CTS Eventim's Q1 2024 Financial Results: Adjusted EBITDA And Revenue Analysis

Table of Contents

CTS Eventim's Q1 2024 Revenue Performance

Overall Revenue Figures

CTS Eventim reported a total revenue of [Insert Actual Revenue Figure Here] for Q1 2024. This represents a [Insert Percentage Change, e.g., 15%] increase compared to Q1 2023's revenue of [Insert Q1 2023 Revenue Figure Here]. The following chart illustrates the year-on-year revenue growth:

[Insert Chart/Graph Here showing Q1 2023 and Q1 2024 Revenue]

Revenue Breakdown by Segment

The revenue growth wasn't evenly distributed across all segments. A breakdown reveals the following contributions:

- Ticketing: [Insert Percentage]% of total revenue, showing [Insert Percentage Change, e.g., 12%] growth. This strong performance reflects increased ticket sales across various events.

- Live Entertainment: [Insert Percentage]% of total revenue, with [Insert Percentage Change, e.g., 20%] growth. This segment benefited from a robust calendar of concerts and festivals.

- Other Business Segments: [Insert Percentage]% of total revenue, showing [Insert Percentage Change, e.g., 5%] growth. This includes areas such as marketing services and venue operations.

Key Factors Influencing Revenue

Several factors contributed to CTS Eventim's Q1 2024 revenue performance:

- Strong Ticket Sales: Increased demand for live events fueled higher ticket sales across all segments.

- Successful Event Programming: A well-curated portfolio of events attracted large audiences.

- Favorable Market Conditions: The overall economic climate and consumer spending patterns positively impacted ticket purchasing.

- Effective Marketing and Sales Strategies: Targeted marketing campaigns effectively reached potential customers.

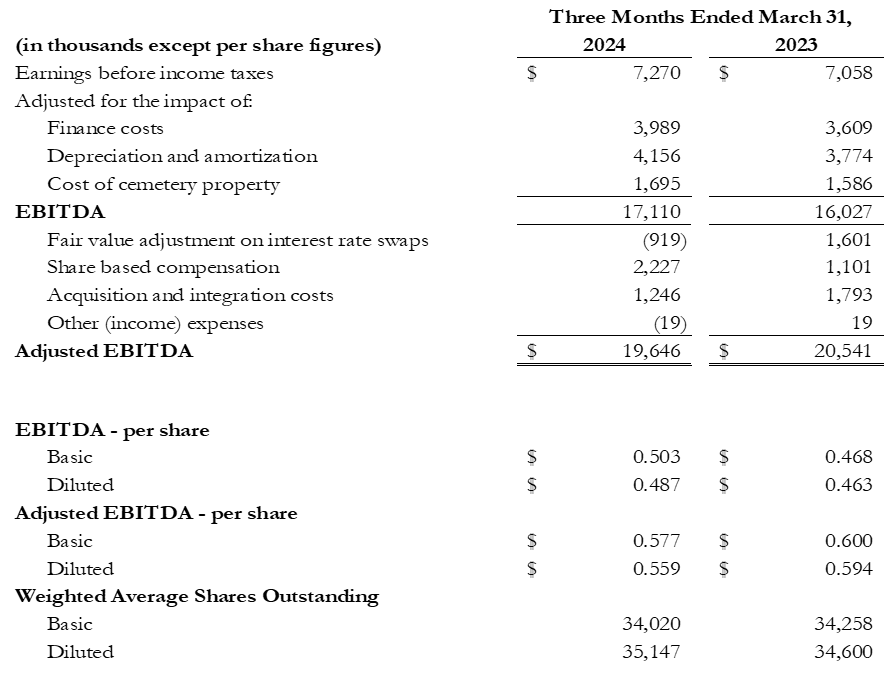

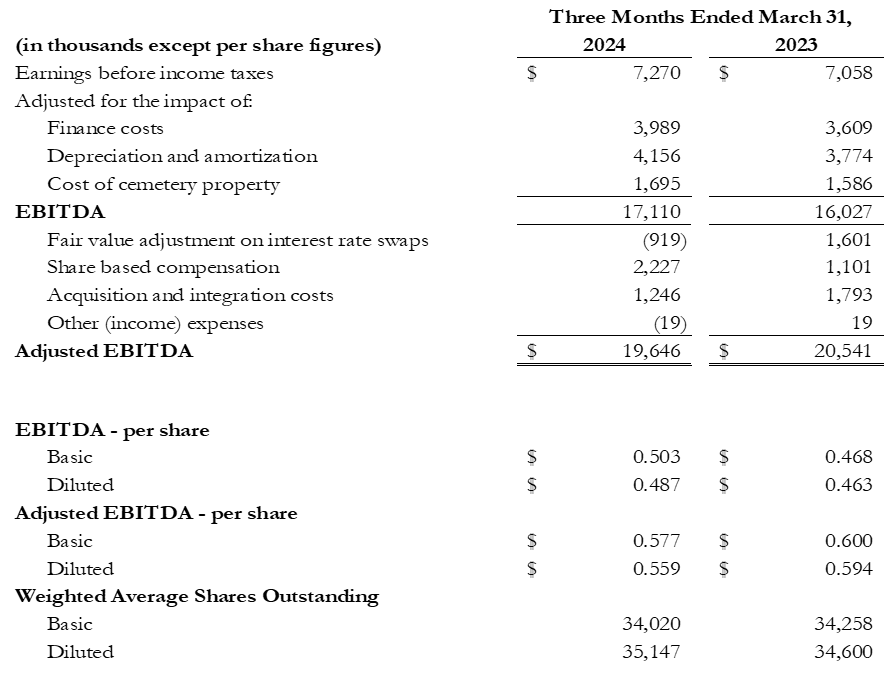

Adjusted EBITDA Analysis for Q1 2024

Adjusted EBITDA Figures

CTS Eventim reported an Adjusted EBITDA of [Insert Actual EBITDA Figure Here] for Q1 2024. This represents a [Insert Percentage Change, e.g., 18%] increase compared to Q1 2023's Adjusted EBITDA of [Insert Q1 2023 EBITDA Figure Here]. The following chart visually represents this growth:

[Insert Chart/Graph Here showing Q1 2023 and Q1 2024 Adjusted EBITDA]

Key Drivers of Adjusted EBITDA

The improvement in Adjusted EBITDA can be attributed to:

- Increased Revenue: Higher ticket sales and strong performance across various segments directly contributed to the higher EBITDA.

- Cost Optimization: Efficient management of operational expenses improved profitability margins.

- Strategic Pricing: Effective pricing strategies maximized revenue generation.

Margin Analysis

The EBITDA margin for Q1 2024 was [Insert EBITDA Margin Percentage Here]%, compared to [Insert Previous Period's Margin Percentage Here]% in Q1 2023. This represents a [Insert Percentage Change, e.g., 2%] improvement and is [Insert Comparison, e.g., above/below] the industry benchmark of [Insert Benchmark Percentage Here]%.

Comparison to Analyst Expectations

Meeting or Exceeding Expectations

Analysts' consensus forecast for CTS Eventim's Q1 2024 Adjusted EBITDA was [Insert Analyst Forecast Figure Here]. The actual result [Insert Comparison, e.g., exceeded/met/fell short of] these expectations by [Insert Difference Figure Here].

Market Reaction

The market reacted [Insert Description, e.g., positively] to the release of the Q1 2024 results. CTS Eventim's share price [Insert Description, e.g., increased] by [Insert Percentage Change, e.g., 3%] following the announcement. [Insert Links to relevant financial news articles].

Future Outlook and Guidance

Management Commentary

CTS Eventim's management expressed [Insert Summary of Management's Statement on Future Outlook, e.g., confidence in the company’s ability to maintain its growth trajectory for the remainder of 2024]. They cited [Insert Key Factors Mentioned by Management, e.g., strong advance bookings and an exciting event calendar] as supporting factors for their positive outlook.

Key Risks and Opportunities

Future performance may be influenced by:

- Economic Uncertainty: Changes in the global economy could impact consumer spending and event attendance.

- Geopolitical Events: Unforeseen global events could disrupt travel and event schedules.

- Competition: Increased competition in the live entertainment industry may impact market share.

- Technological Advancements: Adapting to evolving technological trends will be essential for maintaining a competitive edge.

Conclusion: Key Takeaways from CTS Eventim's Q1 2024 Financial Report – Adjusted EBITDA and Revenue

CTS Eventim's Q1 2024 financial results demonstrate a strong performance, exceeding analyst expectations with robust revenue and Adjusted EBITDA growth. The increase in both metrics reflects strong ticket sales, successful event programming, and effective cost management. While potential risks remain, the company's positive outlook suggests continued growth. To stay informed on future CTS Eventim financial results and further announcements, follow their investor relations website, subscribe to their press releases, or follow their social media channels for the latest updates on CTS Eventim revenue and EBITDA performance.

Featured Posts

-

Glastonbury Tickets Official Resale A 30 Minute Sellout

May 30, 2025

Glastonbury Tickets Official Resale A 30 Minute Sellout

May 30, 2025 -

Rozmowa Trumpa I Zelenskiego Co Wiemy

May 30, 2025

Rozmowa Trumpa I Zelenskiego Co Wiemy

May 30, 2025 -

Improving Rural Healthcare Province Deploys Advanced Care Paramedics In Northern Manitoba

May 30, 2025

Improving Rural Healthcare Province Deploys Advanced Care Paramedics In Northern Manitoba

May 30, 2025 -

Agassi Dezvaluie Nivelul Sau De Stres Inainte De Meciuri

May 30, 2025

Agassi Dezvaluie Nivelul Sau De Stres Inainte De Meciuri

May 30, 2025 -

Sunnova Energy Denied 3 Billion Loan Under Trump Administration

May 30, 2025

Sunnova Energy Denied 3 Billion Loan Under Trump Administration

May 30, 2025