques: Utilize stop-loss orders, diversify your portfolio, and avoid emotional decision-making.

- Effective DCA implementation: Determine a fixed investment amount and schedule, and stick to it consistently.

Conclusion: Act on the Cryptocurrency Investment Alert

VanEck's 185% prediction for cryptocurrencies presents a compelling potential, but the cryptocurrency market remains inherently volatile. This analysis highlighted the need for cautious optimism, emphasizing the importance of independent research and robust risk management strategies. Remember to only invest what you can afford to lose and diversify your portfolio. While the VanEck prediction provides a valuable data point, it's crucial to conduct your own thorough research before making any investment decisions. Use this information to inform your own research and develop a well-informed cryptocurrency investment strategy. Don't rely solely on any single prediction; instead, build a strategy that considers various forecasts, market trends, and your own risk tolerance. Remember, the cryptocurrency investment alert is just that—an alert, not a guarantee. Proceed with caution and conduct your due diligence.

Featured Posts

-

Celtics Star Jayson Tatums Ankle Injury Severity And Impact

May 08, 2025

Celtics Star Jayson Tatums Ankle Injury Severity And Impact

May 08, 2025 -

Japanese Trading House Stock Prices Climb Following Berkshires Acquisition

May 08, 2025

Japanese Trading House Stock Prices Climb Following Berkshires Acquisition

May 08, 2025 -

Oklahoma City Thunder Vs Indiana Pacers Injury Report March 29

May 08, 2025

Oklahoma City Thunder Vs Indiana Pacers Injury Report March 29

May 08, 2025 -

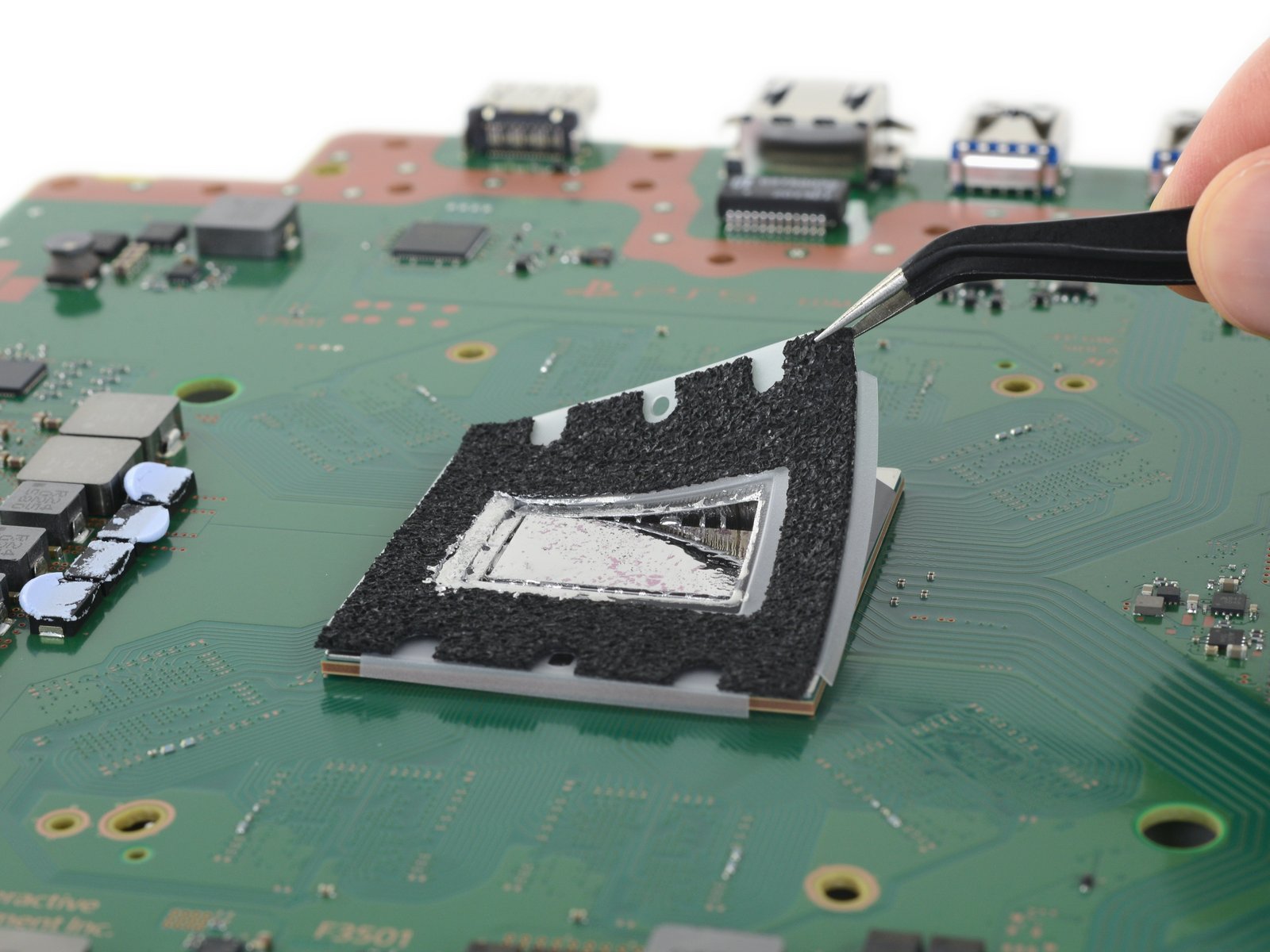

Ps 5 Pro Internal Components Official Teardown Shows Liquid Metal

May 08, 2025

Ps 5 Pro Internal Components Official Teardown Shows Liquid Metal

May 08, 2025 -

Andor Season 2 Trailer Delay Fuels Fan Frustration And Theories

May 08, 2025

Andor Season 2 Trailer Delay Fuels Fan Frustration And Theories

May 08, 2025